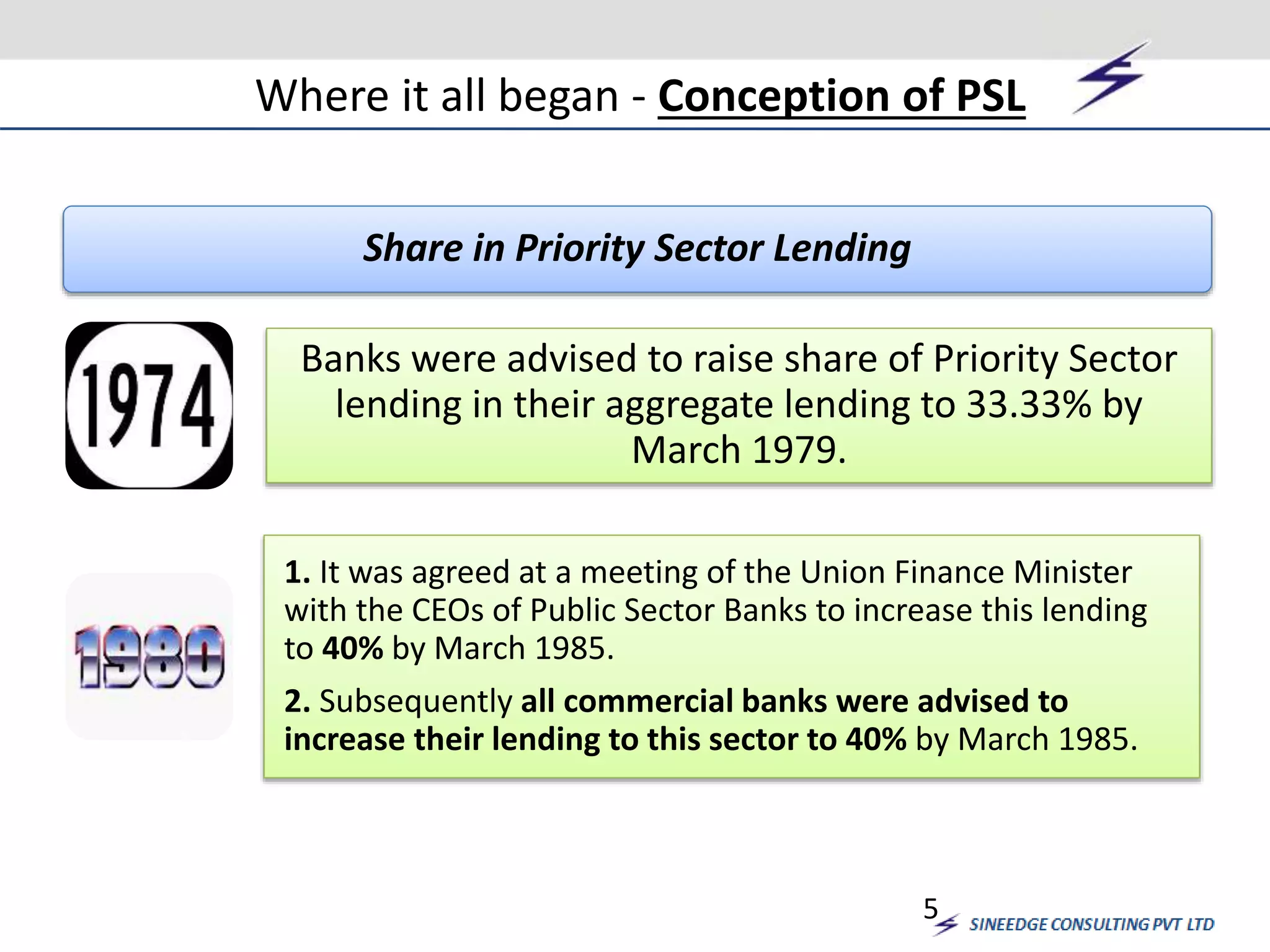

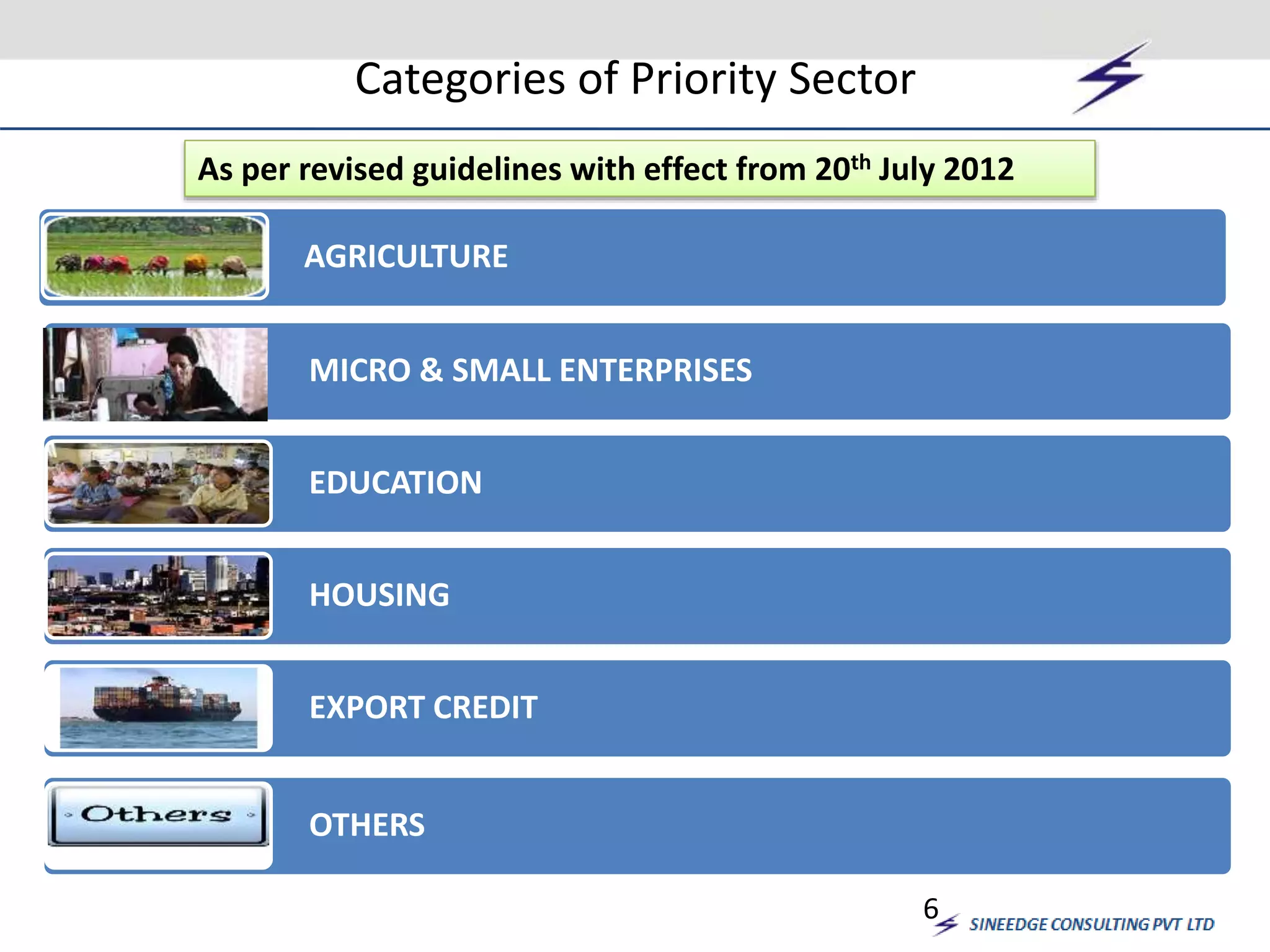

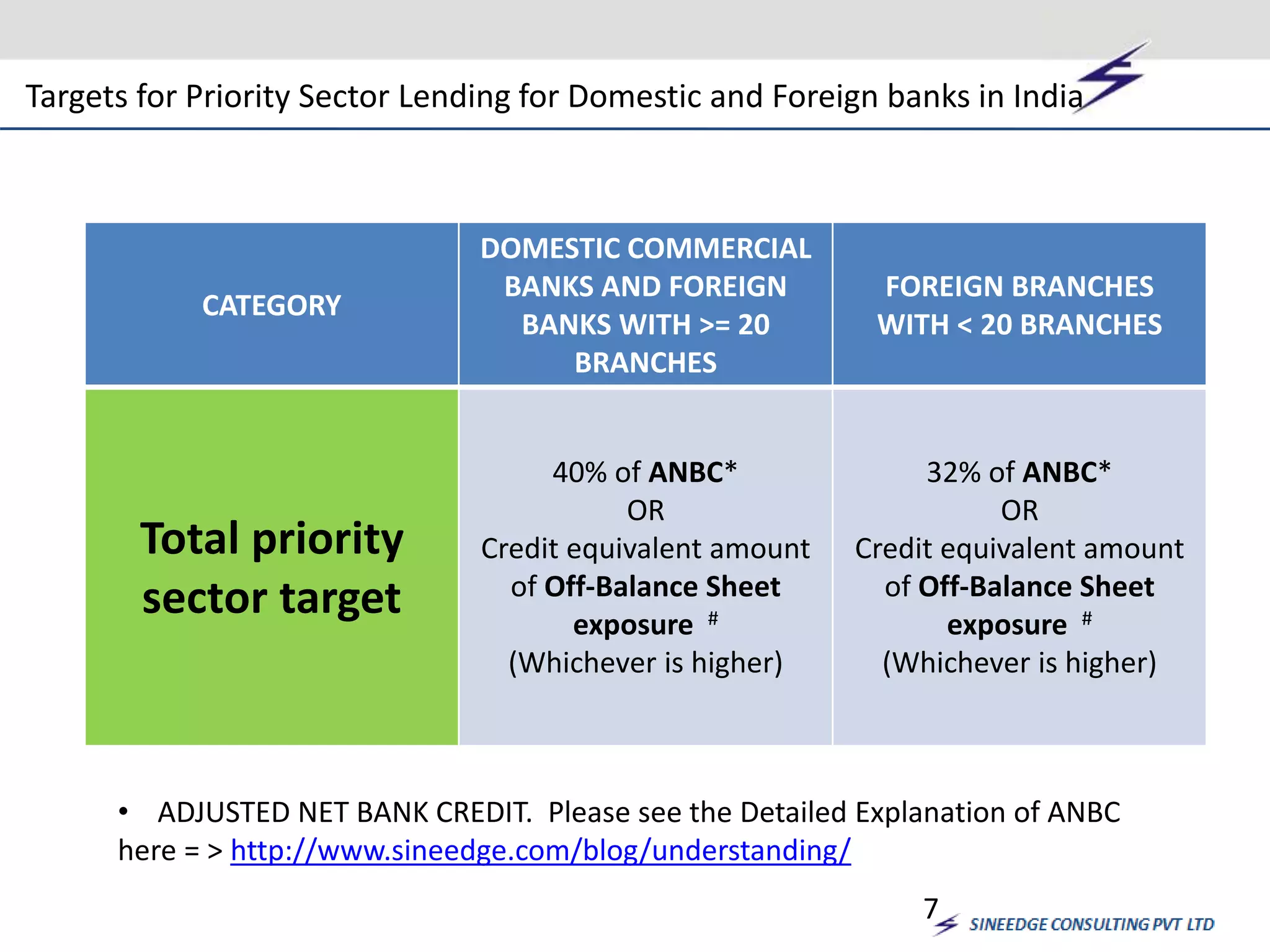

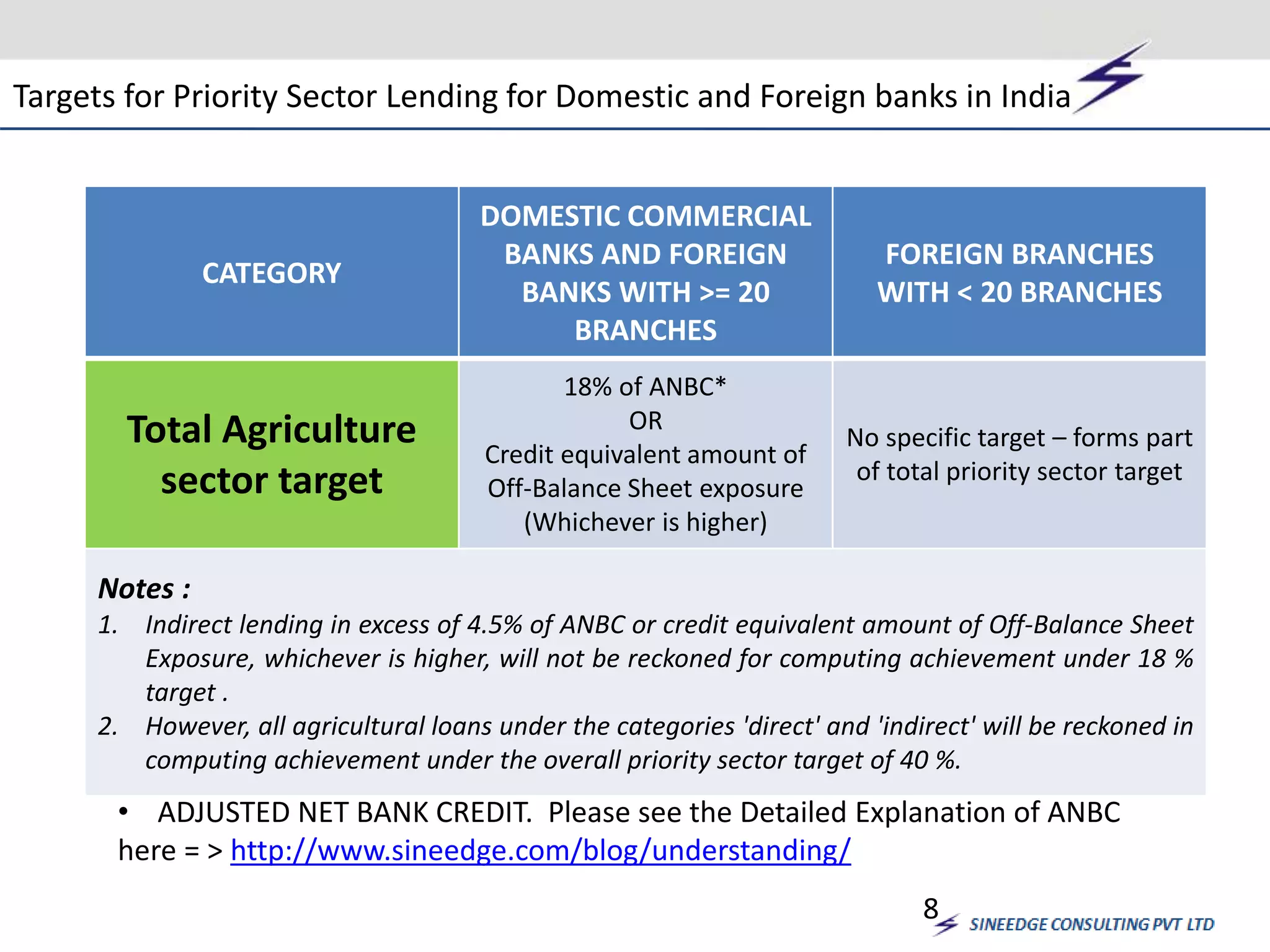

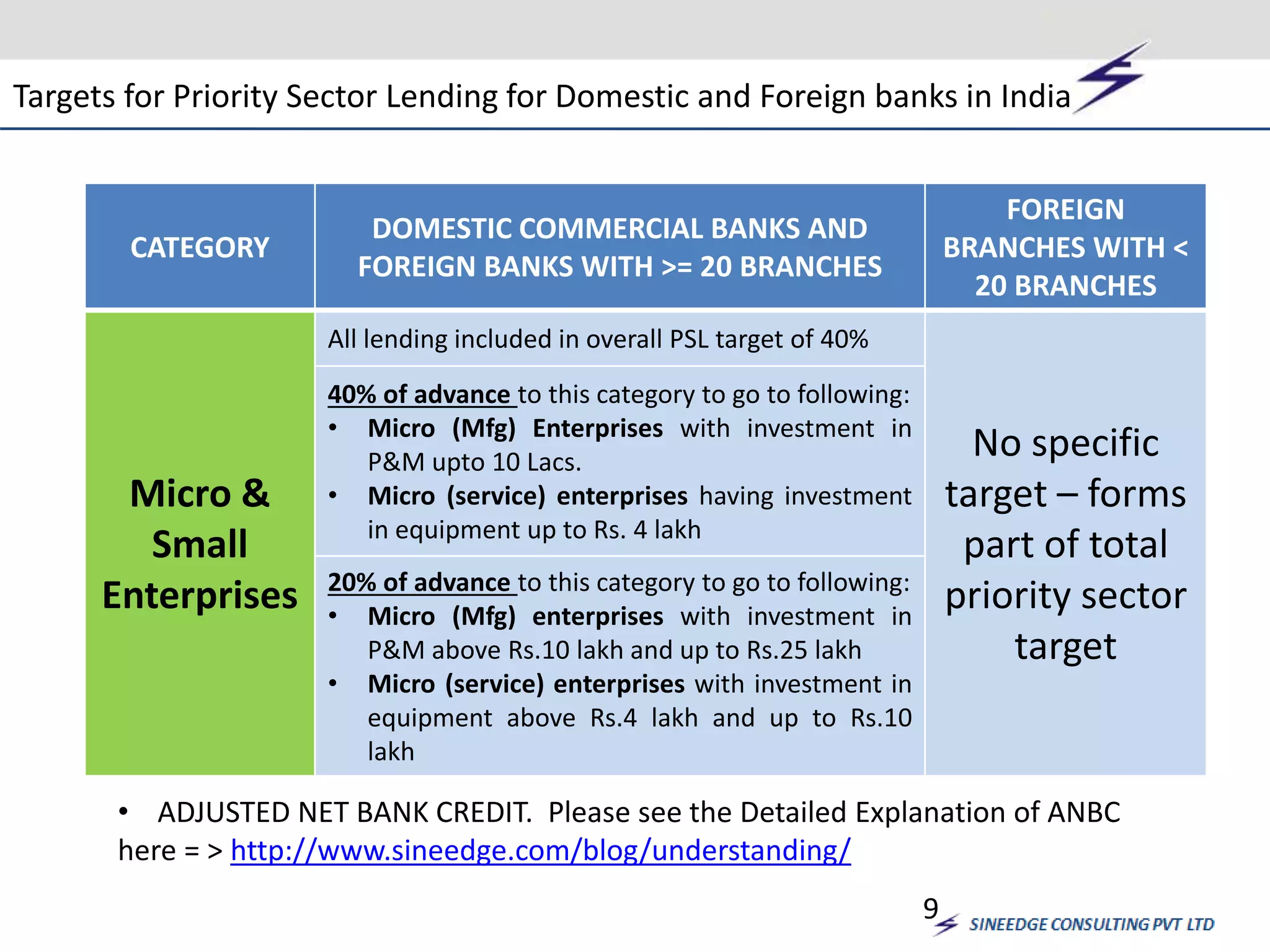

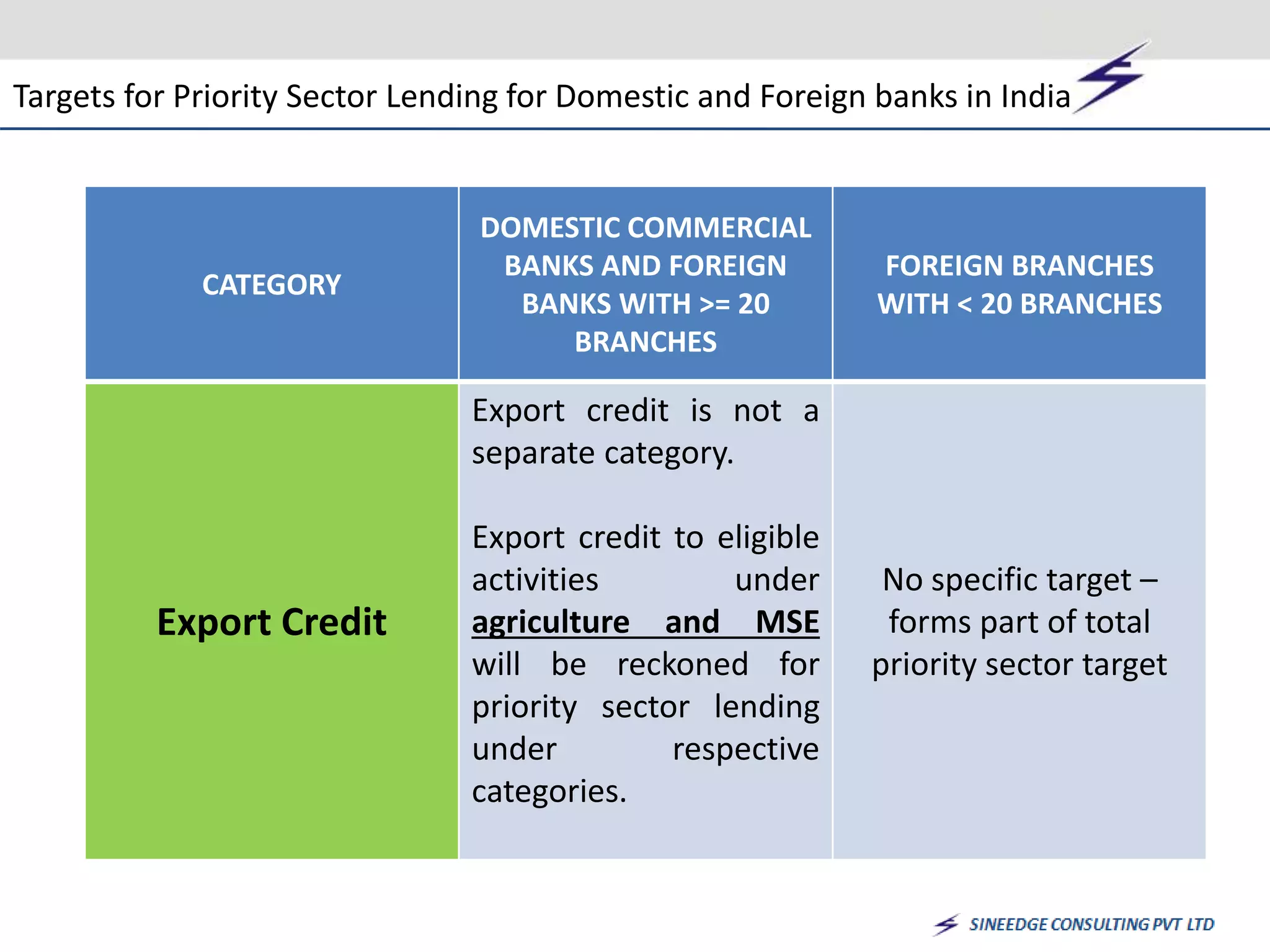

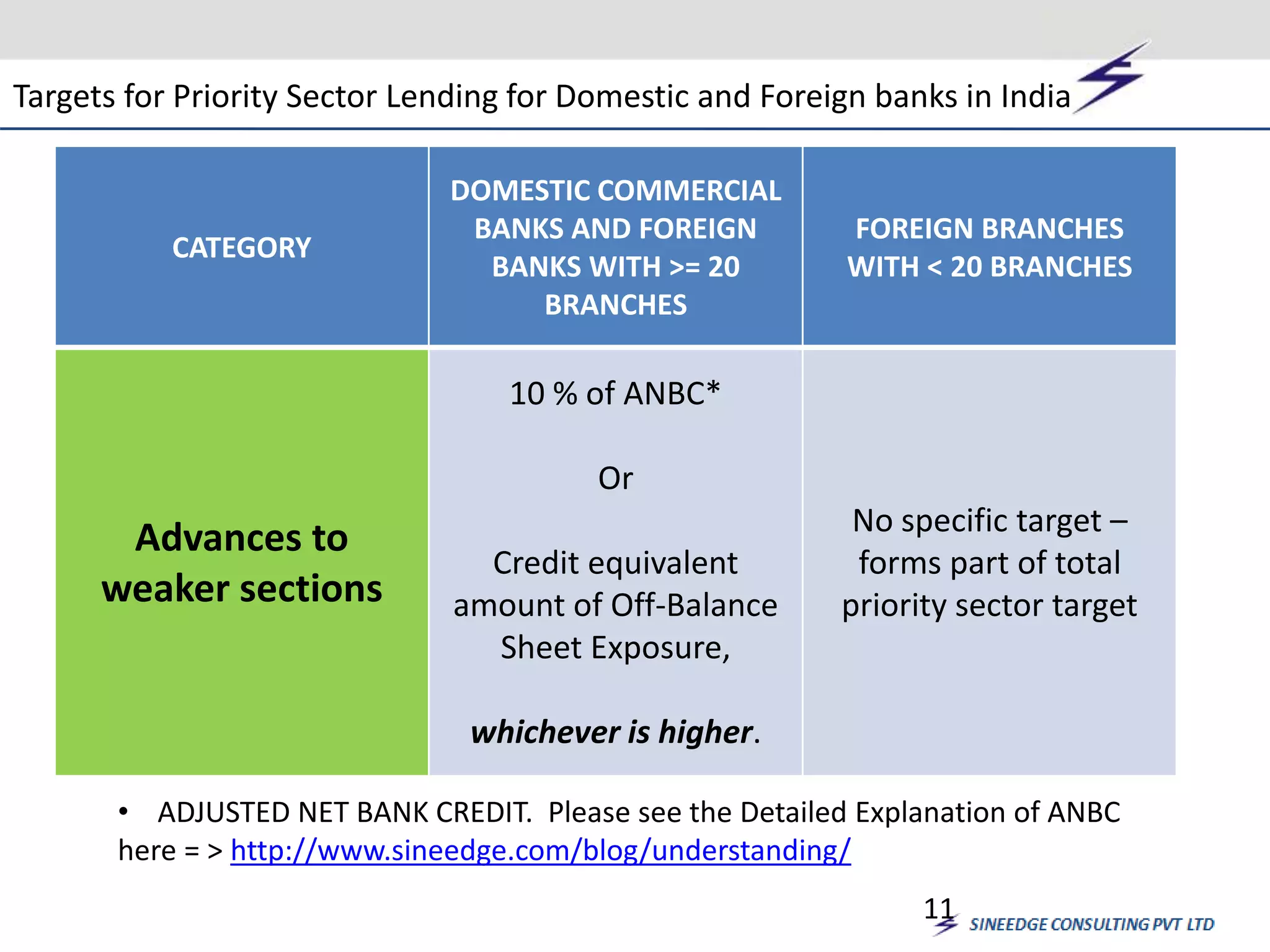

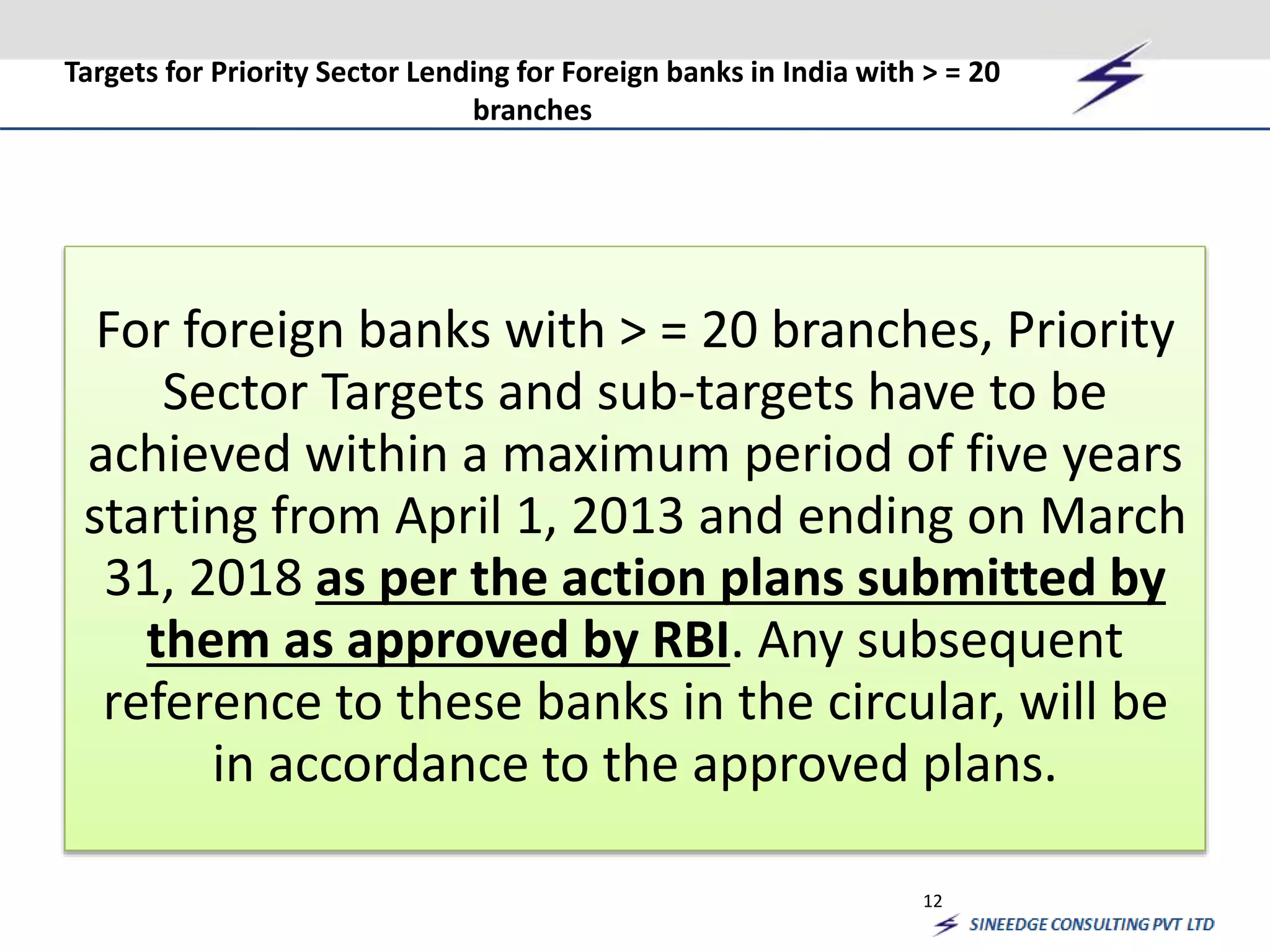

The document outlines the concept and regulations of priority sector lending (PSL) in the Indian banking industry, emphasizing its importance for the development of underfunded sectors such as agriculture and small enterprises. It details the targets set by the Reserve Bank of India (RBI) for banks to allocate a percentage of their lending to priority sectors, with specific guidelines for different types of banks. Additionally, it covers historical milestones and the evolution of PSL since its inception in 1968.