The document provides information on VAT registration in the UAE, including:

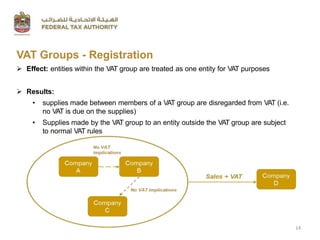

- Who is required to register, with mandatory registration threshold of AED 375,000 in annual supplies.

- How to calculate turnover for registration, including taxable supplies.

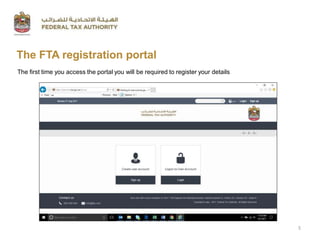

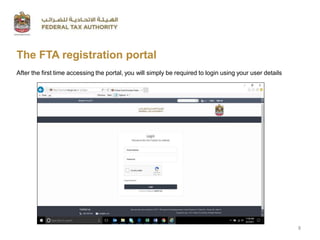

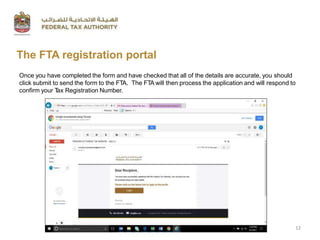

- The process for registering online via the FTA portal, including completing the registration form.

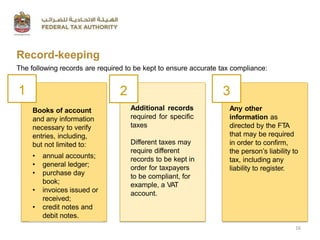

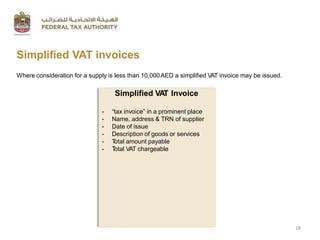

- Record keeping requirements for VAT registered entities.

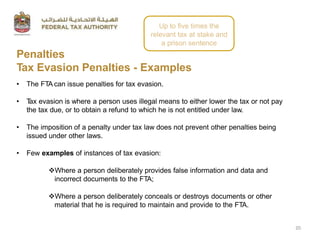

- Penalties for non-compliance and tax evasion.

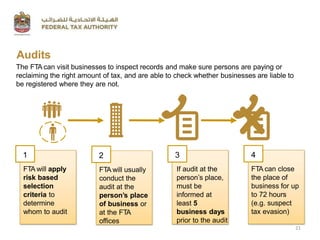

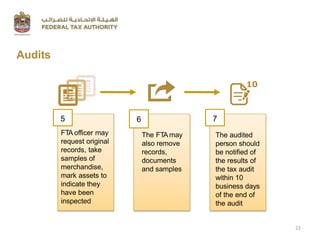

- The FTA's ability to conduct audits of businesses to ensure accurate tax reporting.