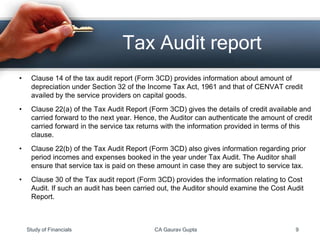

This document provides an overview of understanding financial statements for the purposes of an audit. It discusses reviewing periods of up to 5 years, focusing on key accounting concepts like money measurement and going concern. Trial balances and balance sheets are examined in detail, including accounts, classifications, movements, and balances. Specific items like reverse charge mechanisms, reimbursements, and netting are highlighted. The tax audit report is also reviewed for depreciation, credit balances, and prior period adjustments. Other areas of focus include ratios, foreign transactions, and demands under other laws.