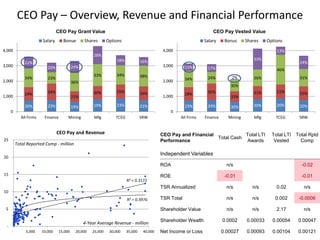

This document analyzes the relationship between CEO pay and company financial performance and shareholder returns. It finds:

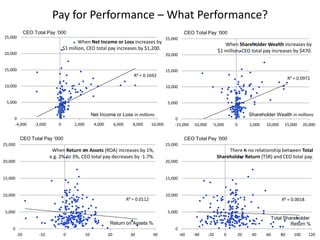

- CEO pay is most strongly correlated with net income, with CEO pay increasing by $1,200 for every $1 million increase in net income.

- CEO pay also increases by $470 for every $1 million increase in shareholder wealth.

- Higher return on assets (ROA) is weakly correlated with lower CEO pay, with pay decreasing by $1.7 for every 1% increase in ROA.

- Total shareholder return (TSR) shows no clear correlation with CEO pay levels.