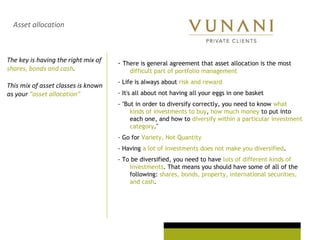

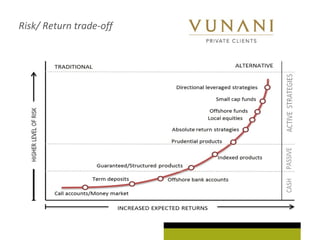

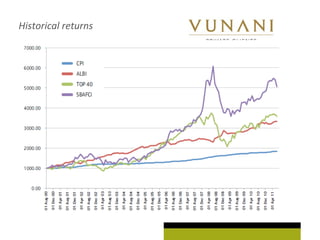

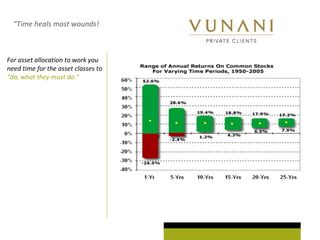

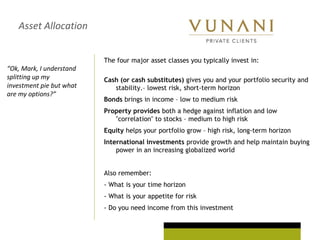

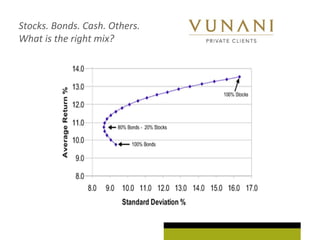

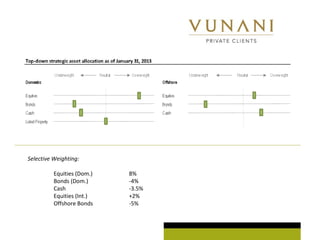

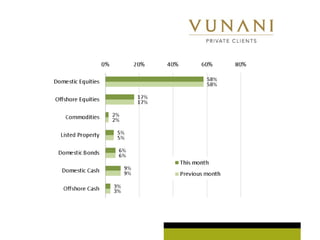

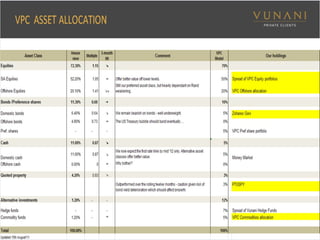

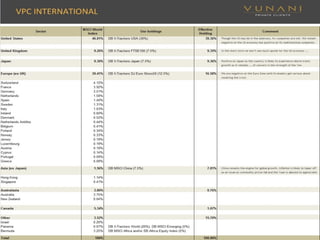

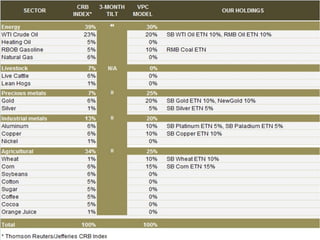

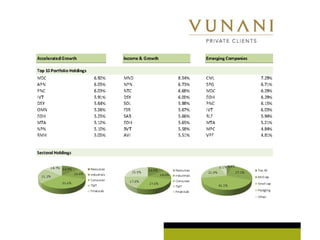

This document discusses diversification and asset allocation in investing. It defines diversification as spreading investments across different sectors, industries, and countries to reduce risk. Proper asset allocation is emphasized as the most important part of portfolio management. The major asset classes discussed are cash, bonds, property, and equities, with their varying risk-return profiles. The document advises that asset allocation should become more conservative as one ages, with a higher stock allocation when younger to take advantage of growth. Historical returns and the risk-return tradeoff are also briefly covered.