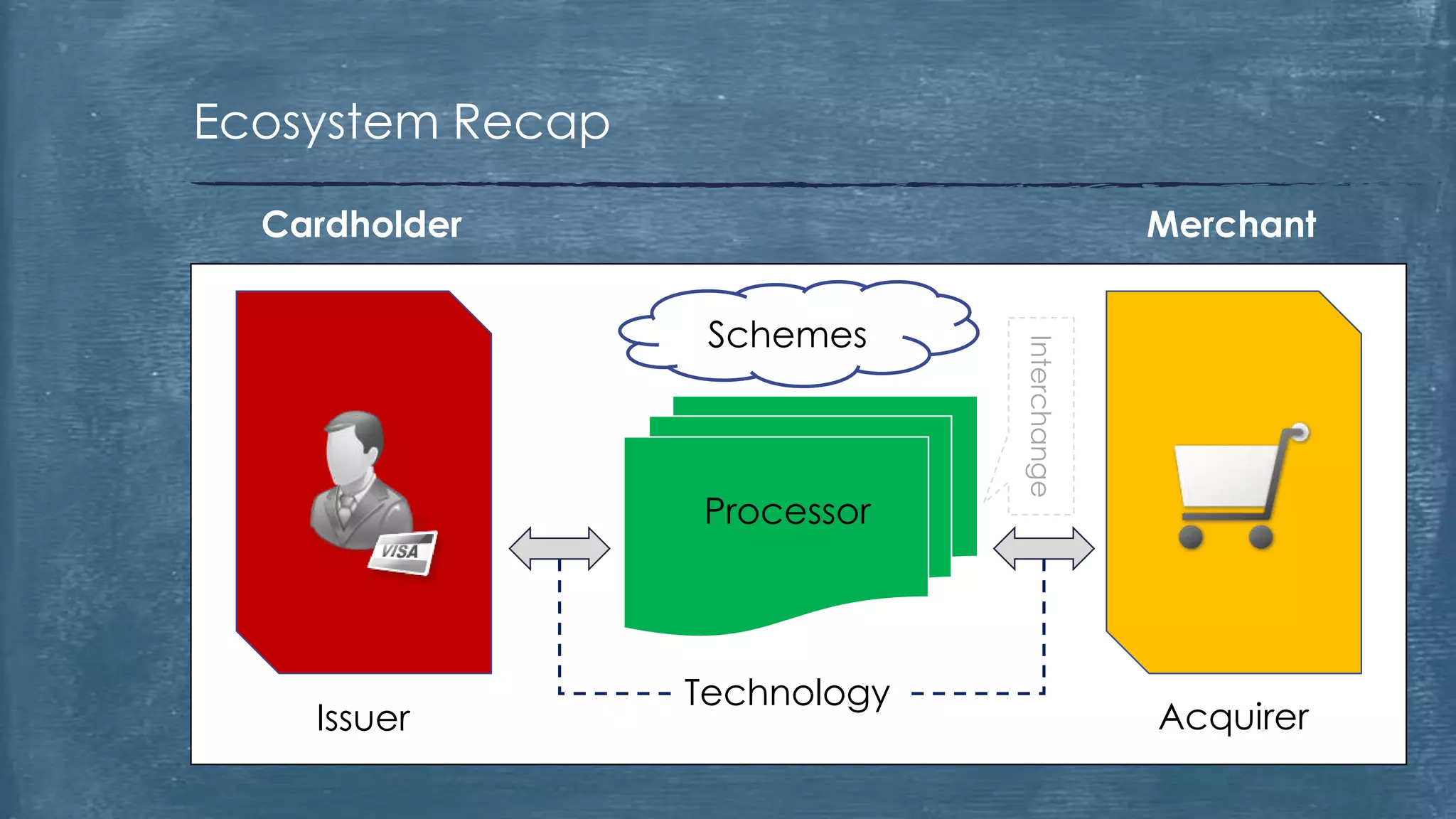

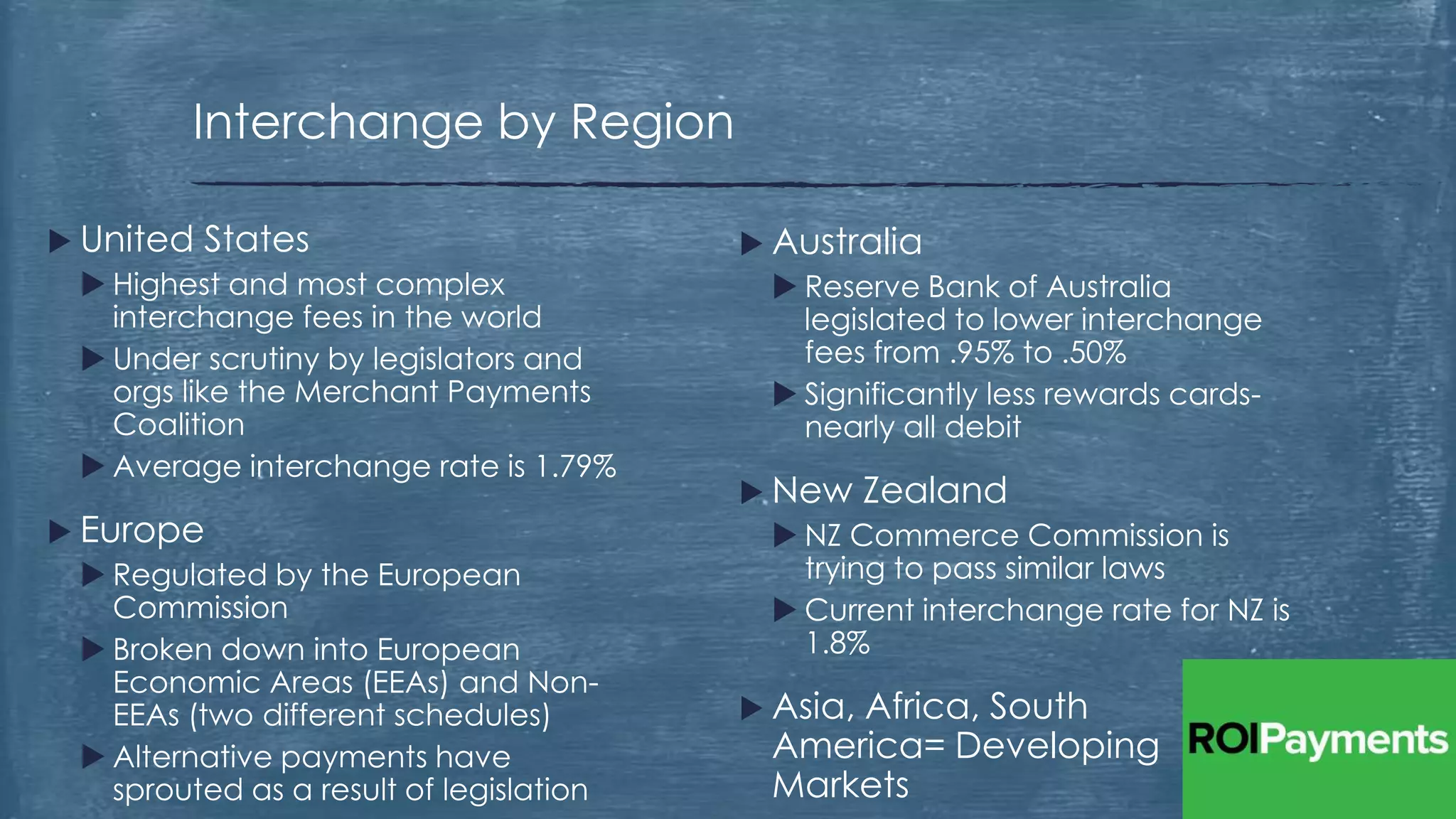

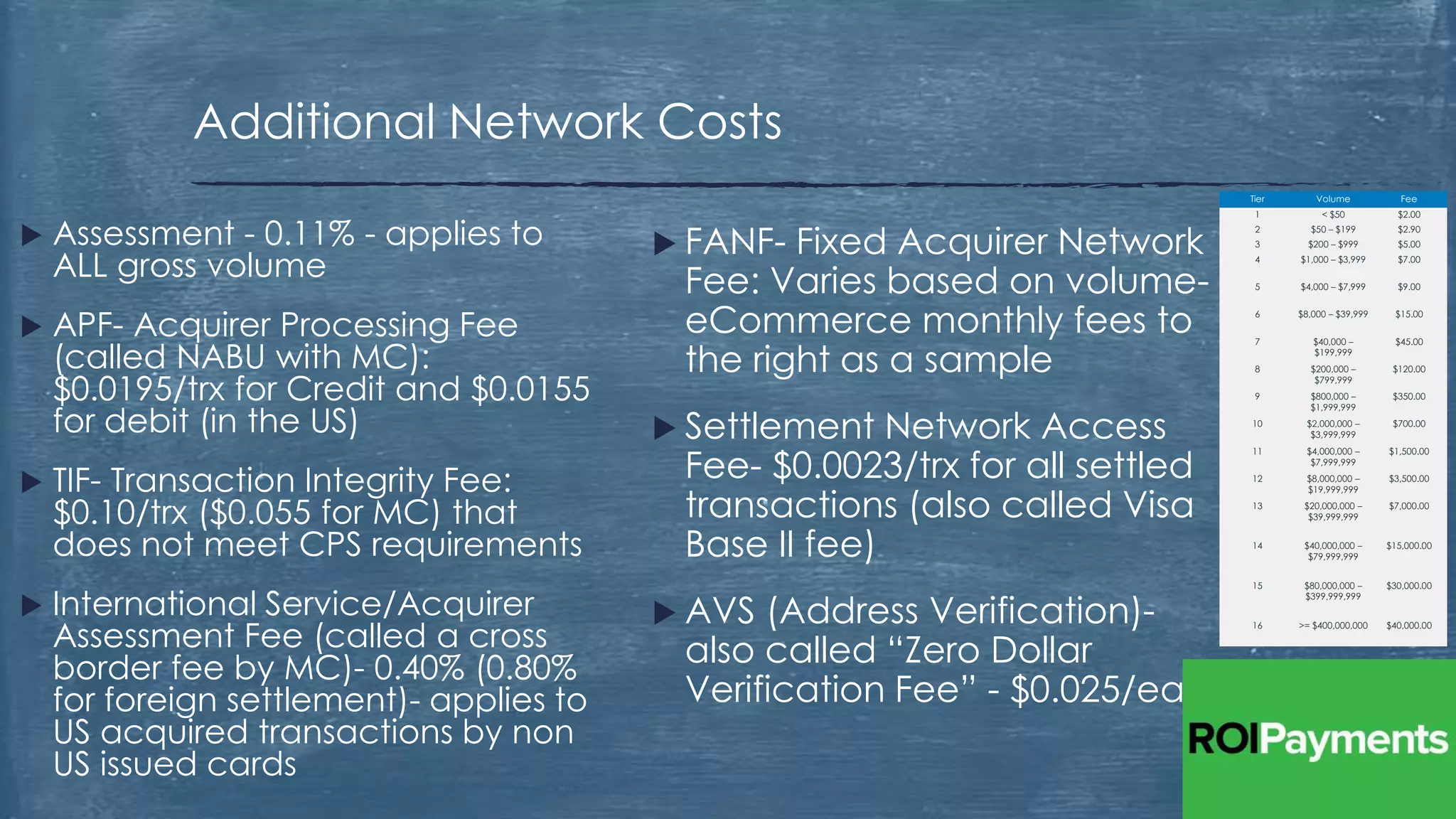

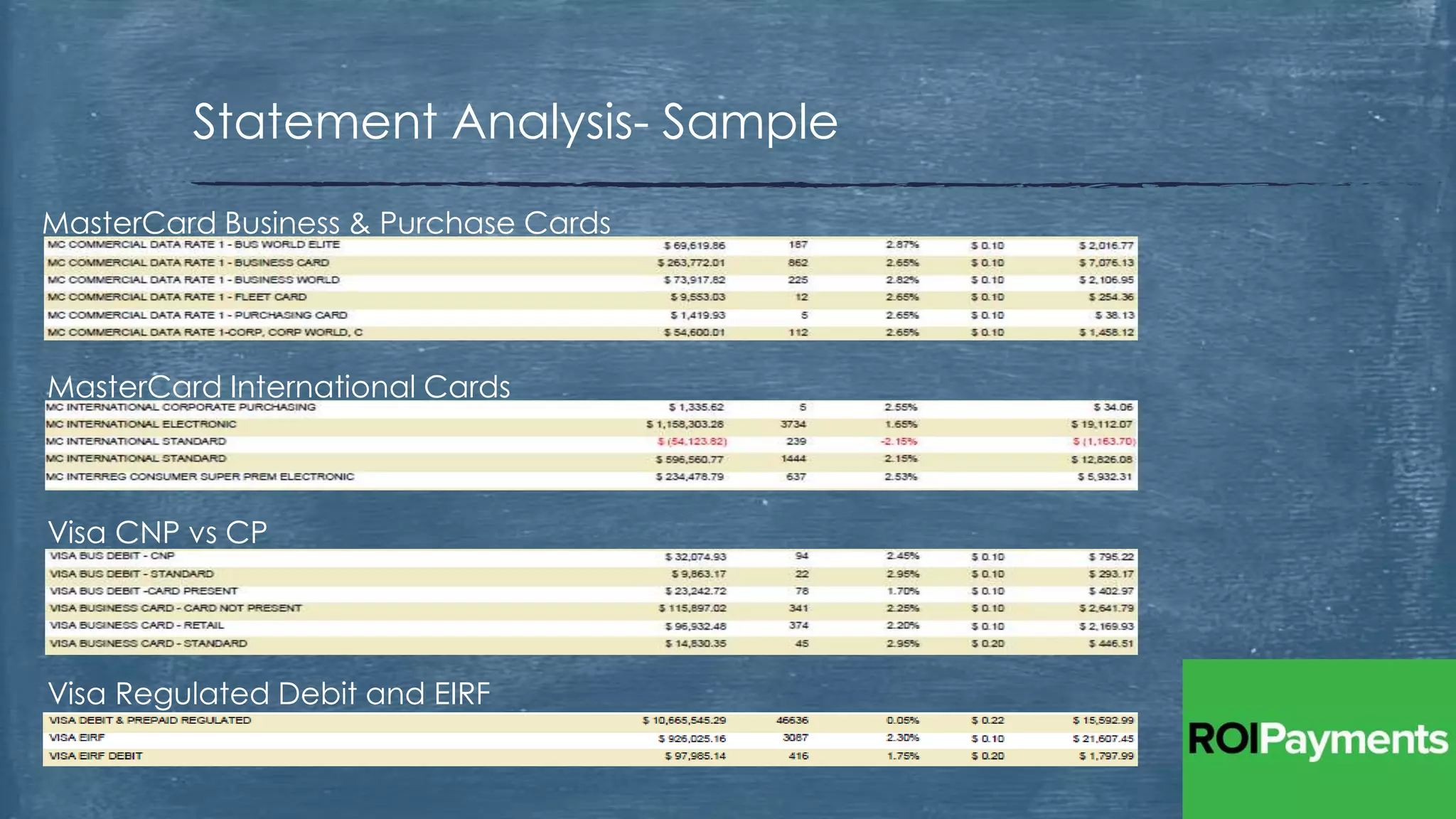

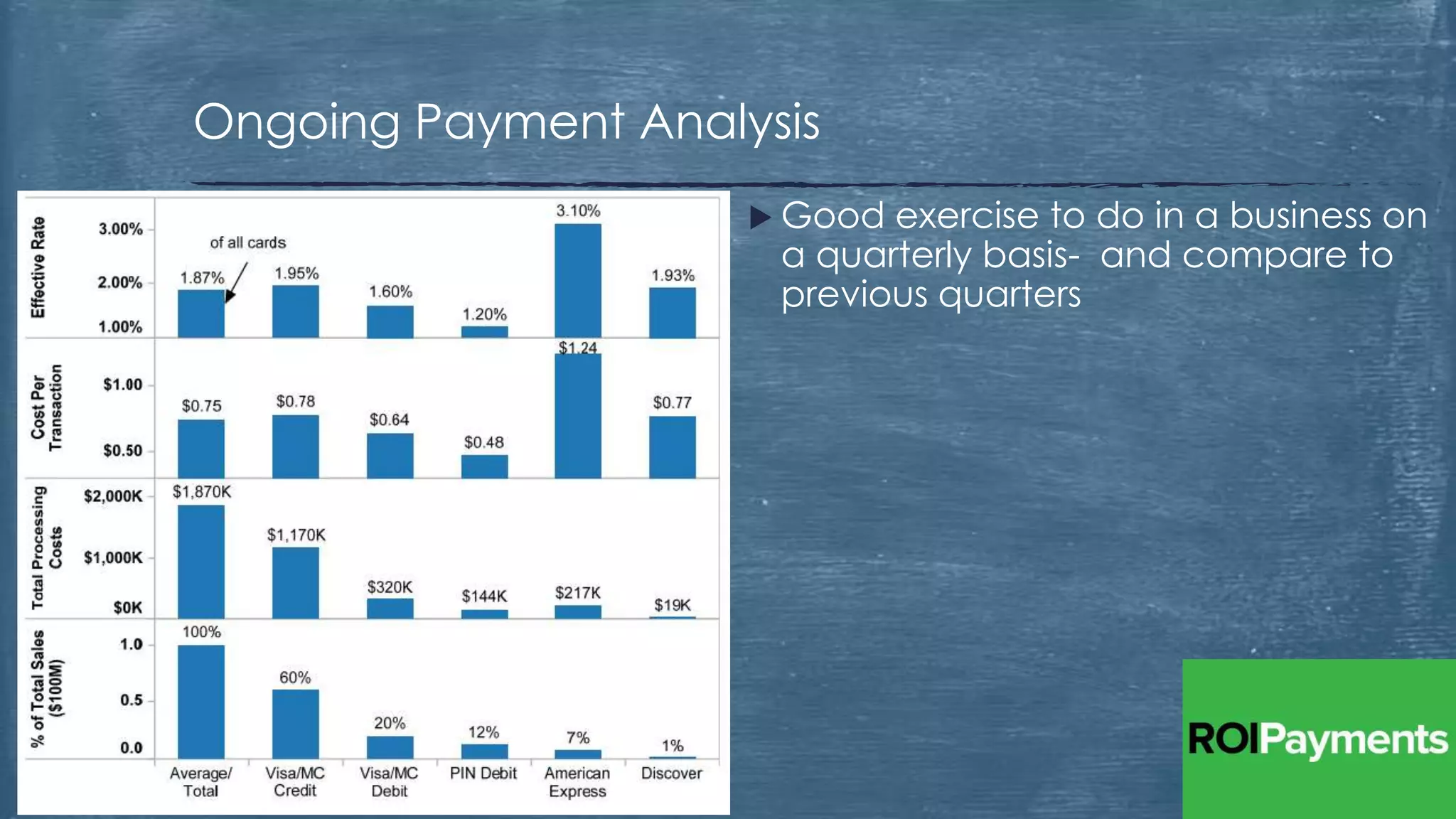

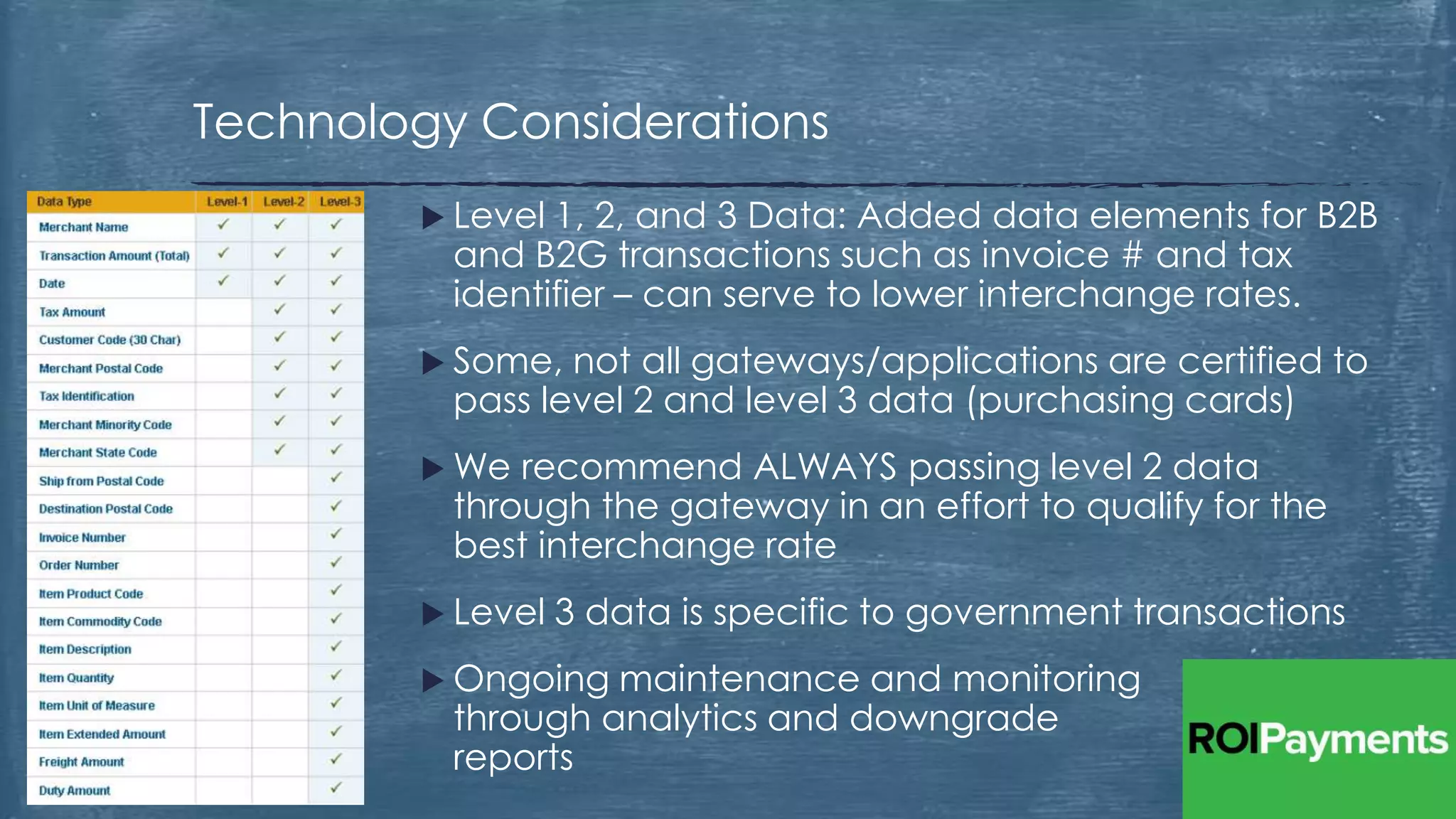

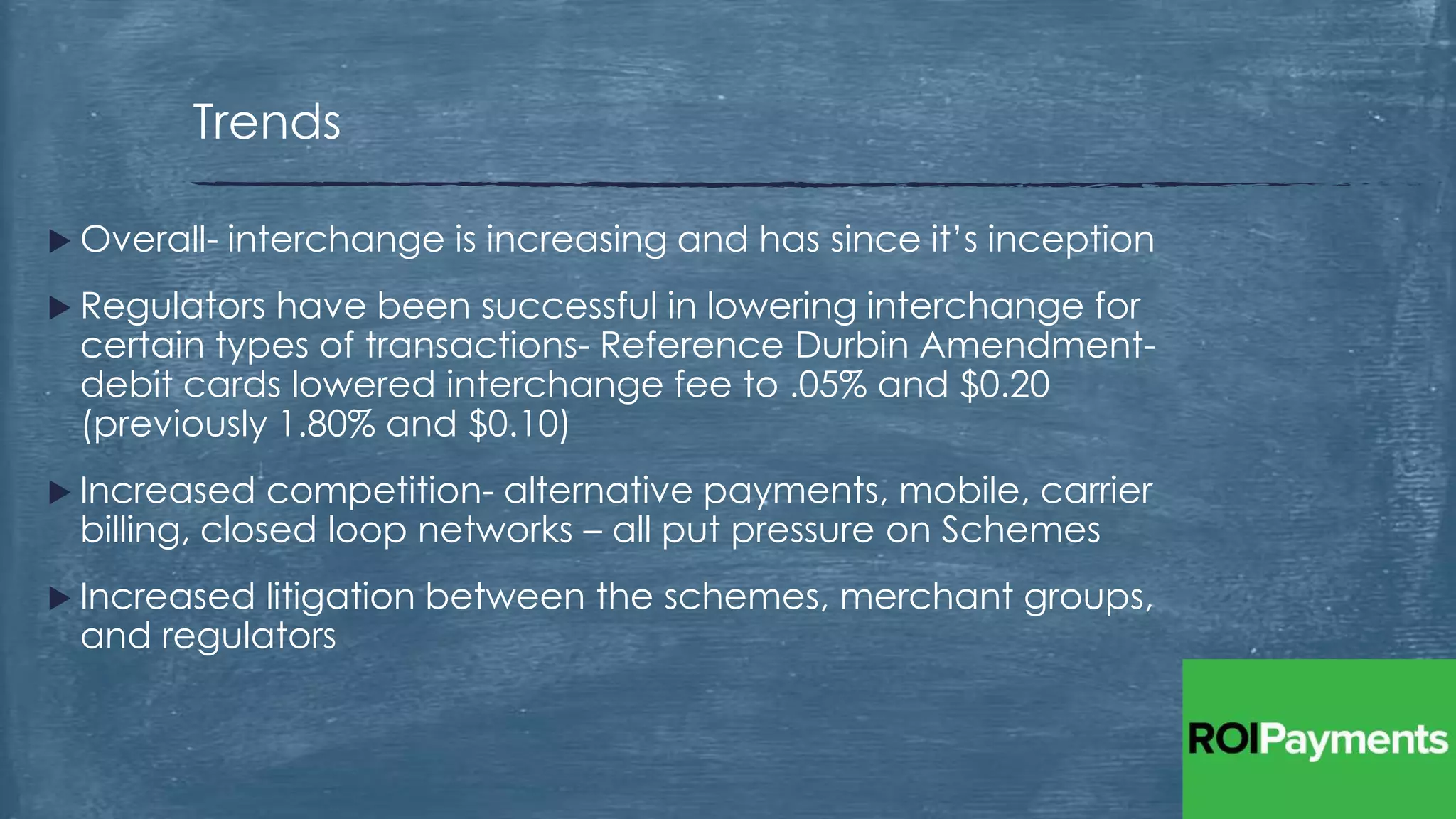

The document outlines a boot camp presentation on improving payment IQ, focusing on understanding interchange and its complexities, particularly in the U.S. It discusses the roles of various stakeholders in the payment ecosystem, interchange fees by region, and strategies for optimizing payments to lower costs. The session emphasizes the importance of comprehensive knowledge in navigating the rapidly evolving payment landscape.