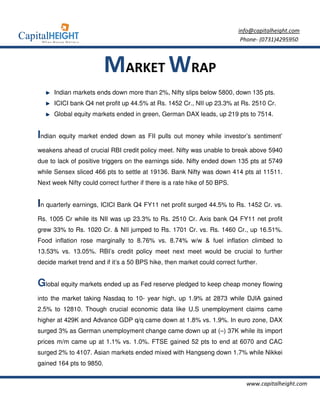

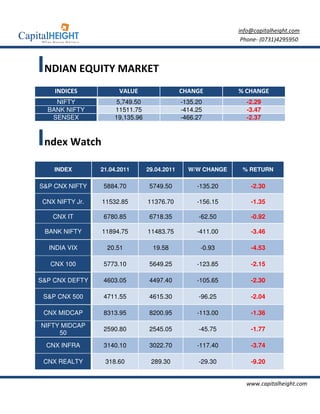

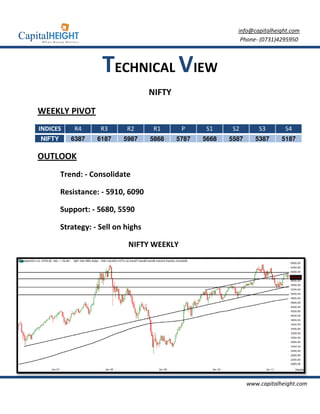

The newsletter reports on a significant decline in Indian equity markets, with the Nifty index falling below 5800, amid weak investor sentiment ahead of an RBI credit policy meeting. Major banks like ICICI and Axis Bank reported strong quarterly earnings, while food and fuel inflation saw slight increases. Global markets performed well, influenced by the Federal Reserve's commitment to economic support, although Indian markets may face further corrections if interest rates rise.