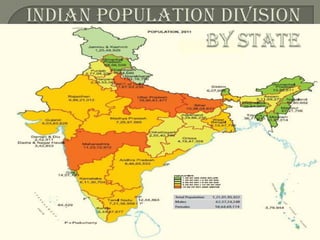

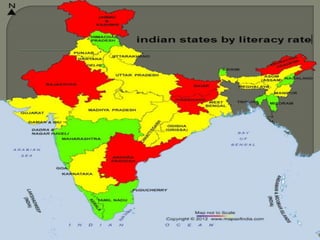

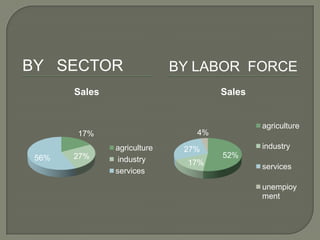

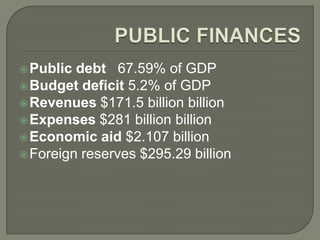

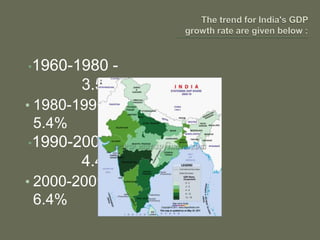

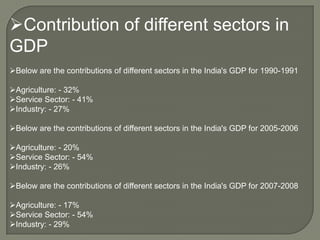

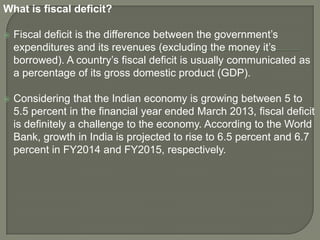

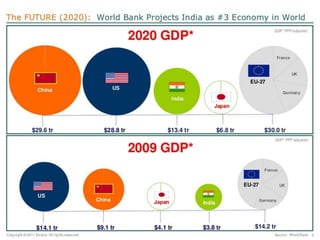

India is the seventh largest country by area and the second most populous nation, with a diverse economy encompassing agriculture, industry, and services contributing significantly to GDP. Despite being the largest producer of milk and pulses, sectors like textiles face declining global demand, while the services sector is rapidly growing, particularly in technology outsourcing. Economic challenges include a high fiscal deficit driven by government spending and lower revenues, which impacts infrastructure and welfare projects.