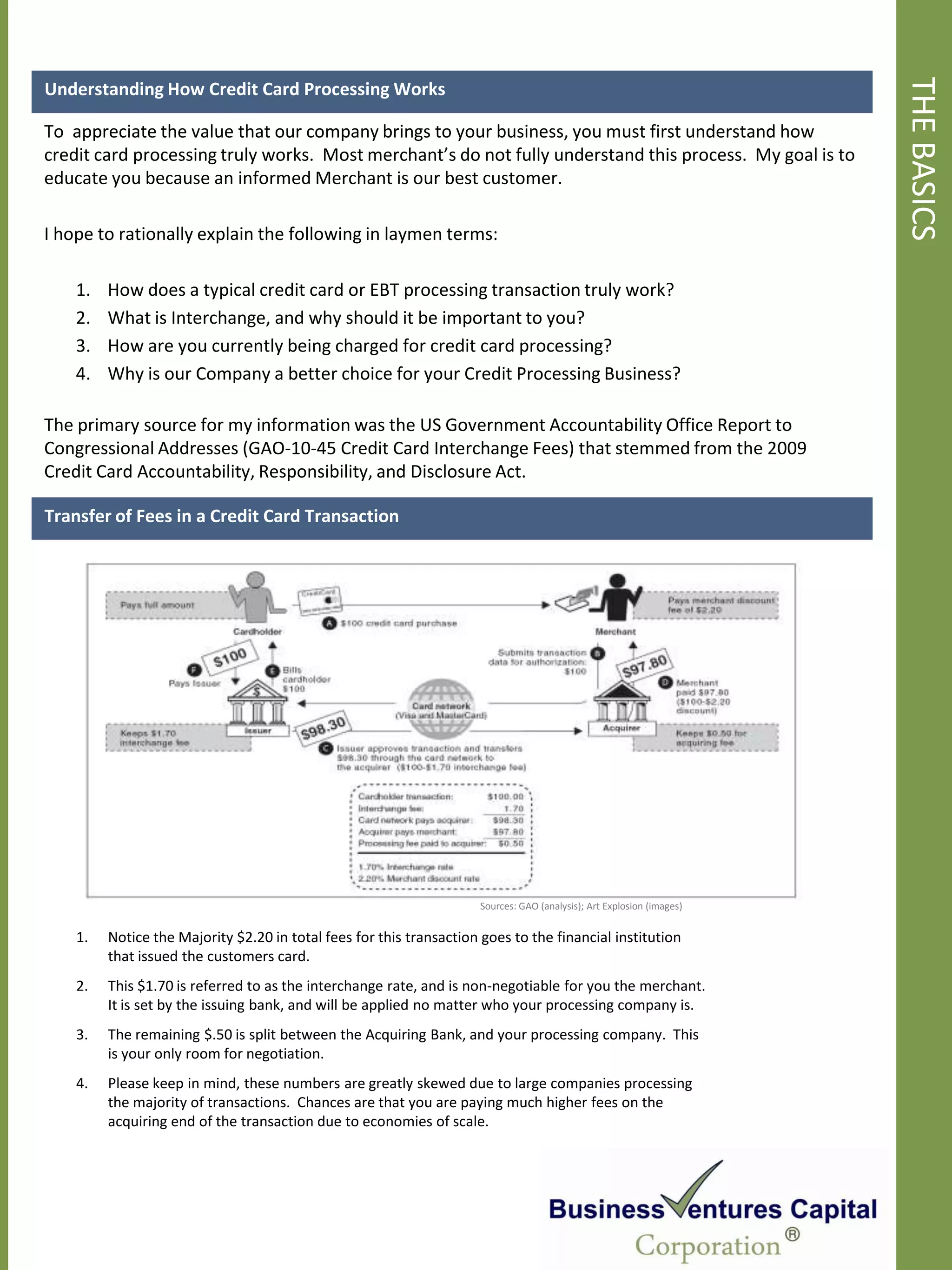

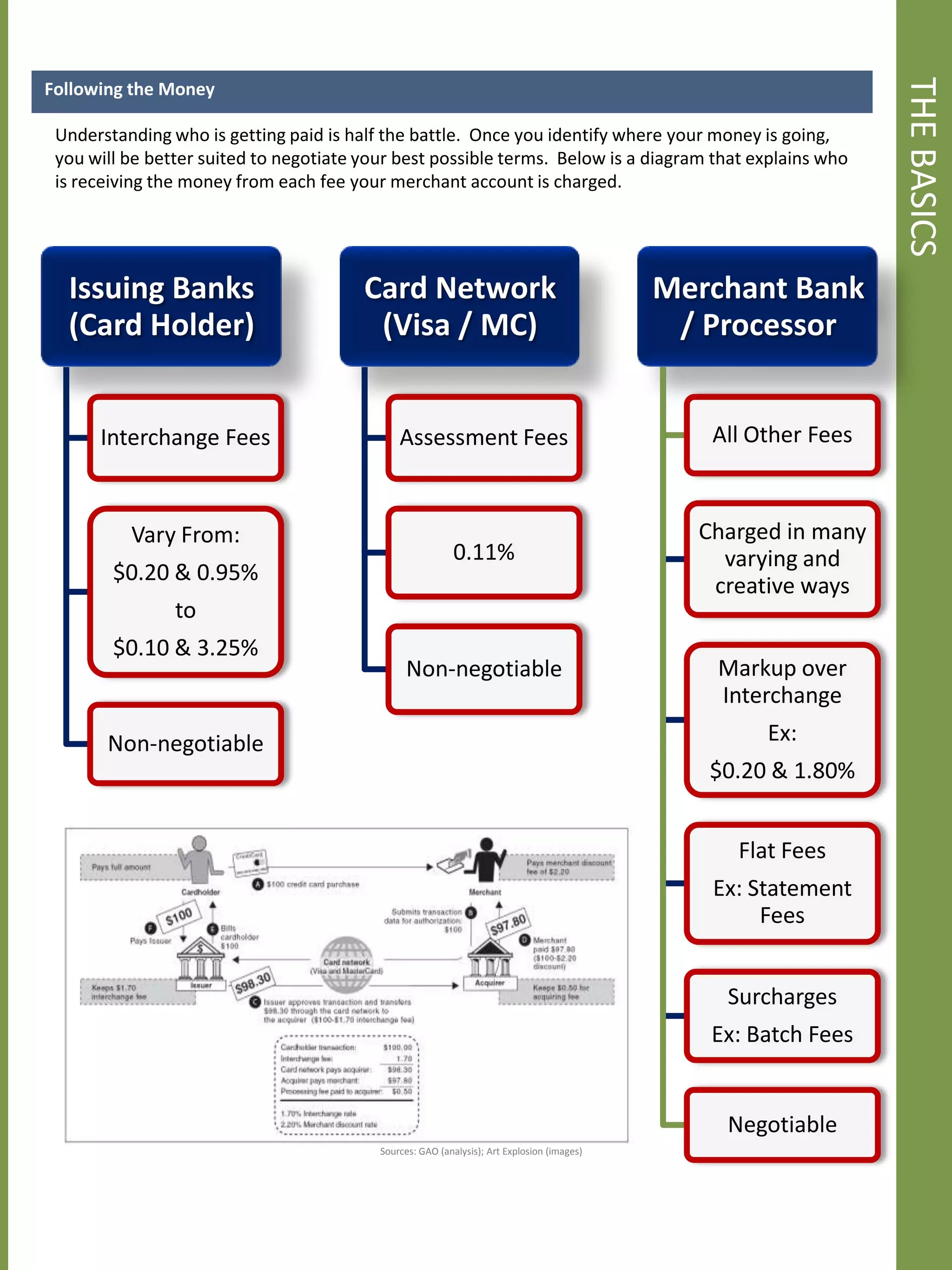

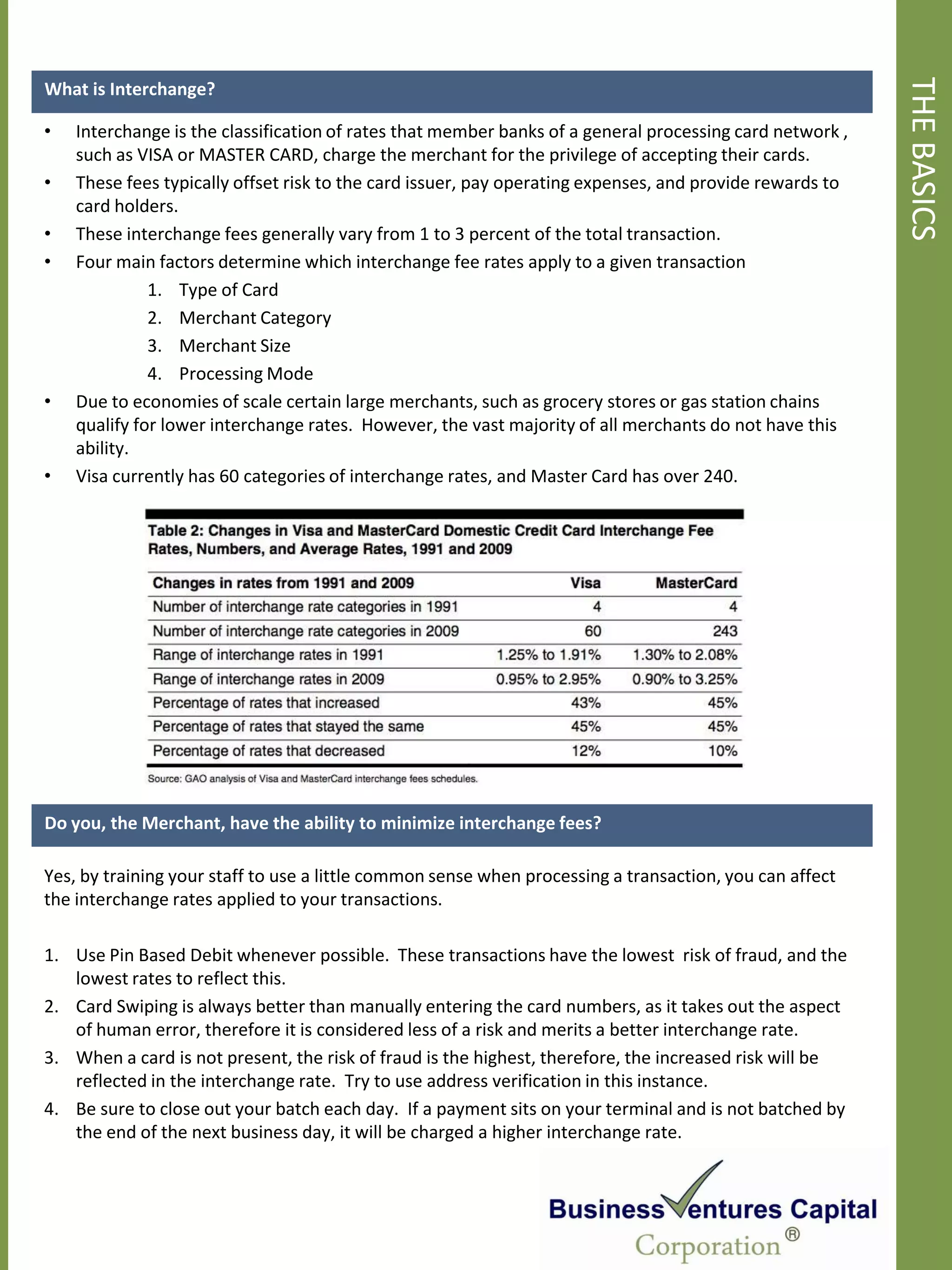

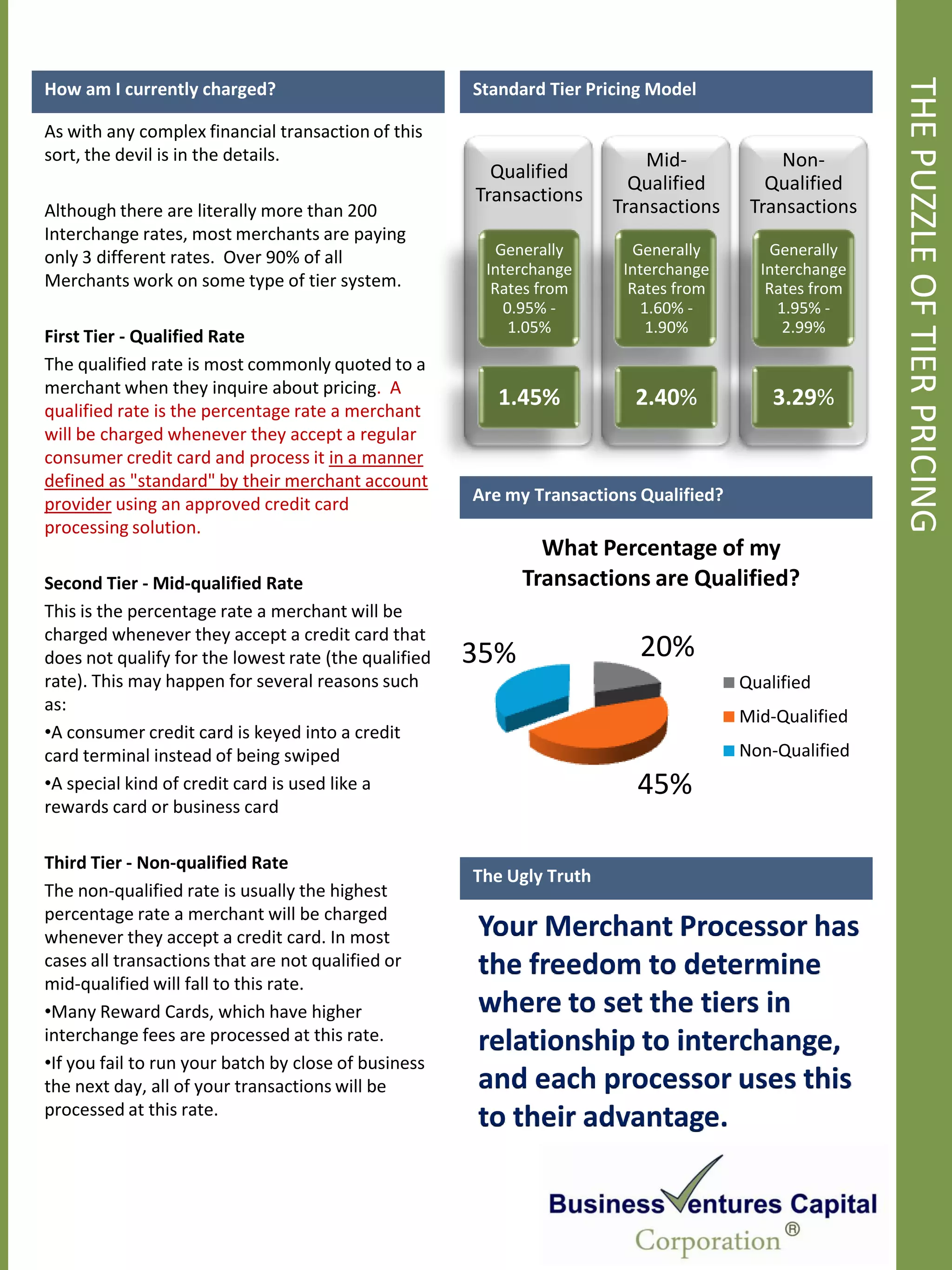

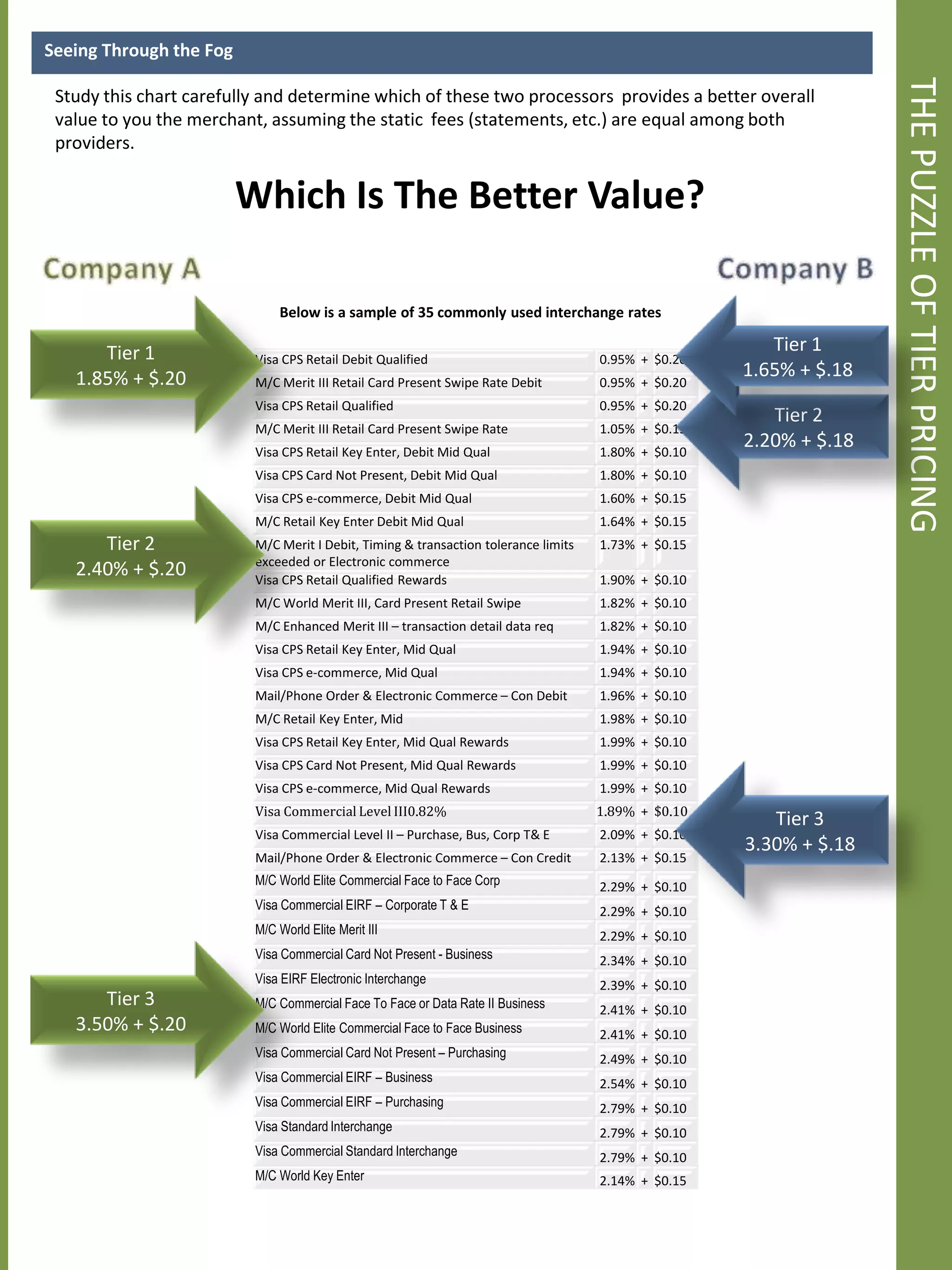

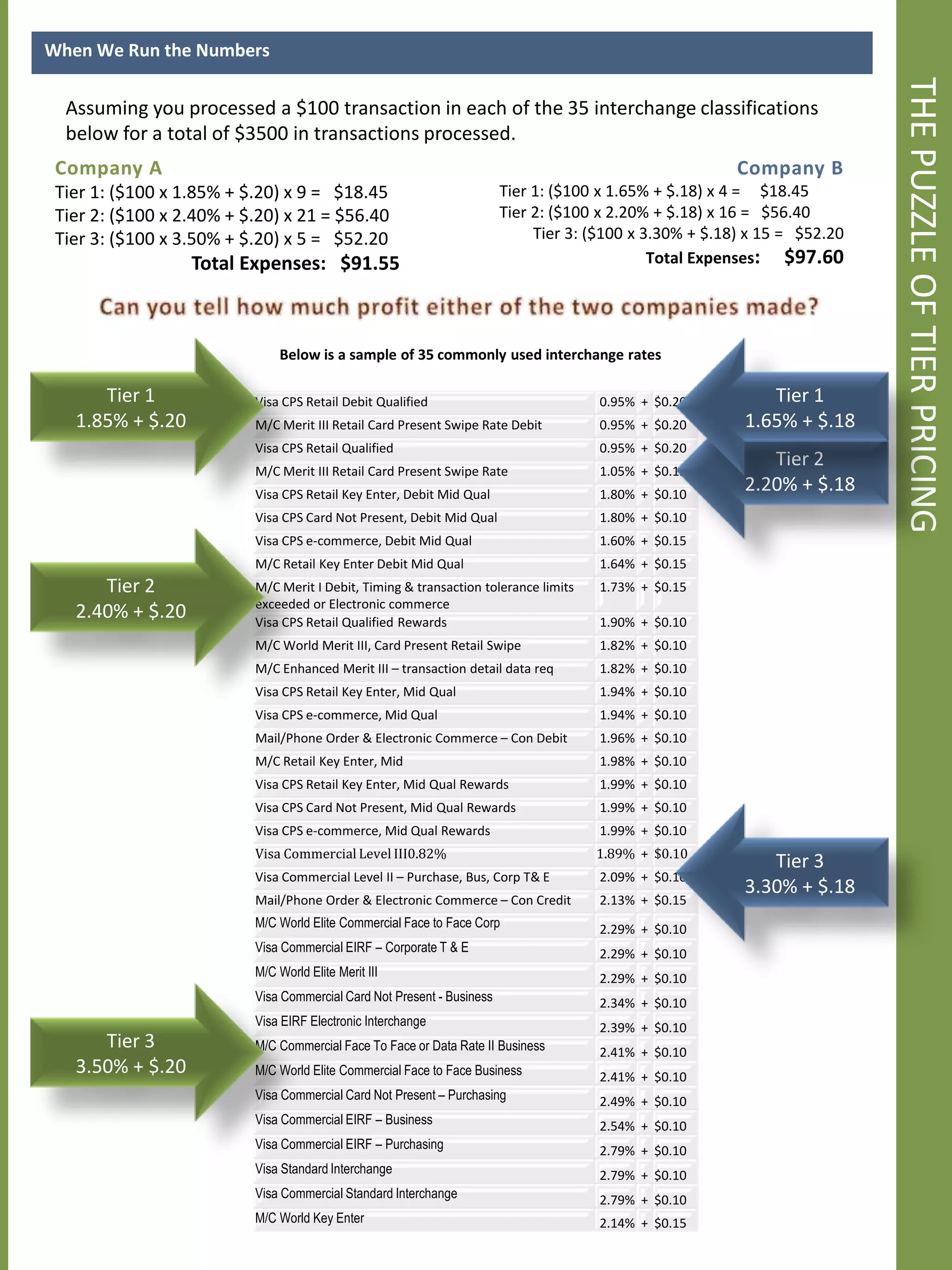

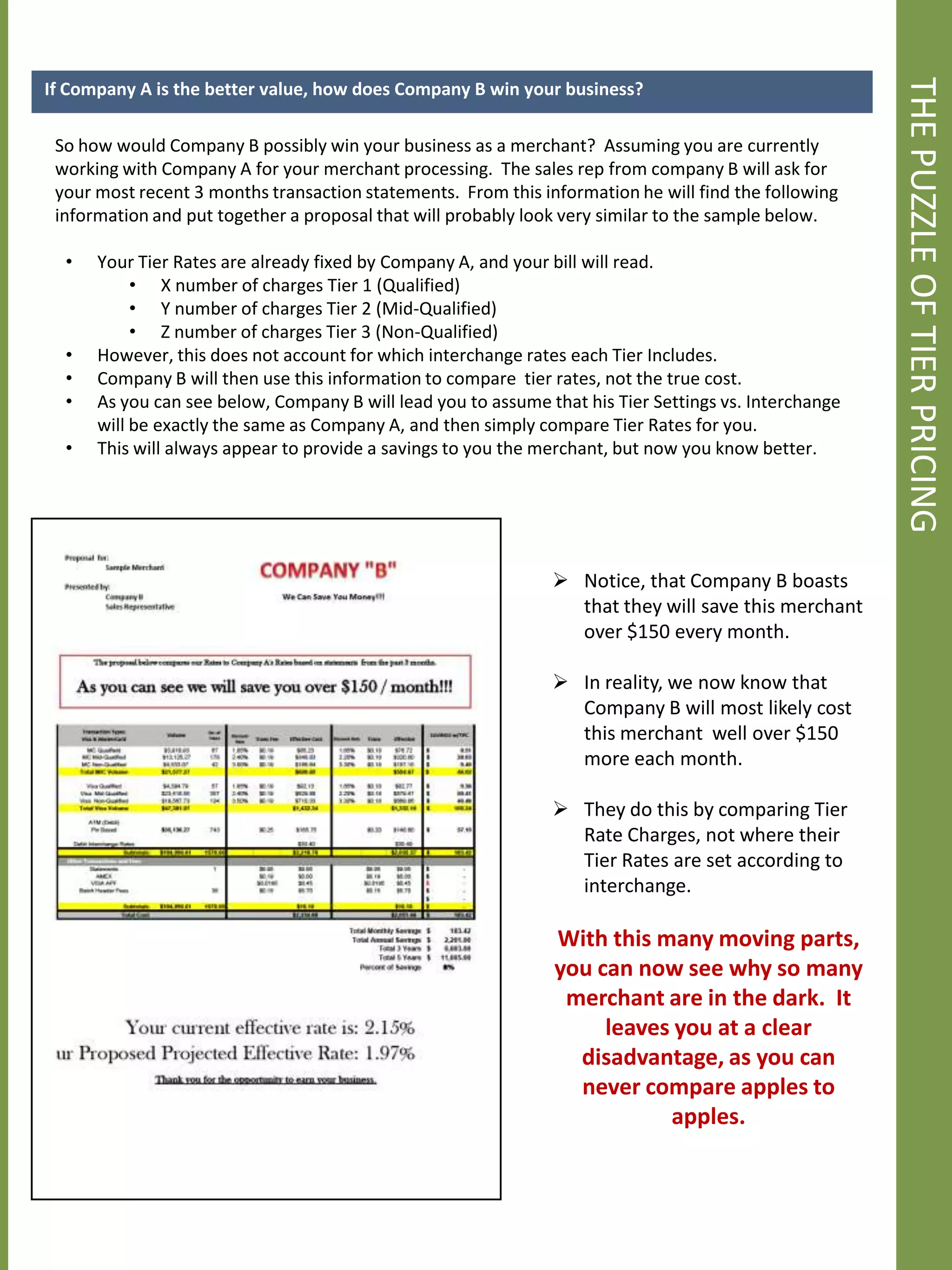

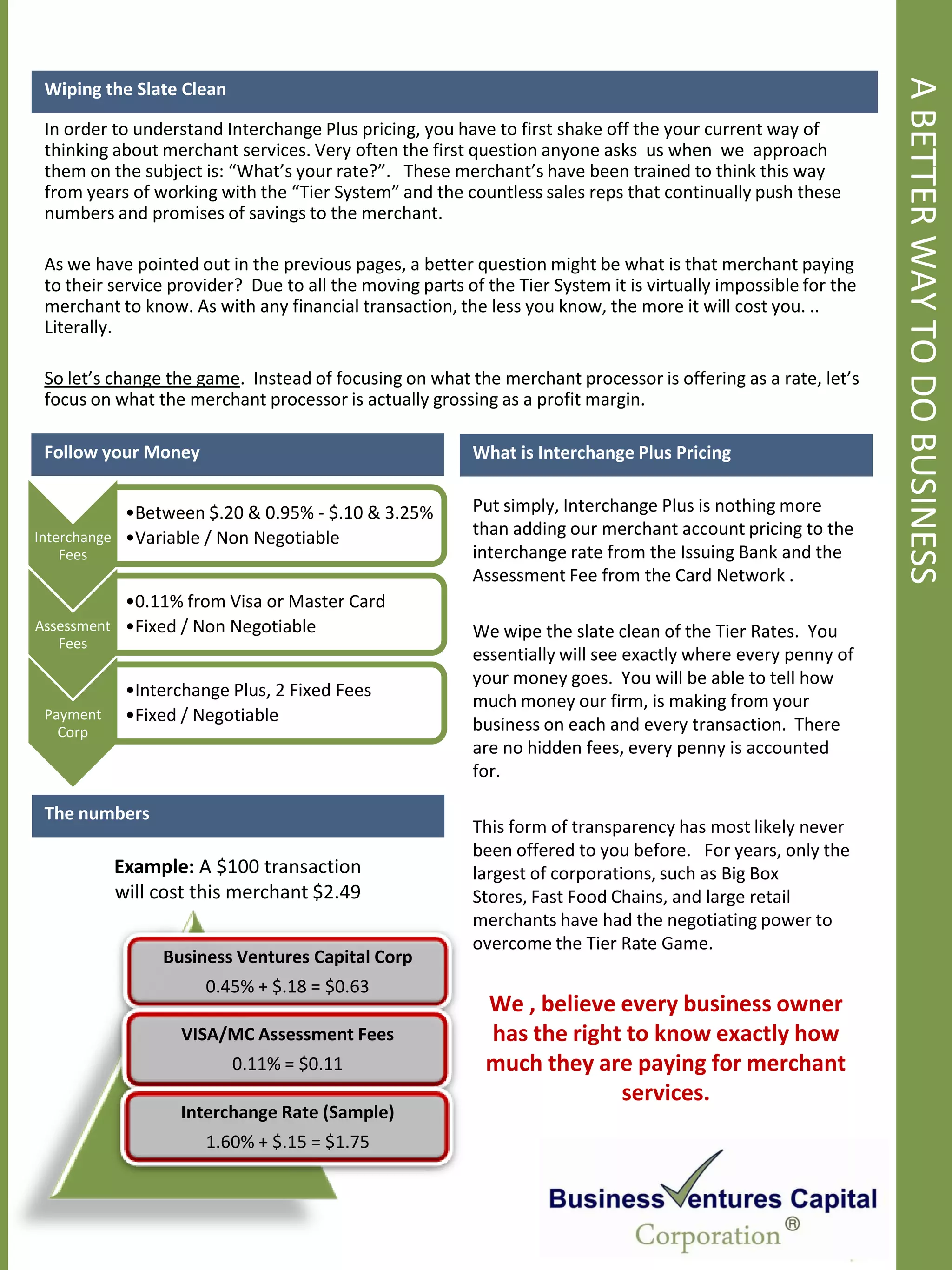

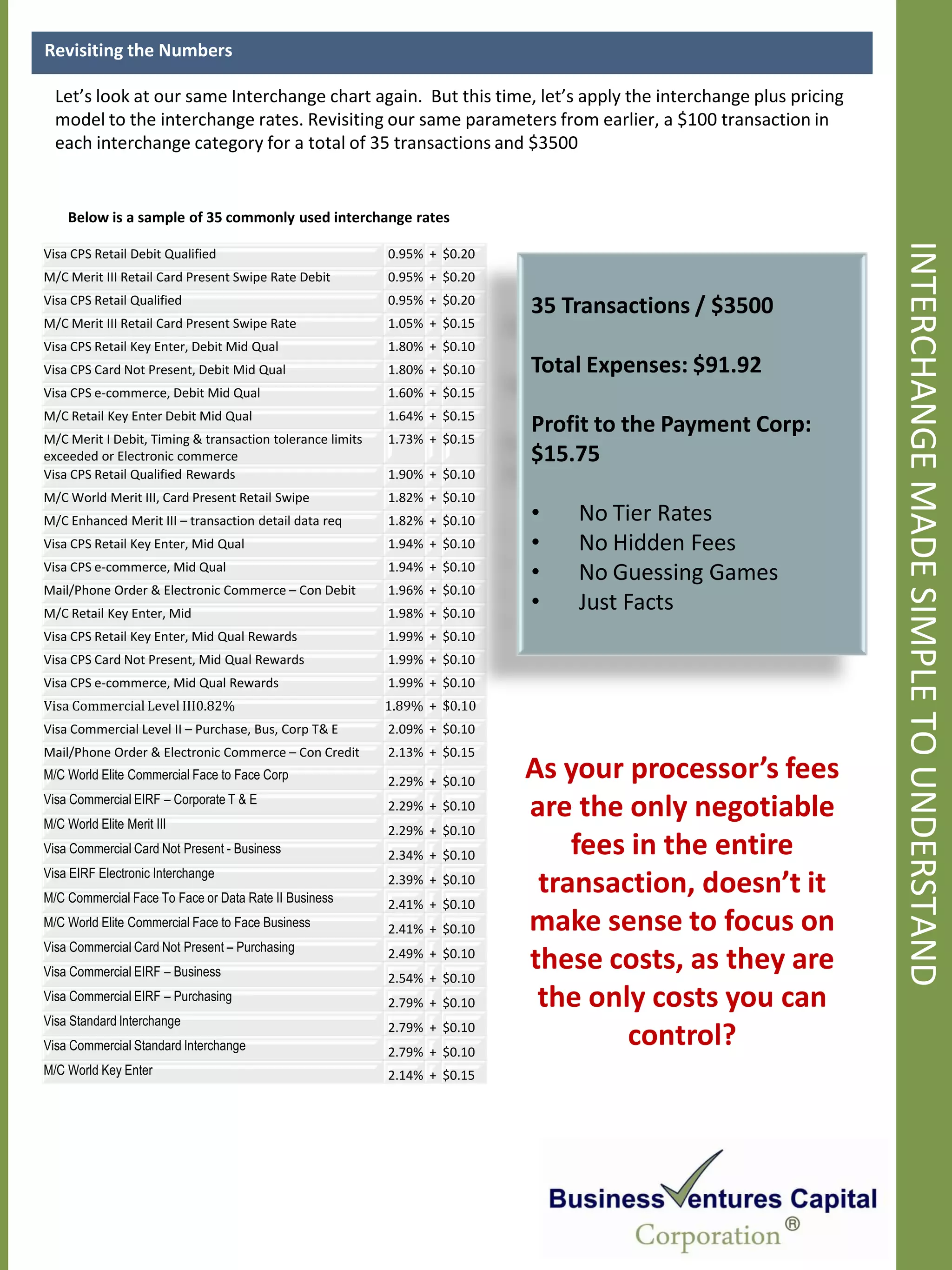

This document discusses how credit card processing works and the fees involved. It explains that most of the fees from a credit card transaction, such as interchange fees, are set and non-negotiable. It goes on to describe how merchants are typically charged different rates depending on what tier their transactions fall into. While most merchants see only 3 tiers, there are actually over 200 possible interchange rates. The document warns that processors can manipulate the tier structure to their advantage, potentially charging merchants higher rates. It provides an example to illustrate how two different processors might tier the rates differently, even for the same transactions, resulting in higher costs for the merchant with one processor over the other. The key information is that interchange fees are out of a merchant