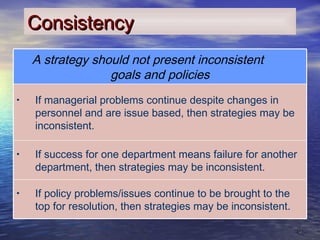

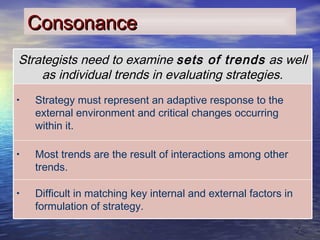

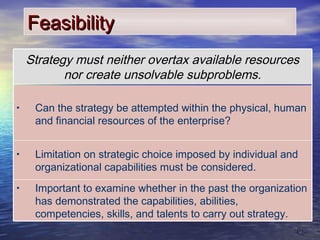

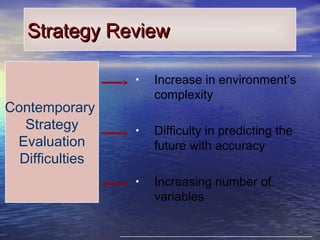

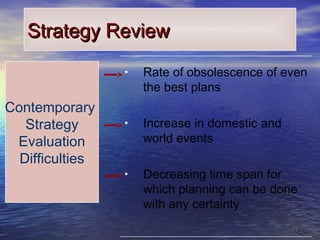

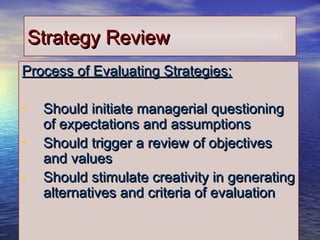

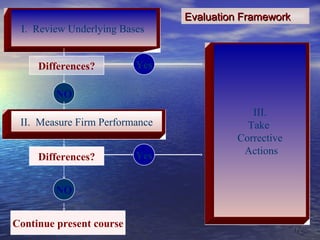

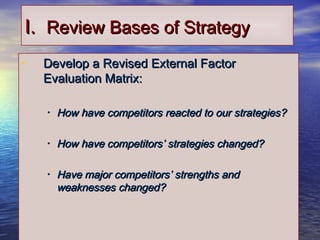

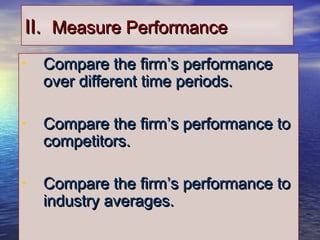

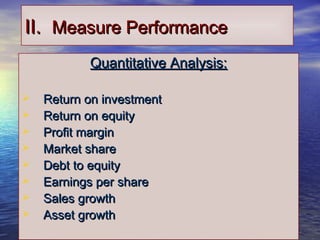

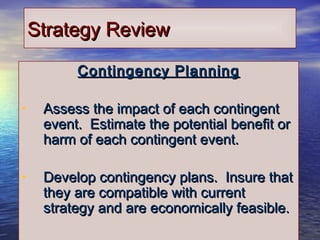

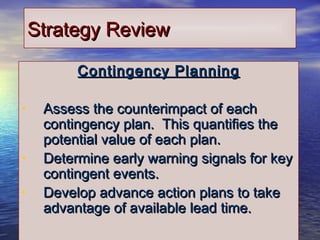

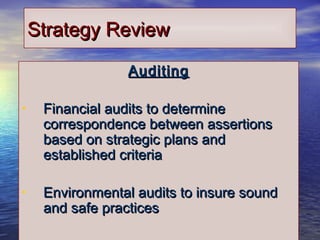

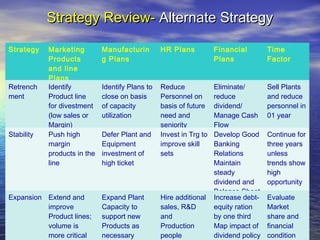

The document discusses strategy evaluation and review. It outlines the basics of strategy evaluation as examining the underlying basis of a firm's strategy, comparing actual to expected results, and taking corrective action for performance gaps. It also discusses criteria for effective strategy evaluation, including consistency, consonance, and feasibility. The document provides a framework for strategy evaluation including reviewing the underlying strategy bases, measuring firm performance, and taking corrective actions if needed. It emphasizes the importance of adequate and timely feedback in the evaluation process.

![11

Strategy Review,Strategy Review,

Evaluation, & ControlEvaluation, & Control

[ADDIE- Assesment, Design,[ADDIE- Assesment, Design,

Development, Initiation,Development, Initiation,

Evaluation]Evaluation]

[PESTEL -Political, Economical,[PESTEL -Political, Economical,

Social, Technological,Social, Technological,

Environmental, Legal]Environmental, Legal]](https://image.slidesharecdn.com/unit1-3strategyevaluation-190312141912/75/Unit-1-3-strategy-evaluation-1-2048.jpg)