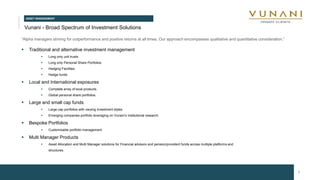

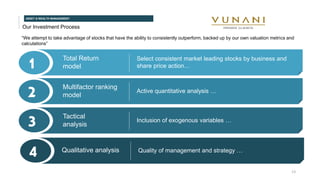

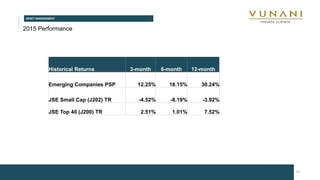

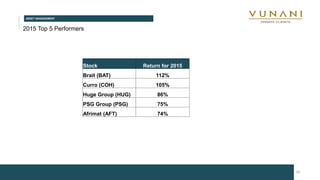

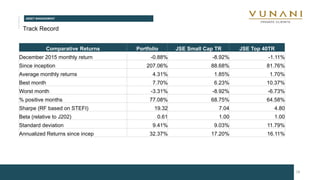

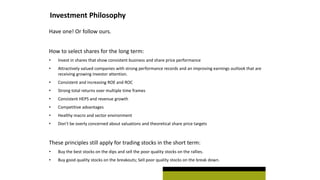

Vunani provides asset management services including traditional and alternative investment management. They offer a variety of investment products including unit trusts, personal share portfolios, hedge funds, and bespoke portfolios. One product is the Vunani Emerging Companies Personal Share Portfolio, which is a fully managed small and mid cap portfolio. It aims to outperform the JSE Small Cap Index through selecting shares of promising small to medium companies. The portfolio has outperformed benchmarks with average annual returns of over 30% since inception. Vunani employs a rigorous investment process combining quantitative and fundamental analysis to select shares that show consistent business and share price performance for long term outperformance.