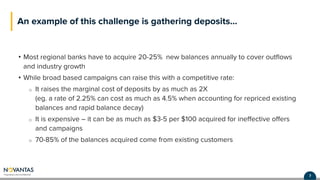

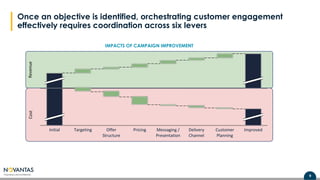

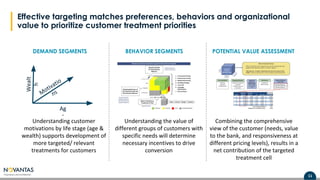

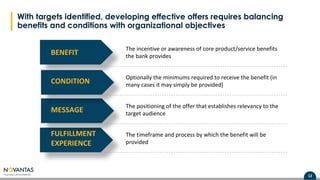

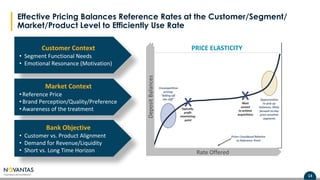

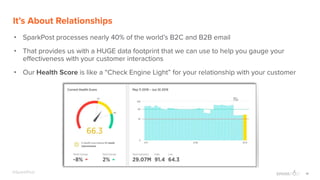

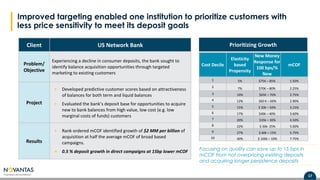

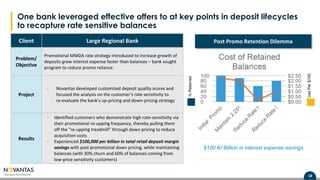

The document discusses the evolving landscape of retail banking, emphasizing the shift from branch-centric to communication-driven strategies focused on customer experience and personalization. It highlights the challenges banks face in acquiring deposits and the need for effective customer engagement through targeted marketing and offers. Case studies illustrate successful strategies that improve deposit growth while reducing costs and maintaining customer relationships.

![25@SparkPost

Upcoming events

OptIn - The Email Intelligence Conference

October 29-30, Carmel Valley, CA

https://events.sparkpost.com/optin19

[Webinar] Maximizing Deposit Margin and

Growth as Rates Decline

July 16, 2019

2 pm Eastern/ 11 am Pacific

https://www.novantas.com/events/maximizing-deposit-margin-webinar/](https://image.slidesharecdn.com/sparkpost-novantaswebinar-slideshare-190621173709/85/Webinar-Retail-Banking-Optimizing-the-Customer-Deposit-Lifecycle-25-320.jpg)