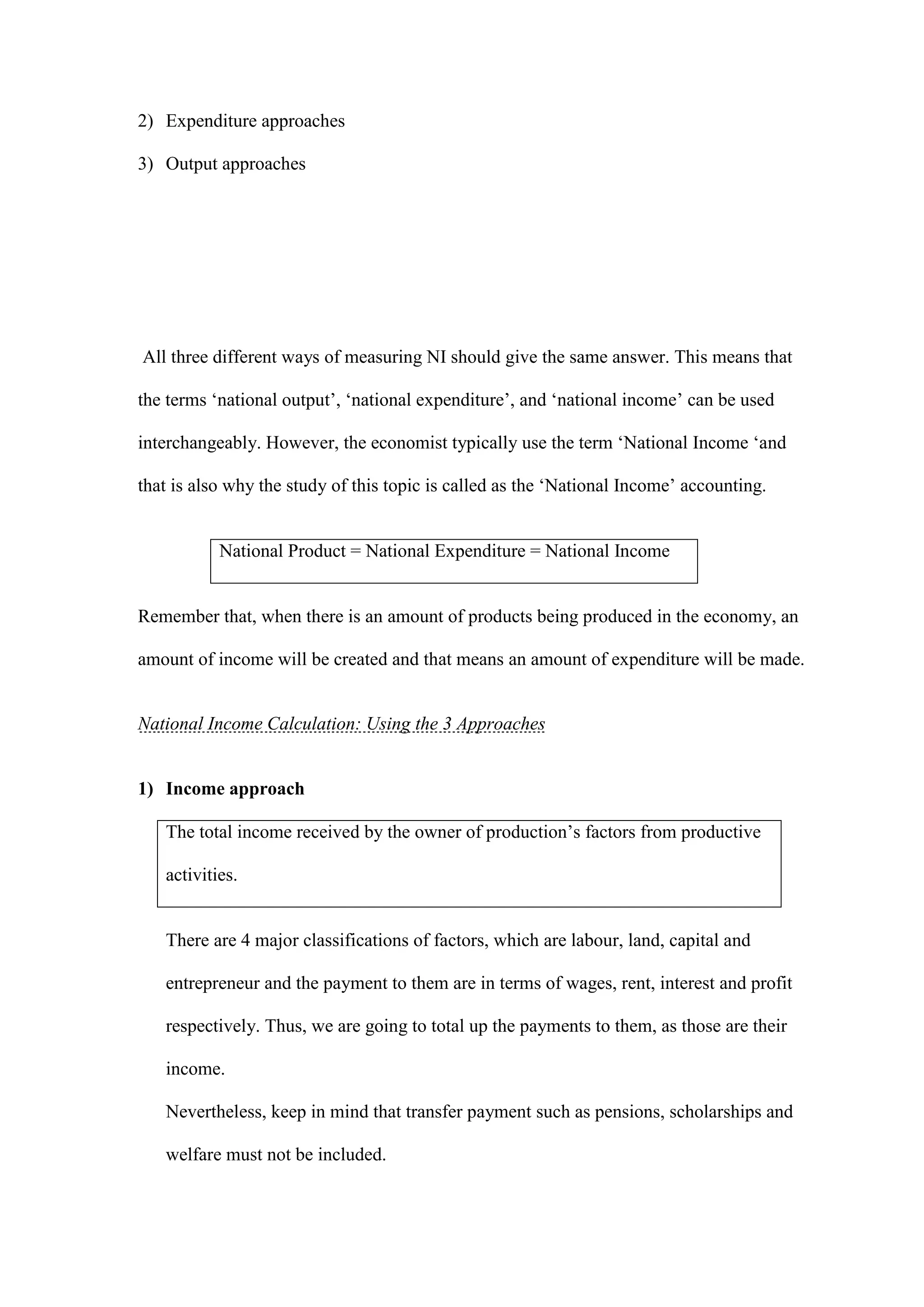

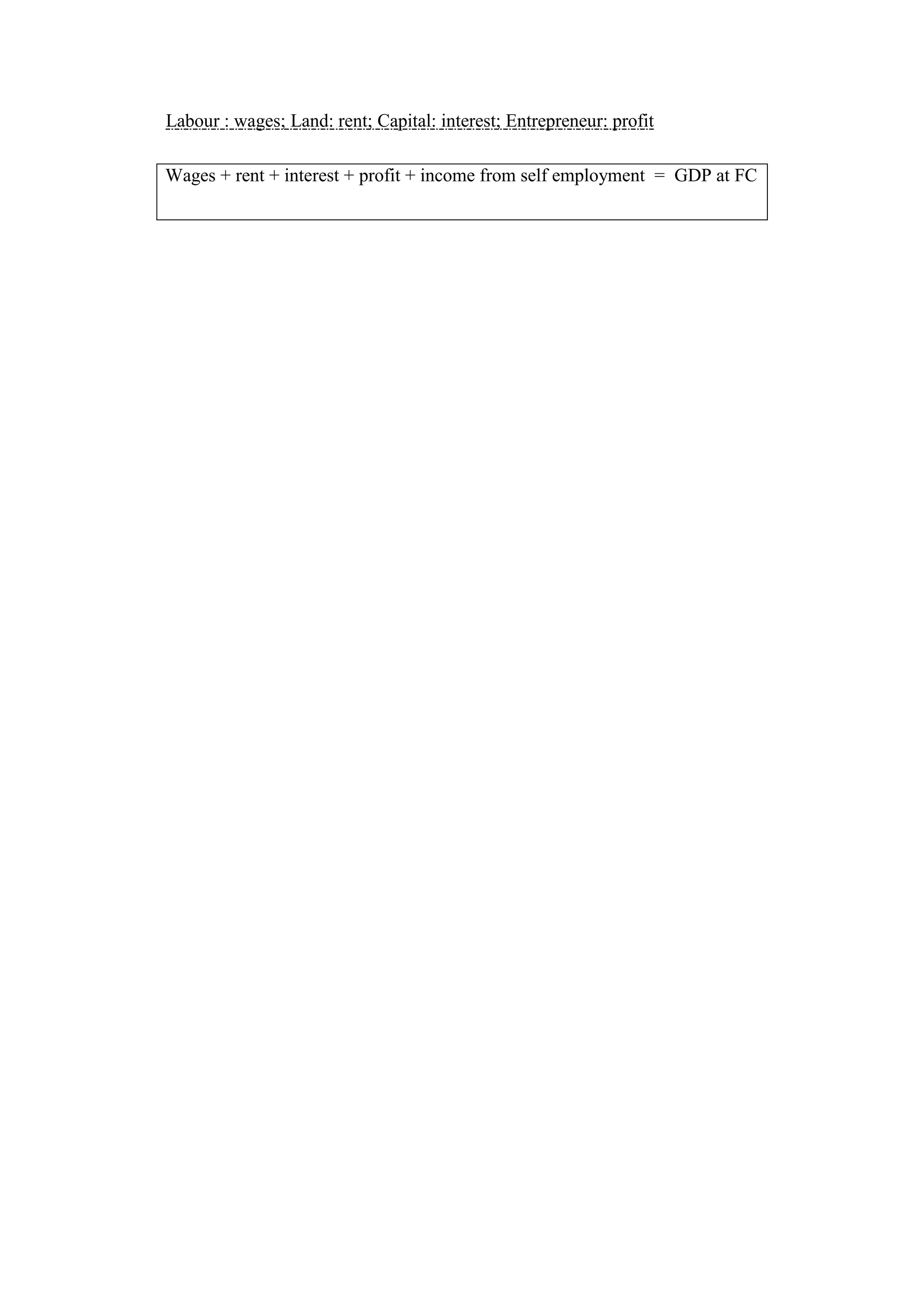

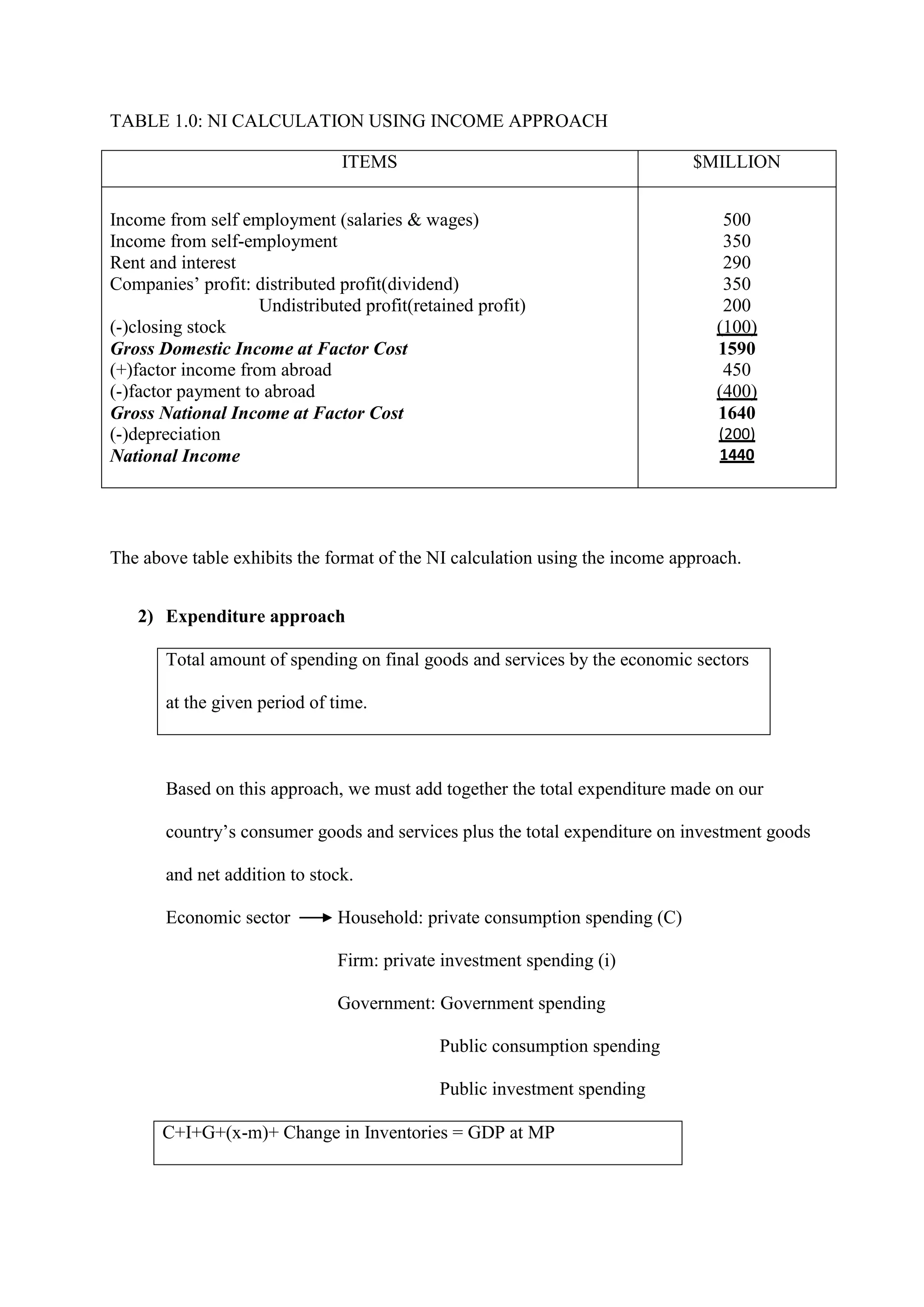

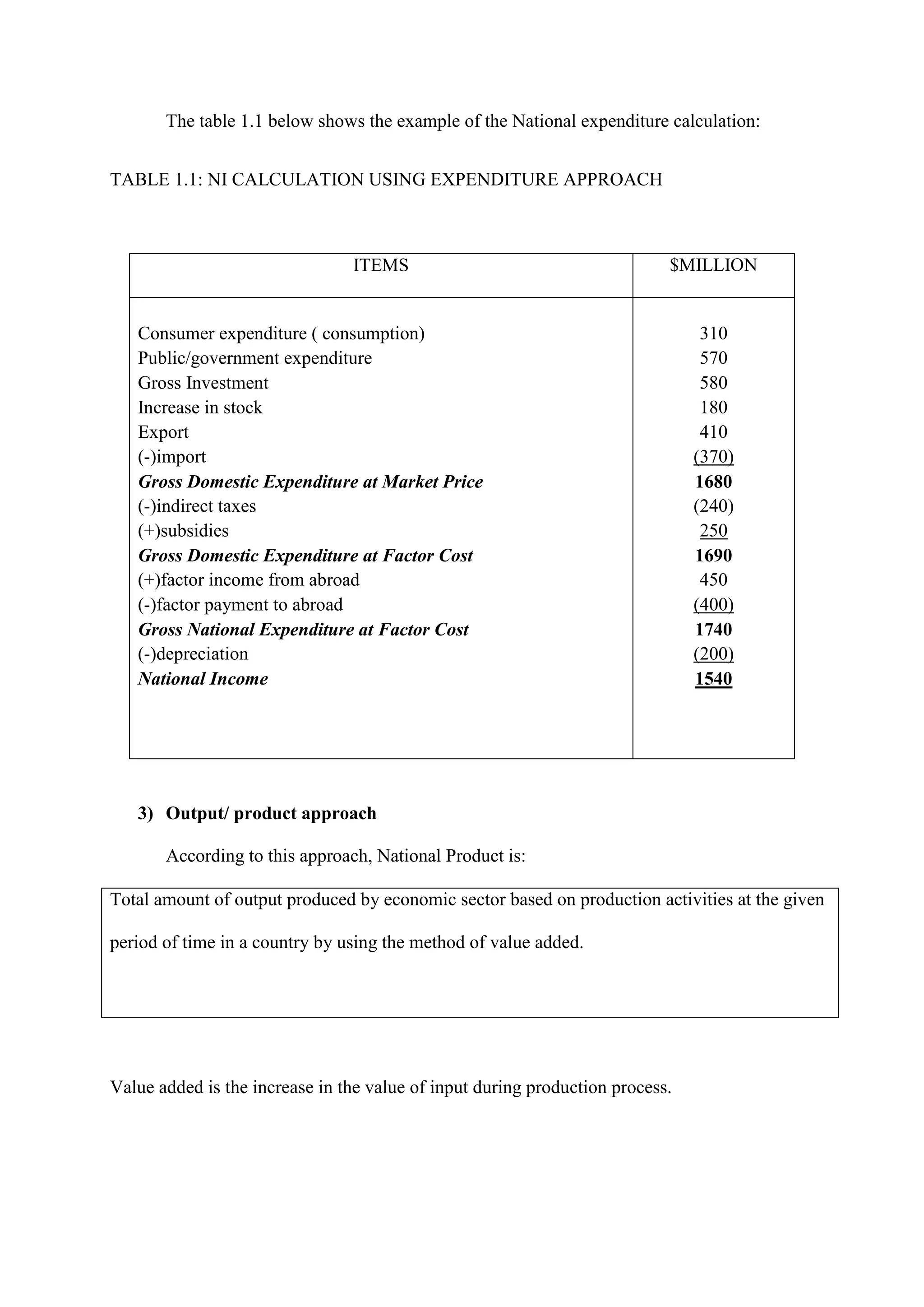

This document provides information about macroeconomics and measuring national income. It discusses the key topics of macroeconomics including full employment, economic growth, price stability, and external balance. It also outlines the three approaches to measuring national income - the income approach, expenditure approach, and output approach. The roles of government in implementing monetary and fiscal policy to influence the national income are also covered.