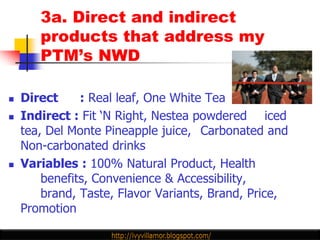

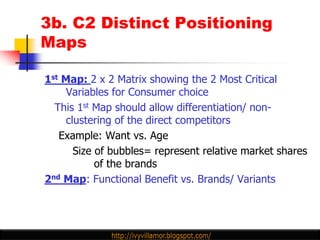

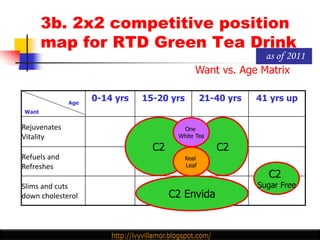

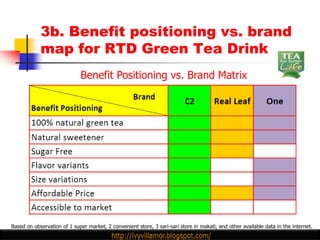

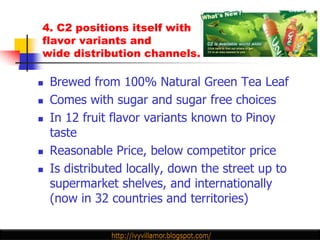

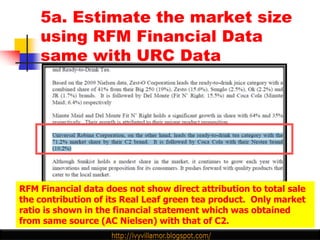

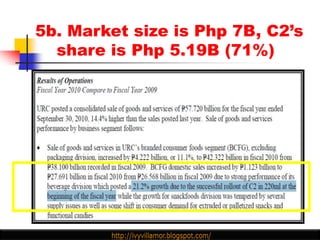

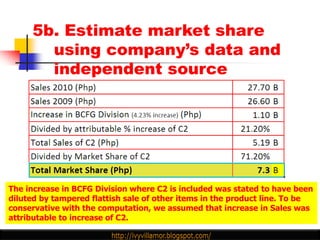

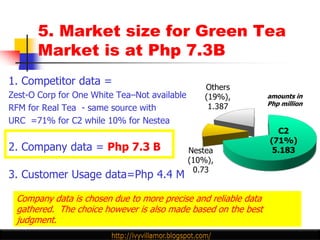

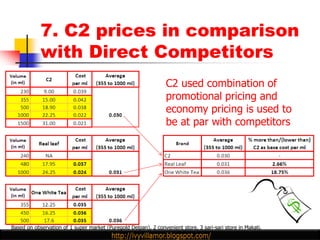

C2 is a green tea brand that aims to target the "cyber age" demographic of 15-40 year olds. It positions itself as a 100% natural, refreshing drink in 12 fruit flavors. C2 has the largest market share of the green tea market at 71%, with the total market size estimated to be PHP 7 billion based on company data. C2 differentiates itself through its variety of flavors and wide distribution channels.