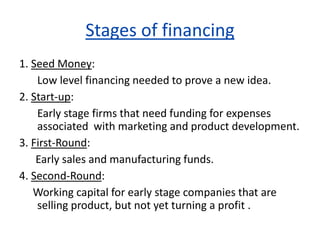

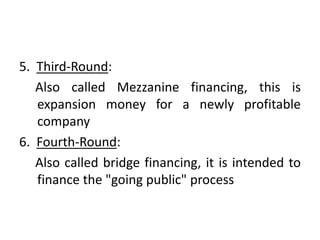

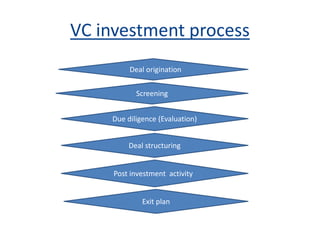

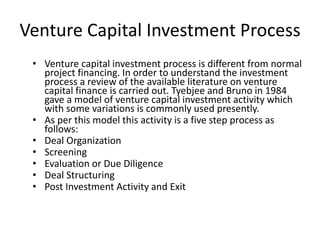

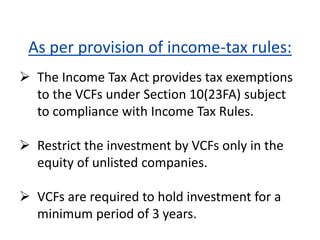

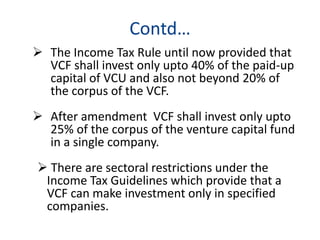

This document provides an overview of venture capital, including its meaning, characteristics, advantages, stages of financing, investment process, development in India, and rules and regulations. It defines venture capital as funds made available for startups and small businesses with high growth potential. Key points include: venture capitalists provide long-term equity financing and business assistance in exchange for equity; the investment process involves deal origination, screening, due diligence, structuring, and exit; and venture capital in India is regulated by SEBI and income tax acts which provide tax exemptions.