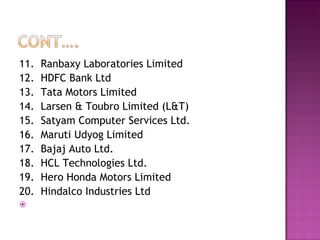

A public company is a company that is owned by shareholders and trades its shares publicly on a stock exchange. It must publish its financial reports so investors can determine the value of its stock. Some examples of large public companies in India are Indian Oil Corporation, Reliance Industries, and Bharat Petroleum Corporation.