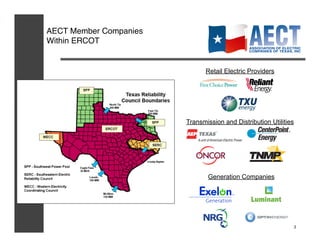

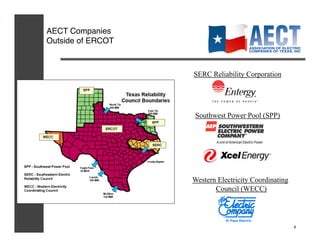

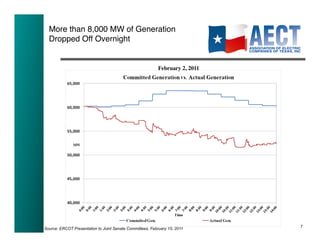

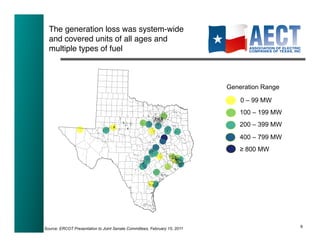

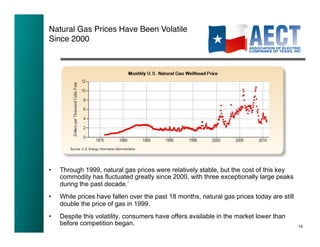

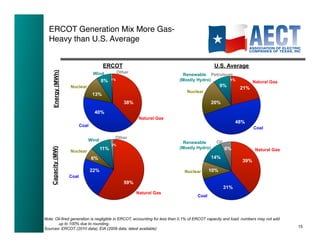

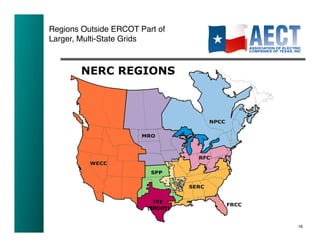

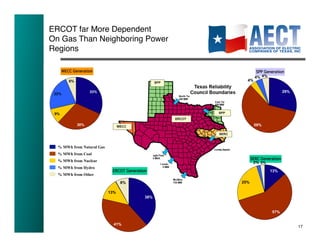

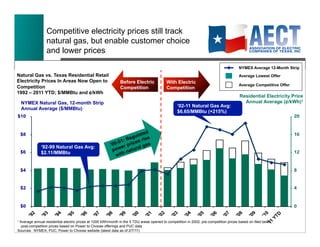

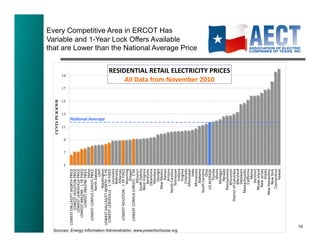

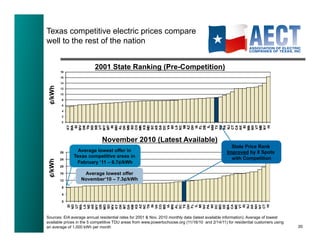

The document provides an update on the electric industry in Texas following power outages in early February 2011. It discusses how severe cold weather caused over 8,000 MW of generation to go offline, leading to controlled outages. It notes lessons learned around winterization and the state's reliance on natural gas generation. Additionally, it highlights competitive retail electric market options and energy efficiency programs that can help lower customer bills.