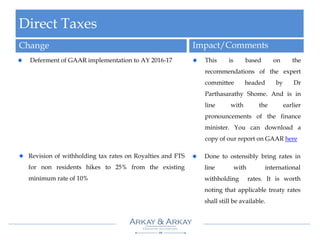

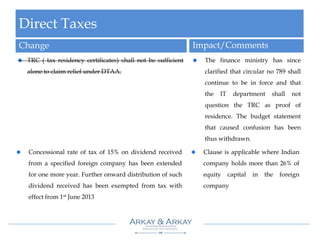

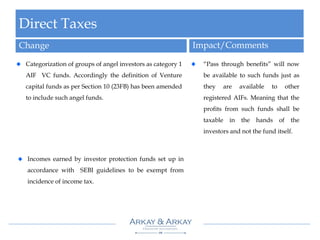

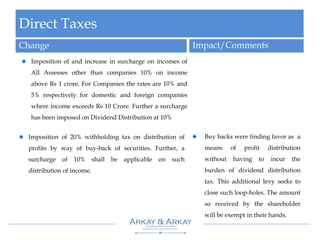

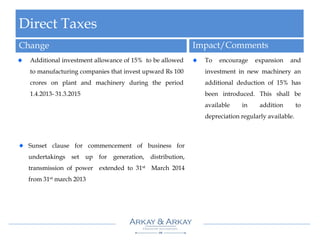

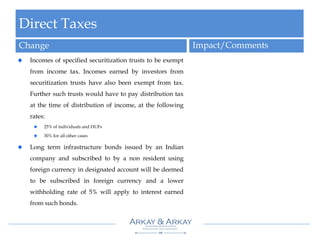

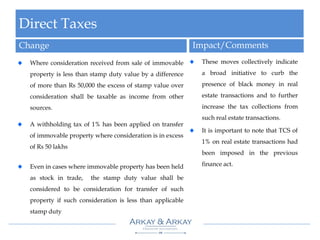

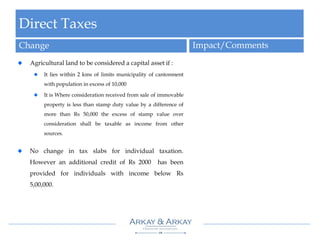

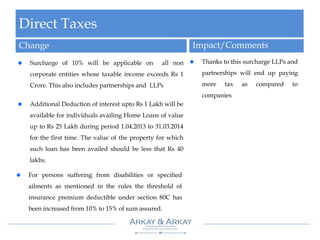

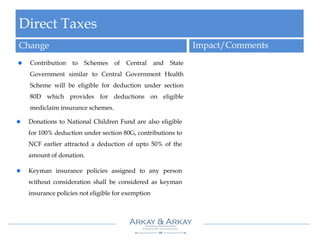

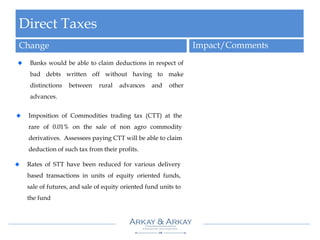

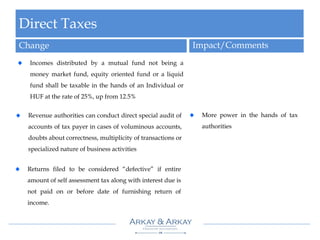

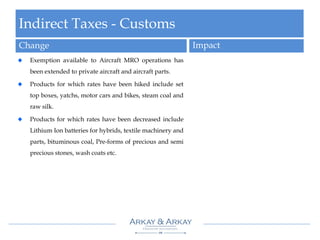

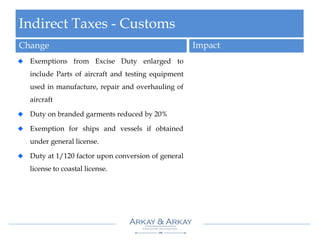

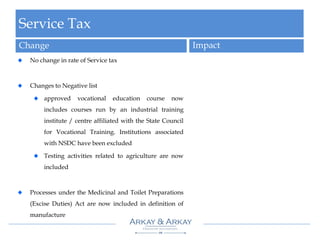

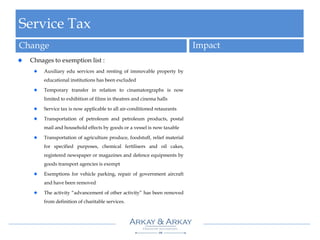

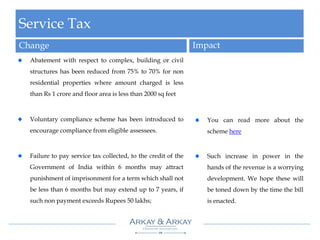

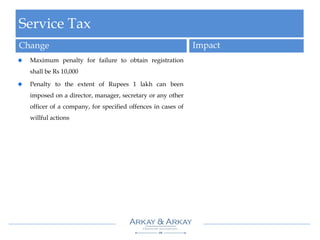

The document provides an analysis of key changes in the Union Budget 2013 related to direct taxes, indirect taxes, and service tax. Regarding direct taxes, key changes include deferring GAAR implementation, revising withholding tax rates on royalties and FTS, and imposing surcharges on various incomes above certain thresholds. For indirect taxes, notable changes involve hiking and lowering customs duty rates on certain products. Under service tax, changes include modifying the negative and exemption lists as well as reducing abatement rates for certain services.