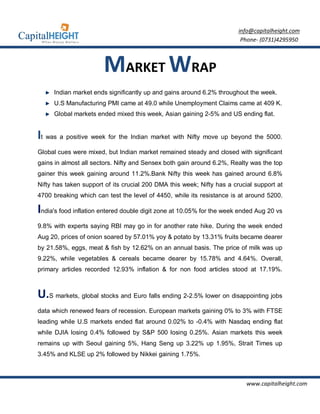

The weekly newsletter reports that the Indian equity market experienced significant gains, with the Nifty index rising over 6% and closing above 5000. While global markets had mixed performances due to disappointing U.S. economic data, the Indian market remained steady, particularly in the real estate sector. Additionally, food inflation reached 10.05%, prompting speculation about potential rate hikes from the Reserve Bank of India.