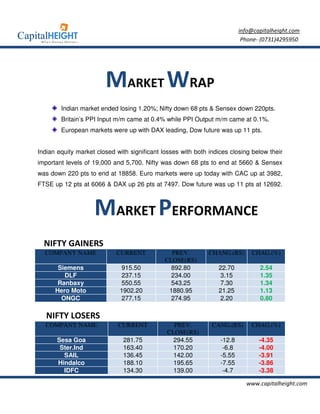

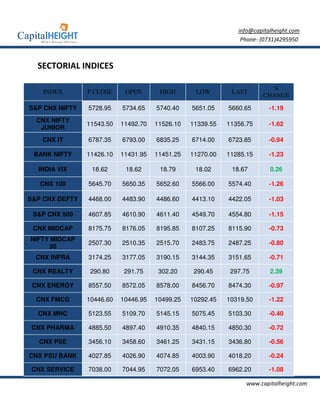

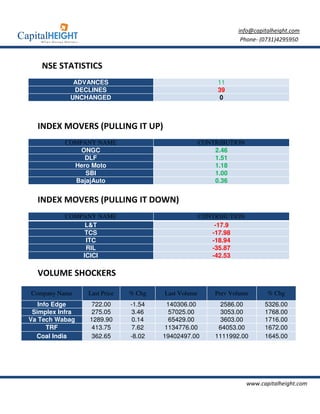

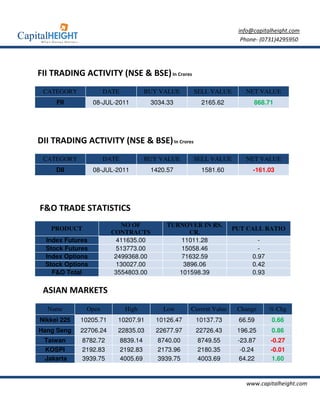

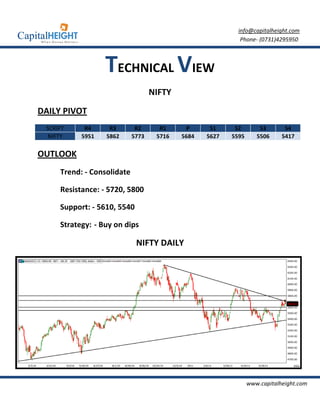

The Indian equity market showed resilience with the Nifty rising by 33 points to 5660, marking the third consecutive week of gains despite closing below critical psychological levels. Food price inflation eased to 7.61%, while fuel inflation remained at 12.67%, suggesting potential for continued softness in price rises. Global markets also ended positively, with U.S. unemployment claims dropping and Asian markets gaining, though European markets exhibited mixed performance.