The document provides an overview of India's customs bonded warehouse scheme. Some key points:

- The scheme allows import of goods without payment of customs duty, with duty deferred until goods are cleared for domestic sale or consumption. Manufacturing and other operations are permitted in the warehouse.

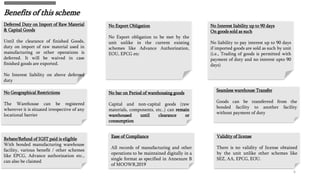

- Benefits include deferred payment of customs duties on imported raw materials and capital goods. No export obligations or interest liability on deferred duties.

- The scheme can provide greater cost optimization than other schemes like Advance Authorization or EOU by allowing duty-free import of inputs and deferred payment of duties.

- Various case studies show how companies in sectors like food processing and mobile manufacturing can benefit from duty savings, working capital gains, and