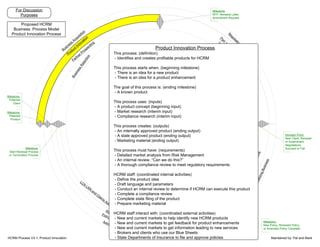

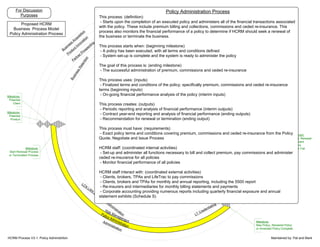

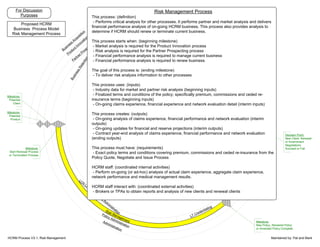

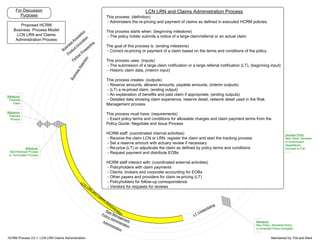

This document outlines several business processes for an organization called HCRM including Product Innovation, Partner Prospecting, Quote Negotiation and Issue, Policy Administration, and Risk Management. Each process is defined in terms of its starting point, goal, inputs, outputs, requirements, and internal/external activities. The processes work together to develop products, identify partners, negotiate policies, administer financials, and analyze risks.