Auditing Substantive Procedures for Non-Current Assets

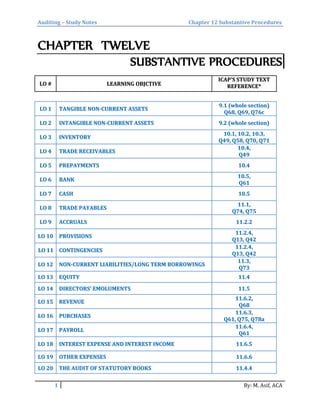

- 1. Auditing – Study Notes Chapter 12 Substantive Procedures CHAPTER TWELVE SUBSTANTIVE PROCEDURES LLOO ## LLEEAARRNNIINNGG OOBBJJCCTTIIVVEE IICCAAPP''SS SSTTUUDDYY TTEEXXTT RREEFFEERREENNCCEE** LLOO 11 TTAANNGGIIBBLLEE NNOONN--CCUURRRREENNTT AASSSSEETTSS 99..11 ((wwhhoollee sseeccttiioonn)) QQ6688,, QQ6699,, QQ7766cc LLOO 22 IINNTTAANNGGIIBBLLEE NNOONN--CCUURRRREENNTT AASSSSEETTSS 99..22 ((wwhhoollee sseeccttiioonn)) LLOO 33 IINNVVEENNTTOORRYY 1100..11,, 1100..22,, 1100..33,, QQ4499,, QQ5588,, QQ7700,, QQ7711 LLOO 44 TTRRAADDEE RREECCEEIIVVAABBLLEESS 1100..44,, QQ4499 LLOO 55 PPRREEPPAAYYMMEENNTTSS 1100..44 LLOO 66 BBAANNKK 1100..55,, QQ6611 LLOO 77 CCAASSHH 1100..55 LLOO 88 TTRRAADDEE PPAAYYAABBLLEESS 1111..11,, QQ7744,, QQ7755 LLOO 99 AACCCCRRUUAALLSS 1111..22..22 LLOO 1100 PPRROOVVIISSIIOONNSS 1111..22..44,, QQ1133,, QQ4422 LLOO 1111 CCOONNTTIINNGGEENNCCIIEESS 1111..22..44,, QQ1133,, QQ4422 LLOO 1122 NNOONN--CCUURRRREENNTT LLIIAABBIILLIITTIIEESS//LLOONNGG TTEERRMM BBOORRRROOWWIINNGGSS 1111..33,, QQ7733 LLOO 1133 EEQQUUIITTYY 1111..44 LLOO 1144 DDIIRREECCTTOORRSS’’ EEMMOOLLUUMMEENNTTSS 1111..55 LLOO 1155 RREEVVEENNUUEE 1111..66..22,, QQ6688 LLOO 1166 PPUURRCCHHAASSEESS 1111..66..33,, QQ6611,, QQ7755,, QQ7788aa LLOO 1177 PPAAYYRROOLLLL 1111..66..44,, QQ6611 LLOO 1188 IINNTTEERREESSTT EEXXPPEENNSSEE AANNDD IINNTTEERREESSTT IINNCCOOMMEE 1111..66..55 LLOO 1199 OOTTHHEERR EEXXPPEENNSSEESS 1111..66..66 LLOO 2200 TTHHEE AAUUDDIITT OOFF SSTTAATTUUTTOORRYY BBOOOOKKSS 1111..44..44 1 By: M. Asif, ACA

- 2. Auditing – Study Notes Chapter 12 Substantive Procedures LLOO 11:: TTAANNGGIIBBLLEE NNOONN--CCUURRRREENNTT AASSSSEETTSS:: Obtain “Fixed Assets’ Schedule” and “Fixed Assets’ Register”. Cast them to ensure mathematical accuracy and agree balances with financial statements. Substantive Procedures for additions during the year: For Purchased Fixed Assets: 1. Obtain list of all fixed asset purchased during the period and agree with fixed assets’ schedule and fixed assets register (completeness and occurrence). 2. Select sample of additions and agree cost to supplier’s invoice. Also inspect invoice to verify cost does not include revenue expenses (valuation). 3. Review repair and maintenance account to verify repairs do not include capital expenditures. (completeness) 4. Inspect sale deed, purchase invoices, and legal documents as evidence of transfer of ownership in the name of company. (rights and obligation) 5. Verify existence of fixed assets acquired during the year (existence). For self-constructed Fixed Assets: 1. Obtain list of all fixed asset constructed during the period and agree with fixed assets’ schedule and fixed assets register (completeness and occurrence). 2. Select a sample of costs and agree with supporting documentation i.e.: Site acquisition costs to purchase invoice, Transfer deed and Paid cheque. Materials (such as cement, bricks, and fittings) to suppliers’ invoice. Labour costs to approved payroll records, time sheets, etc, Overheads to relevant evidence. 3. Review the list of amounts capitalised to ensure that revenue items have not been capitalized. 4. Review expert’s assessment of stage of completion. 5. Physical inspection of the construction at the year end to confirm work to date and assess the reasonableness of stage of completion. 6. Budgeted cost should be compared with actual cost and significant differences should be investigated. 7. Borrowing cost associated with project should be recalculated to ensure its accuracy. 8. Ensure that depreciation starts as and when asset become ‘available for use’. Substantive Procedures for disposals during the year: Obtain list of all fixed asset disposed during the period and agree with fixed assets’ schedule and fixed assets register (Completeness and Occurrence). Check that cost and accumulated depreciation has been removed from books of accounts, and fixed assets’ register. Select a sample of disposals and agree Cost and Accumulated Depreciation with Fixed Assets’ Register and Sale Price with Invoice. Recalculate profit or loss recognized on disposal of assets (Accuracy). Substantive Procedures for Closing Balance: 1. Obtain list of all fixed asset at year end and agree with fixed assets’ schedule and fixed assets register (Completeness and Occurrence). 2. Select a sample of assets from non-current assets’ register and: a. physically inspect them. (Existence). 2 By: M. Asif, ACA

- 3. Auditing – Study Notes Chapter 12 Substantive Procedures b. During physical verification, also select assets from the floor and trace them into fixed assets’ register (Completeness). c. During physical verification, also check for conditions and usage of asset for indications of impairment (Valuation). 3. If non-current assets are stated at revaluated amount, ensure that: a. valuation is performed by a professional valuer, b. amount of valuation is reasonable, c. valuation is performed for all assets in the same class, d. valuation is regularly updated and e. valuation is appropriately accounted for in accounts. 4. Inspect sale deed, purchase invoices, and legal documents as evidence of transfer of ownership in the name of company. Substantive Procedures for depreciation/impairment expense: 1. Review Fixed Assets' Register to ensure: depreciation has been charged on all depreciable fixed assets correctly. depreciation on addition starts when asset is available for use. fully depreciated assets are separately identifiable and no depreciation is charged on such assets. 2. Check whether residual value, useful life/depreciation rate, depreciation method are: reasonable (considering nature of asset), and consistent with last year and industry practice and AFRF. 3. Recalculate depreciation expense (using analytical procedures) and compare with actual expense to ensure reasonableness of depreciation expense. 4. Check whether allocation of depreciation expense between manufacturing and operating expenses is on reasonable basis. 5. Review gain or losses on disposal as indication of possible understatement or overstatement of depreciation expense. (if depreciation is reasonable, there should not be significant gain or loss) CONCEPT REVIEW QUESTION List the audit procedures for the verification of fixed assets as appearing in the financial statements. Also give the related ‘audit assertion’ against each step. (12 marks) (CA Inter -Autumn 2007) What are the basic assertions which the auditor would aim to address whilst carrying out the verification of fixed assets? (05 marks) (CA Inter -Autumn 2003) Describe substantive procedures you should perform at the year end to confirm each of the following for plant and equipment: (i) Additions; and (ii) Disposals (04 marks) F8 (ACCA - June 2012) 3 By: M. Asif, ACA

- 4. Auditing – Study Notes Chapter 12 Substantive Procedures LLOO 22:: IINNTTAANNGGIIBBLLEE NNOONN--CCUURRRREENNTT AASSSSEETTSS:: Purchased Goodwill: 1. Confirm from documents prepared to acquire business: a. the cost of acquisition and b. reasonableness of fair value of assets acquired. 2. Check that cost of Goodwill is difference between the cost of acquisition and fair value of net assets. 3. Review the possibility of impairment of goodwill subsequent to acquisition. If so, ensure impairment loss has been correctly calculated and recorded. Development Cost: 1. Ensure that following criteria required by IAS - 38 to recognize development cost as intangible asset has been met. a. Probable future economic benefits from Intangible Asset. b. Intention to complete and use/sell Intangible Asset c. Resources (technical, financial and other) to complete and use/sell Intangible Asset are available and adequate. d. Ability to use/sell Intangible Asset. e. Technical feasibility. f. Expenditure can be reliably measured. 2. Discuss the feasibility of the project with management i.e. a. Review projects and forecasts. b. Production and marketing plans actually exist. c. Obtain representation from management regarding intention to complete the project. 3. For a sample of costs, inspect supporting documents e.g. development contracts, billing and timesheets. 4. Test controls over documentation and safekeeping of scientists’ notes, discoveries and conclusions. Other Intangibles: 1. Inspect legal and purchase documents to ensure existence, valuation and right of entity over intangible asset. 2. Check amortization calculation using client’s policy to ensure its accuracy (audit procedures for amortization are same as of depreciation). 3. Review the possibility of impairment subsequent to acquisition. If so, ensure impairment loss has been correctly calculated and recorded. CONCEPT REVIEW QUESTION You are the audit manager at JL. The following issue arose during the audit and now requires your attention: JL incurred an expenditure of Rs. 25 million on the development of five new products. It is expected that these new products would generate future economic benefits. Required: Comment on the matters that you should consider and state the audit evidence that you expect to be available. (06 marks) (CA Final - Summer 2011) Recommend the principal audit procedures to be performed in respect of the goodwill initially recognised on the acquisition of Canary Co. (05 marks) P7 (ACCA - June 2012) 4 By: M. Asif, ACA

- 5. Auditing – Study Notes Chapter 12 Substantive Procedures LLOO 33:: IINNVVEENNTTOORRYY:: 1. Obtain “inventory lists” from client. Cast them to ensure mathematical accuracy and agree balances with financial statements. 2. Select a sample of items from inventory lists and: a. physically inspect them. (Existence). b. During physical verification, also select assets from the floor and trace them into inventory list (Completeness). c. During physical verification, also check for conditions of inventory for indications of impairment (Valuation). 3. Review reconciliation between physical balance and book balance at year end if total of listing differs with book value. (Completeness) Valuation: Inventory is valued at lower of Cost and NRV. 1. Cost of Raw Material will be verified by auditor as follows: Check figure of cost by comparing with prices as per purchase invoice. Recalculate the cost using approach adopted by management (e.g. FIFO or Weighted Average). 2. Cost of Work in Process and Finished Good will be verified by auditor as follows: Obtain a breakup of cost of each item of Work in Process and Manufactured Finished Good and agree the total to the general ledger. Check that correct cost and quantity of Material has been used in valuation. Check Labor cost to approved payroll records, time sheets, etc, Check only production overheads are included in the valuation (selling/admin overheads are excluded). Also check that overheads are based on normal levels of output. Review expert’s assessment of stage of completion. 3. NRV of inventory will be verified by auditor as follows: Review client’s procedures for comparing NRV with cost of each item of inventory. During physical verification, also check for conditions of obsolescence, damage indicating that NRV may be lower than Cost. Review prices at which inventory has been sold subsequent to year end as evidence of NRV. Review aged inventory reports and identify any damaged, slow moving or obsolete goods, and ensure they have been recorded at lower of Cost and NRV in Balance Sheet. Inquire management about estimated selling price of inventory, cost of completion and cost to make sale. Rights and Obligation: 1. Check inventory owned by a third party (e.g. on "consignment basis" or "approval basis") is separately identifiable, and not included in closing inventory. Presentation and Disclosure: 1. Ensure that all disclosures as required by IAS – 2 have been included in the financial statements. 2. Review that disclosures in the financial statements are correct and clear. 5 By: M. Asif, ACA

- 6. Auditing – Study Notes Chapter 12 Substantive Procedures Audit Procedures/Responsibilities before, during and after inventory count: Before Inventory count (i.e. Planning) During inventory count (i.e. Observing and Recording) After inventory count (i.e. Follow up) Review client’s instruction for inventory (discussed in previous chapter) count to assess effectiveness of count. Determine if any inventory is held by third parties to assess need to send confirmation letter. Determine whether there is need of an expert or component auditor. Decide which counts locations will be observed by audit team. Observe the count to ensure that management’s instructions are being followed. Perform test count by checking items from inventory sheet to warehouse and vice-versa. Observe conditions of inventory for possible NRV adjustment. Ensure that inventory belonging to third parties but held by client is segregated. Perform cutoff test on sales and purchases. Obtain signed copies of count sheets from client. Ensure quantity of final valuation match with inventory list. Inspect aging of inventory to identify slow moving and obsolete stock and discuss provisioning with management. Ensure that inventory is valued at lower of cost and NRV. Ensure that Cutoff procedures have been appropriately applied while recording sales and purchases. CONCEPT REVIEW QUESTION List the substantive procedures that may be performed by the auditor to verify the amount of inventories as appearing in the financial statements of a manufacturing concern. (15 marks) (CA Inter - Spring 2012) You have been asked by your senior to observe the stock count at one of the audit clients: (a) What procedures would you perform prior to the physical count to ensure a smooth stock count? (04 marks) (b) During the stock count, how would you ensure that the physical inventory listing provided to you is complete? (04 marks) (CA Inter -Autumn 2001) How does the auditor deal with the situation when inventory is found under the custody and control of a third party ? Include in your answer the considerations which the auditor is likely to take into account in this regard. (05 marks) (CA Final - Summer 2001) (i) Identify and explain FOUR financial statement assertions relevant to account balances at the year end; and (ii) For each identified assertion, describe a substantive procedure relevant to the audit of year-end inventory. (08 marks) F8 (ACCA - June 2012) The management of Redburn Co have told you that inventory is correctly valued at the lower of cost and net realisable value. You have already satisfied yourself that cost is correctly determined. Required: (i) Define net realisable value; (02 marks) (ii) State and explain the purpose of FOUR procedures that you should use to ensure that net realisable value of the inventory is at or above cost. (08 marks) F8 (ACCA - December 2009) 6 By: M. Asif, ACA

- 7. Auditing – Study Notes Chapter 12 Substantive Procedures LLOO 44:: TTRRAADDEE RREECCEEIIVVAABBLLEESS:: Existence, Completeness, and Rights and Obligation: 1. Obtain a listing of trade receivables from the sales ledger. Cast it and agree to the control account and financial statements. Review reconciliation between control account and sales ledger if difference exists. 2. Calculate debtors’ turnover ratio and compare with prior years. Investigate any significant differences. 3. Review the list of trade receivables against prior years to identify any significant variations/omissions. 4. Select a sample of debtors from sales ledger at year end and perform a trade receivables’ circularization (i.e. direct confirmation). Perform alternative audit procedures in case of non-response and additional audit procedures in case of exceptions identified. 5. Select a sample of debtors from sales ledger at year end and agree back to valid supporting documentations of GDN and Sales orders. 6. Review whether effect of cut-off on sales have been appropriately accounted for in debtors. 7. Review the control account entries shortly before and after the year end for unusual items and investigate them. 8. Review cash receipts after year end and trace to debtors at year end. 9. Review credit notes after year end to identify any sales transactions before year end which should be reversed. Evaluate adequacy of Provision for bad debts: a) Inquire management regarding estimates used in calculation of provision for bad debts. b) Obtain aged receivable ledger. Compare it with control account and test the aging. Review the aged receivable ledger to identify any slow moving or old receivable balances. Discuss the status with the management to assess whether they are likely to pay. c) Examine whether there are any cash recovery of doubtful debts or bankruptcy after balance sheet date. d) For large overdue balances, review financial statements of debtors and discuss with management likelihood of their collection. e) Recalculate provision for bad-debts using sales, write-offs and current economic conditions of customers. f) Inquire management about any disputes with customers and review board minutes for disputed receivables. g) Review communication of client with customers, lawyers and collection agencies regarding debts which are in dispute or unlikely to be paid. For Presentation & Disclosures: Determine if any receivables have been pledged, discounted, factored. Inquire about receivables from officers, directors or other related parties. Ensure that receivables are correctly disclosed and classified in financial statements. CONCEPT REVIEW QUESTION You are the senior member of the audit engagement team, auditing the financial statements of a manufacturing company, Hard Stone Limited. List down the primary substantive procedures, which you would carry out in the verification of trade debts (excluding receipts from customers). (06 marks) (CA Inter -Autumn 2009) List down any five (05) key audit procedures for verification of provisions against doubtful receivables. (05 marks) (ICMAP - 2014 May ) 7 By: M. Asif, ACA

- 8. Auditing – Study Notes Chapter 12 Substantive Procedures LLOO 55:: PPRREEPPAAYYMMEENNTTSS:: 1. Obtain a schedule of all prepayments. Cast list to ensure mathematical accuracy and agree balances with financial statements. 2. Nature and amount of all prepayments should be compared with prior periods. 3. For sample of prepayments, recalculate their amounts with supporting documents and payment from bank statement. 4. Agree prepayments to the adjustments after the end of the year. LLOO 66:: BBAANNKK:: 1. Obtain a list of all bank accounts (including accounts closed during the year) along with closing balances. Cast list to ensure mathematical accuracy and agree balances with financial statements. 2. Obtain bank confirmation letter for all bank accounts (including accounts closed during the year) and perform following procedures: Agree balances as per bank confirmation letter with bank reconciliation statements (to ensure accuracy) and with list of bank accounts (to ensure completeness). Confirmation should be reviewed for evidence of loans, collateral or any lien/restriction on balance. 3. Obtain Bank Reconciliation Statements (BRS) for each bank account and perform following procedures: Cast BRS to ensure mathematical accuracy and agree balances of BRS with bank statement and cash book. Trace deposits in transit into deposit slips and cash book of current month; and in bank statement of subsequent month. For significant delays inquire explanation from management. trace unpresented cheques into cash book of current month; and in bank statement of subsequent month. For significant delays inquire explanation from management. for untraced items examine supporting documentation. 4. Perform cutoff test on cheque receipts and cheque payments. 5. Review cash book and bank statement for large transfers near year-end as indication of window-dressing. CONCEPT REVIEW QUESTION List the substantive procedures that may be performed by an auditor to verify Bank reconciliation statements. (06 marks) (CA Inter - Autumn 2012) Describe substantive procedures the auditor should perform to confirm the bank and cash balance of Fox Industries Co at the year end. (07 marks) F8 (ACCA - June 2013) List down at least five audit procedures undertaken by the auditor in respect of the following: (i) Bank reconciliation statements (05 marks) (ii) Bank confirmations (05 marks) (ICMAP - 2015 March ) 8 By: M. Asif, ACA

- 9. Auditing – Study Notes Chapter 12 Substantive Procedures LLOO 77:: CCAASSHH:: 1. Perform cash count at year end (including petty cash) and agree the total to the balance includes in financial statements. 2. Review reconciliation for difference between book balance and physical balance. 3. Perform cutoff test on cash receipts and cash payments. 4. Ensure cash is under proper lock and key, and in safe custody. CONCEPT REVIEW QUESTION You are a part of the team on the audit of Fresh Meat (Private) Limited which sells fresh meat products through 25 retail outlets. Each outlet holds cash at the year end. Sales are made on cash as well as against credit cards. All the accounting records are maintained at the outlets and balances with the Head Office are reconciled on a monthly basis. Required: List the audit assertions relevant to the audit of cash in hand and state how you would obtain audit evidence to support those assertions. (06 marks) (CA Inter - Autumn 2011) LLOO 88:: TTRRAADDEE PPAAYYAABBLLEESS:: 1. Obtain a listing of trade payables from the purchase ledger. Cast it and agree to the control account and financial statements. Review reconciliation between control account and purchase ledger if difference exists. 2. Calculate creditors’ turnover ratio and compare with prior years. Investigate any significant differences. 3. Review the list of trade payables against prior years to identify any significant variations/omissions. 4. Select a sample of creditors from purchase ledger at year end and perform circularization (i.e. direct confirmation). Perform alternative audit procedures in case of non-response and additional audit procedures in case of exceptions identified. 5. Select a sample of creditors from purchase ledger at year end and agree back to valid supporting documentations of GRN and Purchase Orders. 6. Review the control account entries shortly before and after the year end for unusual items and investigate them. 7. Review debit notes after year end to identify any purchases transactions before year end which should be reversed. To ensure Occurrence of Trade Payables: 1. Examine cash paid to supplier after the balance sheet date. 2. If cash is not paid or partly paid to supplier, auditor shall: inspect valid supporting documents e.g. supplier signed purchase orders, suppliers’ invoices, Goods Received Notes and other documents. obtain explanation for cash not paid within credit period. 3. Perform cut-off test by examining purchases near balance sheet date. To ensure Completeness of Trade Payables: 4. Examine cash paid to supplier after the balance sheet date and ensure liabilities were recorded at balance sheet date. 5. Inspect pending GRNs (i.e. goods received but suppliers’ invoices not received) and ensure they are recorded at balance sheet date. 6. Perform cut-off test by examining purchases near balance sheet date. 9 By: M. Asif, ACA

- 10. Auditing – Study Notes Chapter 12 Substantive Procedures CONCEPT REVIEW QUESTION Describe substantive procedures the auditor should perform on the year-end trade payables of audit client. (05 marks) F8 (ACCA - December 2010) You are the audit manager at Hawthorn Enterprises Co (Hawthorn). Hawthorn receives monthly statements from its main suppliers and although these have been retained, none have been reconciled to the payables ledger as at 31 March 2015. The engagement partner has asked the audit senior to recommend the procedures to be performed on supplier statements. (03 marks) Required: Describe substantive procedures you would perform to obtain sufficient and appropriate audit evidence in relation to the above matter. F8 (ACCA - June 2015) LLOO 99:: AACCCCRRUUAALLSS:: 1. A schedule of accruals should be obtained. Check for arithmetical accuracy and agree to the financial statements. 2. Individual accruals should be compared with prior periods. 3. Ensure that period end accruals of expenses includes necessary items (e.g. Salaries accrual, Accruals for Utility bills, Withholding tax payable etc.) 4. Agree accruals to the payments made after the end of the year e.g. tax on salaries paid to FBR. 5. Check calculations of individual accruals to supporting documentation e.g. tax payable on salaries should be based on payroll. 6. For Accrued Wages and Salaries: a. Check whether accrual is based on last month’s payroll using correct records of time, records of wage rates and salaries. b. Confirm that additional costs (e.g. employer’s contributions) have been accounted for. c. Test reasonableness of accrual balance by performing analytical procedures e.g. calculate ratio of accrued expenses to total salaries expenses and compare with last year. CONCEPT REVIEW QUESTION Draft audit programmes for the following: (a) Accrued expenses (b) prepayments (06 marks) (CA Inter -Spring 2005) LLOO 1100:: PPRROOVVIISSIIOONNSS:: 1. Obtain a schedule of provisions. Check for arithmetical accuracy and agree to the financial statements. 2. Ensure that recognition and measurement of each element of provision is appropriate in accordance with IAS 37. 3. Compare provisions for the current financial year with provisions in previous years, and investigate any major differences or omissions. 4. Ensure that period end provisions includes necessary items (e.g. Provision for bad debts, Provision for slow moving stock, Provision for warranty, Provision for redundancy, Provision for Legal cases, Provision for site restoration, etc.) 10 By: M. Asif, ACA

- 11. Auditing – Study Notes Chapter 12 Substantive Procedures 5. Review whether provisions have been adjusted in accordance with events occurring after the balance sheet date. 6. Check calculations of individual provisions. 7. Relate the testing of provisions to other areas of the audit work e.g. correspondence with lawyers. CONCEPT REVIEW QUESTION State five key substantive audit procedures for verification of Provisions. (05 marks) (CA Inter - Spring 2016) LLOO 1111:: CCOONNTTIINNGGEENNCCIIEESS ((ee..gg.. lliittiiggaattiioonnss)):: Follow up contingencies reported in last year. Discuss with management (also obtain written representation if necessary). Review minutes of BOD meetings (where such matters are likely to be discussed). Review client’s correspondence with lawyers and invoices for legal services. Send confirmation to external legal counsel (listing specific areas where contingencies may exist). Check status subsequent to reporting period. Consider whether expert advice may be required from outside sources other than lawyers. Review business press and trade journals for possibility of industry-wide contingencies. CONCEPT REVIEW QUESTION List any five substantive procedures for the verification of each of the following: (i) Accrued expenses (ii) Contingencies (10 marks) (CA Inter - Autumn 2014) LLOO 1122:: NNOONN--CCUURRRREENNTT LLIIAABBIILLIITTIIEESS//LLOONNGG TTEERRMM BBOORRRROOWWIINNGGSS:: 1. Obtain a list of all borrowings from client (with opening balance, new borrowings, repayments and closing balance) including debentures, bank loans, and finance lease obligations. 2. Cast list to ensure mathematical accuracy and agree balances with financial statements. 3. Agree the opening balances on the listing with the amount for non-current liabilities in last year’s statement of financial position. 1. For new borrowings: a. Check that authorization has been made in accordance with company procedures. b. Inspect loan agreements (for securities, repayment schedule, interest rate and restrictive conditions etc.) c. Check that interest payments have been presented separately from long-term loans in accounts. 2. Confirm loan repayments during the year with payments recorded in the cash book, entries in bank statements and also with any correspondence from lenders. 3. Obtain confirmation letter from lenders for outstanding amounts. 11 By: M. Asif, ACA

- 12. Auditing – Study Notes Chapter 12 Substantive Procedures For Presentation and Disclosure: 4. Review disclosure of interest rates and split between current and non-current portion. 5. Check whether loan-agreement gives lender right to impose penalty or withdraw facility in case of breach of conditions of loan. Also check that client is not in breach of any conditions. CONCEPT REVIEW QUESTION List the substantive procedures which may be performed by the auditor to verify the Long Term Bank Loan. (07 marks) (CA Inter - Spring 2014) List down any five (05) key audit procedures for the following: (i) Verification of loans obtained during the year. (05 marks) (ii) Verification of provisions against doubtful receivables. (05 marks) (ICMAP - 2014 May) LLOO 1133:: EEQQUUIITTYY:: Share Capital: 1. Check authorized and issued share capital complies with legal requirements. 2. For share capital issued during the year, auditor should check: a. Cash received is properly recorded in accounts. b. supporting documents and ensure that all legal requirements have been complied with. 3. Agree amount of issued share capital in balance sheet with register of shareholders. Reserves: 1. Obtain a list of all reserves from client (with opening balance, additions, deletions and closing balance). 2. Check accuracy of listing of client with supporting documents. 3. Ensure that legal requirements relating to reserves have been complied (e.g. regarding use of share premium) 4. Check authorization and calculation of dividend and ensure that payment is consistent with issued share capital at relevant dates. 5. Ensure that dividend has been paid in accordance with legal requirements. CONCEPT REVIEW QUESTION State four substantive procedures for verification of share premium account appearing in the statement of financial position. (02 marks) (CA Inter - Autumn 2015) LLOO 1144:: DDIIRREECCTTOORRSS’’ EEMMOOLLUUMMEENNTTSS:: 1. Obtain a schedule of emoluments paid to directors during the year and agree with financial statements’ disclosure. 2. Inspect minutes of BOD and obtain confirmations from directors to ensure there are no undisclosed bonuses or other remuneration. 3. Inspect bank statements to verify actual amounts paid to directors. 4. Review the tax returns of directors to ensure these agree with emoluments as per listing. 12 By: M. Asif, ACA

- 13. Auditing – Study Notes Chapter 12 Substantive Procedures 5. Develop an expectation of current year’s directors’ emolument to ensure emoluments in accounts is complete. 6. Obtain written representation from directors that they have disclosed all directors’ remuneration and related party transactions to the auditor. CONCEPT REVIEW QUESTION Describe substantive procedures you should perform to confirm the directors’ bonus payments included in the financial statements. (03 marks) F8 (ACCA - June 2014) LLOO 1155:: RREEVVEENNUUEE:: Completeness: Select a sample of customer orders and agree these to the despatch notes and sales invoices and sales/subsidiary ledger to ensure completeness of revenue. Occurrence: Select a sample of sales recorded in Sales Journal and vouch back to sales invoices, shipping documents and customer orders. Accuracy: Select a sample of sales invoices and perform following procedures to ensure these are accurate: (a) compare prices, discounts and terms and conditions with authorized price list and authorized terms and conditions. (b) recalculate sales tax on invoice. Cut-off on Sales: At year-end, auditors should select the last goods despatch note (GDN) made on that day. He should then select further a sample of GDN for despatches immediately before and after the last GDN. The sample of GDNs should be traced to the associated sales invoices to ensure that despatches have been posted as sales in the correct accounting period. Presentation & Disclosures: -Review accounting policies for revenue recognition and ensure they comply with AFRF and are properly disclosed. -Read notes to the accounts to ensure they are accurate, complete, and easy to understand. CONCEPT REVIEW QUESTION (i) Identify and explain FOUR financial statement assertions relevant to classes of transactions and events for the year under audit; and (ii) For each identified assertion, describe a substantive procedure relevant to the audit of REVENUE. (08 marks) F8 (ACCA - June 2015) LLOO 1166:: PPUURRCCHHAASSEESS:: Completeness: 13 By: M. Asif, ACA

- 14. Auditing – Study Notes Chapter 12 Substantive Procedures Select a sample of purchases orders and agree these to the goods receipt notes and purchase invoices and purchase/subsidiary ledger to ensure completeness of purchases. Occurrence: Select a sample of purchases recorded in Purchase Journal and vouch back to purchase invoices, receiving documents, and purchase orders. Accuracy: Select a sample of purchase invoices and perform following procedures to ensure these are accurate: (a) compare prices, discounts and terms and conditions with authorized terms and conditions. (b) recalculate tax on invoice. Cut-off on Purchases: At year-end, auditors should select the last goods receipt note (GRN) made on that day. He should then select further a sample of GRN for receipts immediately before and after the last GRN. The sample of GRNs should be traced to the associated purchases invoices to ensure that receipts have been posted as purchases in the correct accounting period. CONCEPT REVIEW QUESTION What do you understand by a cut off test? How an auditor normally performs it in case of local purchases? (05 marks) (CA Inter -Spring 2003) State the significant procedures auditors generally include in the audit programme for Purchases. (06 marks) (CA Inter - Spring 1999) List the substantive procedures that may be performed by an auditor to verify the Raw material purchases (06 marks) (CA Inter - Autumn 2012) LLOO 1177:: PPAAYYRROOLLLL:: 1. Compare the total payroll expense to the prior year and investigate any significant differences. 2. Compare payroll expense of month-wise to ensure payroll expense in one month does not unusually change in next month. 3. Obtain all payroll sheets processed during the year. Agree total of payroll sheets with financial statements. 4. Cast a sample of payroll sheets to confirm completeness and accuracy of the payroll expense. 5. Perform analytical procedures on total salaries expense, incorporating joiners and leavers and the pay increase. Compare this to the actual wages and salaries in the financial statements and investigate any significant differences. 6. For a sample of employees, recalculate the gross and net pay and agree to the payroll records to verify accuracy. 7. Select a sample of employees from payroll and check whether employees exist. CONCEPT REVIEW QUESTION List the substantive procedures that may be performed by an auditor to verify the Payroll. (08 marks) (CA Inter - Autumn 2012) 14 By: M. Asif, ACA

- 15. Auditing – Study Notes Chapter 12 Substantive Procedures LLOO 1188:: IINNTTEERREESSTT EEXXPPEENNSSEE AANNDD IINNTTEERREESSTT IINNCCOOMMEE:: 1. Inspect legal documents (e.g. loan agreements) creating right of entity to receive/pay interest. 2. Confirm reasonableness of interest by following formula Interest Expense = Principal x Applicable Interest Rate x Period 3. Vouch the payment from recording into G.L. and tracing into bank statement. 4. Confirm interest payments/receipts during the year with payments recorded in the cash book, entries in bank statements and also with any correspondence from lenders/borrower. LLOO 1199:: OOTTHHEERR EEXXPPEENNSSEESS:: Other expenses can be verified by performing analytical procedures, and checking supporting documents of sample of transactions. LLOO 2200:: TTHHEE AAUUDDIITT OOFF SSTTAATTUUTTOORRYY BBOOOOKKSS:: The auditor should confirm that the required statutory records are maintained by the client company and are up-to-date. These statutory books may include: Minutes of board meetings and general meetings of company. Register of members/shareholders. Register of directors and their interests in company. Register of charges on the company’s assets. Copies of directors’ service contracts and details of directors’ remuneration packages. Exam Tips In exam if a concept review question is set from “substantive procedures”, you may be required to: 1. State substantive procedures to verify whole area e.g. Long term bank loan, Inventory, Provisions, Contingencies, Payroll, Purchases, Trade debts and Prepayments. 2. State substantive procedures to verify a critical part of the area e.g. Bank Reconciliation Statement, Provision for bad debts, fixed assets carried at revalued amount. 3. State risks in the audit of an area. If so, not meeting assertions is risk. 15 By: M. Asif, ACA