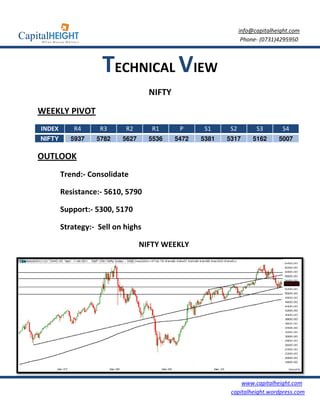

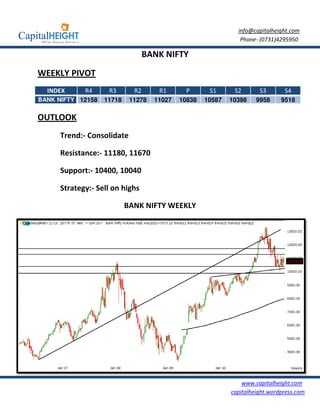

The weekly newsletter provides a market wrap of the Indian equity market ending down 1.70% on geopolitical tensions and a natural disaster in Japan. Key indices like Nifty fell below 5500 and Sensex dropped over 300 points. Market performance data lists the top gainers like Tata Coffee up 51% and top losers like Mphasis down 31%. Global market indices also ended lower with declines of 1-4%. A technical analysis sees Nifty support at 5300 and resistance at 5610/5790 while Bank Nifty support is at 10400 and resistance at 11180/11670.