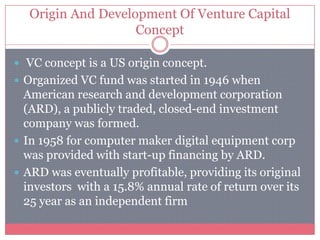

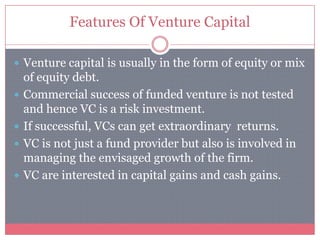

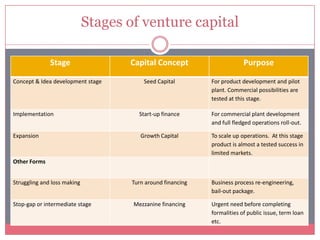

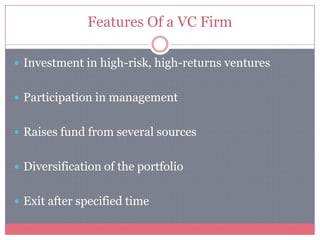

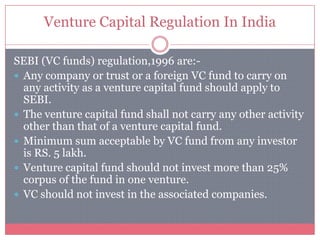

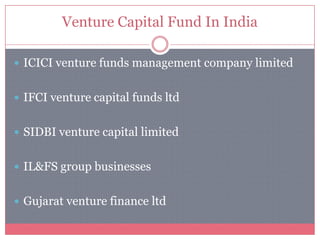

This document discusses venture capital, including its concept, definition, origin, features, stages, eligibility for funding, and the investment process. It provides an overview of venture capital, including that it finances startups and early-stage businesses through high-risk investments. Venture capital funds invest across various stages from seed to growth. The document also summarizes India's venture capital regulation and some major venture capital funds in India. It outlines advantages of venture capital for investors, enterprises, and the economy.