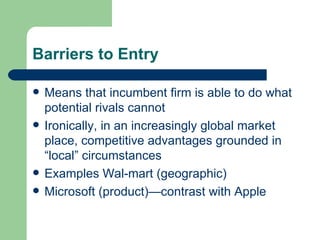

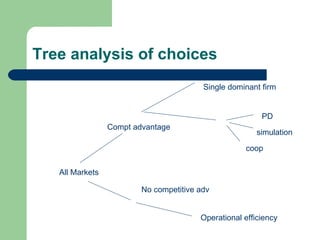

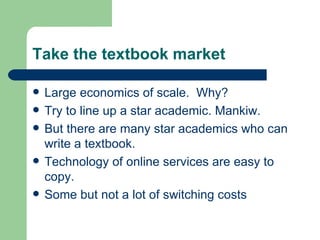

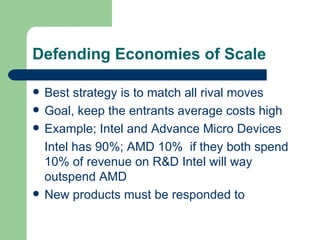

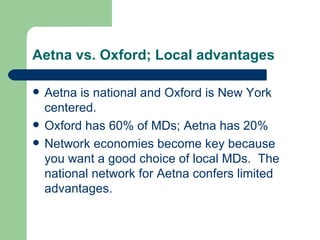

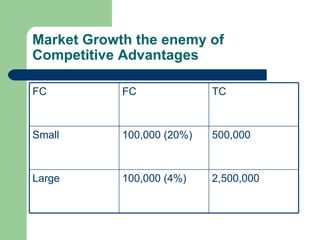

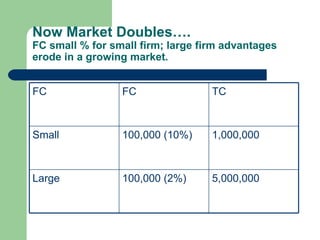

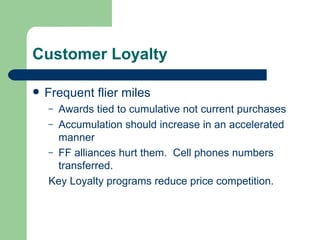

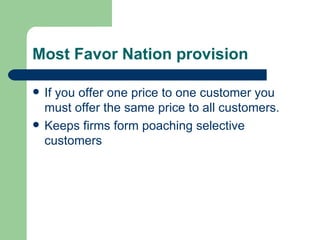

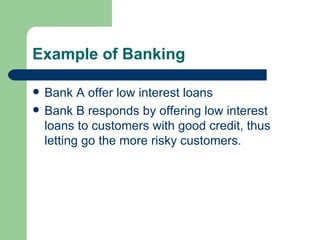

The document discusses strategic vs tactical decisions and competitive advantages in business. It explains that strategic decisions are made by top management and involve long-term planning around key questions of what business to be in and how to develop competencies. Tactical decisions are operational and focus on short-term goals. Competitive advantages can come from supply advantages like proprietary technology, demand advantages like customer loyalty, or economies of scale that lower costs as production increases. Barriers to entry like brand loyalty or switching costs help companies maintain advantages.