Embed presentation

Download to read offline

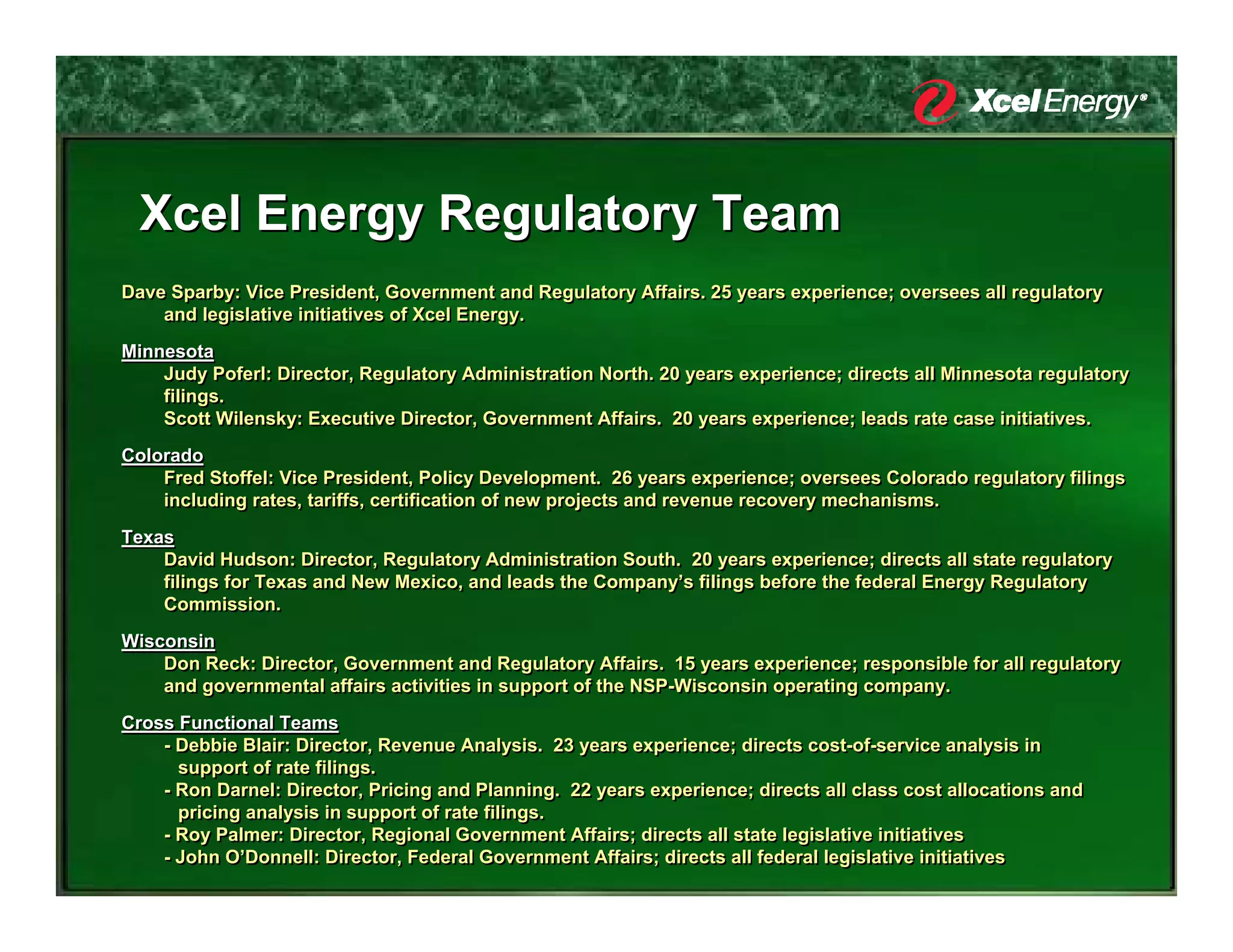

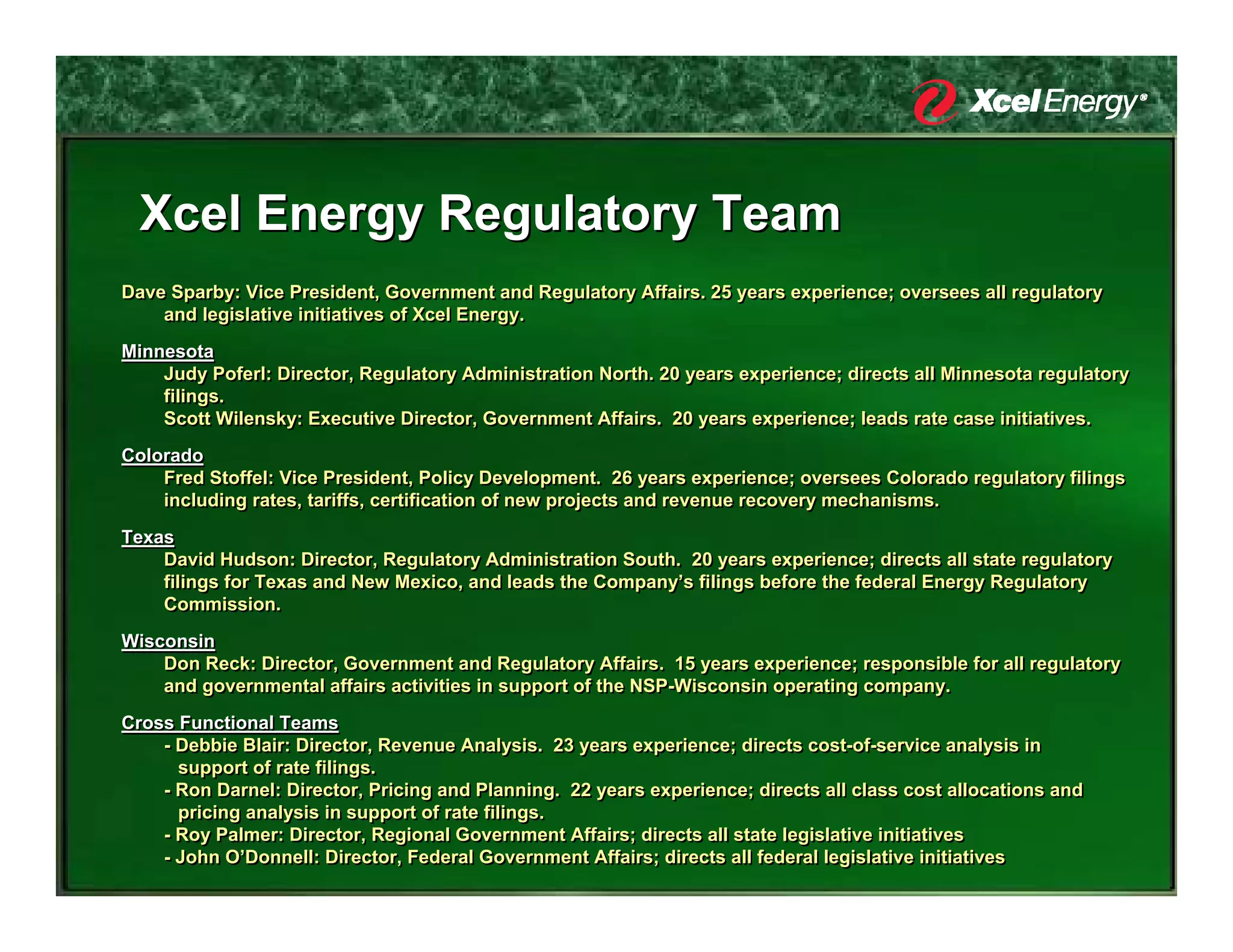

Mike Kaluzniak: Director, Minnesota Regulatory Affairs. 20 years experience; leads Minnesota regulatory strategy and proceedings. Attorneys: Fredrickson & Byron: Lead outside counsel for Minnesota regulatory matters. Consultants: Brubaker & Associates: Lead regulatory consultant for Minnesota proceedings. Colorado