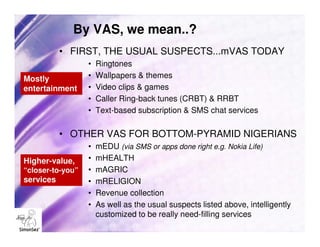

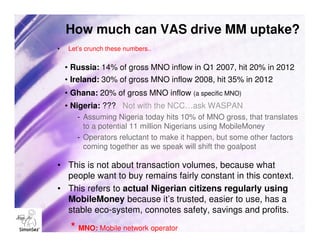

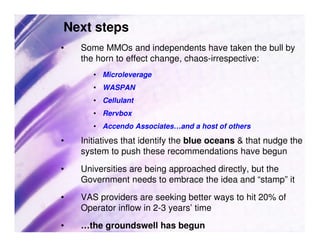

This document discusses how mobile value-added services (VAS) can help catalyze uptake of mobile money in Nigeria. While mobile money services were launched in 2011, adoption remains low due to issues like technology interoperability challenges, lack of customer understanding and trust, and insufficient expertise in rollout strategies. The document notes that Nigerians already pay for digitized services like VAS. It recommends that the government, mobile network operators, and private sector collaborate to harness the opportunity of VAS to drive more Nigerians to use mobile money services, with the goal of transitioning the customers accustomed to VAS payments to the mobile money ecosystem. Initiatives discussed include using mobile services for agriculture and implementing well-