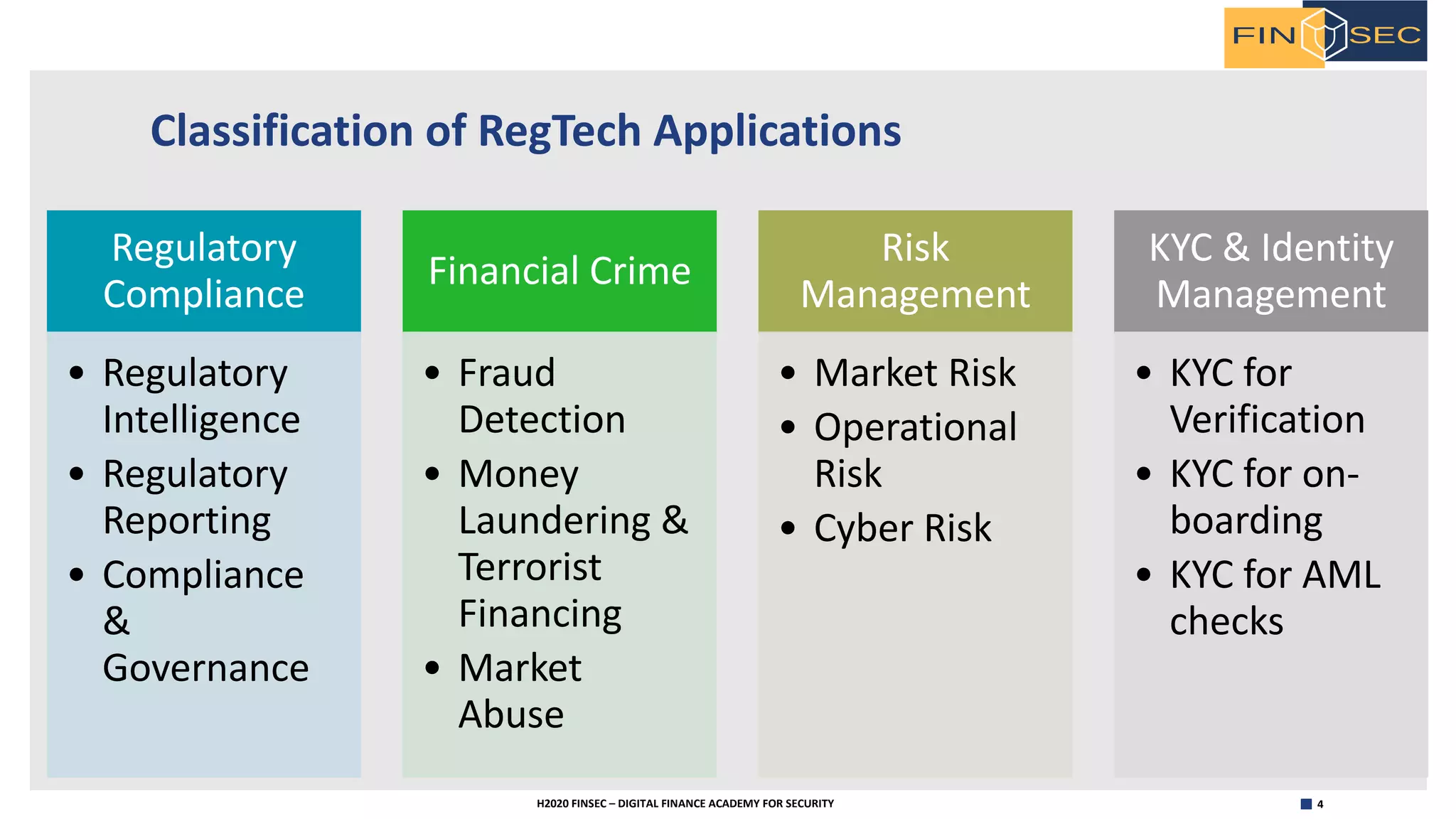

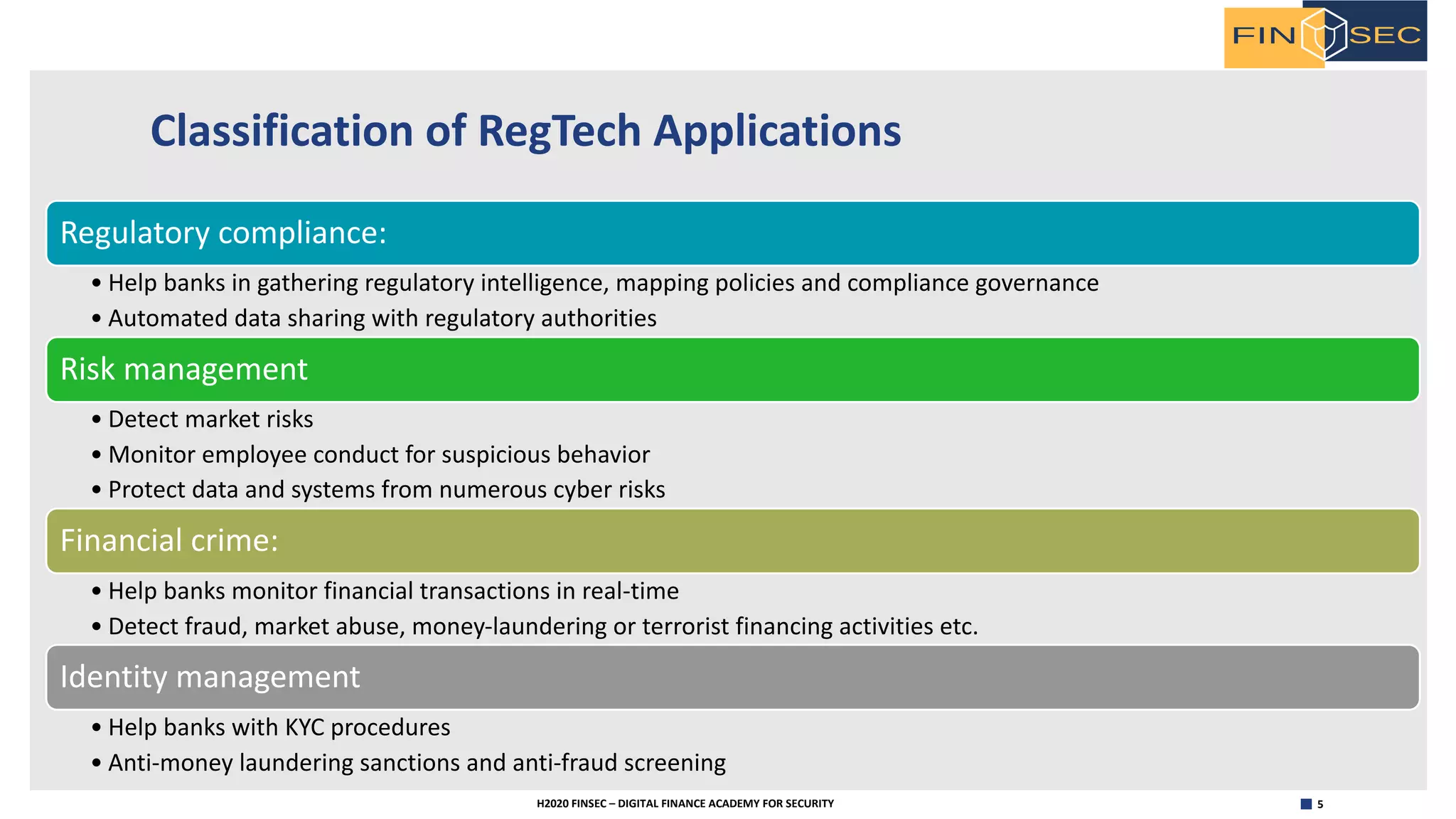

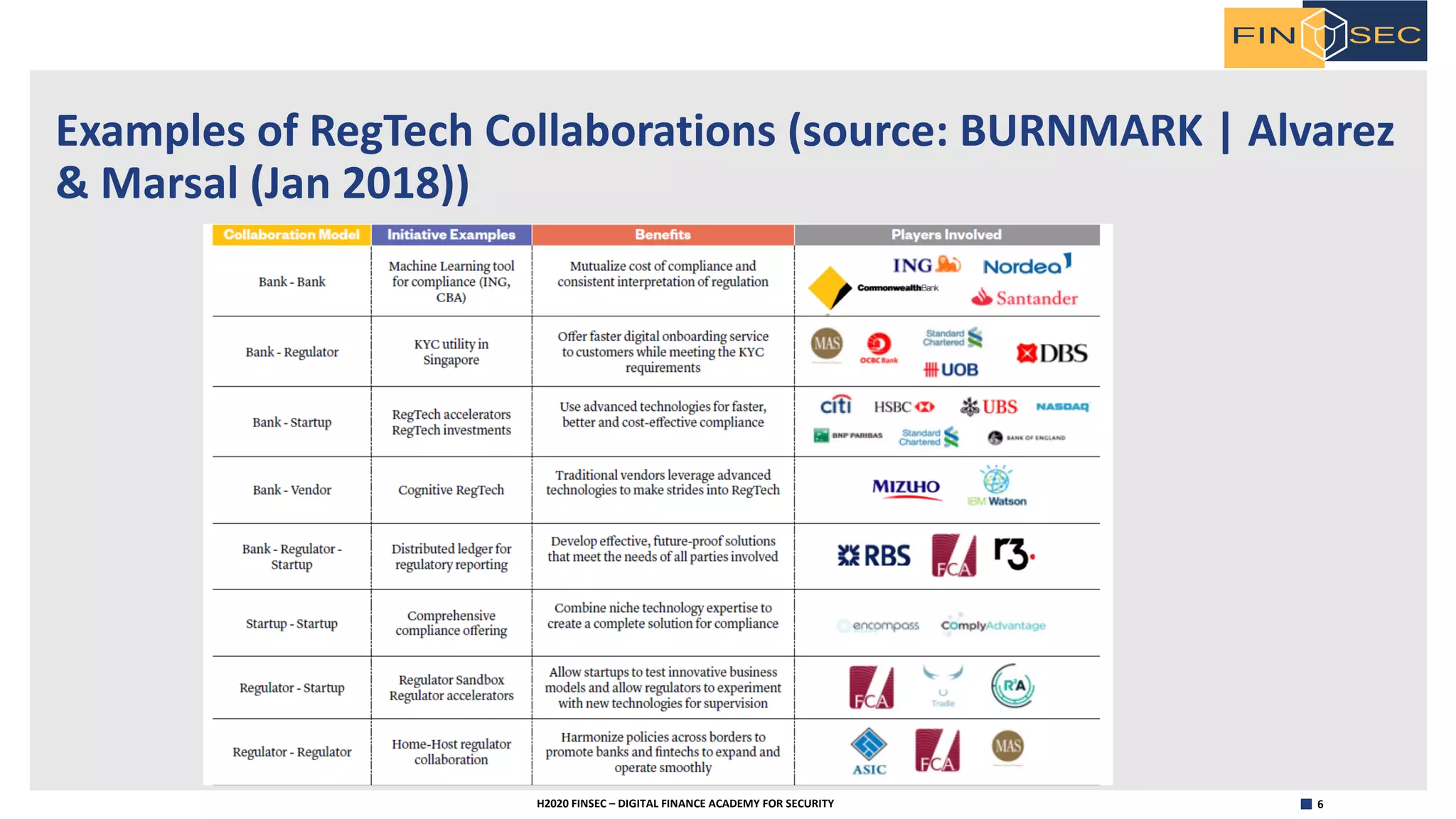

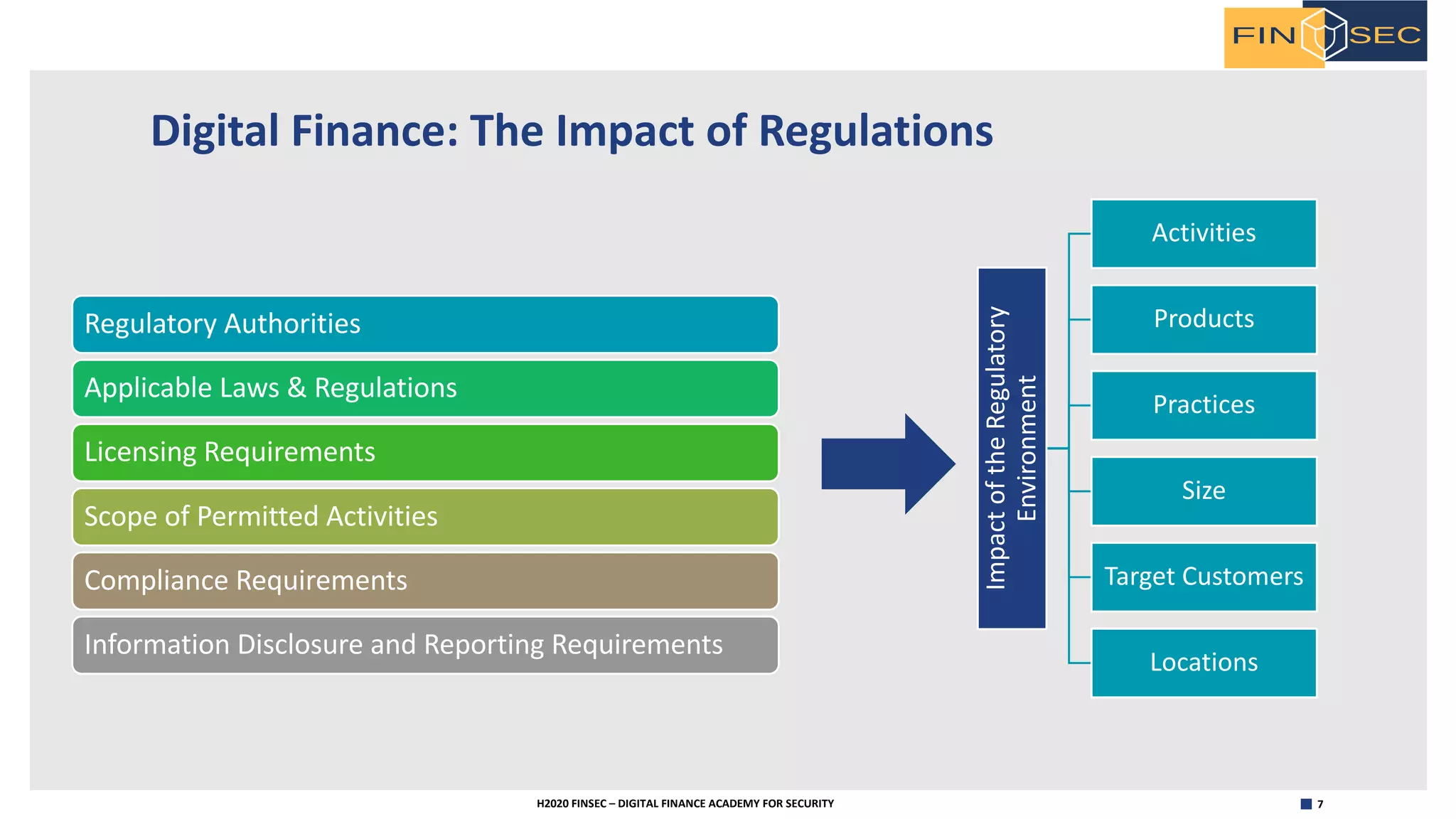

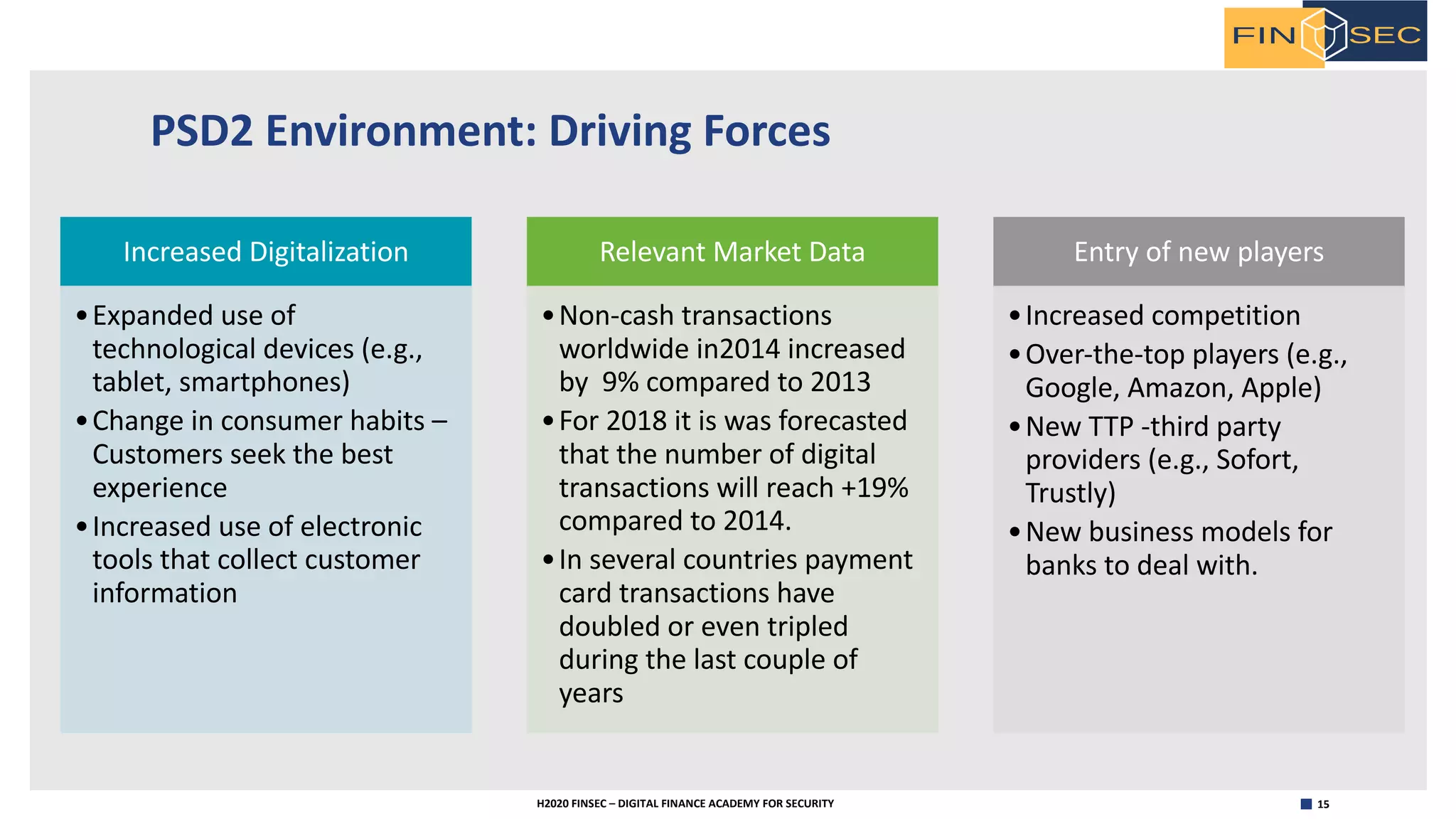

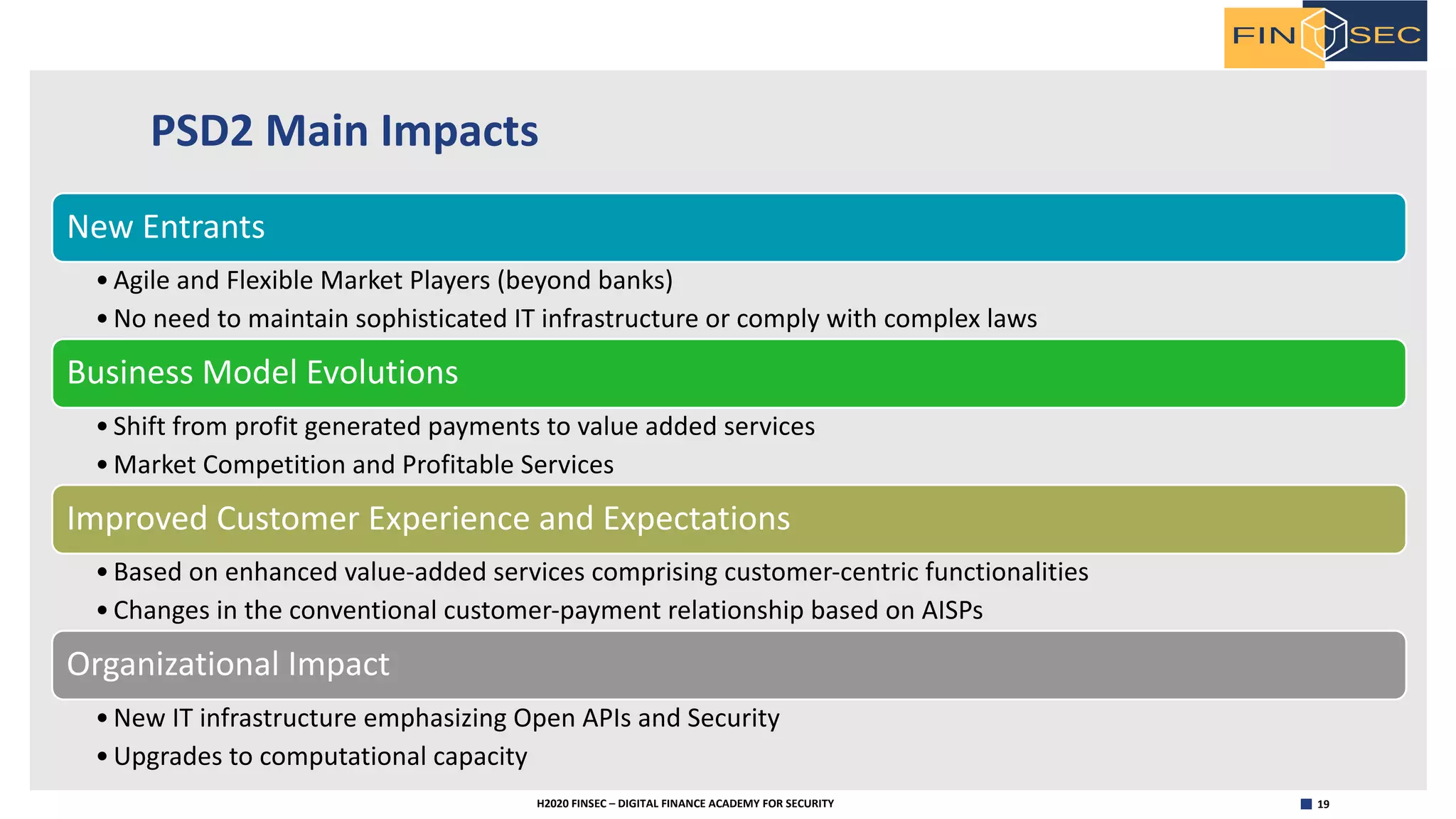

This document discusses RegTech and the regulatory landscape for digital finance. It defines RegTech as technologies that help financial institutions meet regulatory requirements more efficiently. RegTech applications include regulatory compliance, risk management, financial crime prevention, and know-your-customer processes. The document also examines the EU's Payment Services Directive 2 (PSD2), which aims to increase competition by regulating new market players like account information and payment initiation service providers. PSD2 establishes rules for bank data access and sharing liability for fraudulent transactions.