This document outlines several special decision situations in capital budgeting, including:

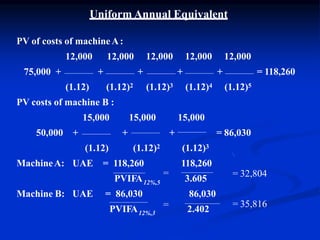

1) Choosing between projects of unequal life by converting costs to a uniform annual equivalent

2) Determining optimal timing by examining net future value at alternative dates

3) Calculating economic life by minimizing total annual costs over an asset's life

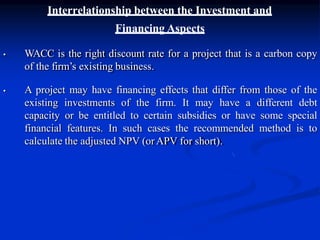

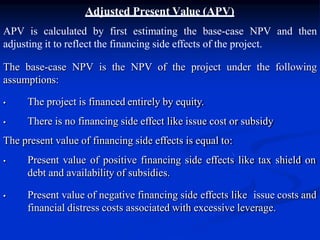

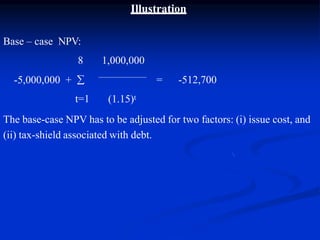

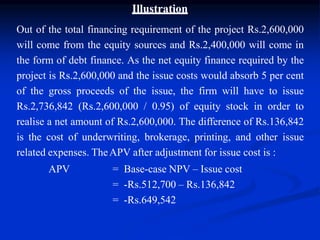

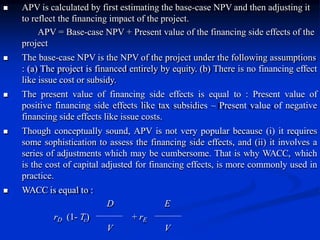

It also discusses adjusting net present value for financing effects using the adjusted present value (APV) method and adjusting the cost of capital. Additional topics covered are inflation, international capital budgeting, and investing in organizational capabilities.