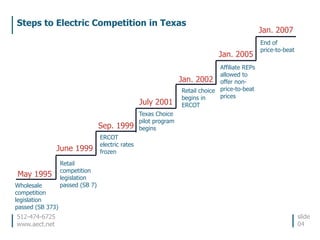

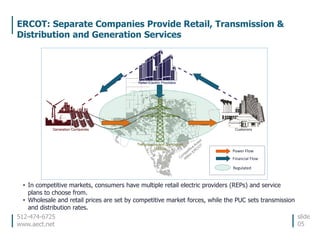

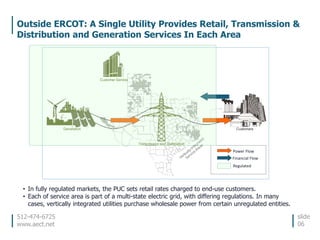

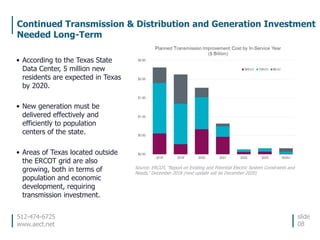

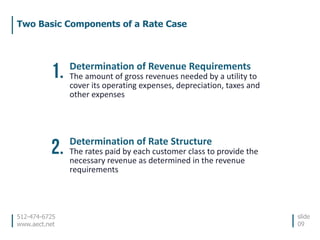

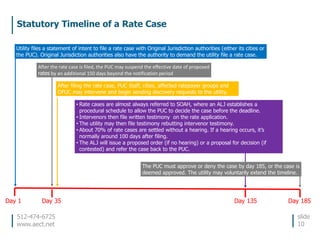

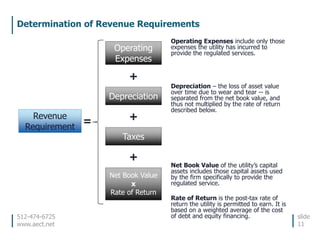

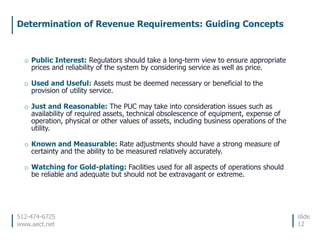

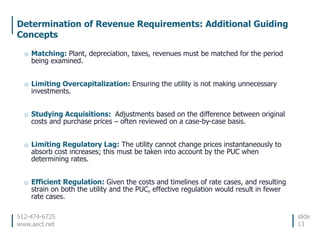

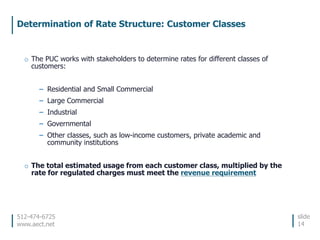

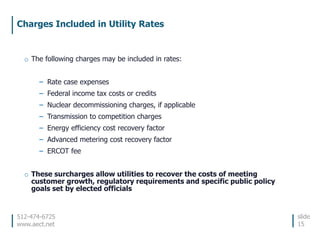

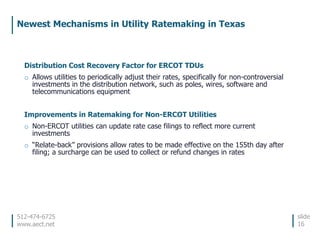

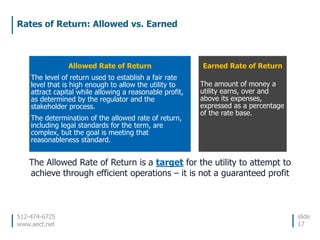

The document discusses electric ratemaking in Texas, including how rates are determined through revenue requirements and rate structures, the regulatory process for rate cases, and recent mechanisms introduced in utility ratemaking like distribution cost recovery factors. It also covers concepts like allowed versus earned rates of return and how utilities are regulated differently within and outside the ERCOT grid.