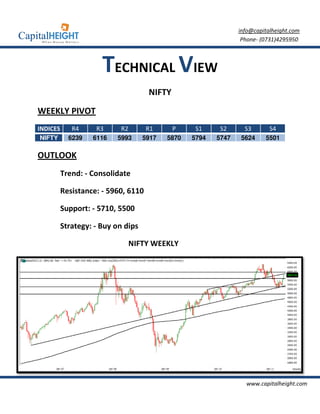

The weekly newsletter provides a summary of the Indian and global equity markets for the past week. Domestically, the Nifty ended slightly higher while the Sensex was flat. Food inflation declined but fuel inflation remained unchanged. Globally, markets were also flat with small gains as crude oil prices rose. The technical outlook is for the Nifty to consolidate between support at 5710-5500 and resistance at 5960-6110.