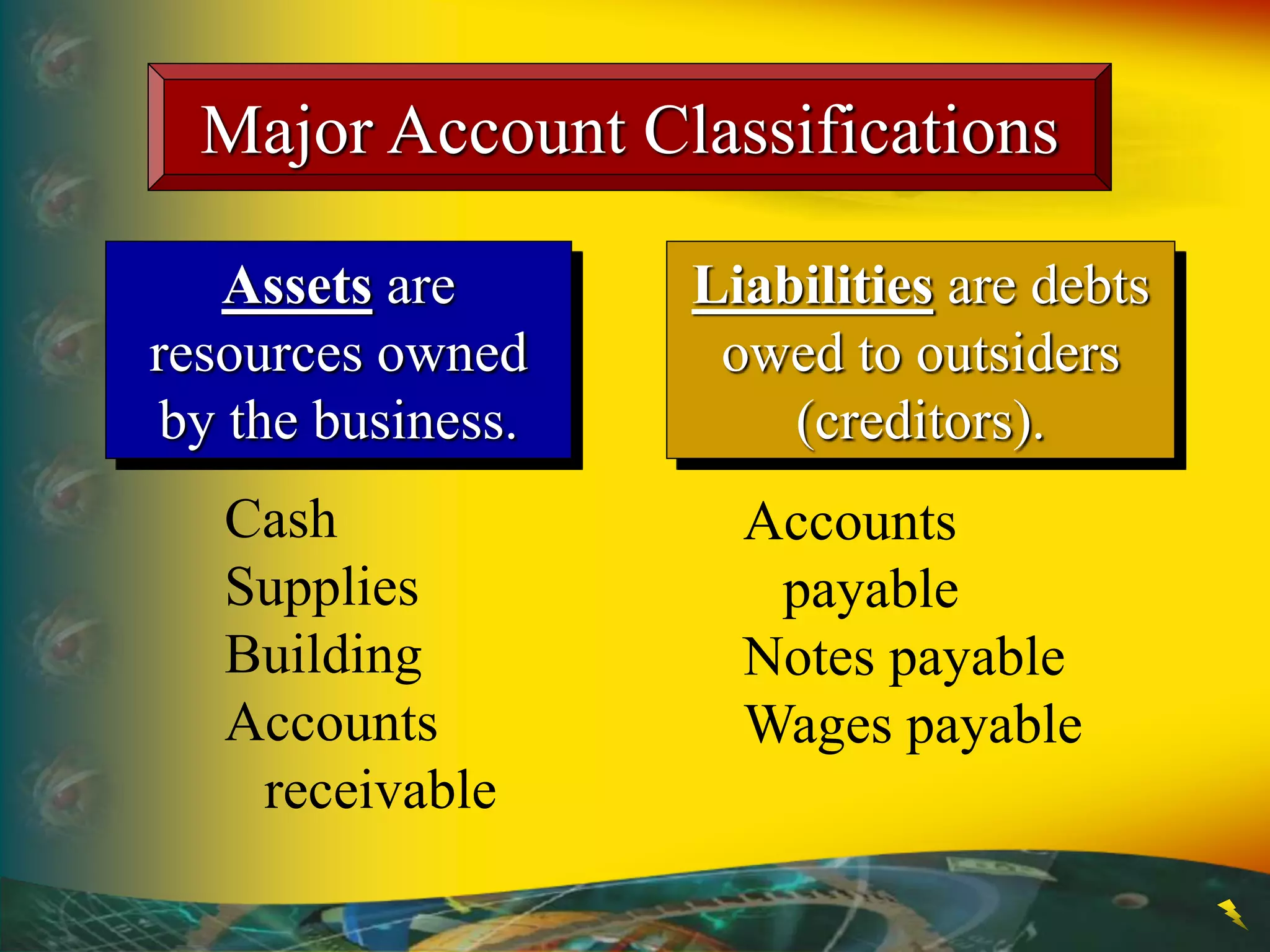

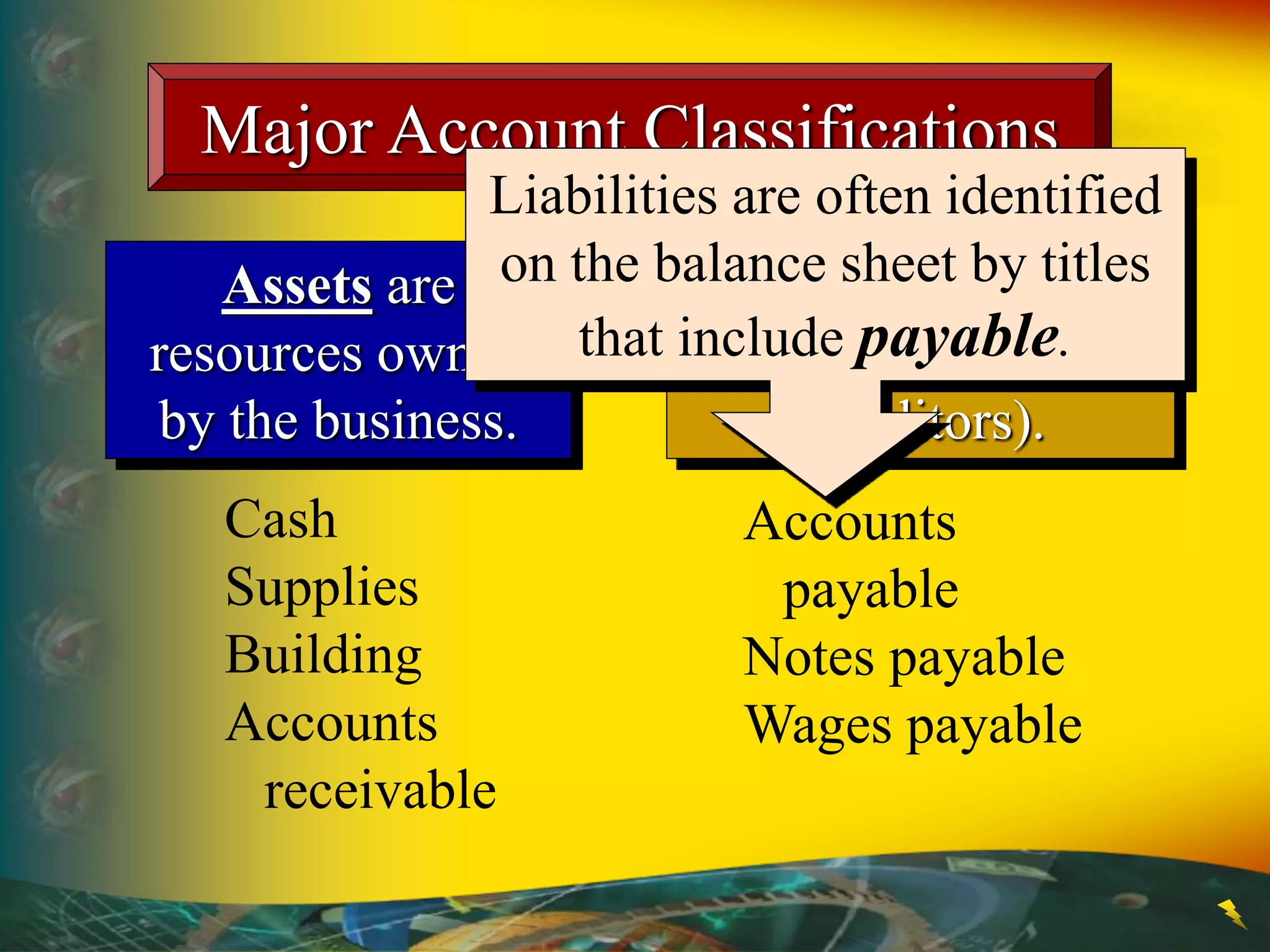

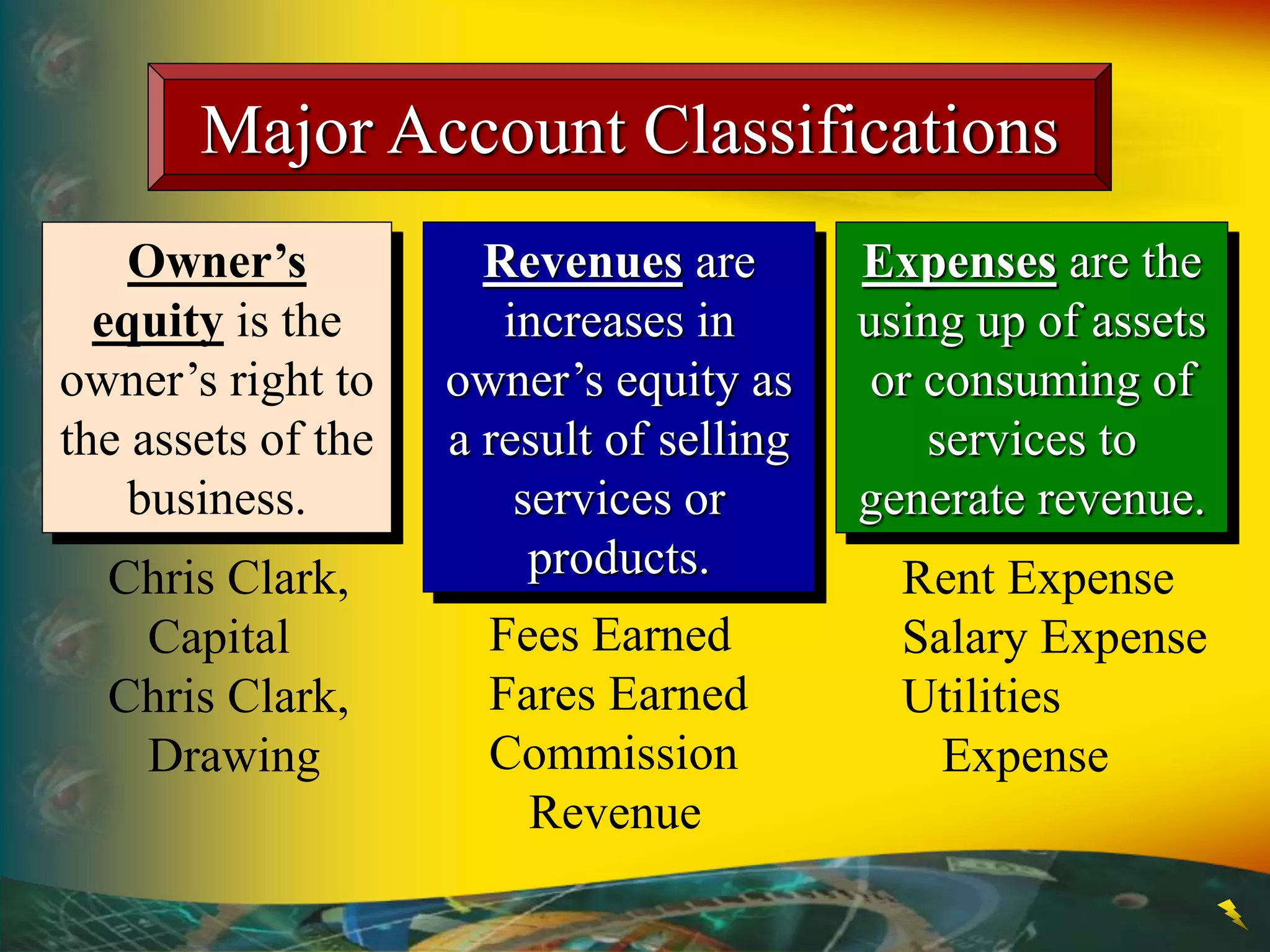

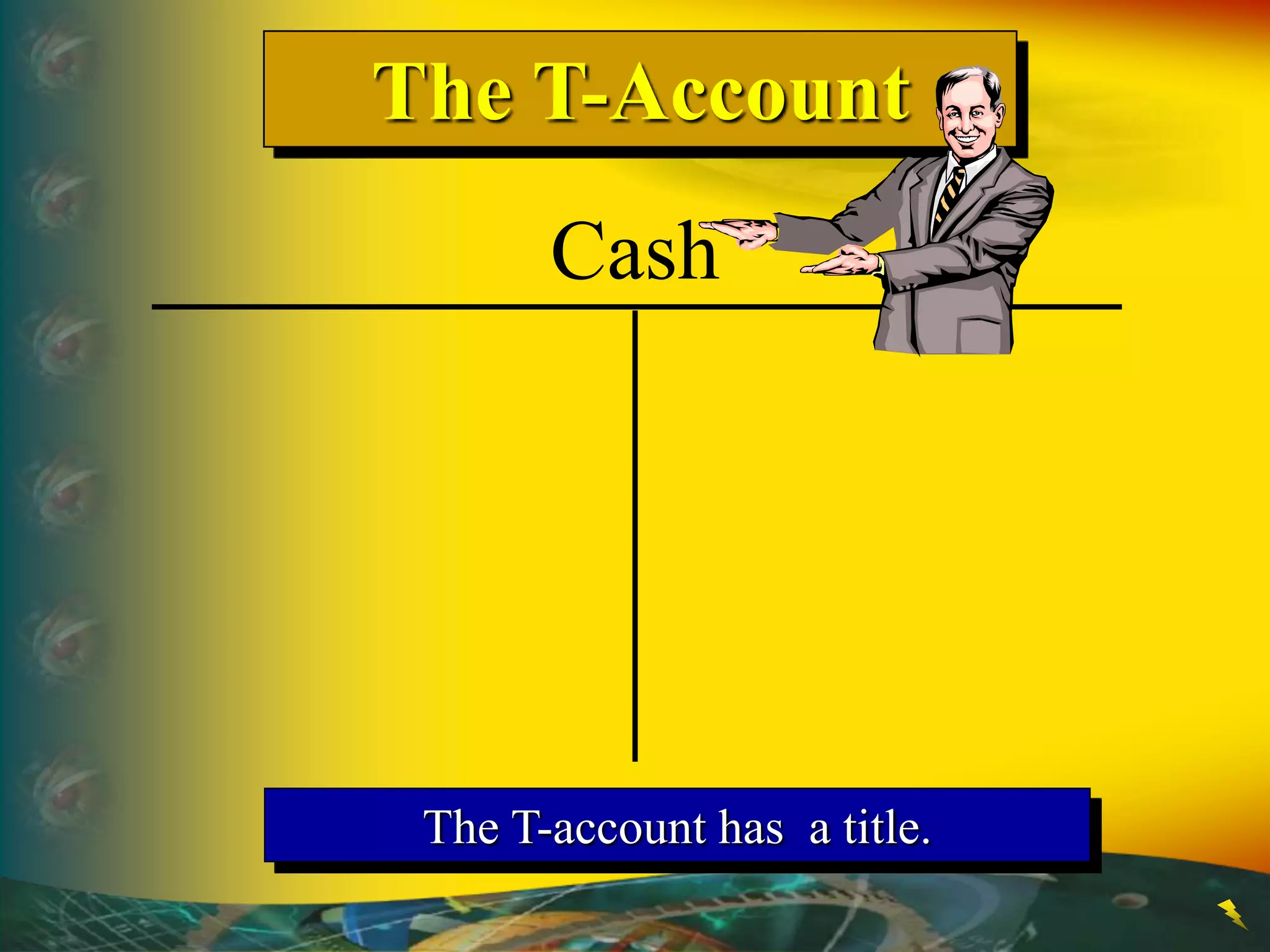

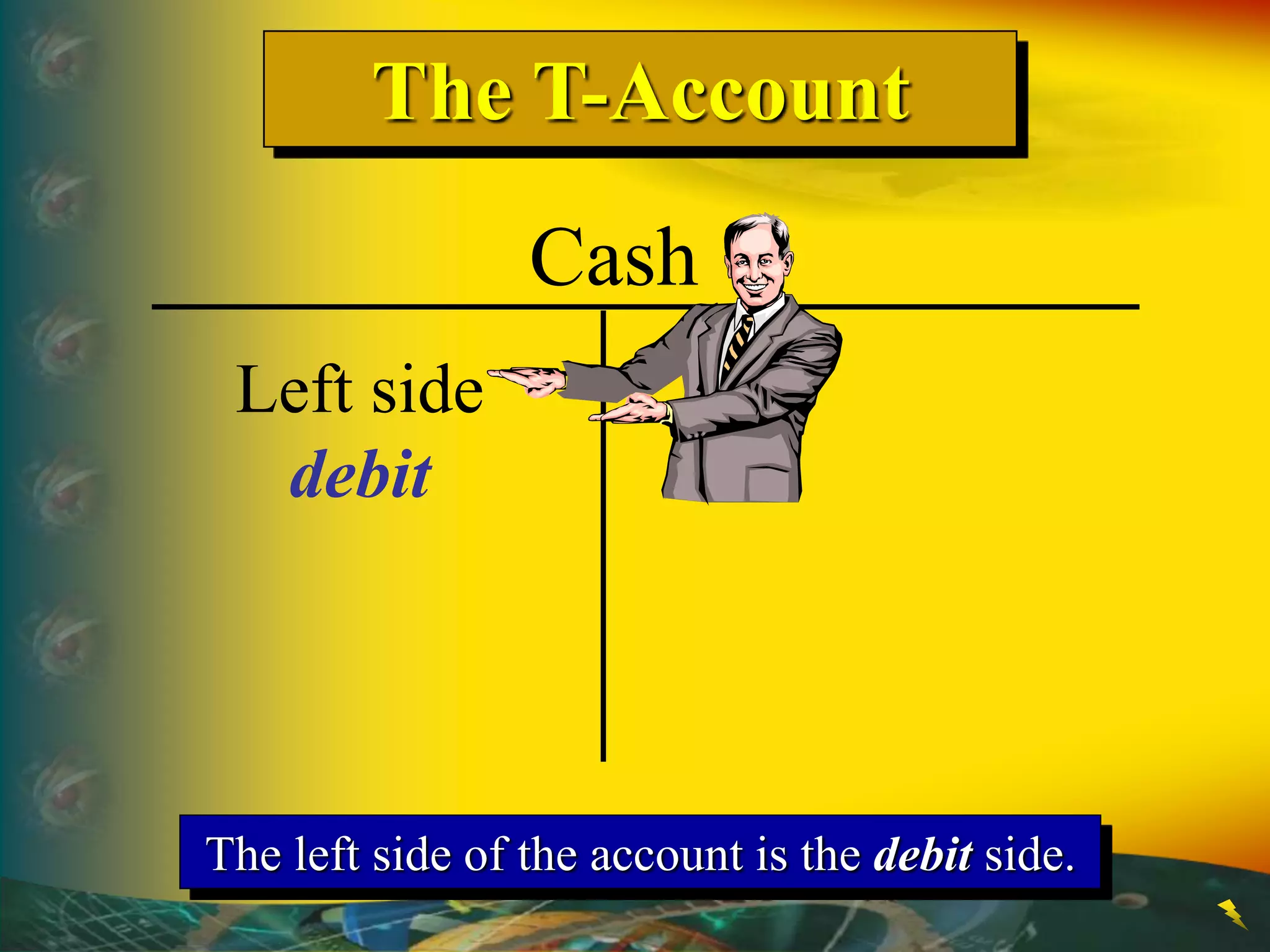

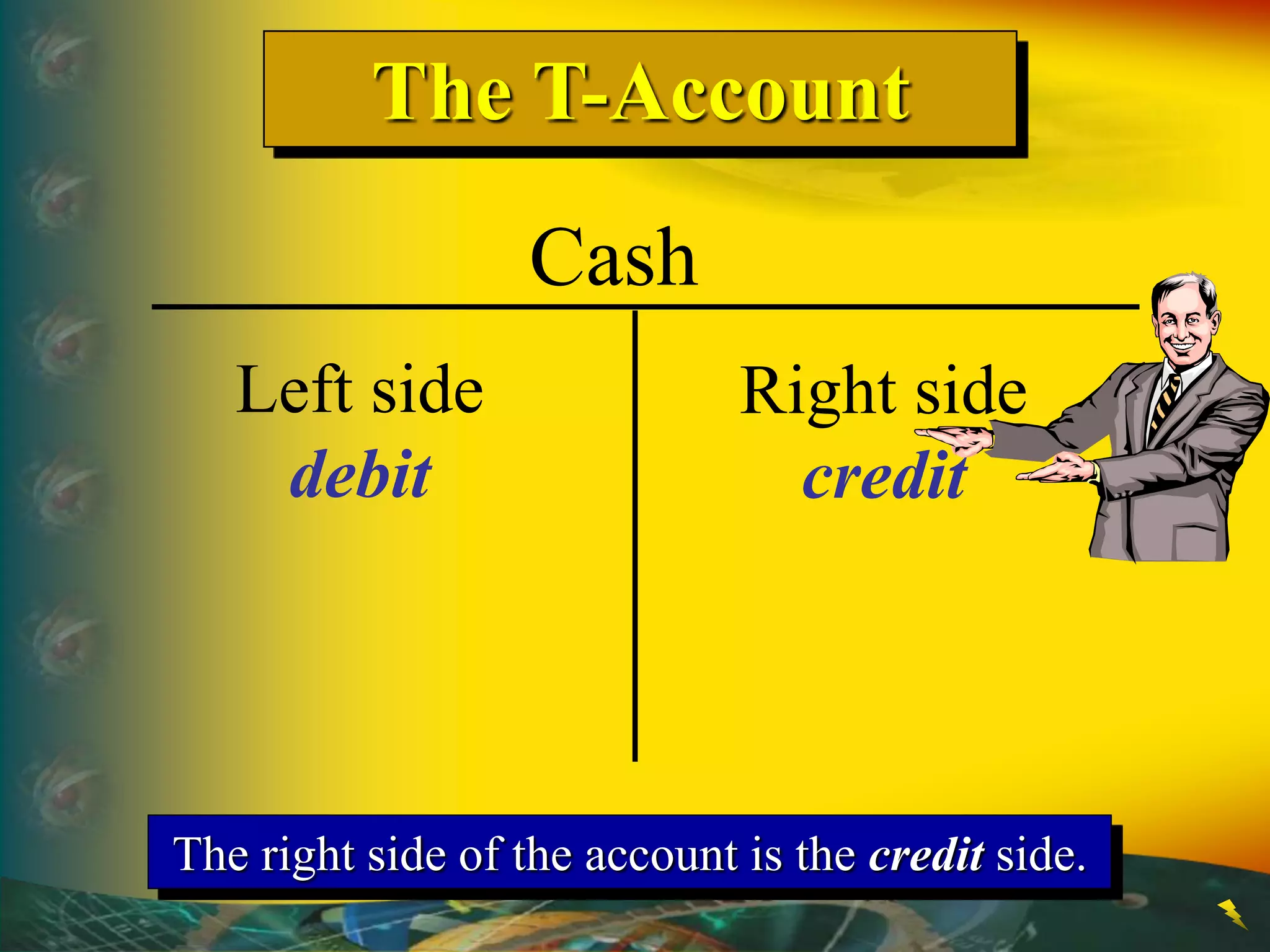

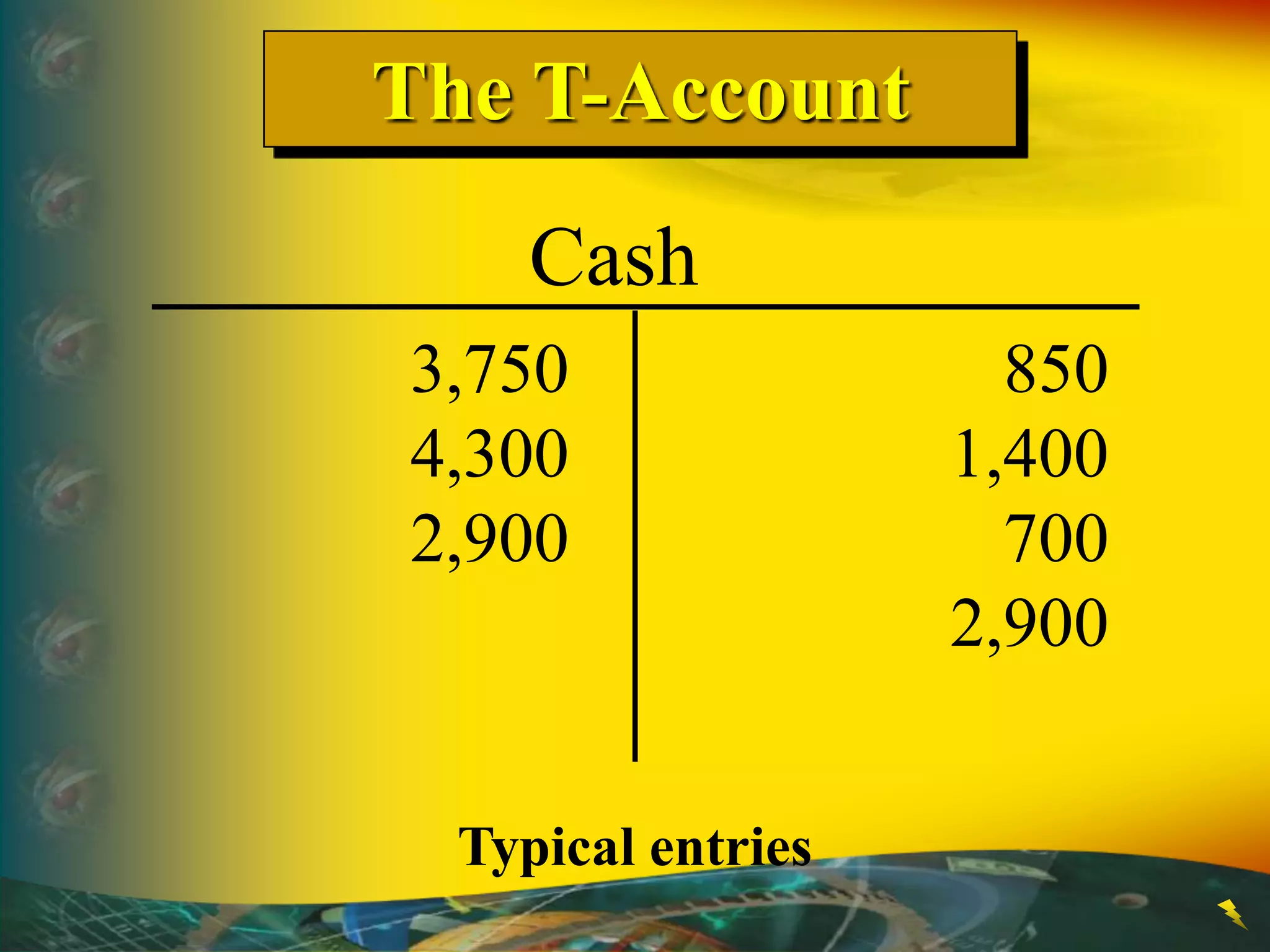

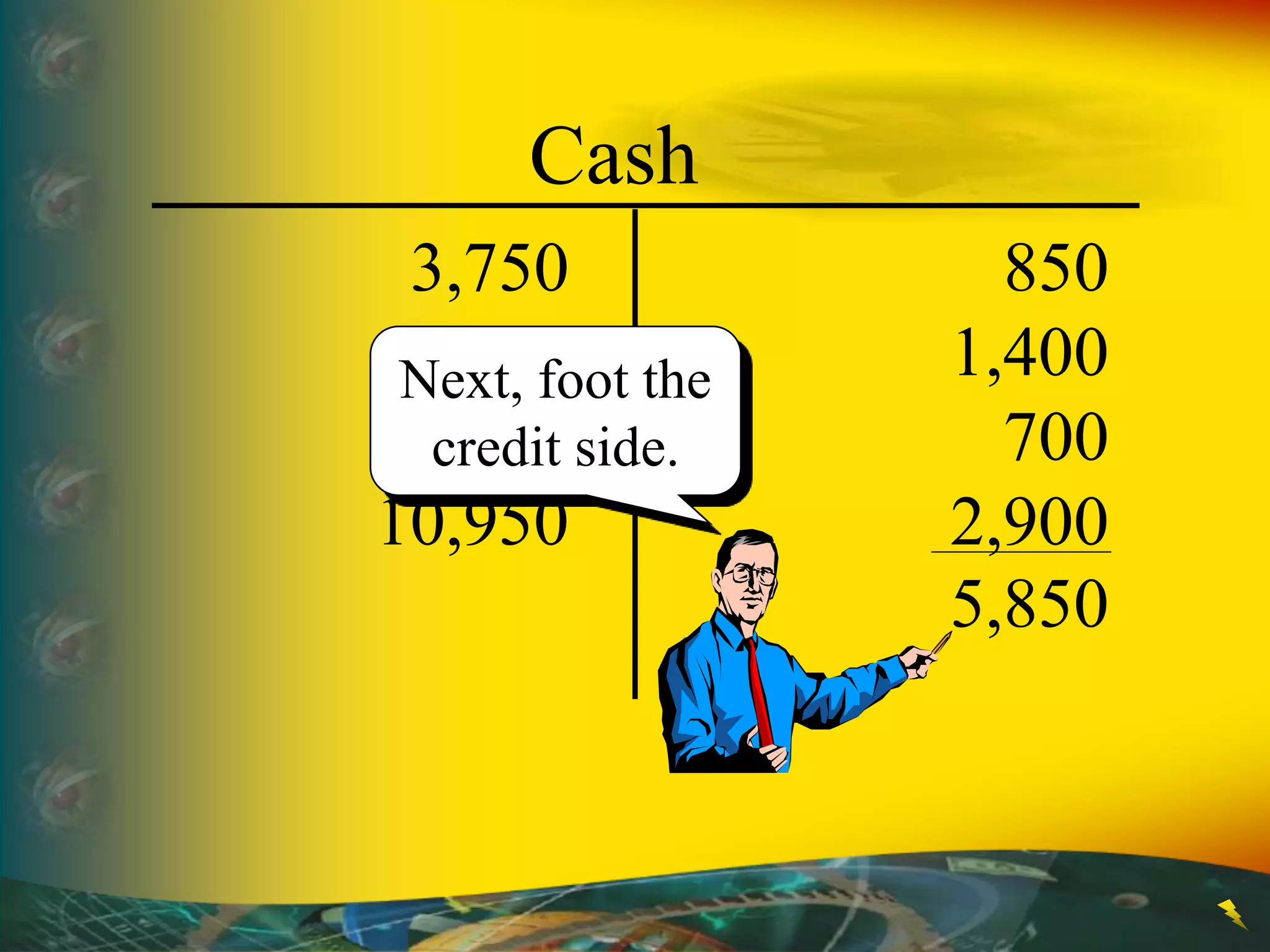

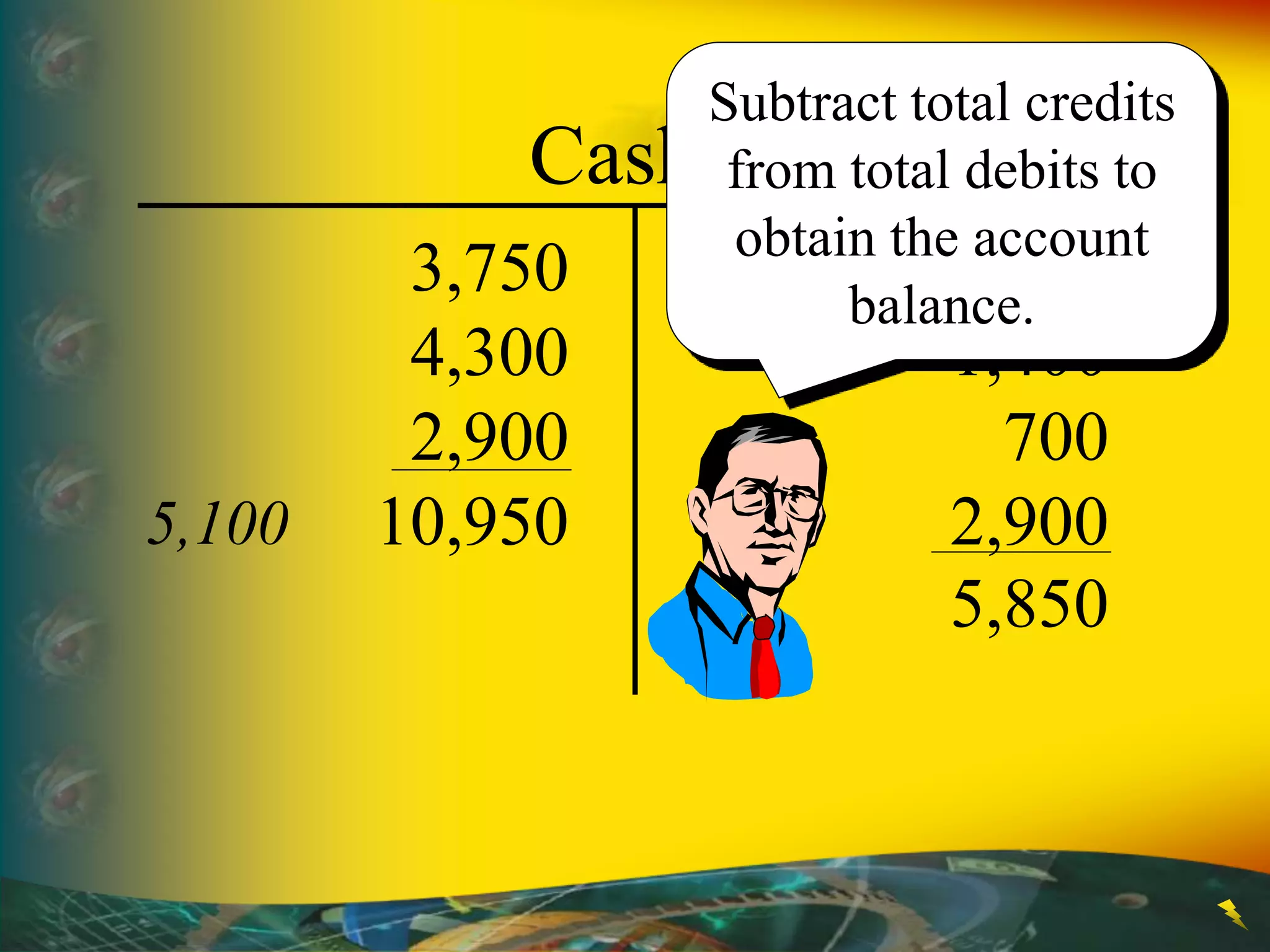

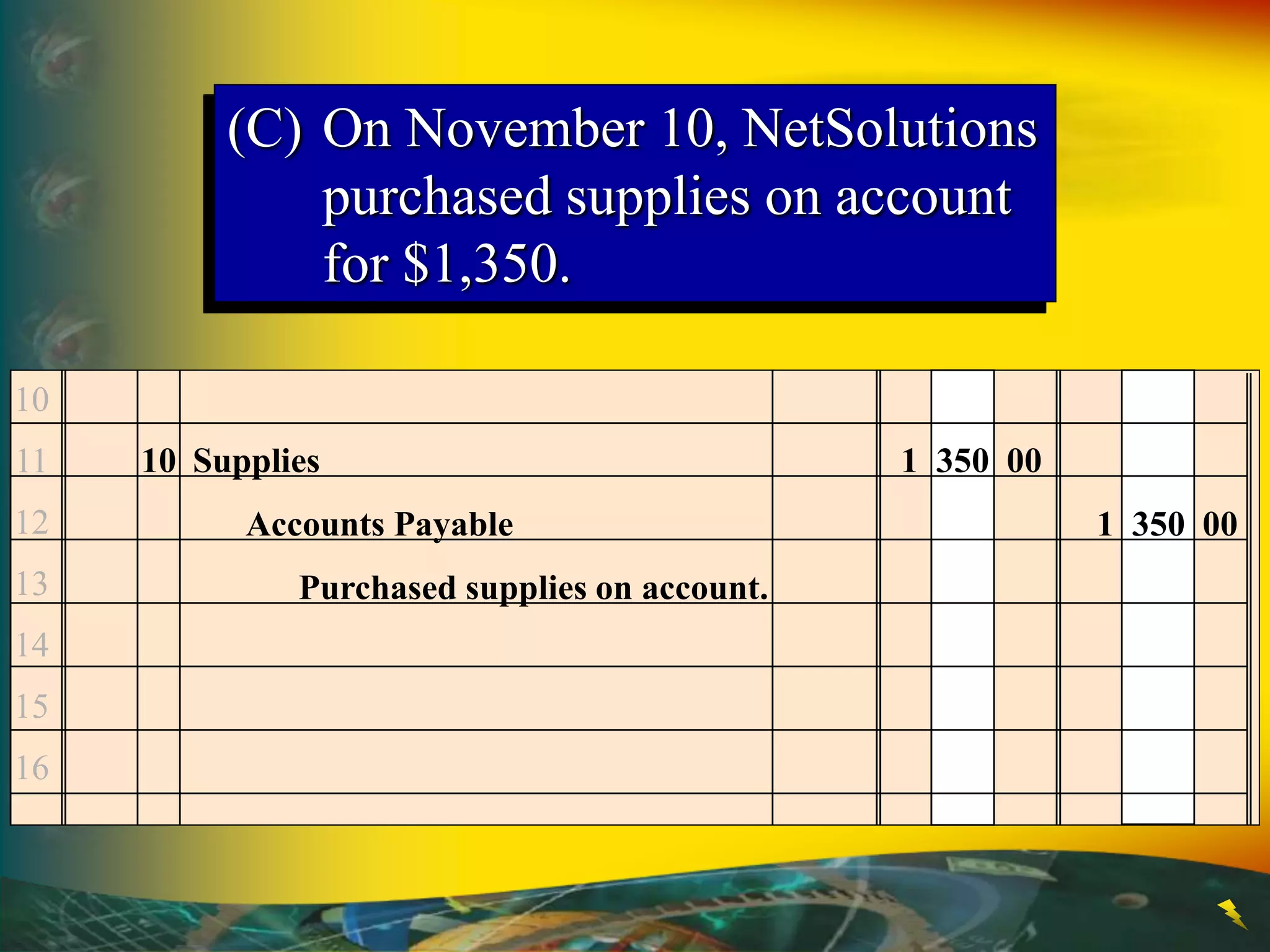

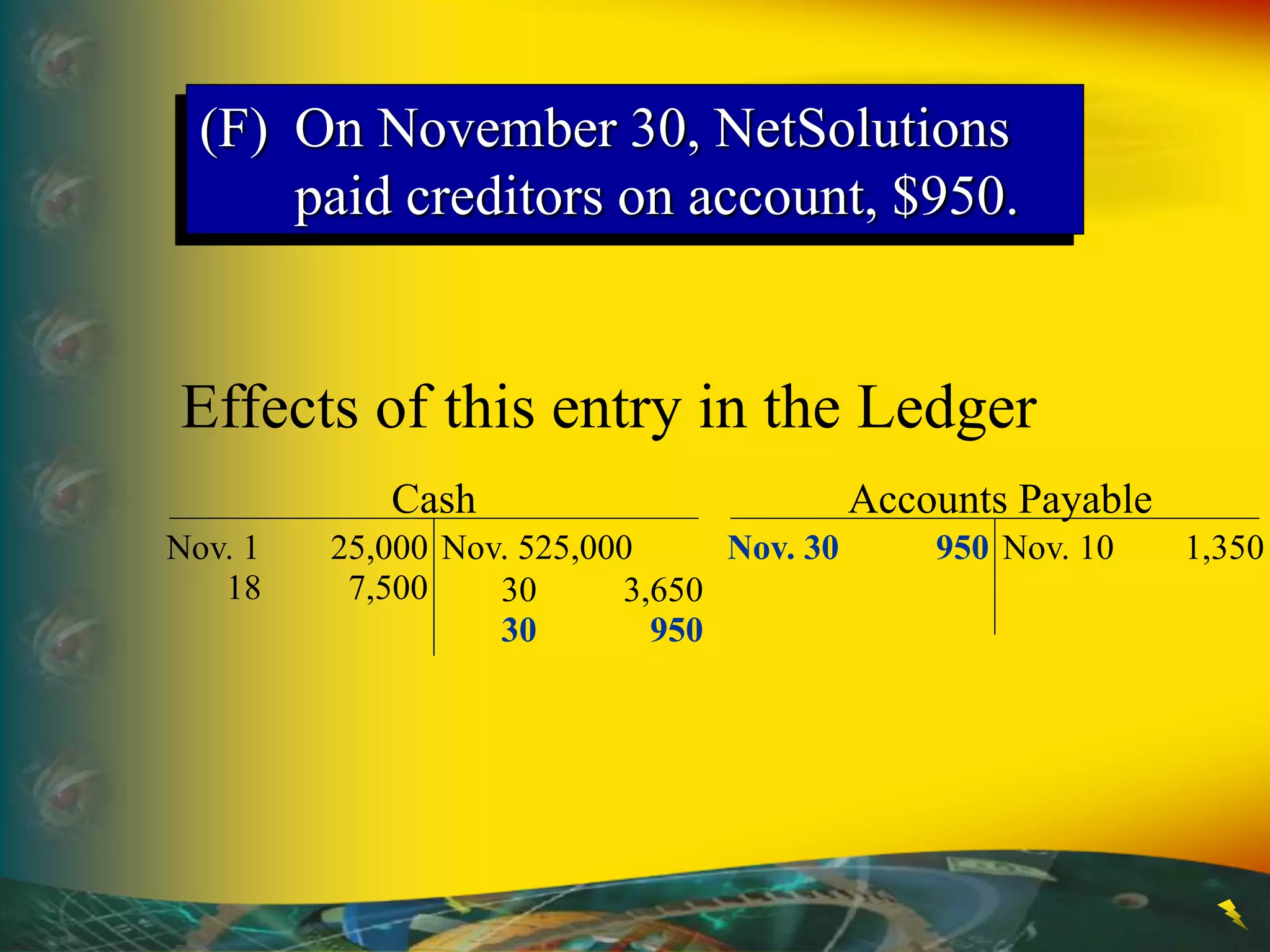

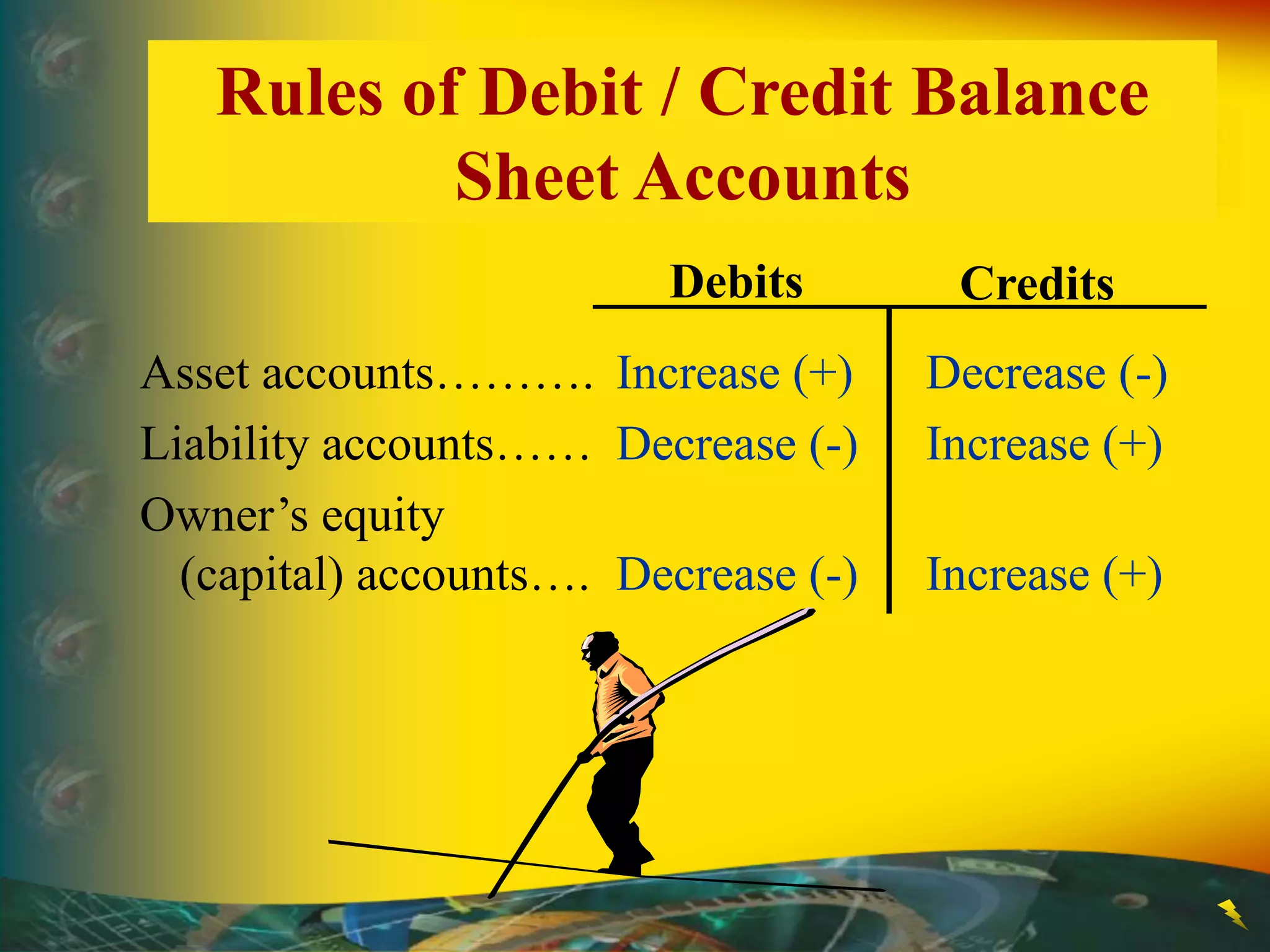

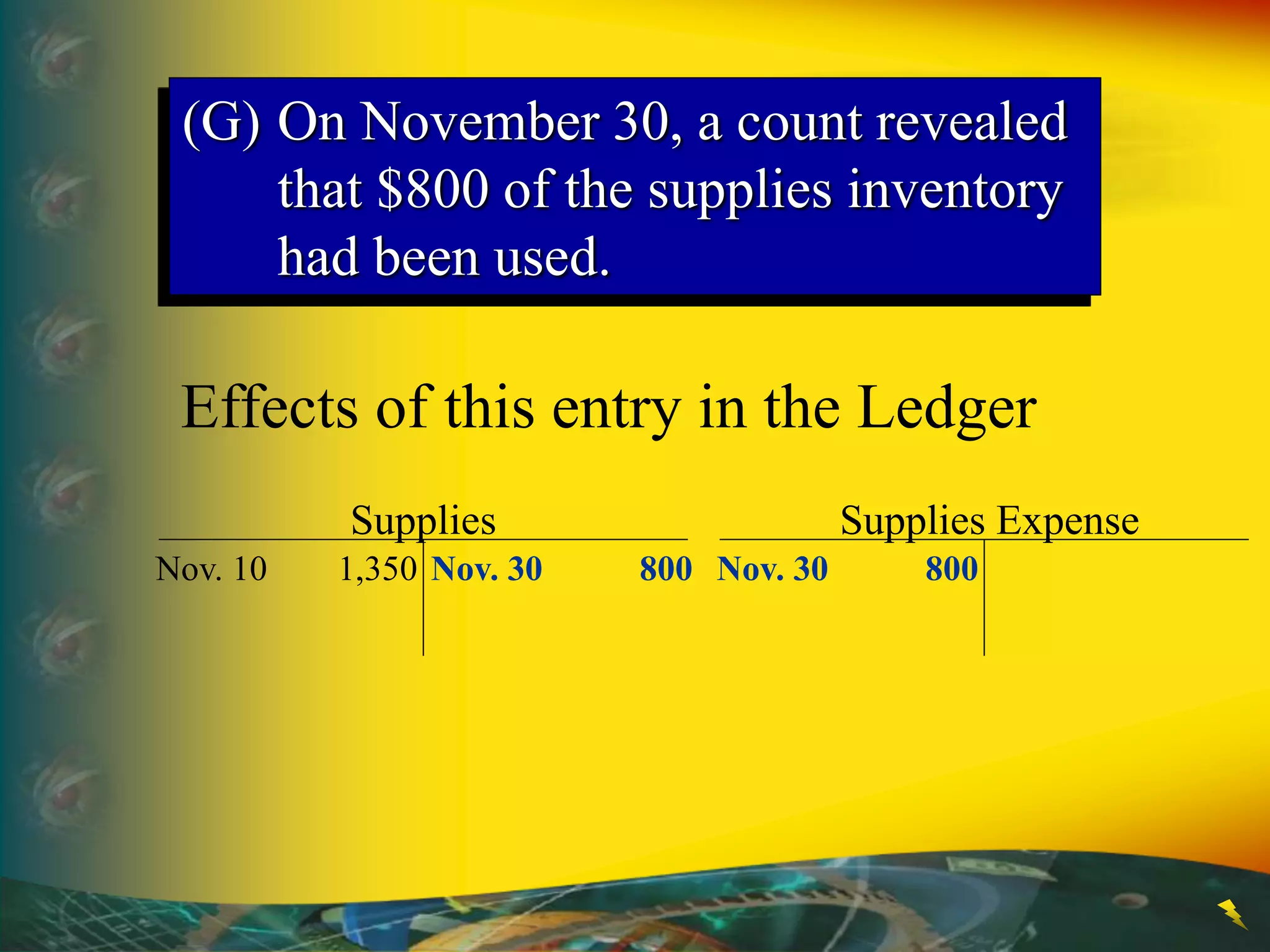

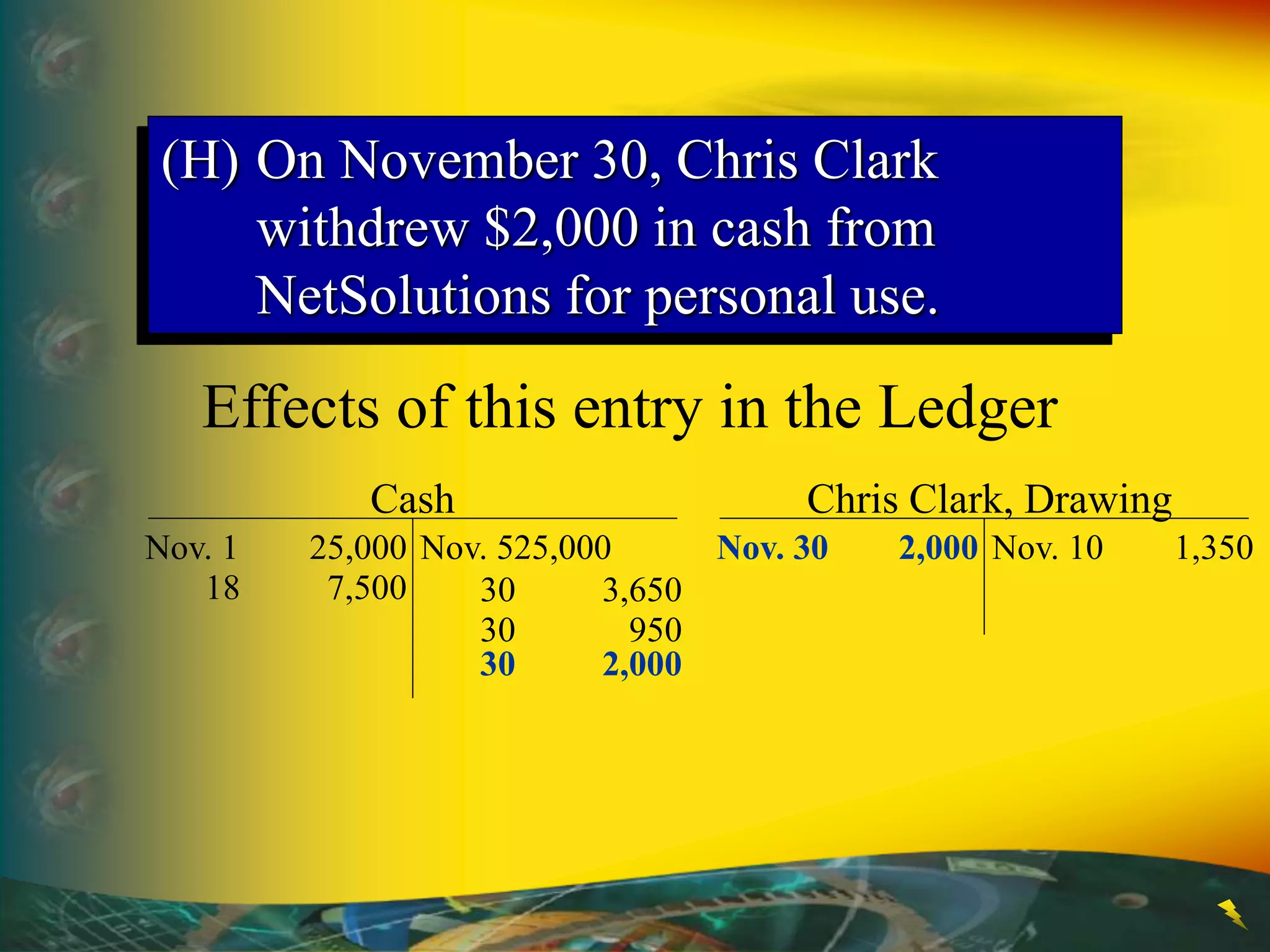

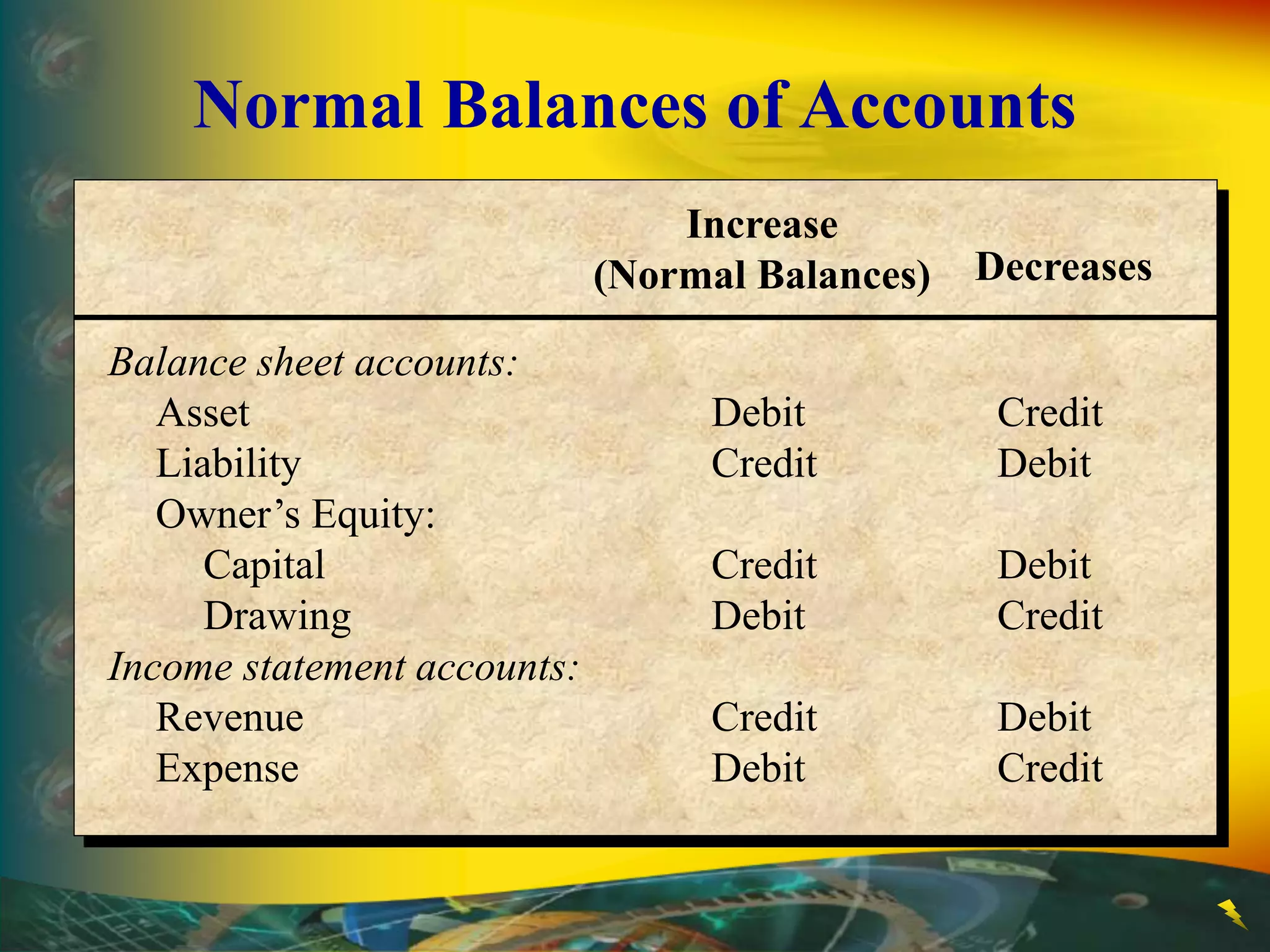

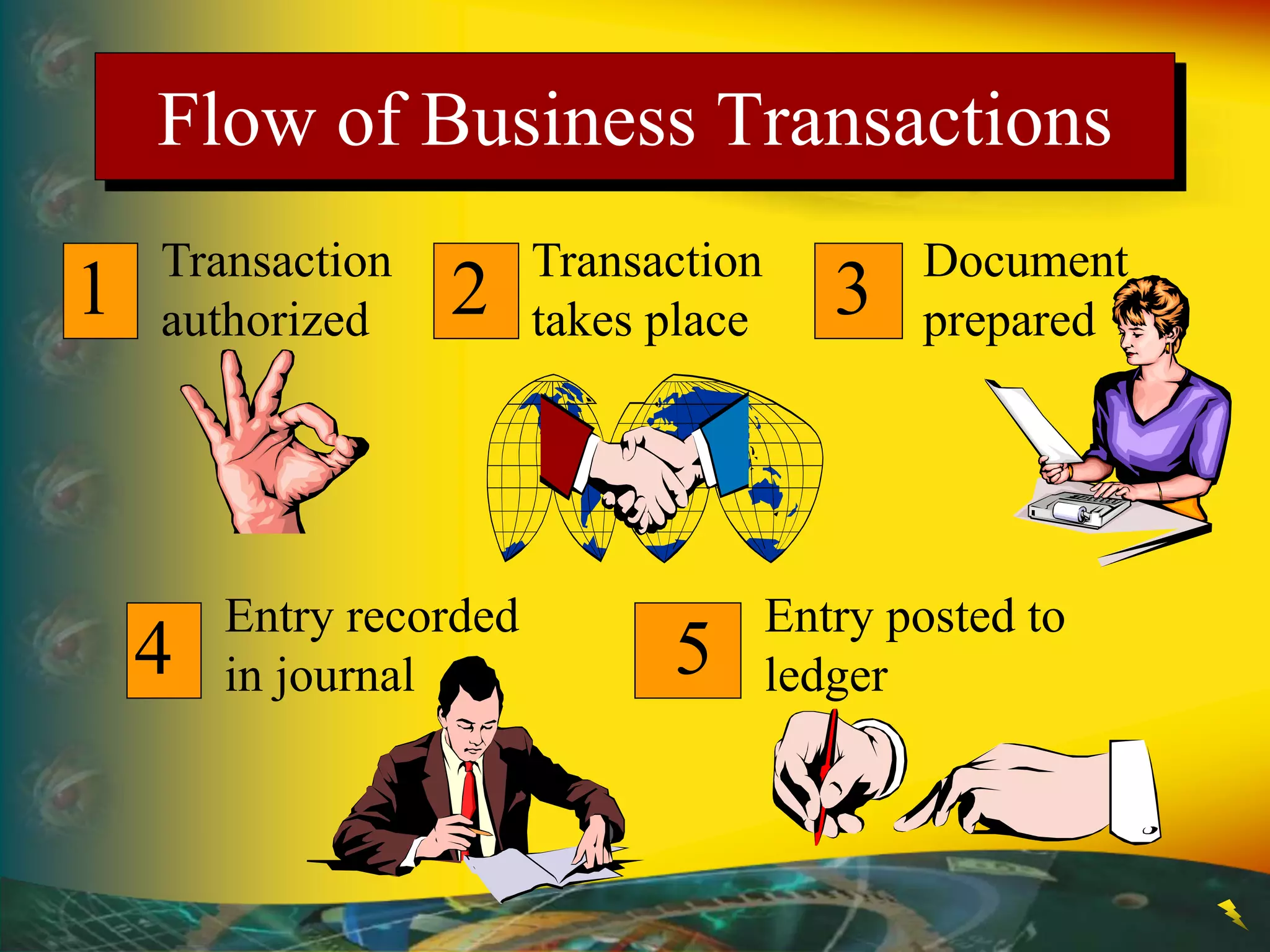

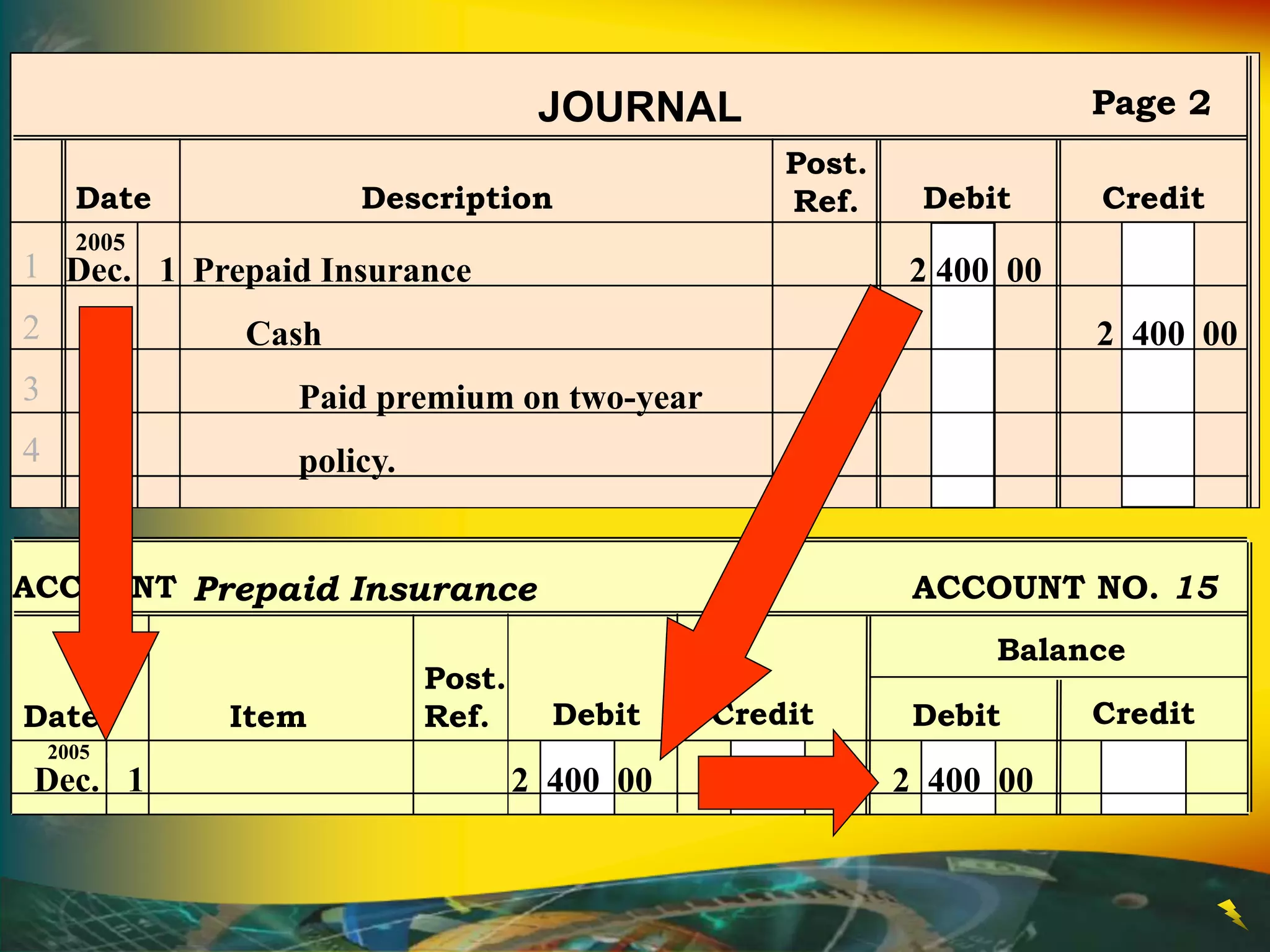

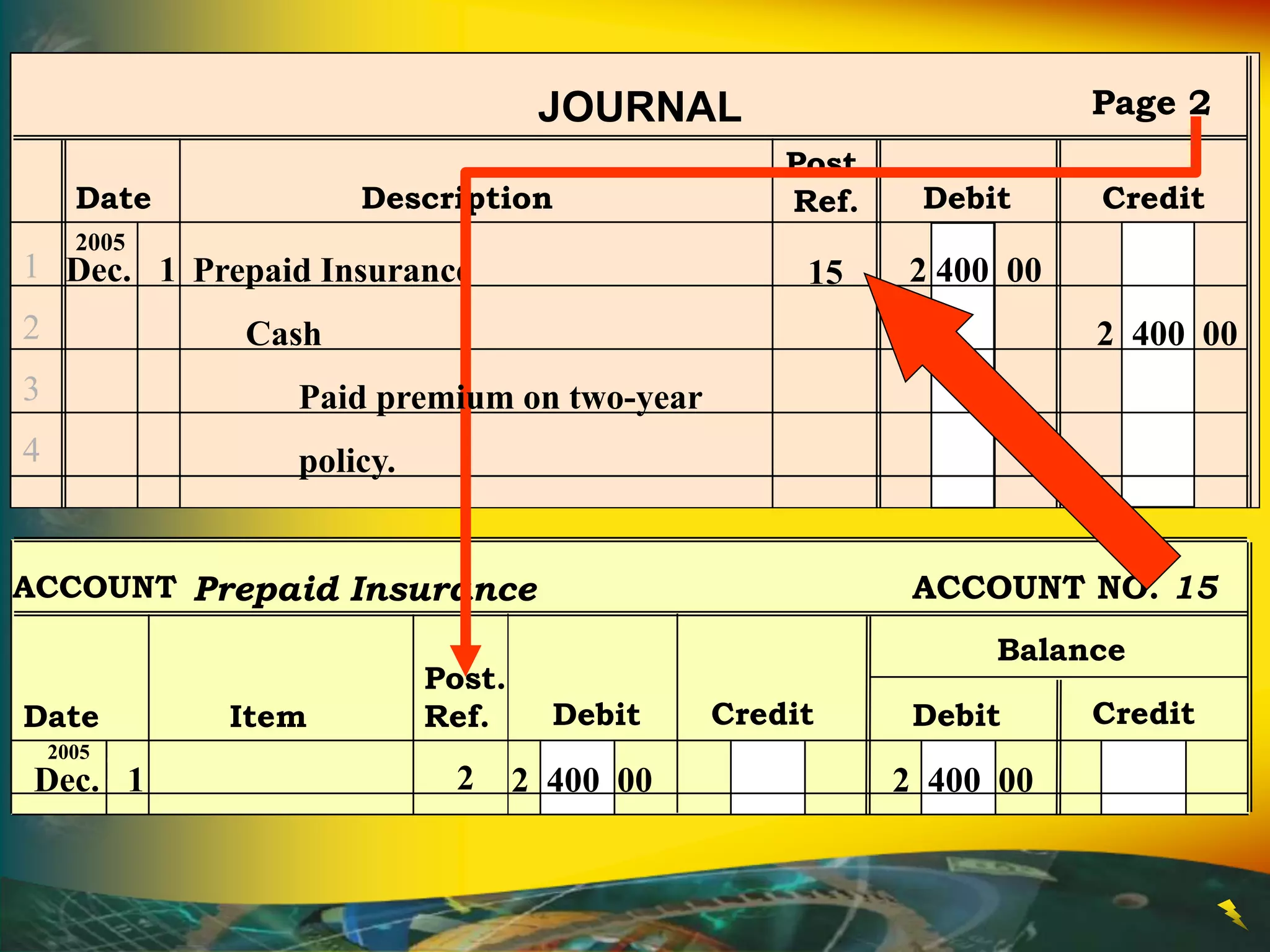

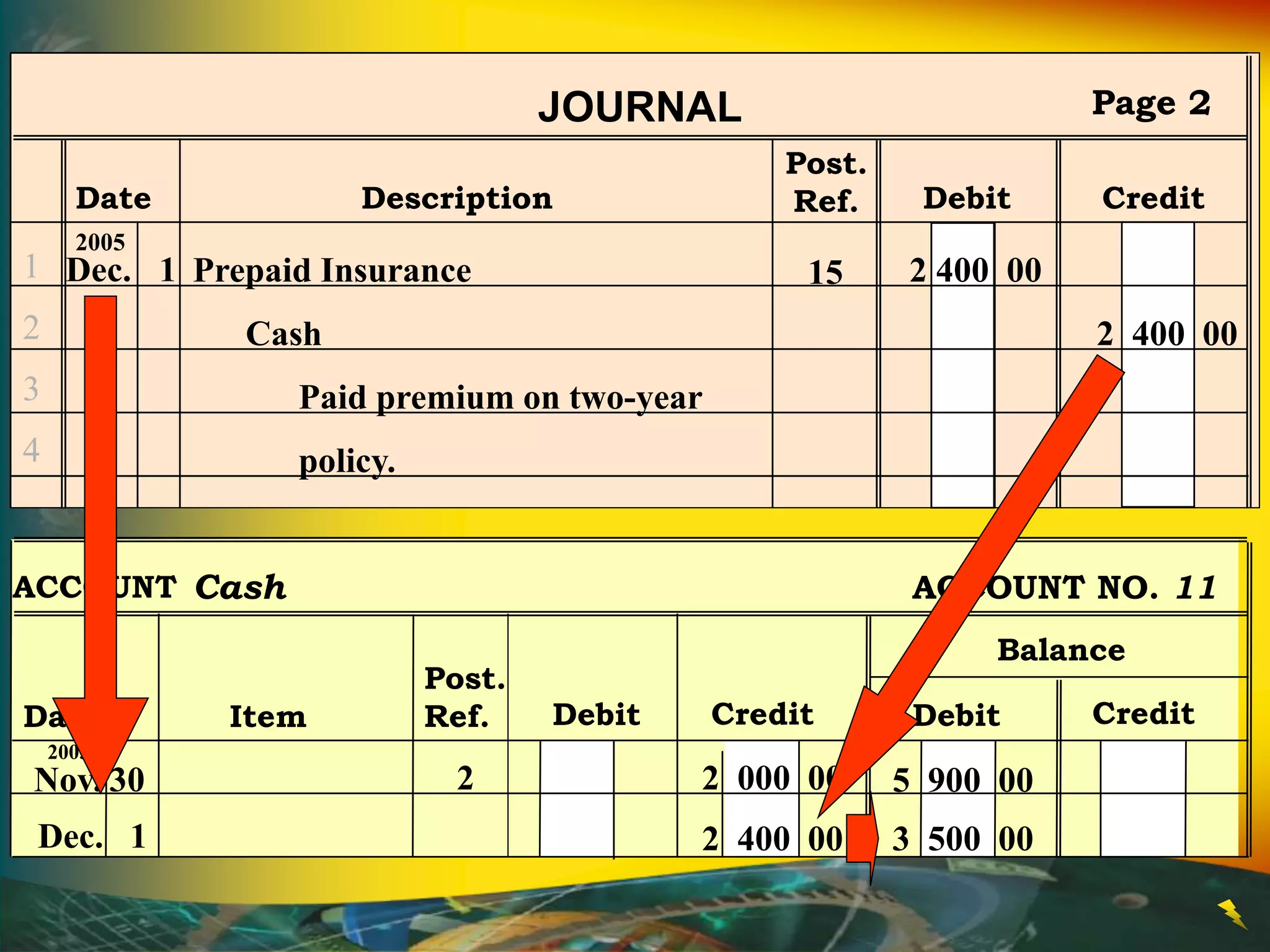

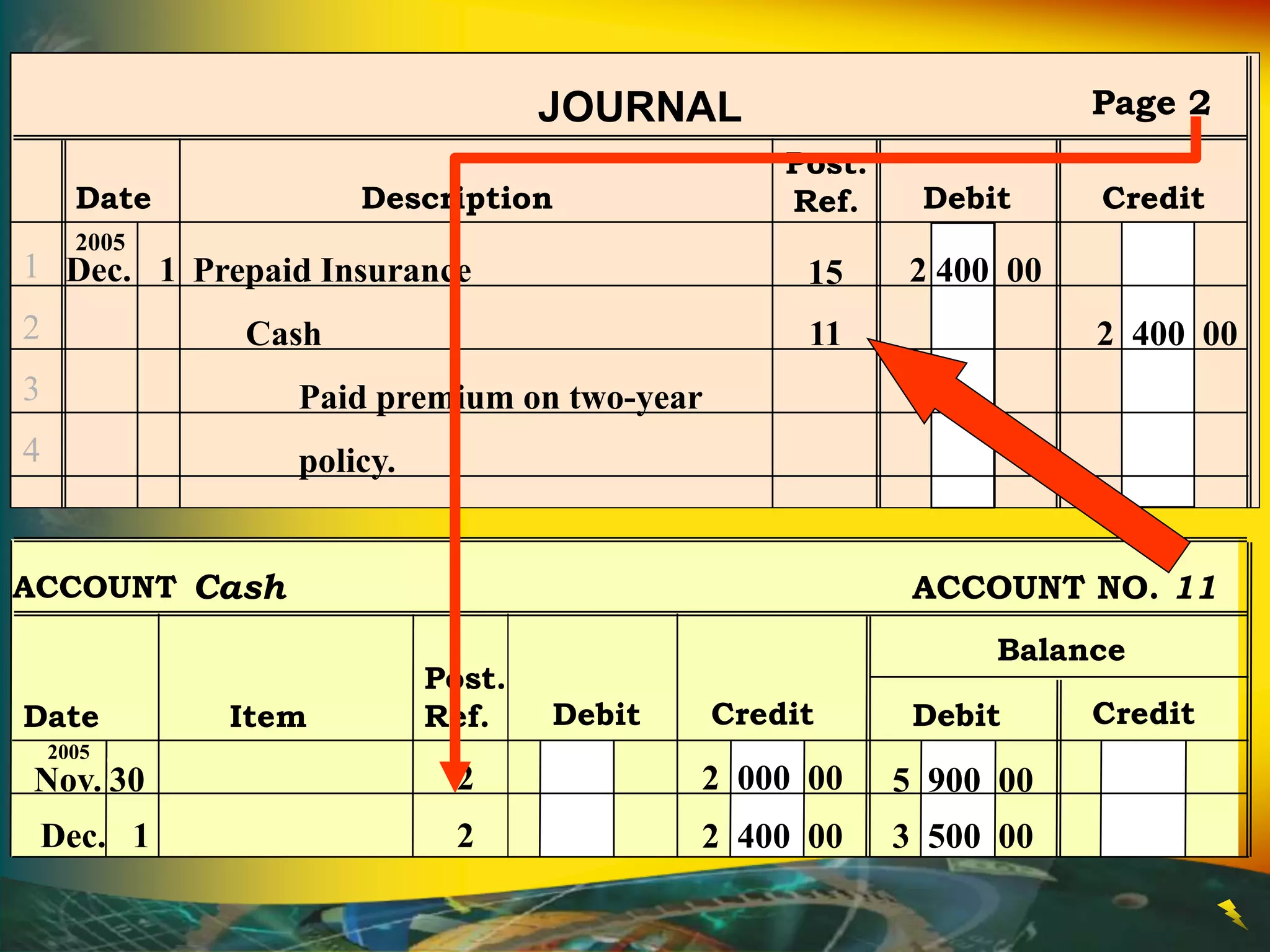

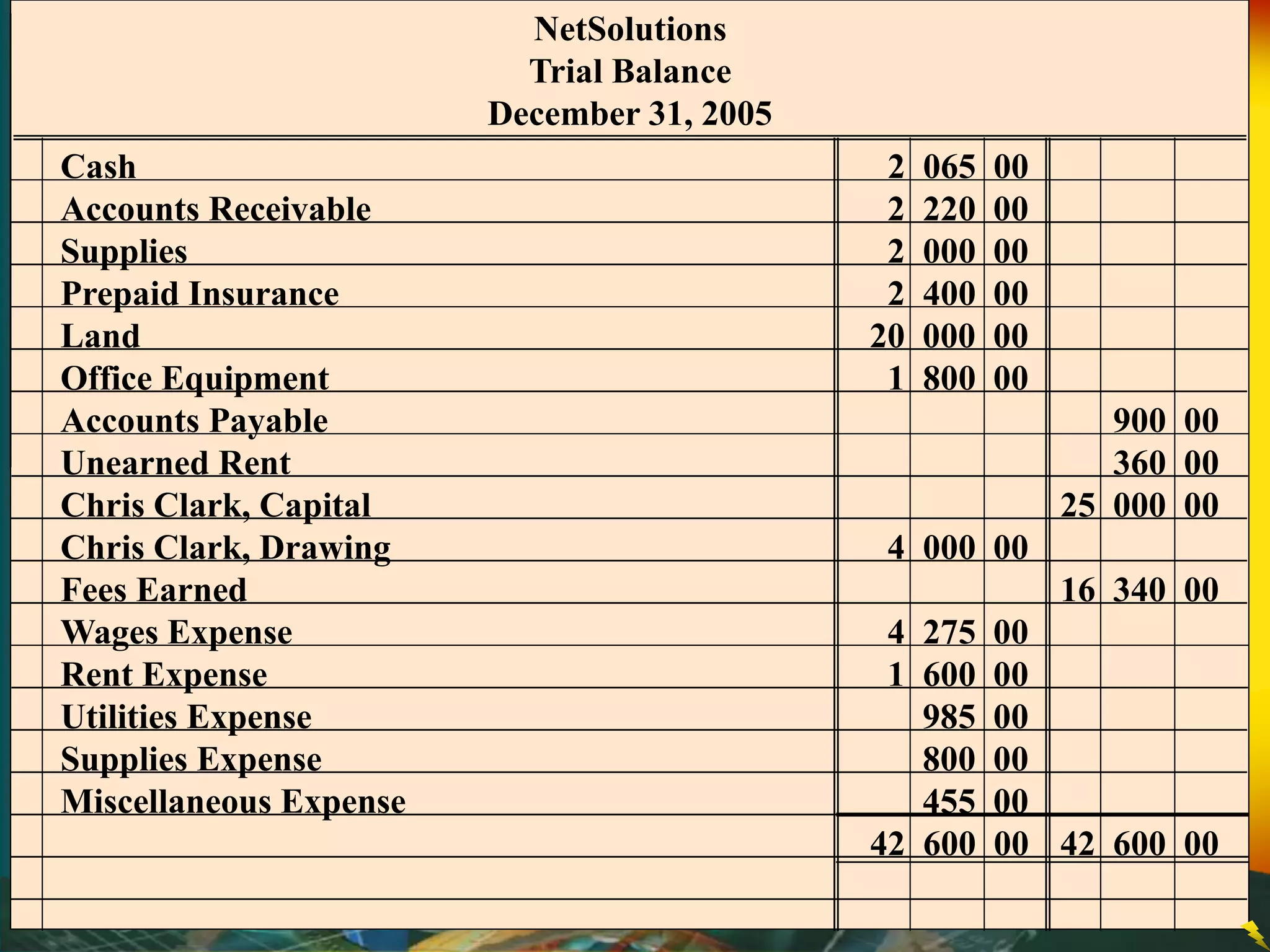

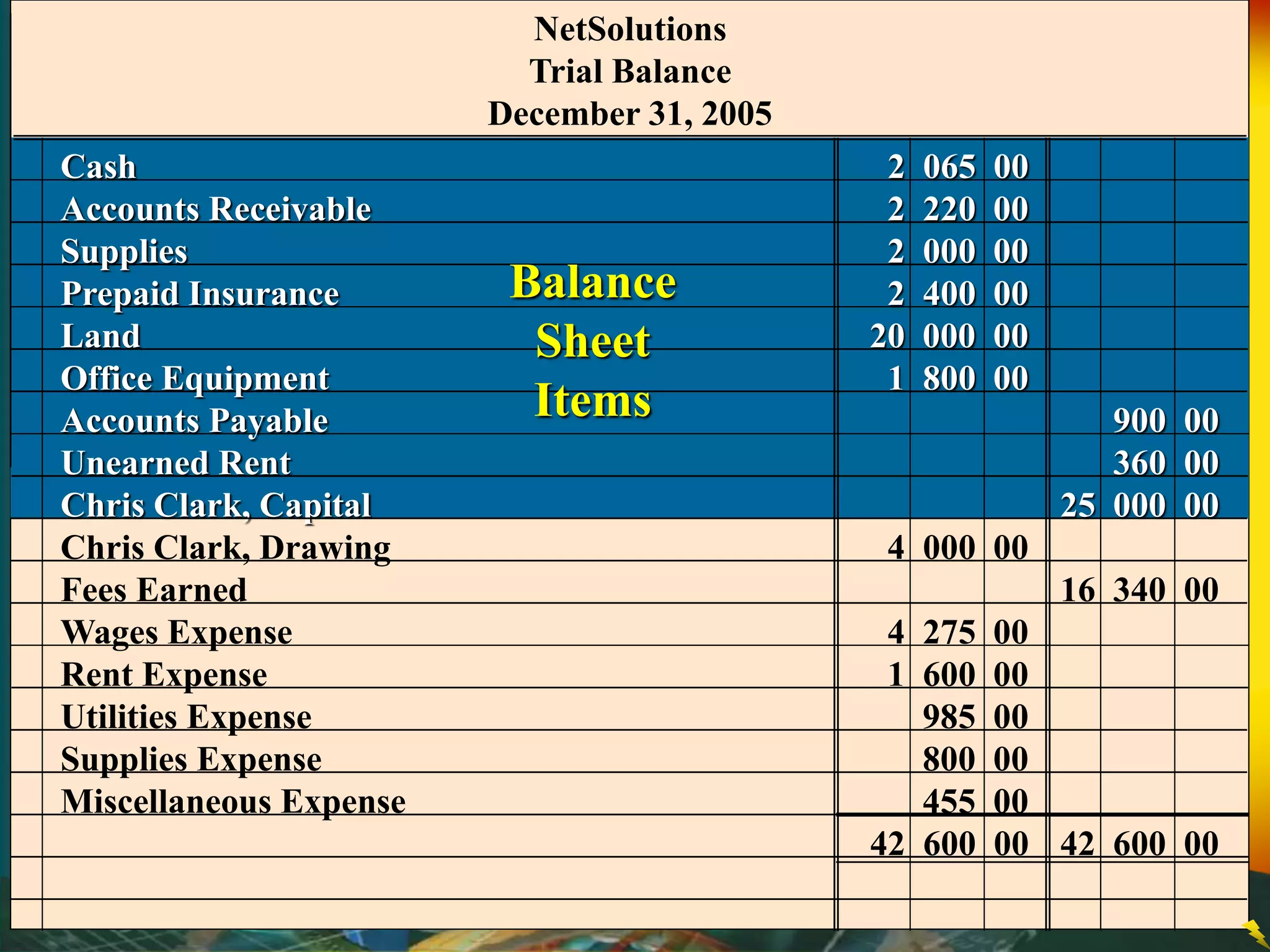

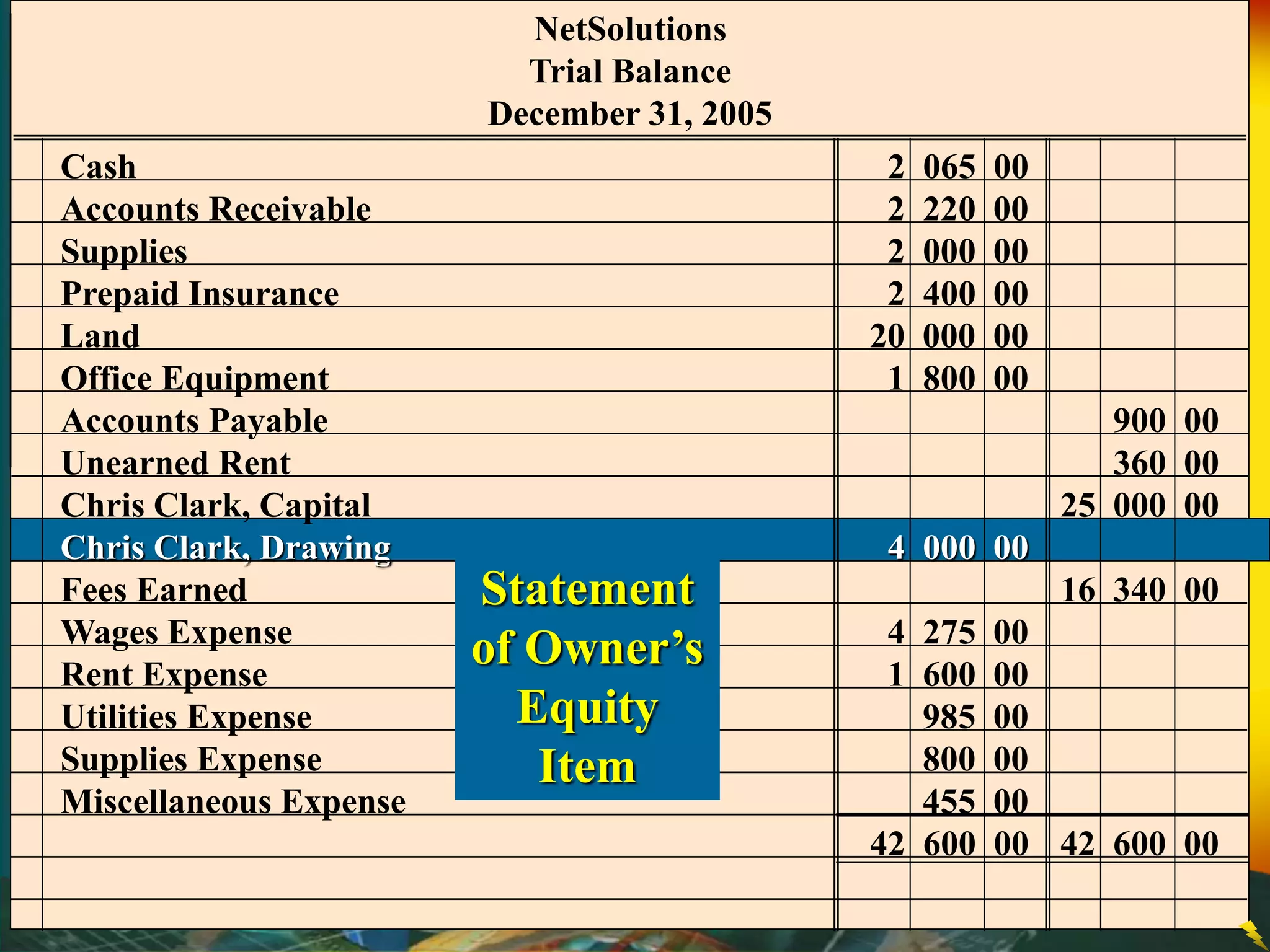

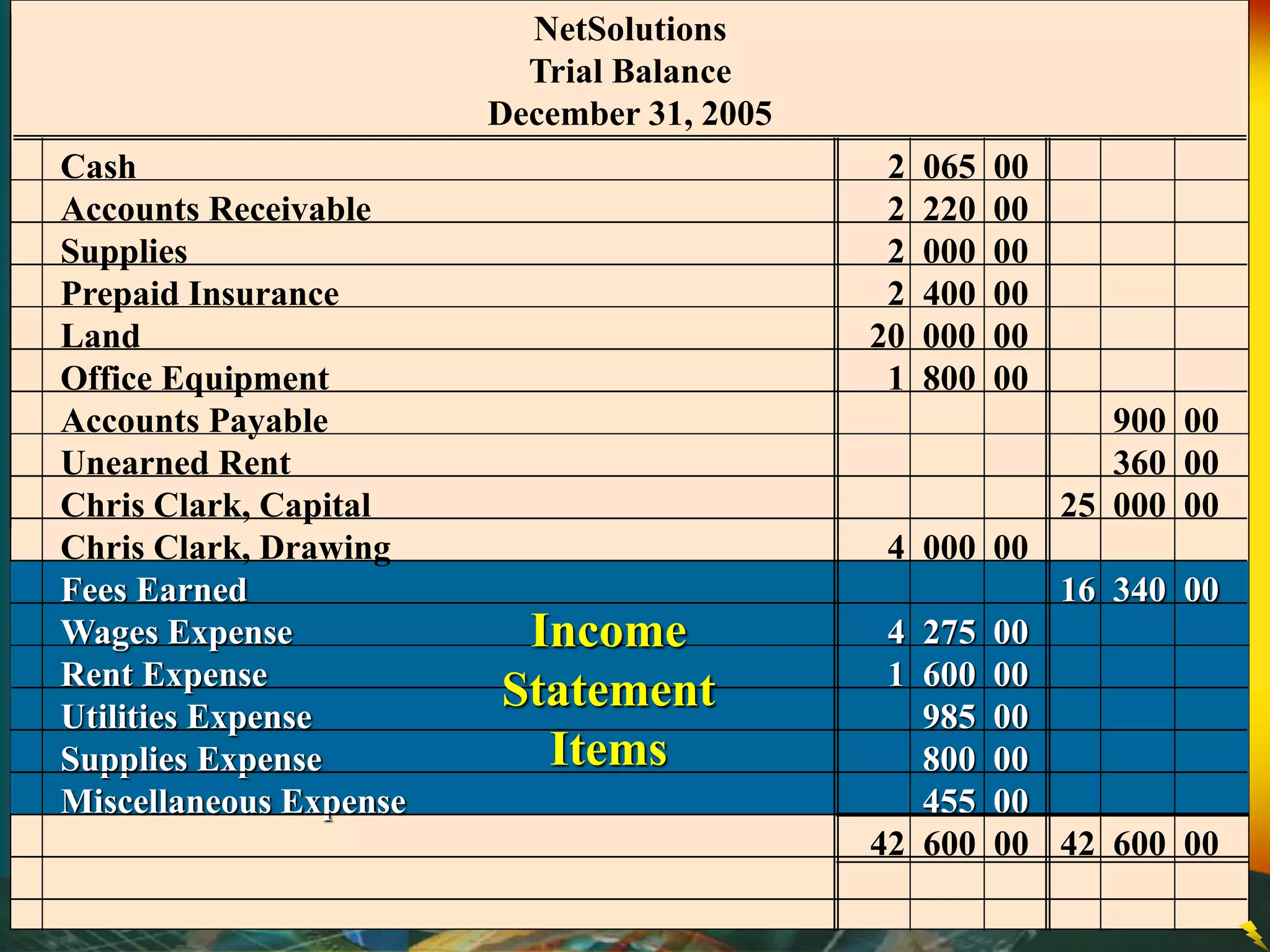

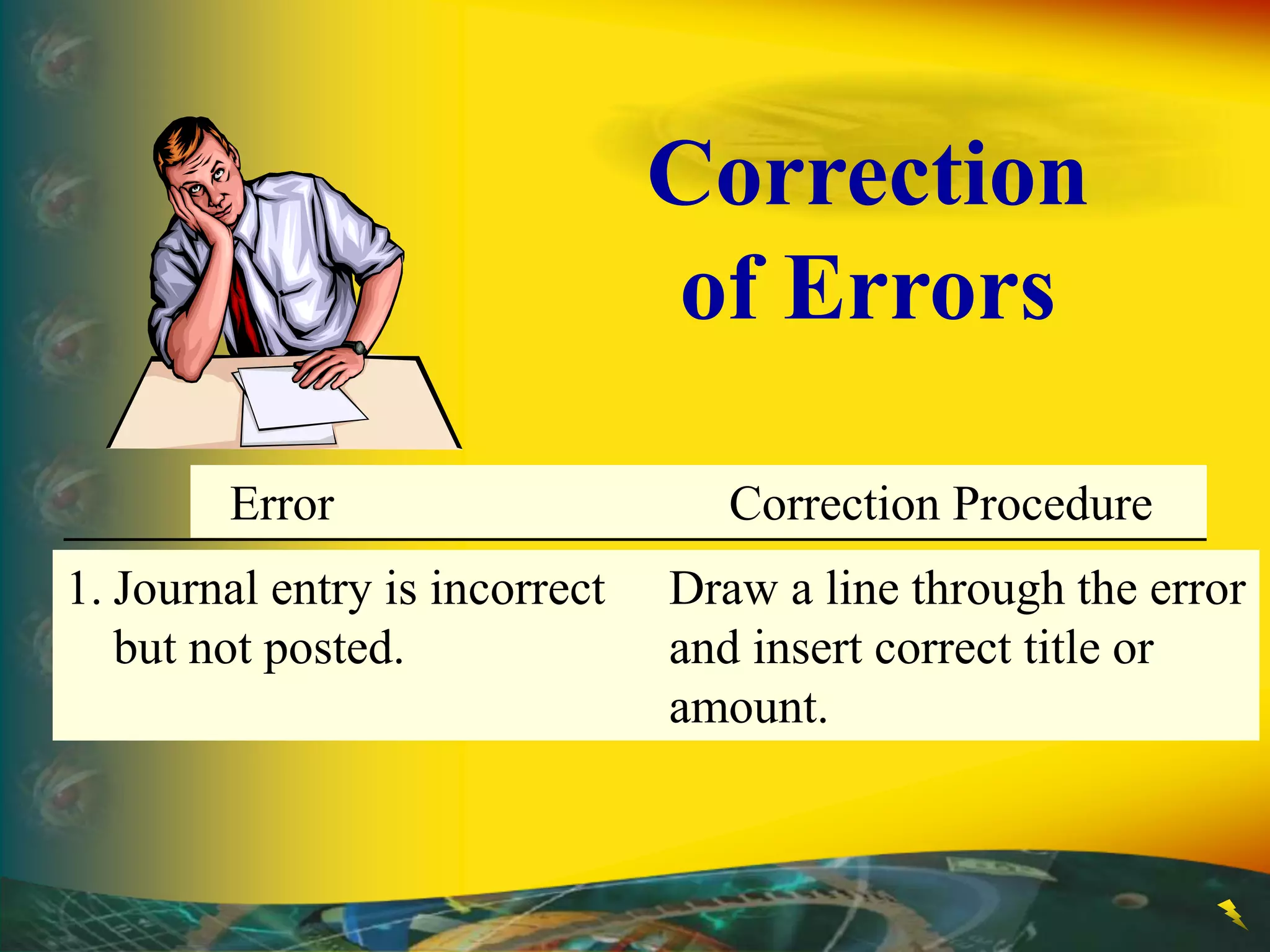

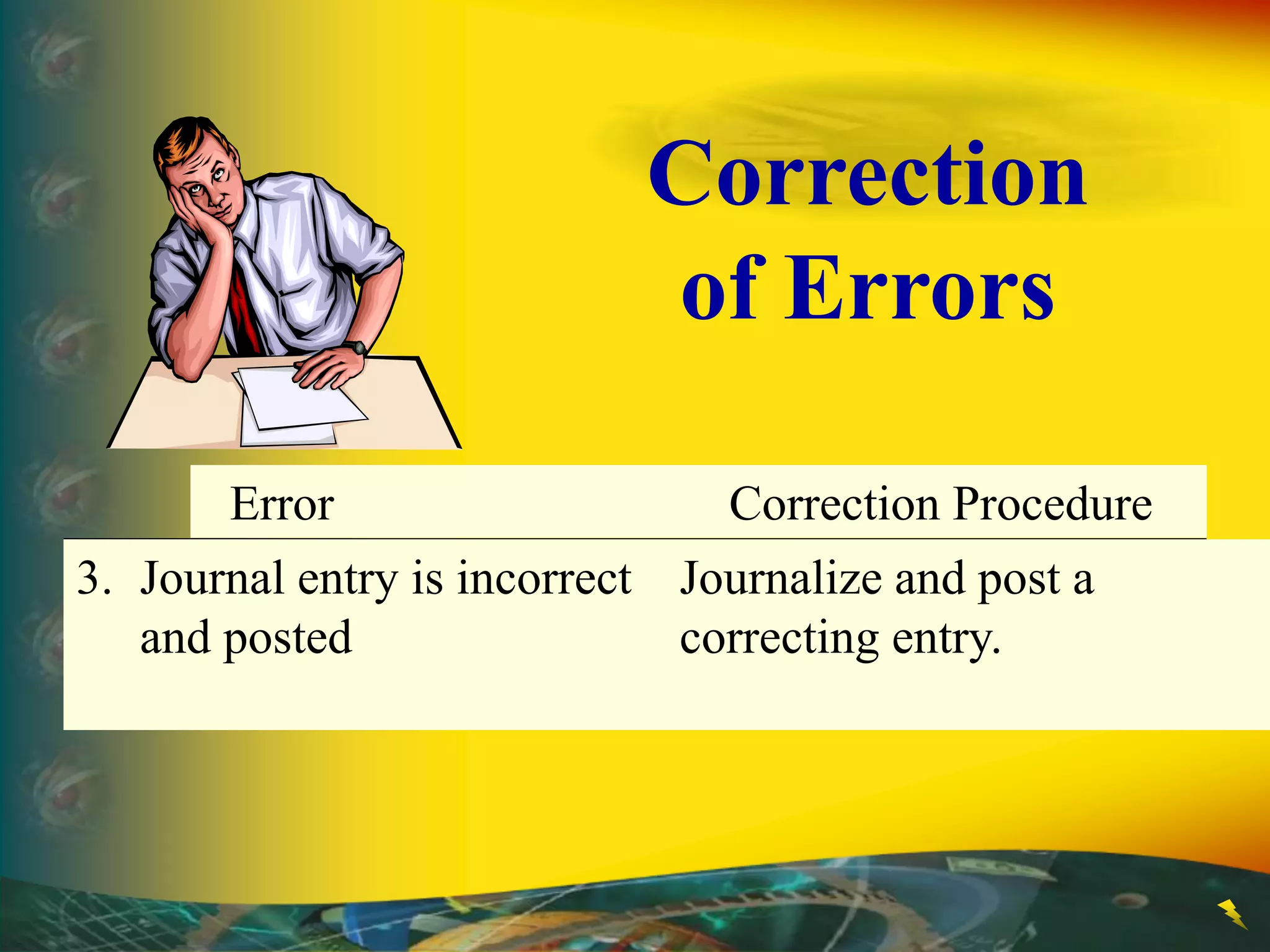

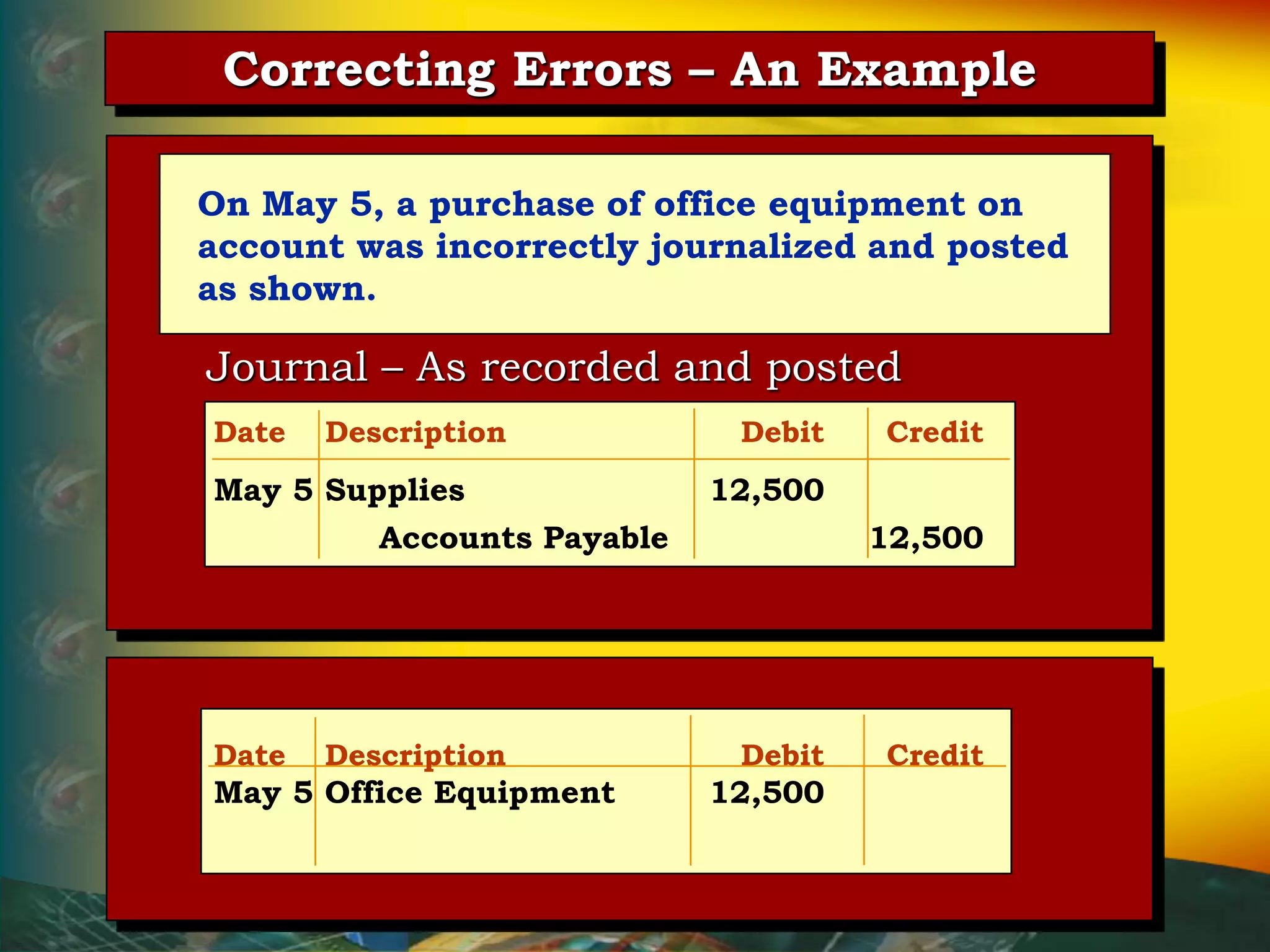

Chapter 2 of the accounting textbook discusses the fundamental concepts of analyzing transactions, including account classifications like assets, liabilities, and owner’s equity, as well as the double-entry accounting system. It covers the structure of financial statements, journal entries, and the T-account method for managing transactions. Additionally, the chapter includes examples of various transactions and emphasizes the importance of maintaining balanced debits and credits in accounting.