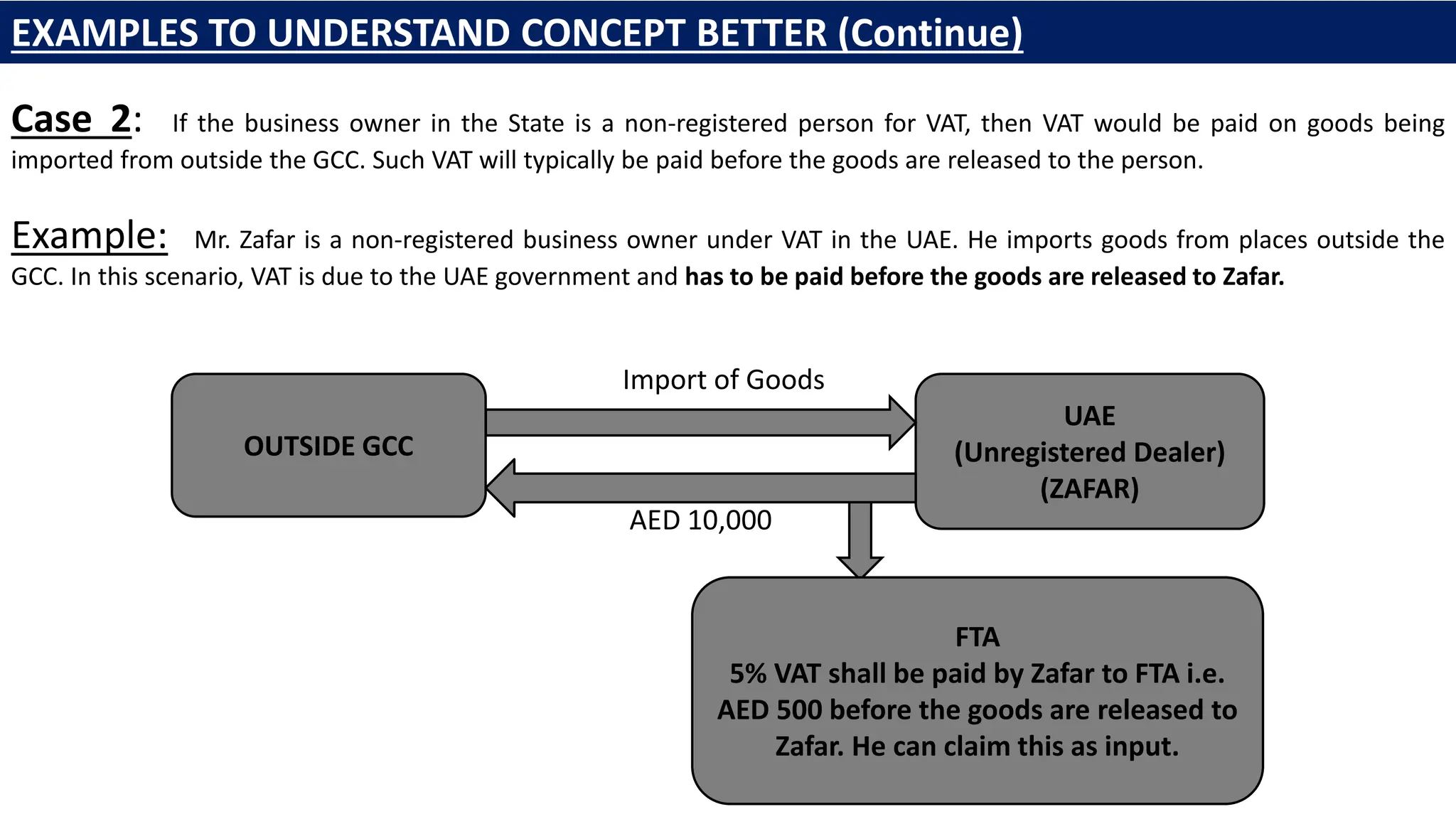

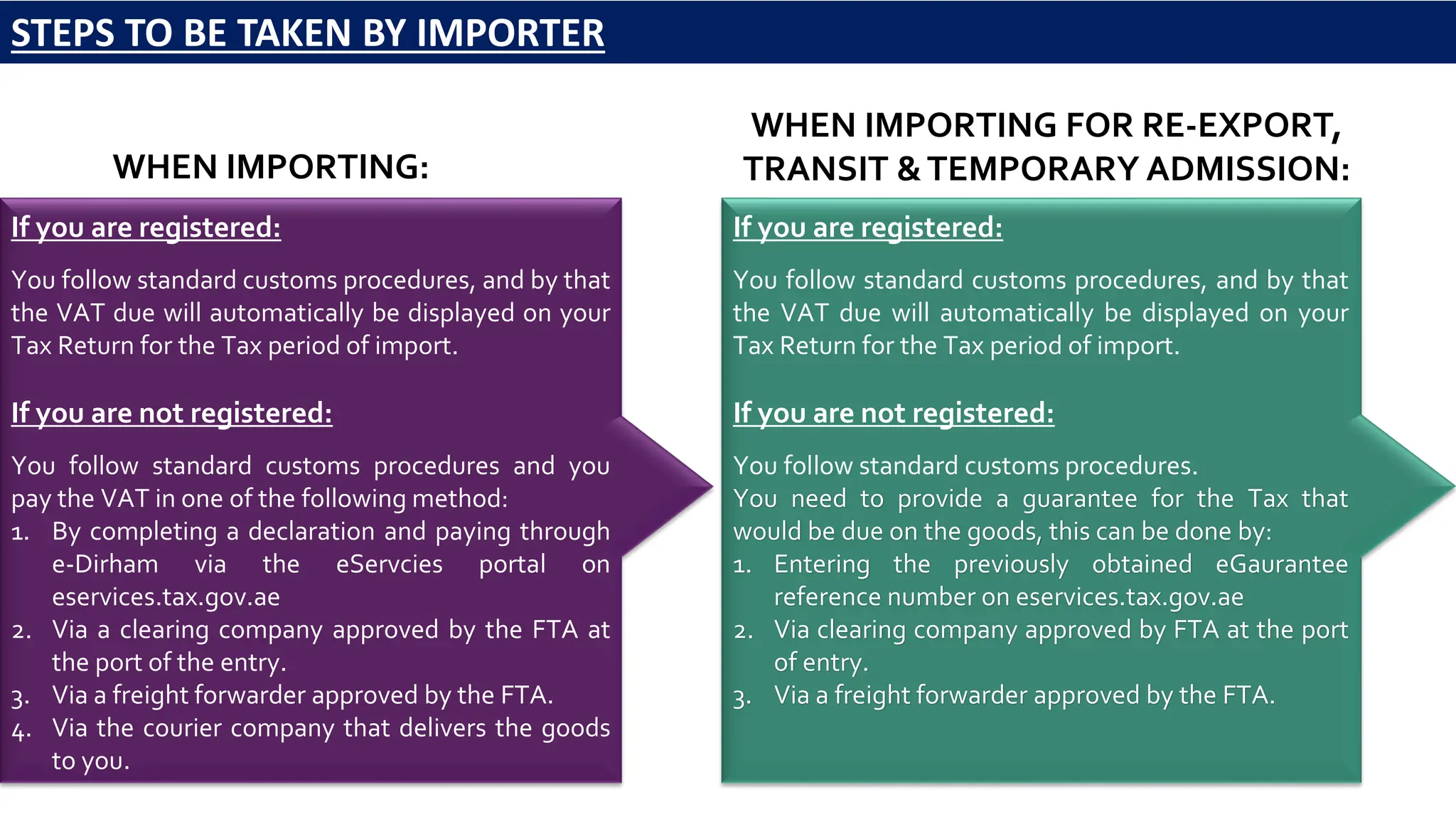

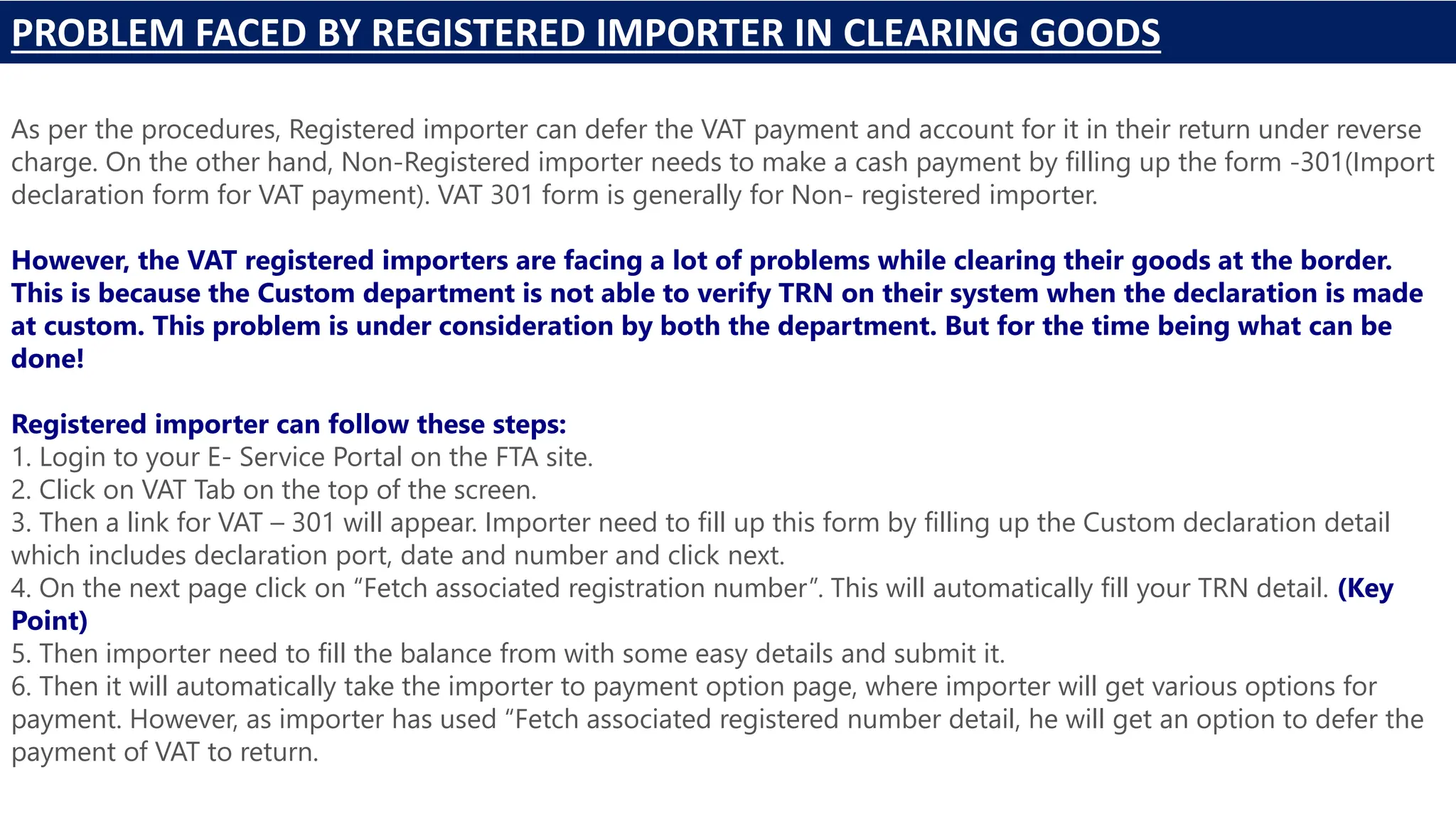

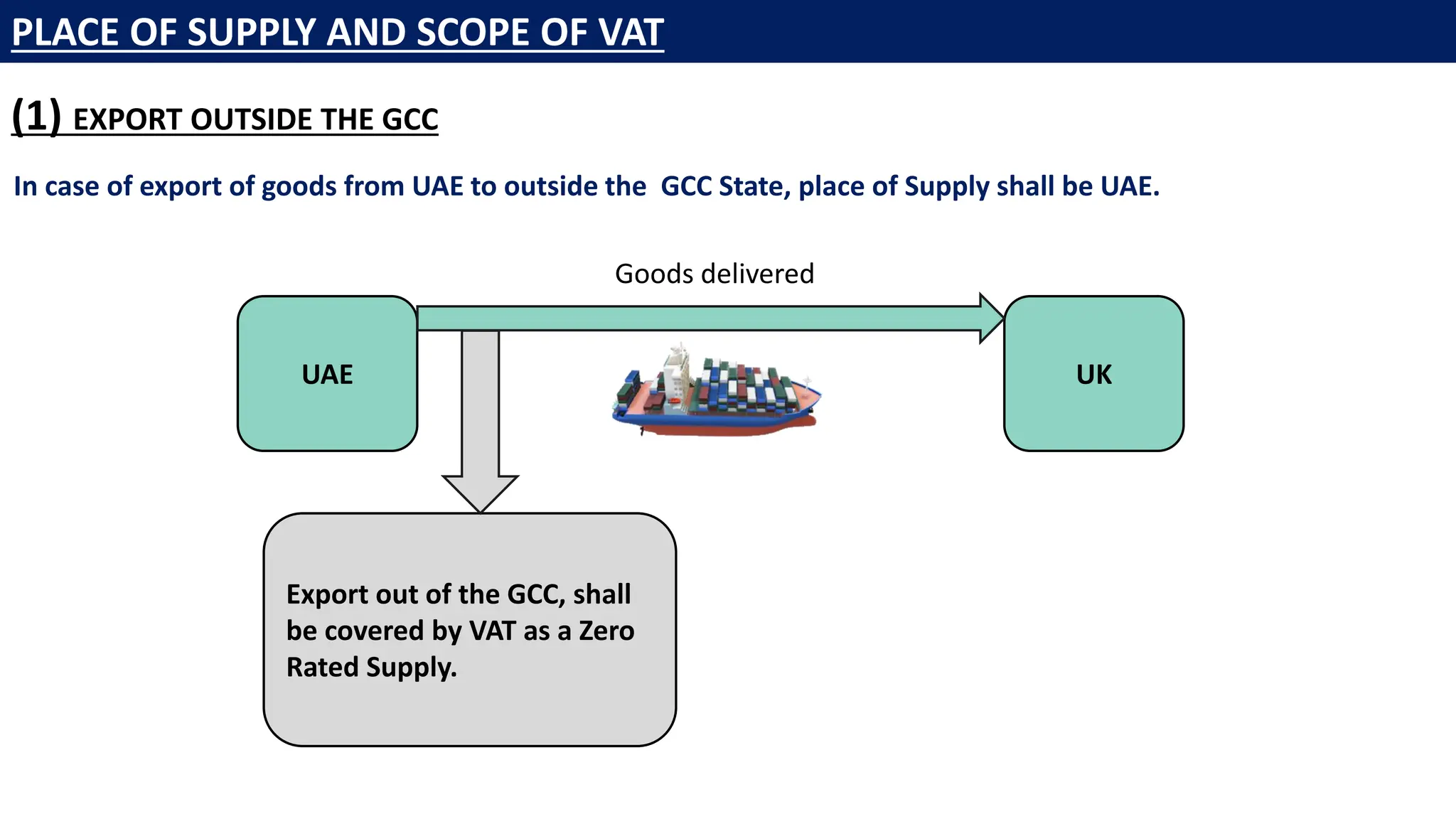

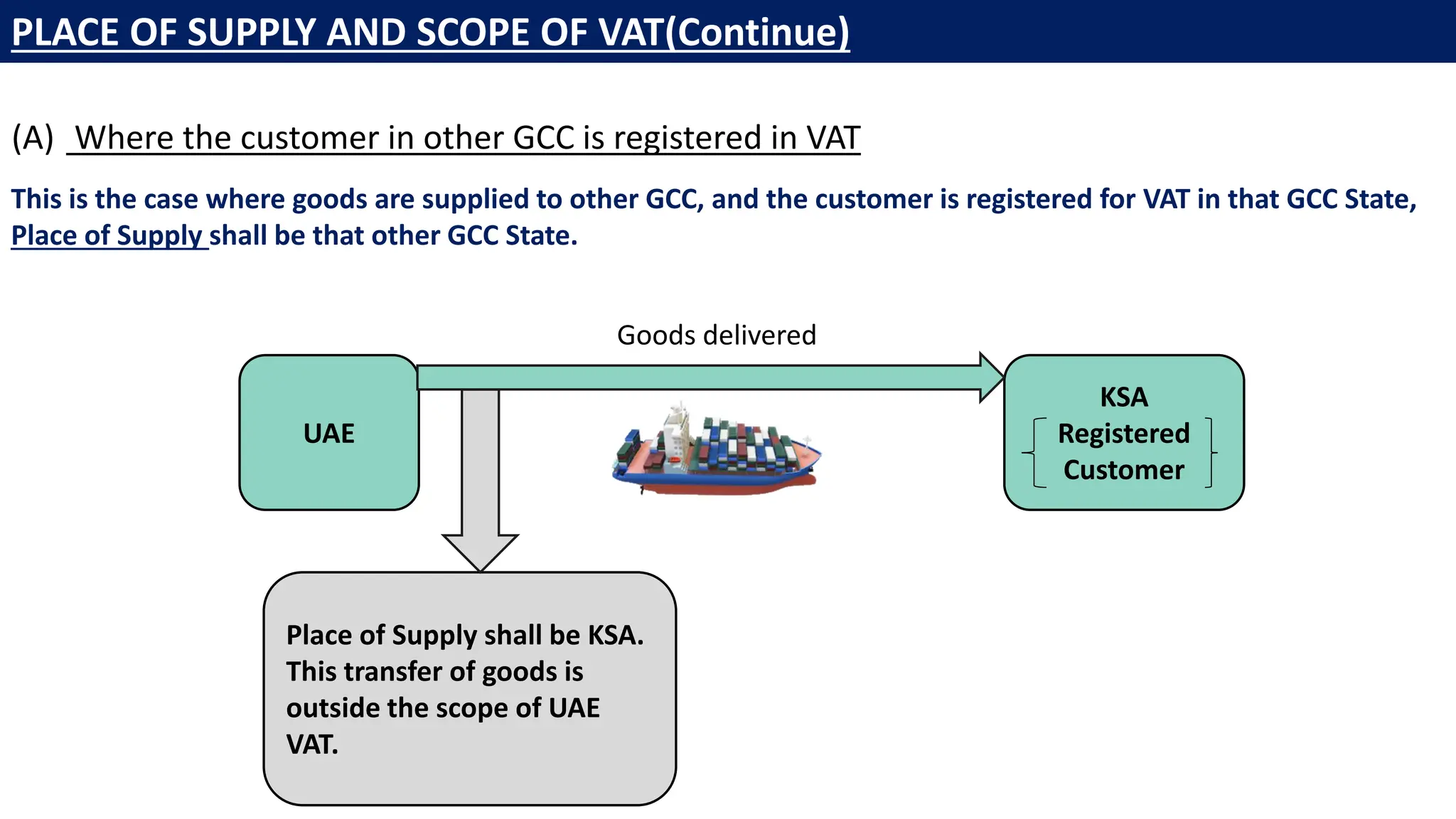

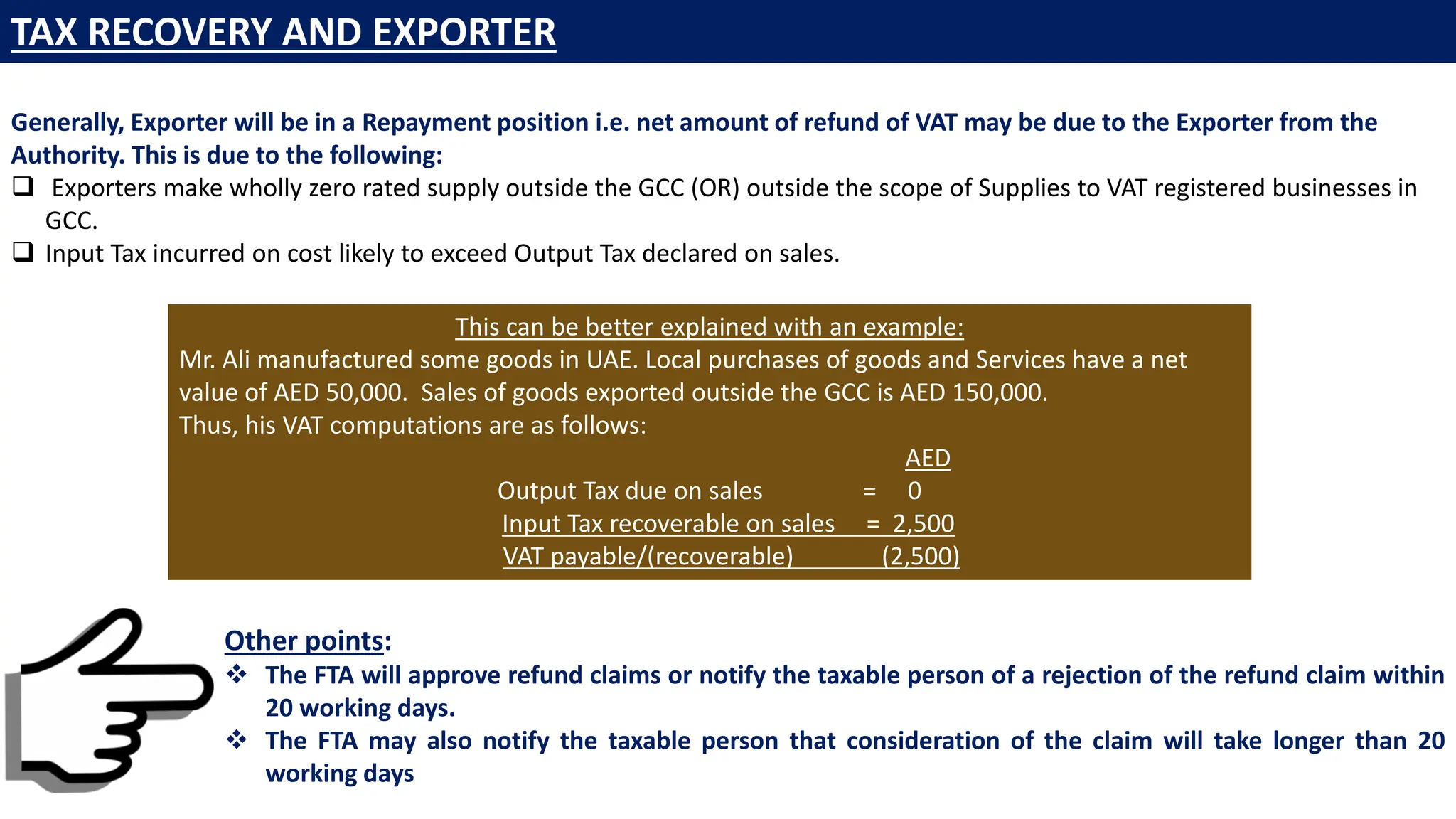

The document outlines the VAT regulations related to designated zones in the UAE, including conditions for import and export processes. Key points highlight that goods imported into these zones are not classified as imports under specific conditions, and procedures for registered versus non-registered importers differ significantly. It also details zero-rated exports, necessary documentation, and potential tax implications for goods transhipped or exported to GCC countries.