The document provides information on VAT registration in the UAE, including:

- Who is required to register, with mandatory registration threshold of AED 375,000 in annual supplies.

- How to calculate turnover for registration, including taxable supplies.

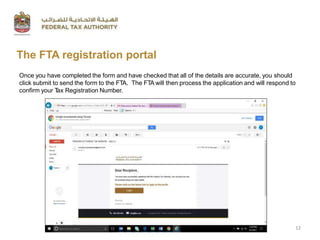

- The process for registering online via the FTA portal, including completing the registration form.

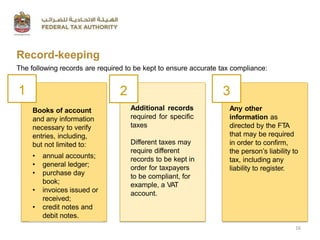

- Record keeping requirements for VAT registered entities.

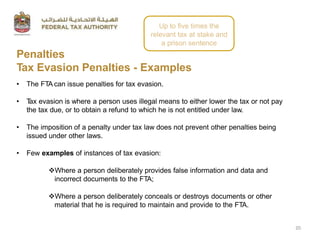

- Penalties for non-compliance and tax evasion.

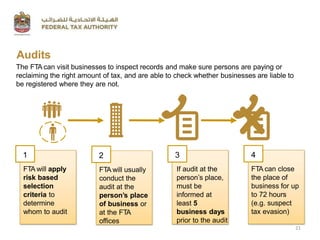

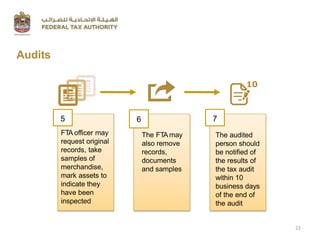

- The FTA's ability to conduct audits of businesses to ensure accurate tax reporting.