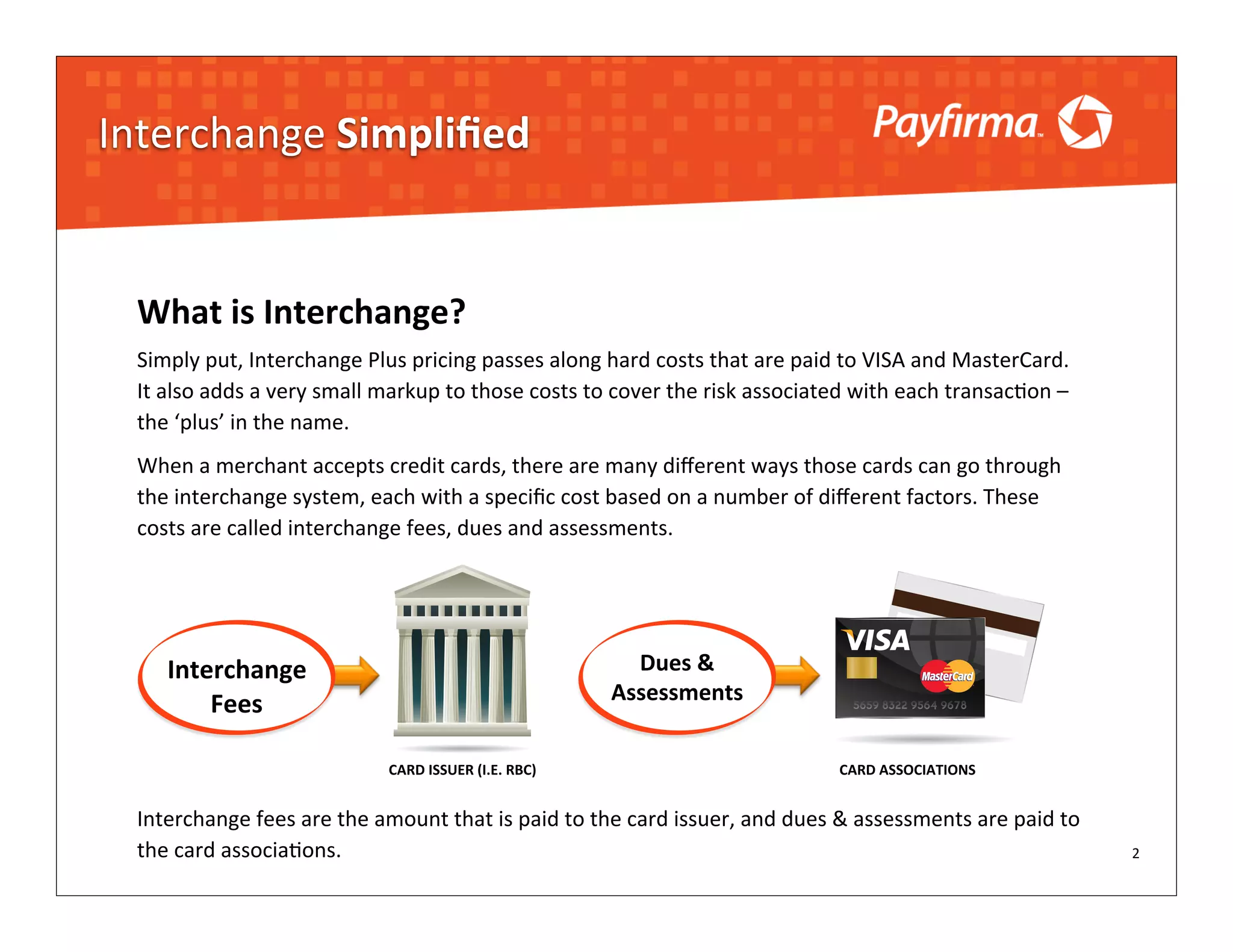

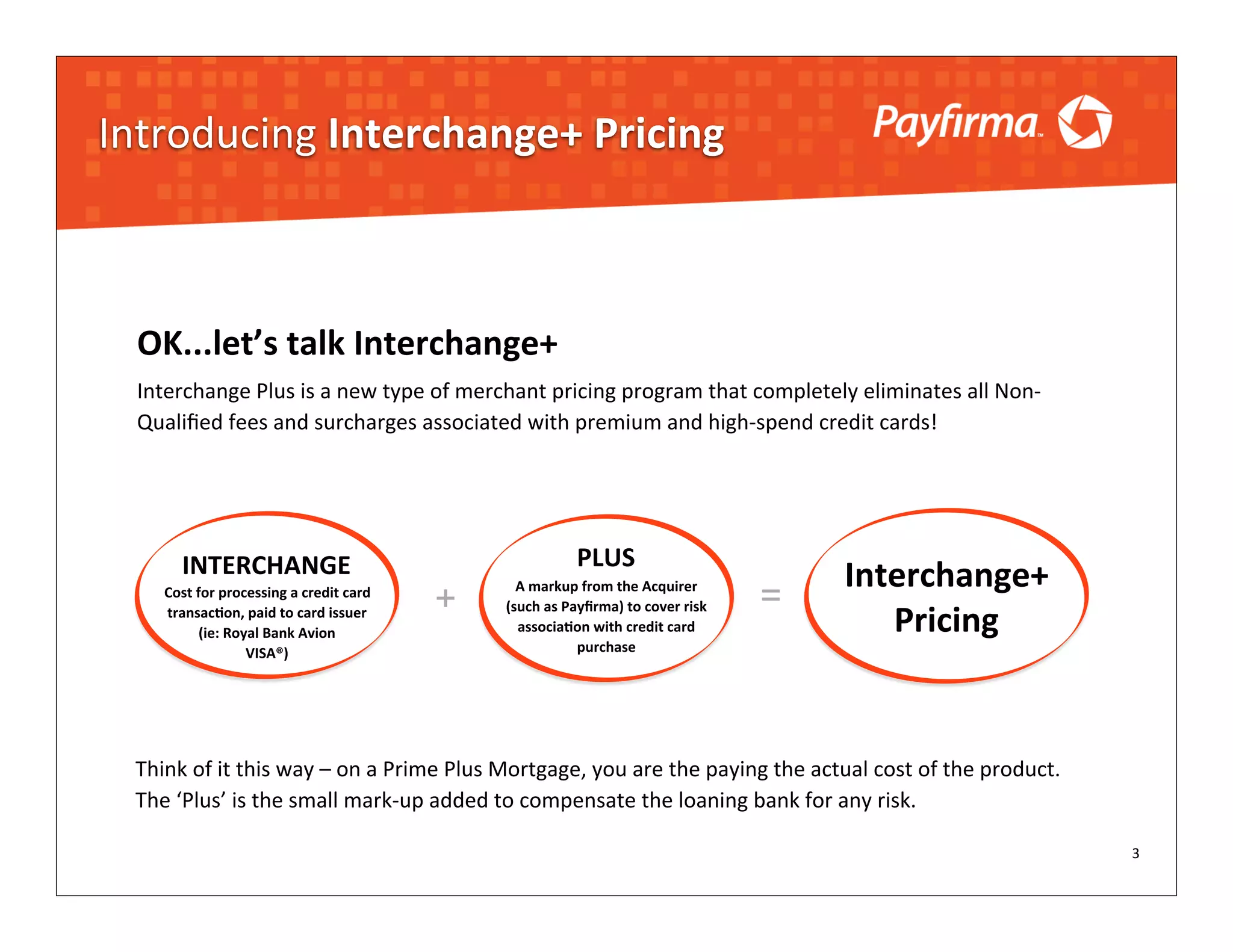

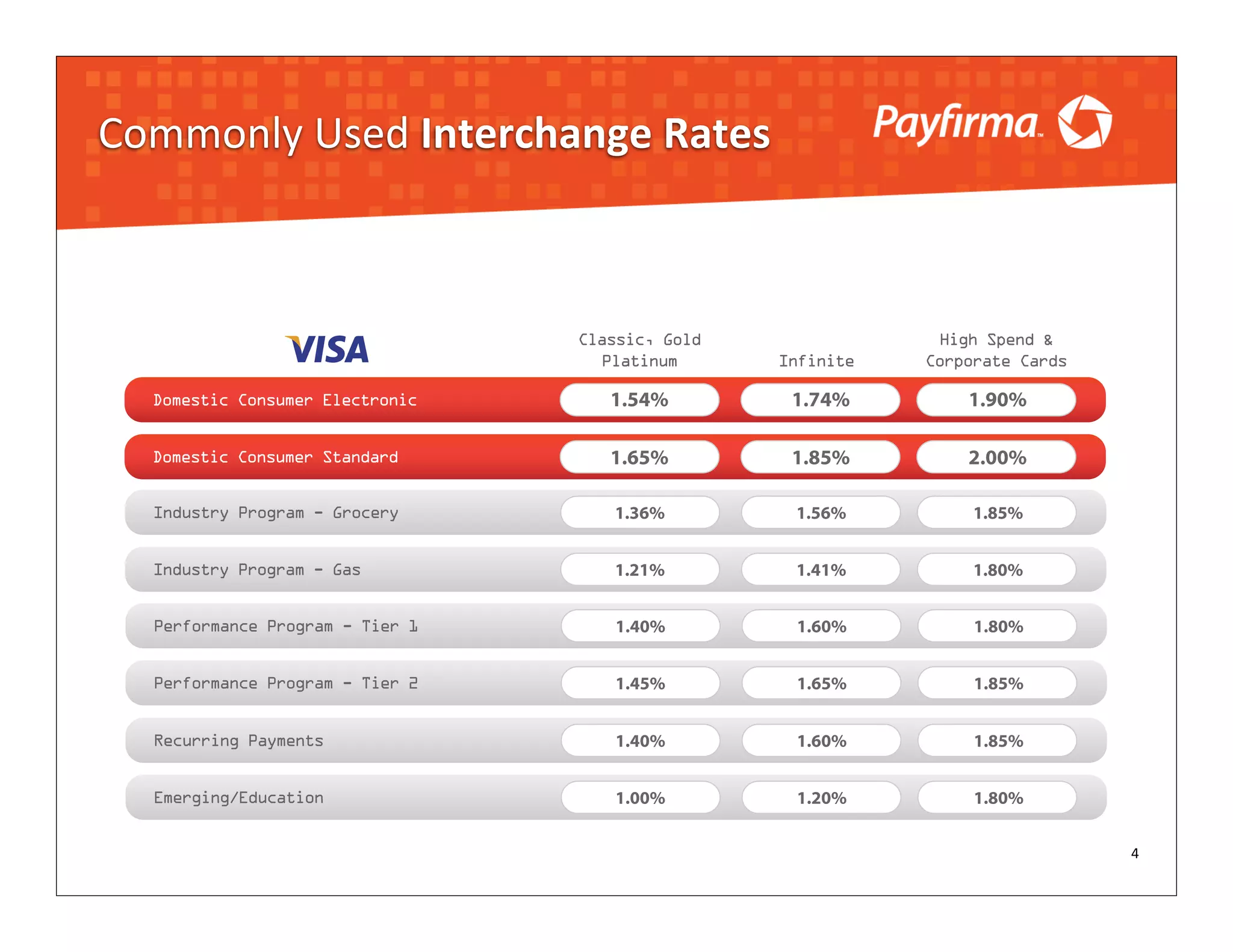

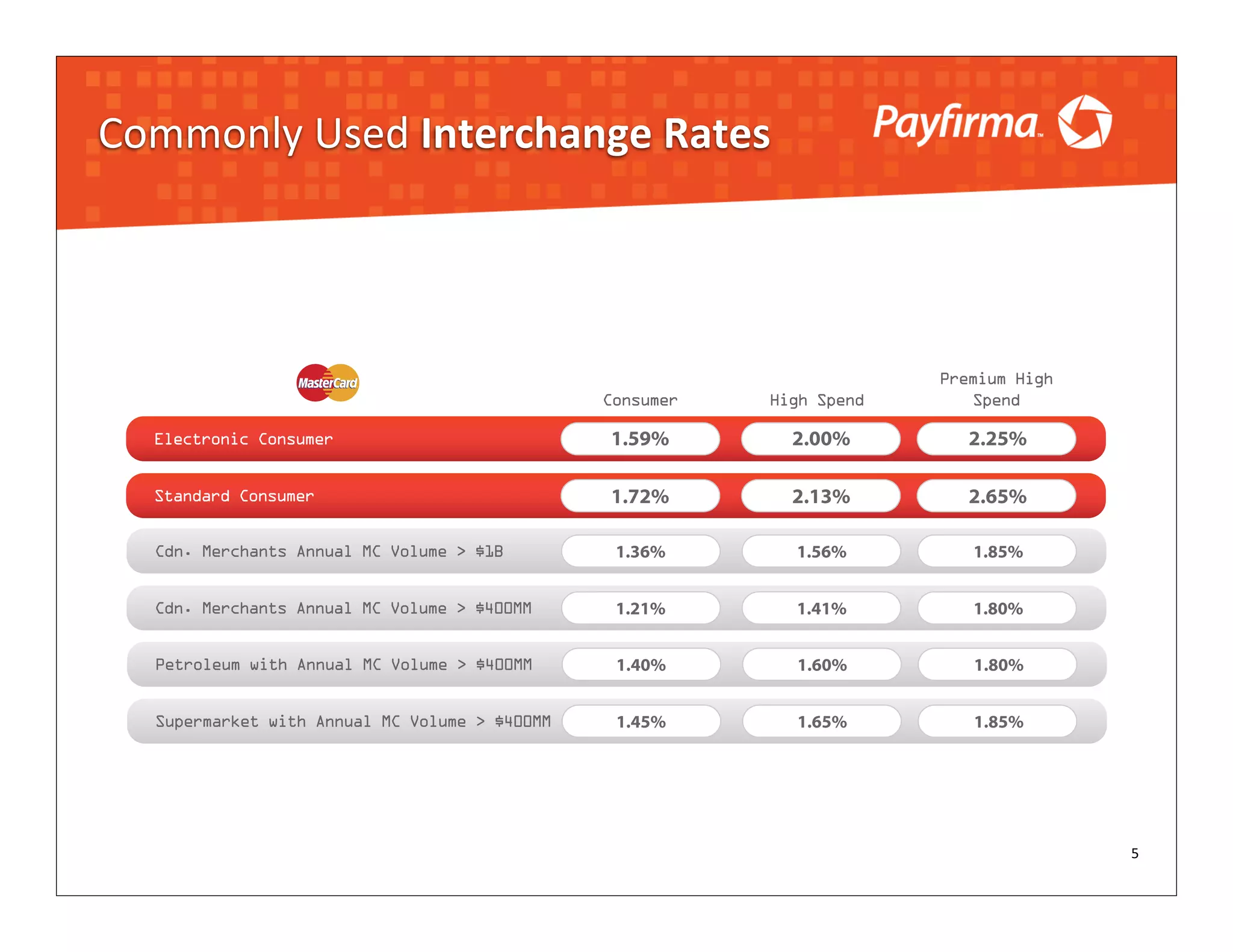

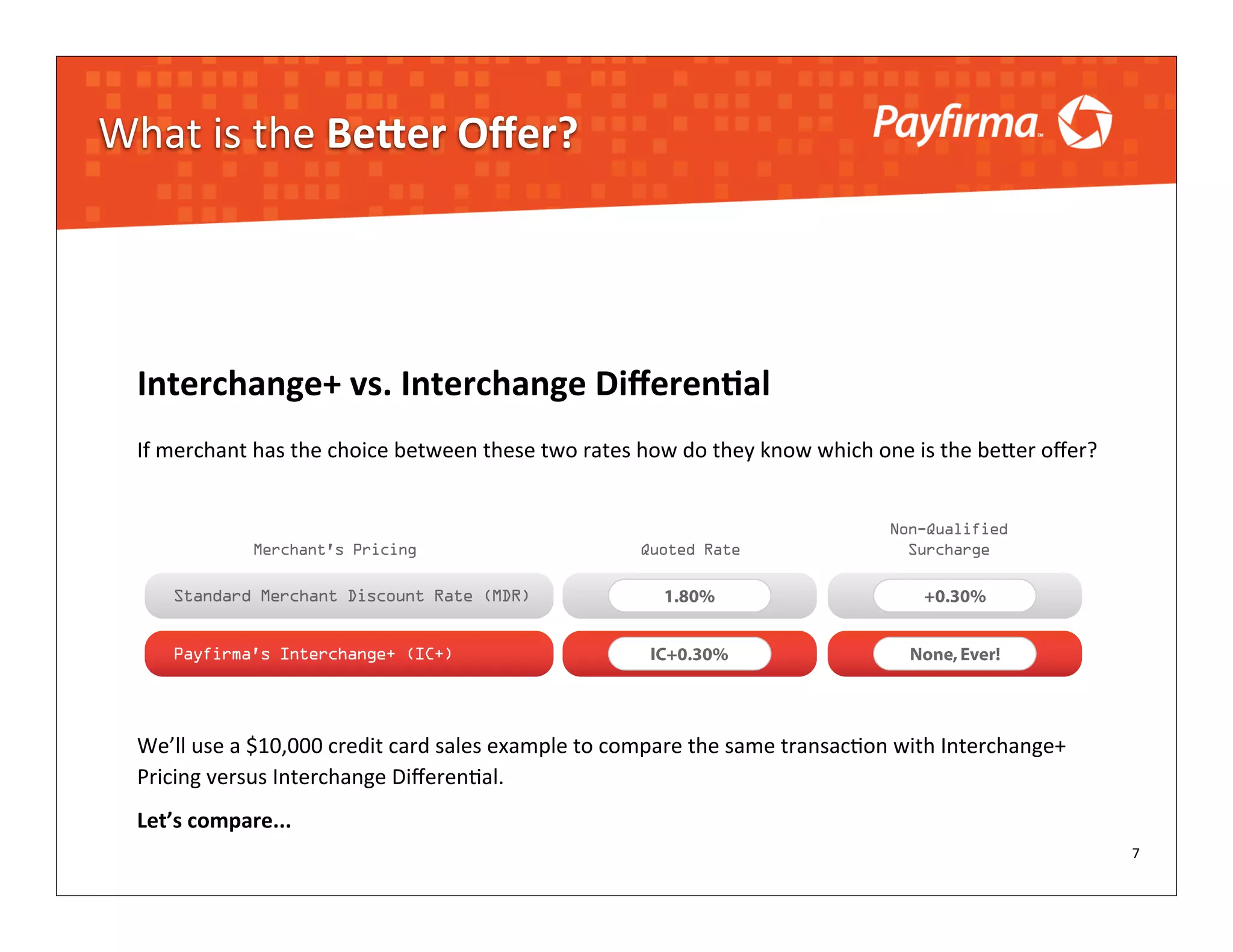

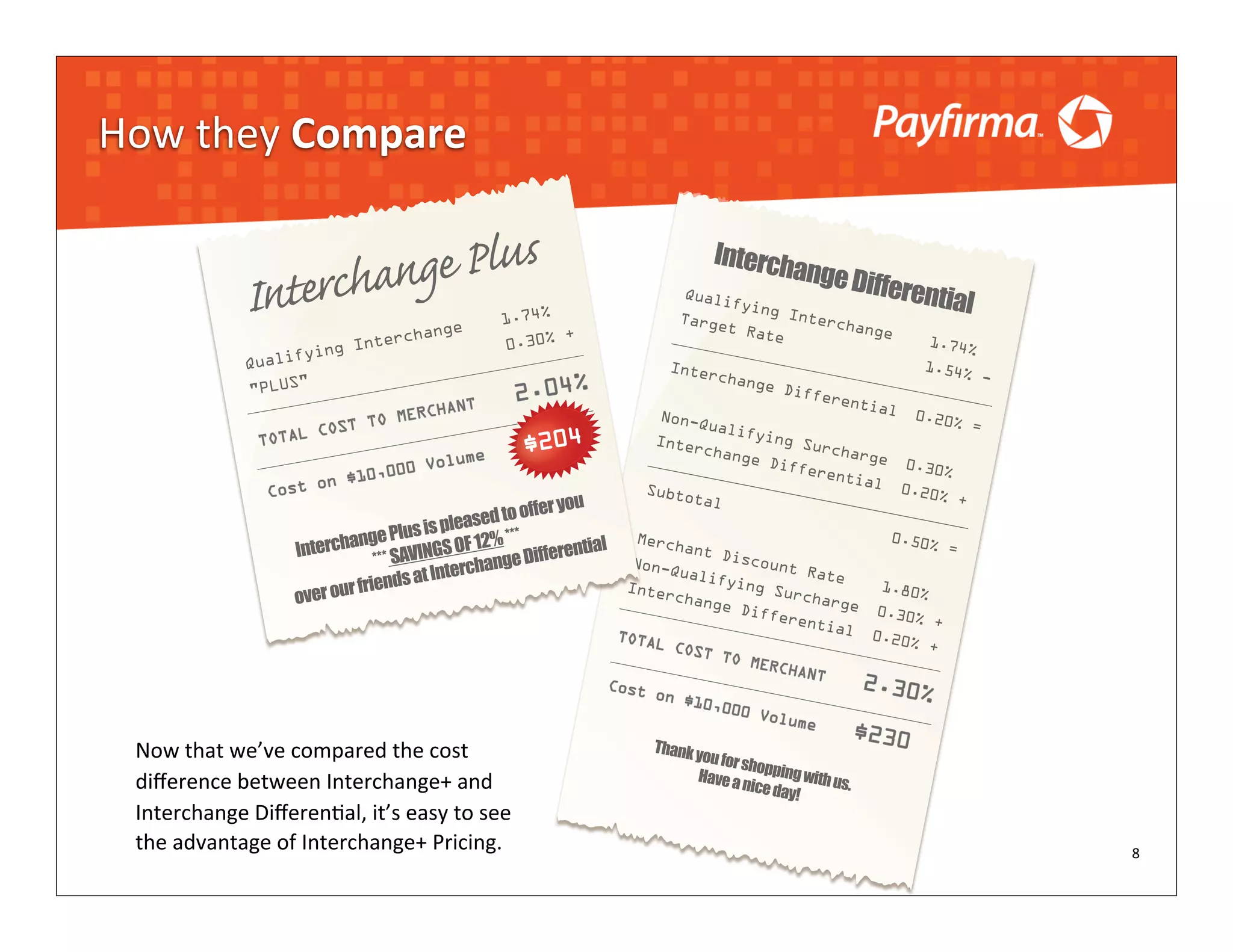

This document provides an overview of interchange plus pricing for credit card processing. It explains that interchange plus pricing passes on the actual interchange fees paid to card issuers and associations, plus a small markup to cover processing risks. This pricing model eliminates non-qualified fees and surcharges. The document uses an example to show that interchange plus pricing results in lower costs for merchants compared to interchange differential pricing. It encourages merchants to switch to interchange plus pricing for savings and transparency.