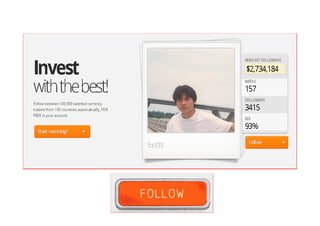

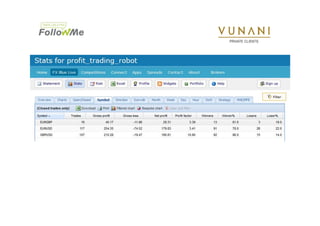

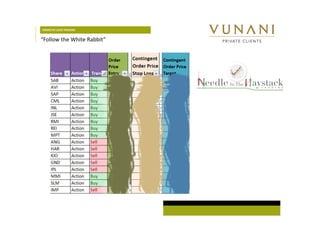

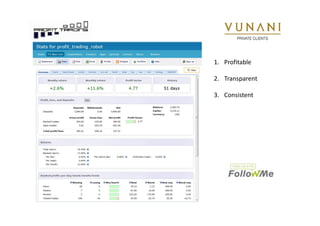

The document outlines coattail investing strategies for enhanced trading profitability through copy trading with various lead traders at Vunani Private Clients. It discusses specific trading strategies, portfolio qualifications, and the importance of managing risk and diversifying investments. Additionally, it emphasizes the necessity of understanding trader actions and provides details on automated forex trading accounts for maximizing performance with minimal risk.