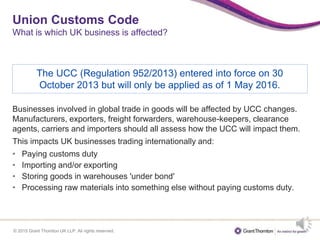

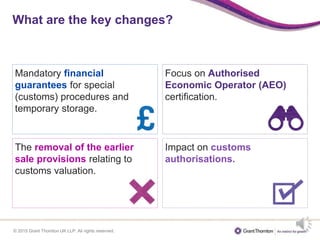

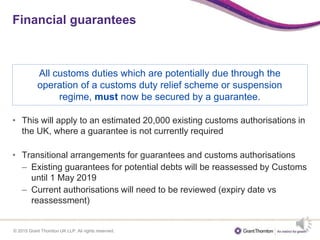

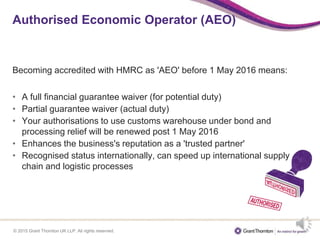

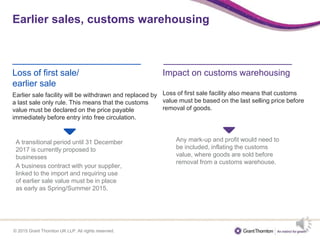

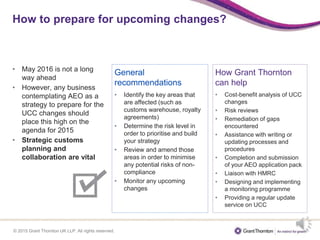

The Union Customs Code (UCC) will be applied beginning May 2016 and replaces earlier customs regulations. It will impact UK businesses involved in international trade through changes such as mandatory financial guarantees for customs procedures, a focus on Authorised Economic Operator certification, modifications to customs authorizations, and replacing earlier sales provisions with a last sale rule for customs valuation. Affected companies should review how the UCC updates will influence them and their supply chains. Strategies like pursuing AEO status by 2015 could help minimize risks of noncompliance with the new regulations.