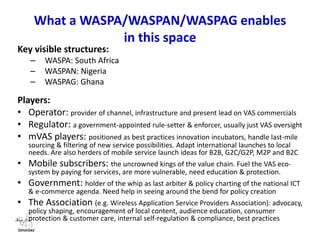

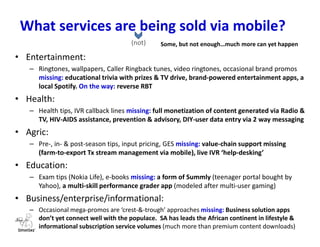

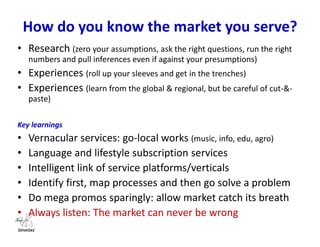

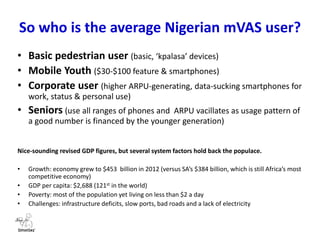

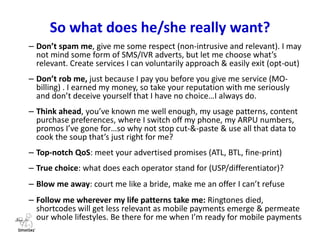

The document discusses the expectations and desires of Nigerian mobile value-added service (VAS) customers, focusing on their demand for relevant, non-intrusive services and high-quality user experience. It outlines the roles of various stakeholders in the VAS ecosystem, including operators, regulators, and consumers, while highlighting gaps in the current offerings. Key recommendations include leveraging user data for personalized services, improving service quality, and ensuring customer choice and respect in the engagement process.