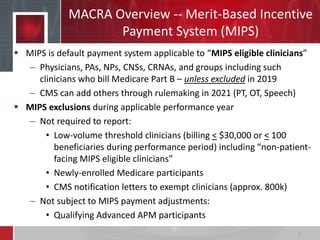

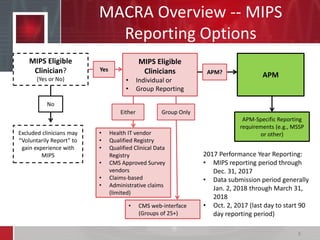

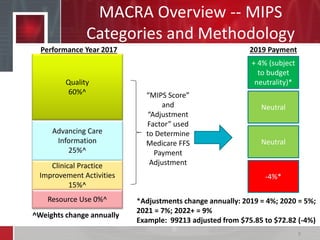

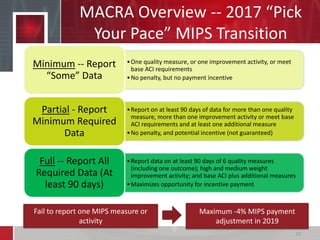

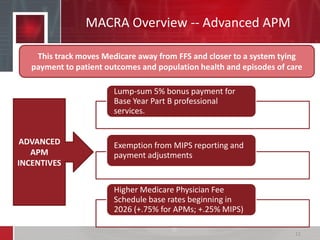

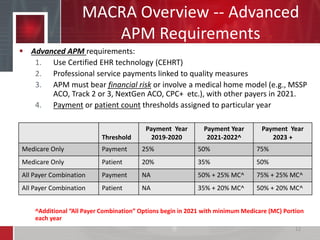

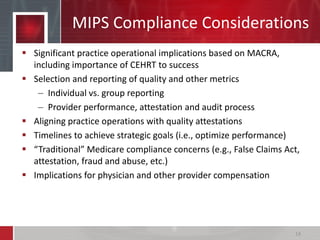

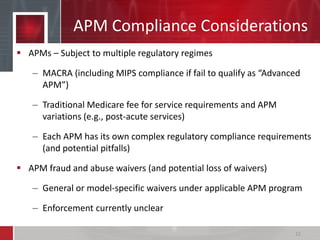

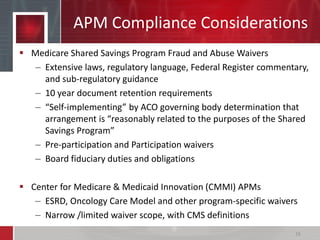

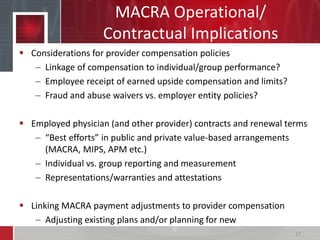

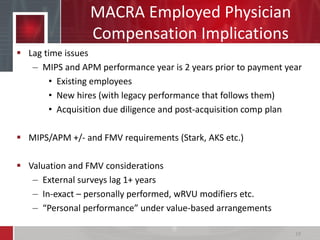

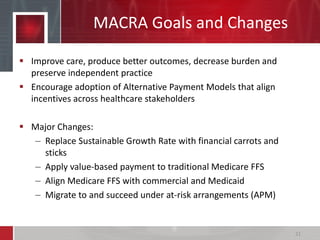

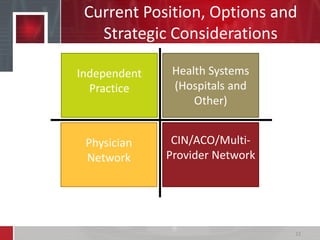

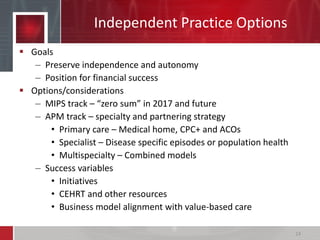

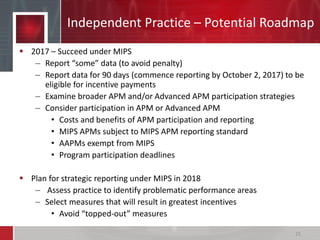

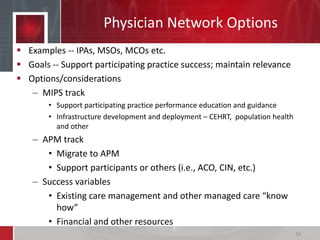

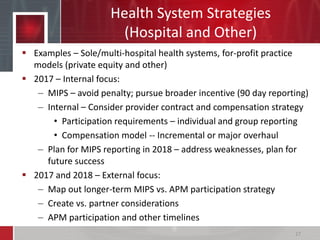

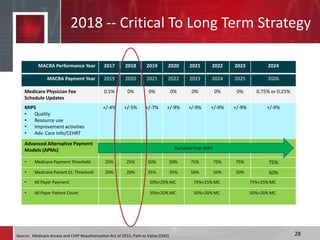

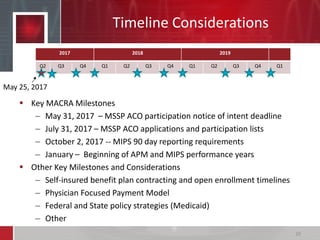

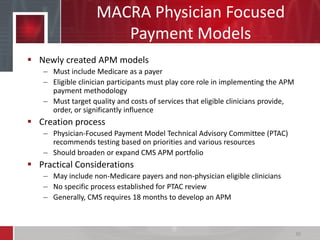

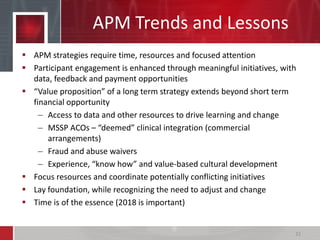

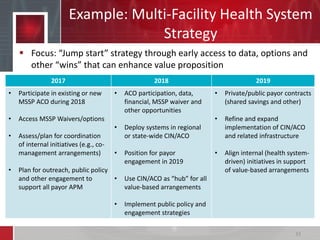

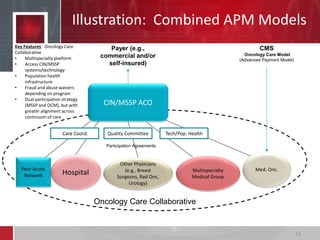

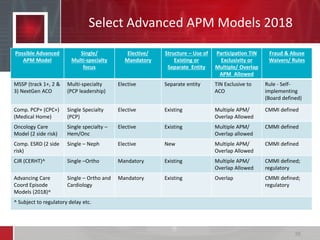

The document provides an overview of MACRA's Merit-based Incentive Payment System (MIPS) and Alternative Payment Models (APMs), including compliance and strategic considerations. It discusses that MACRA aims to improve care quality, outcomes and value while preserving independent practice. Clinicians can succeed under MIPS or participate in APMs, with various reporting options and timelines outlined. Compliance and operational impacts are significant. Strategic planning is important to optimize performance and position for future payment models.