Embed presentation

Downloaded 17 times

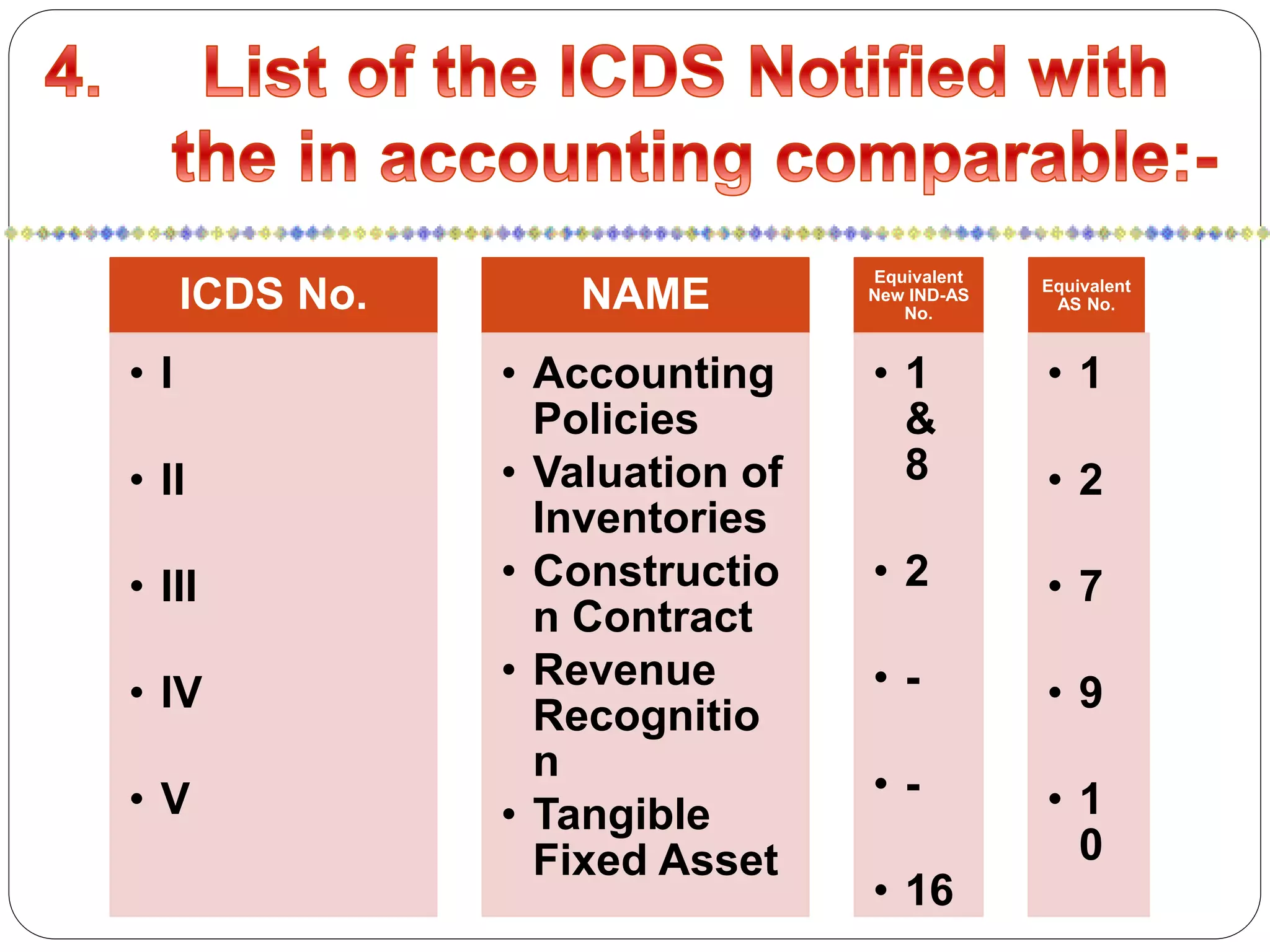

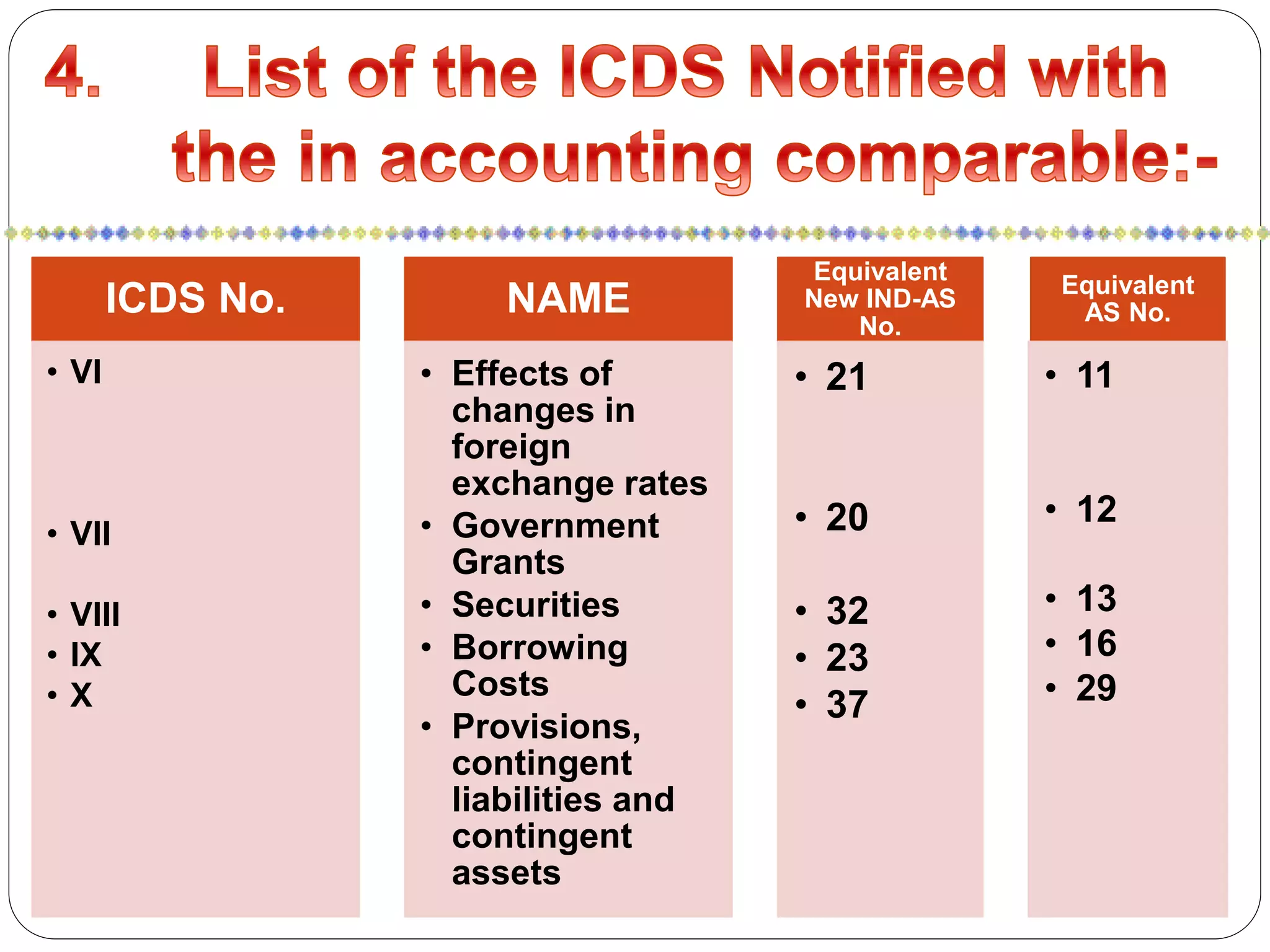

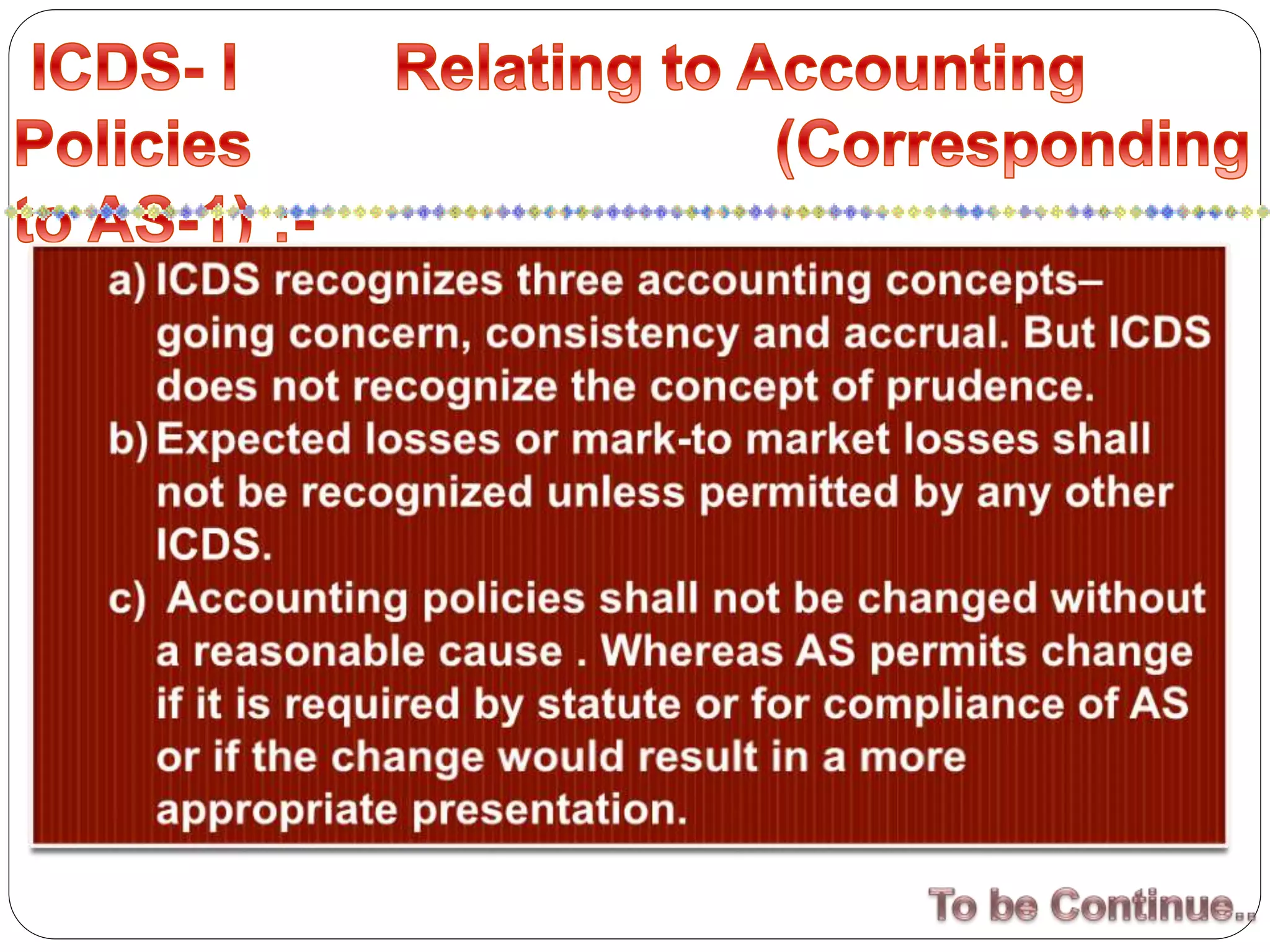

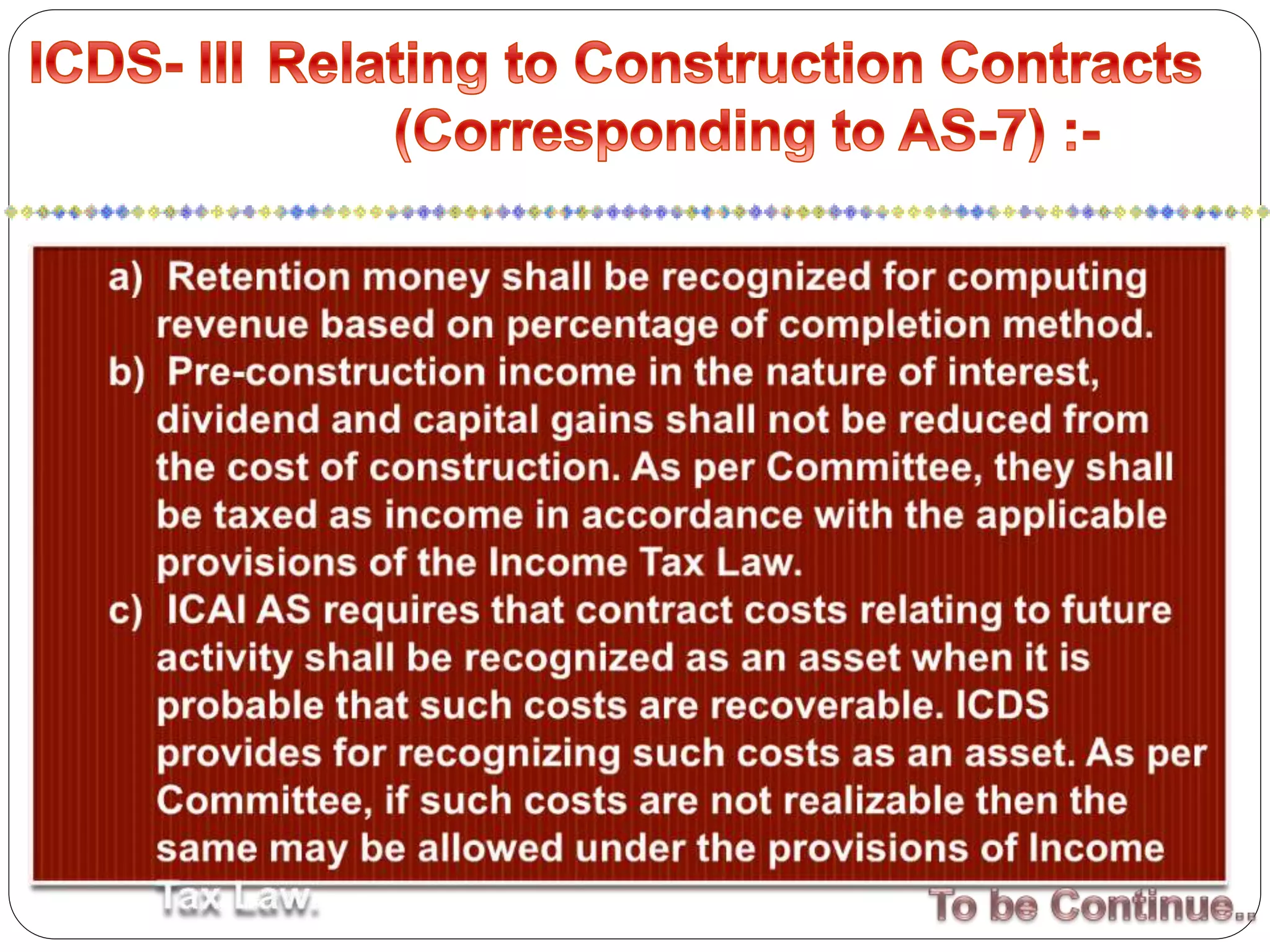

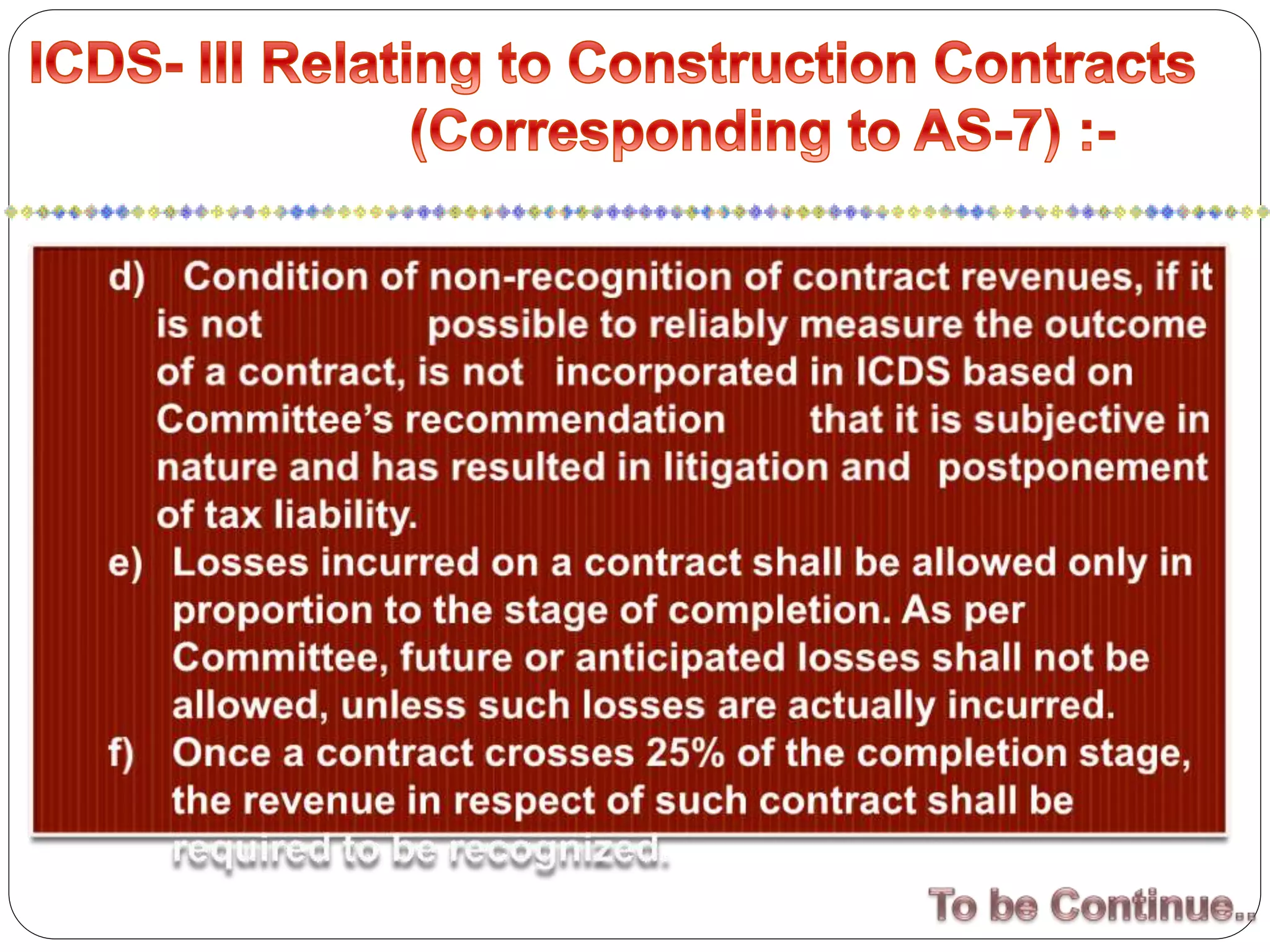

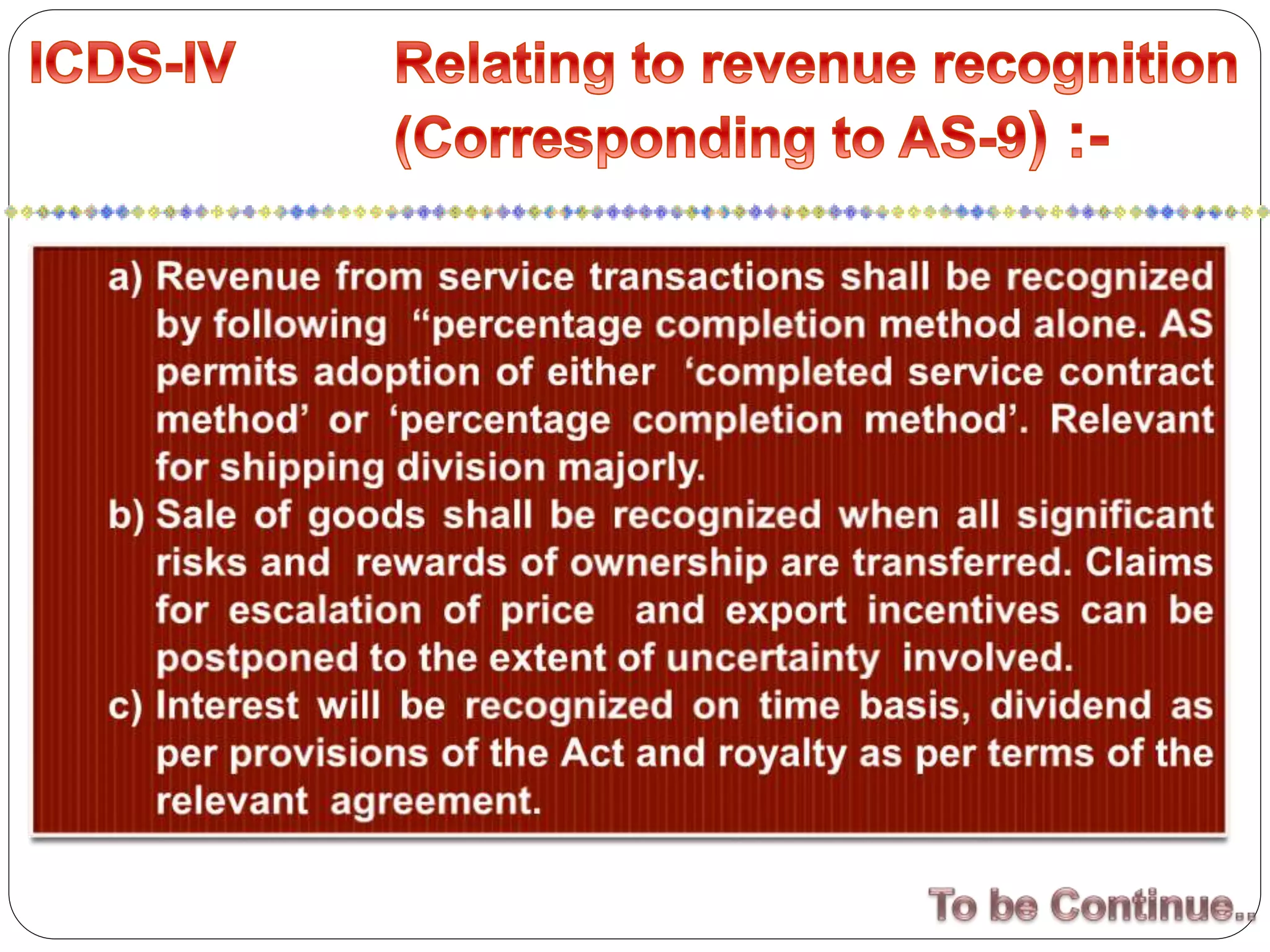

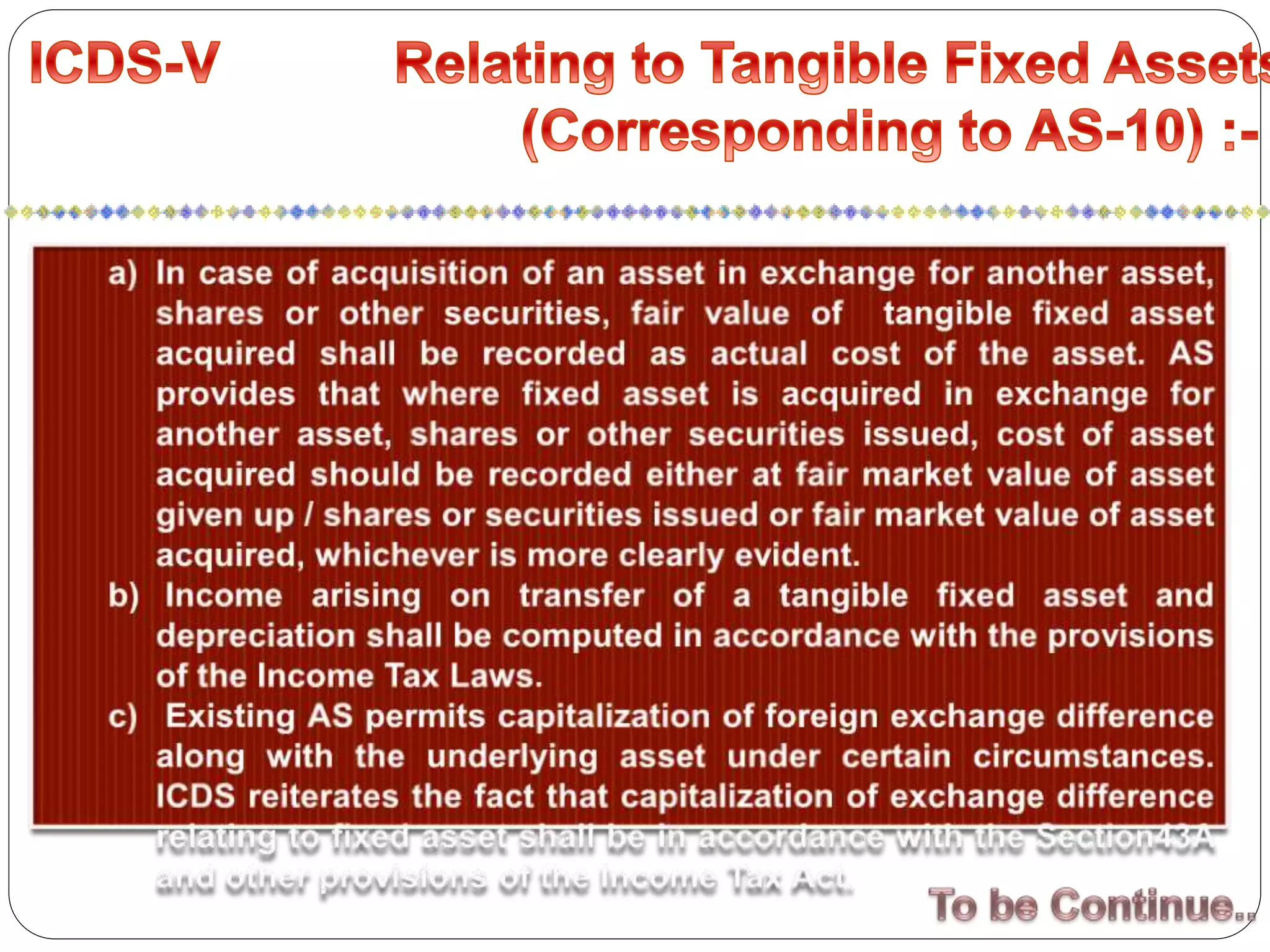

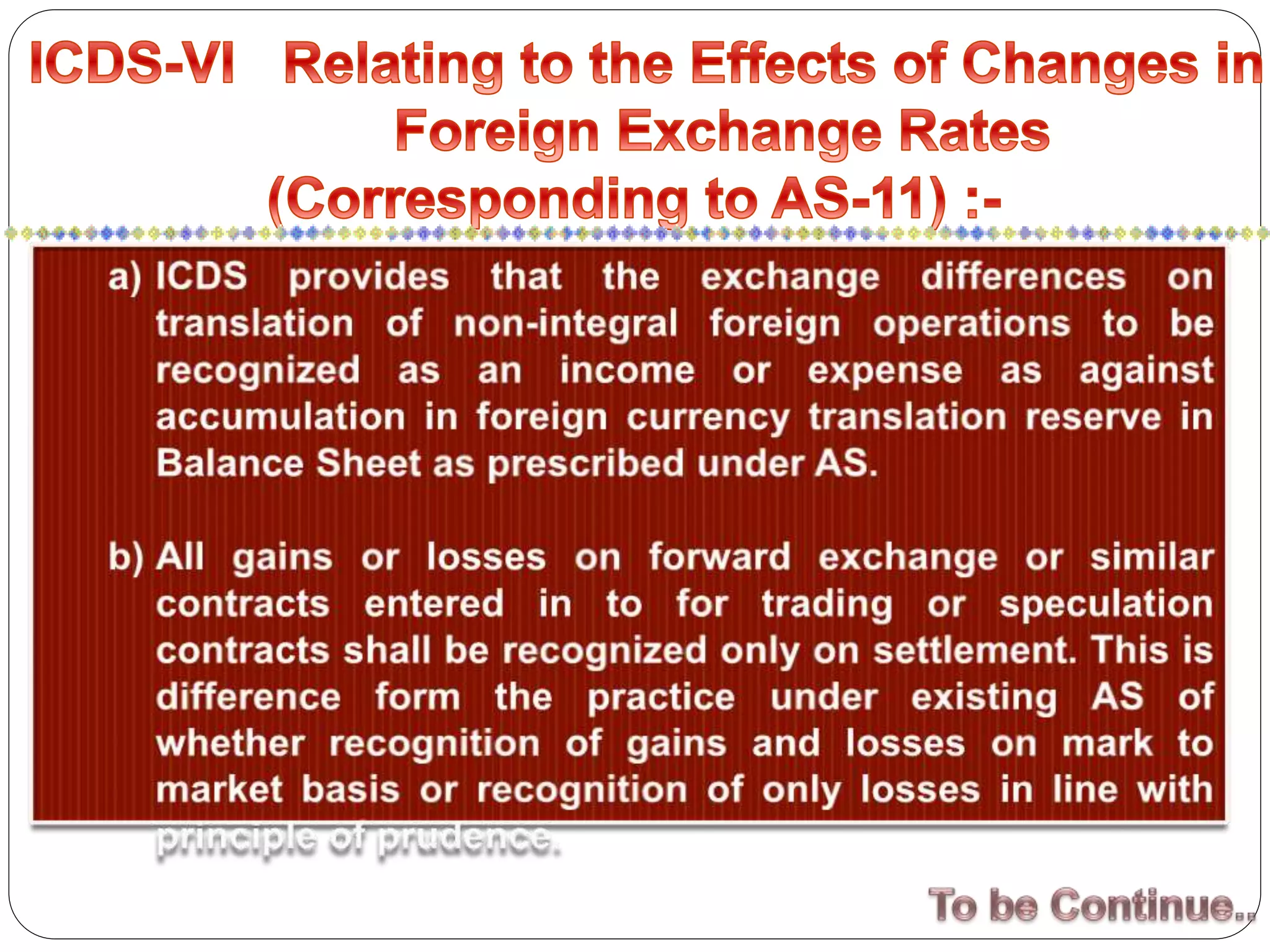

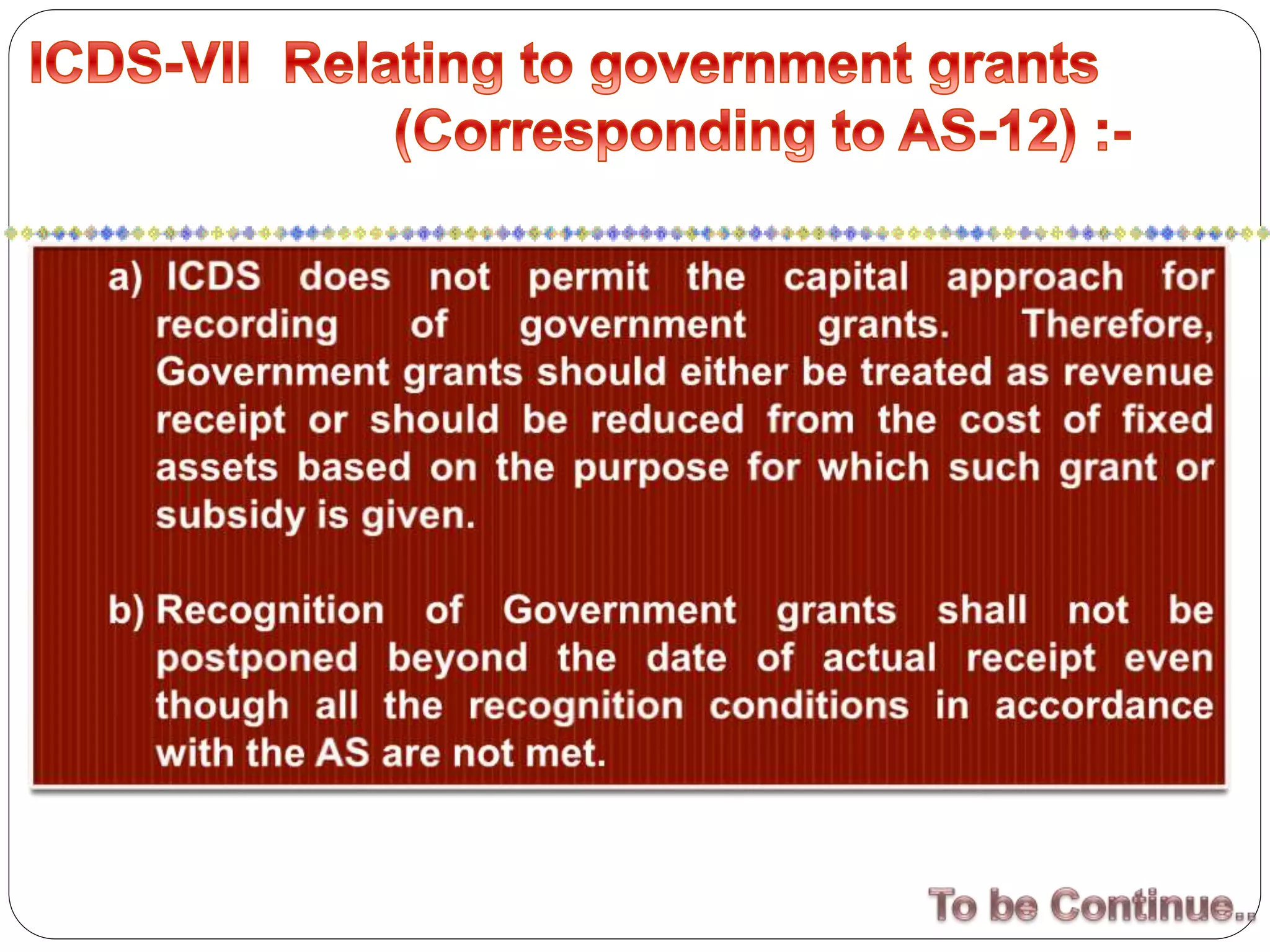

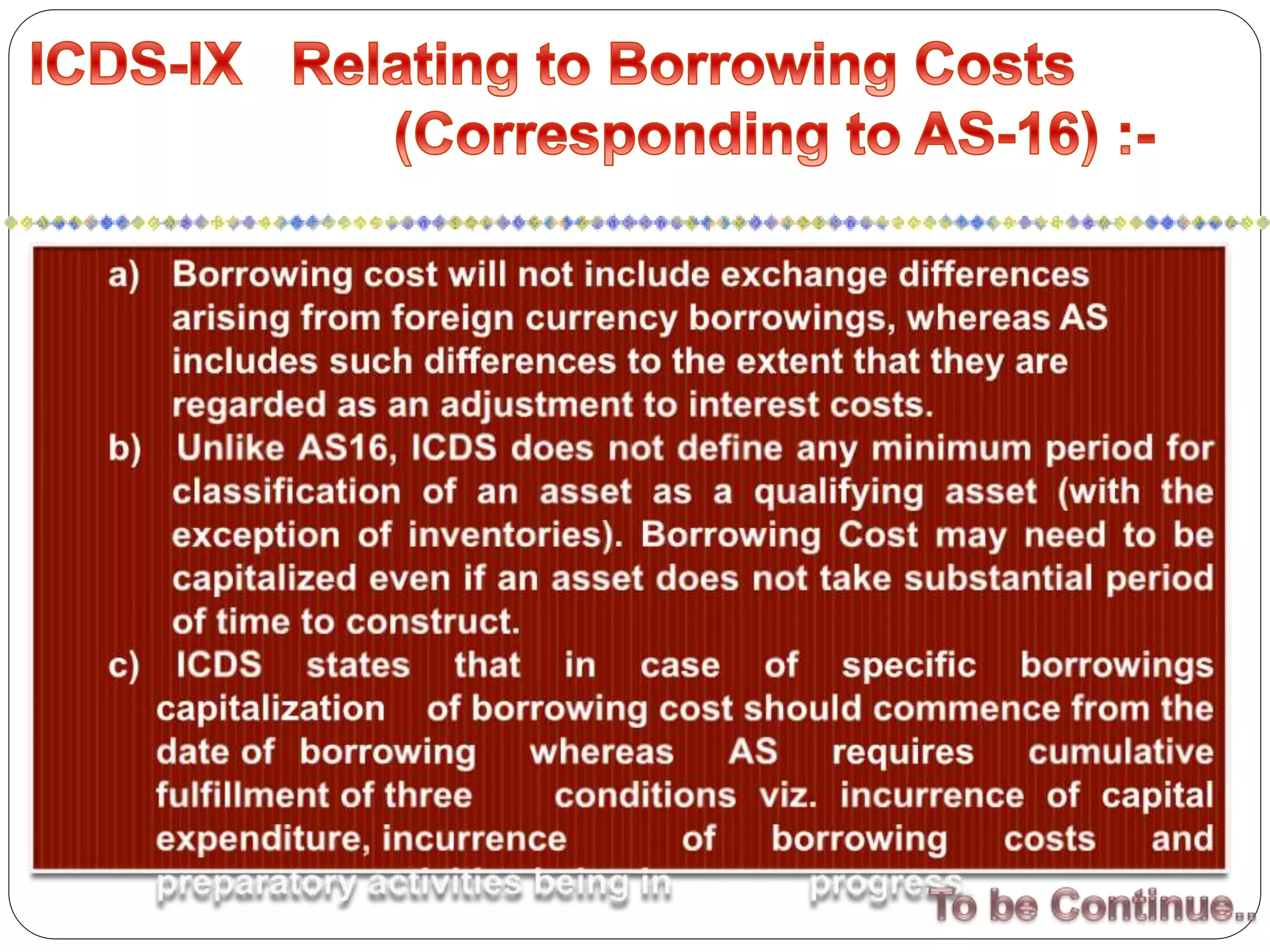

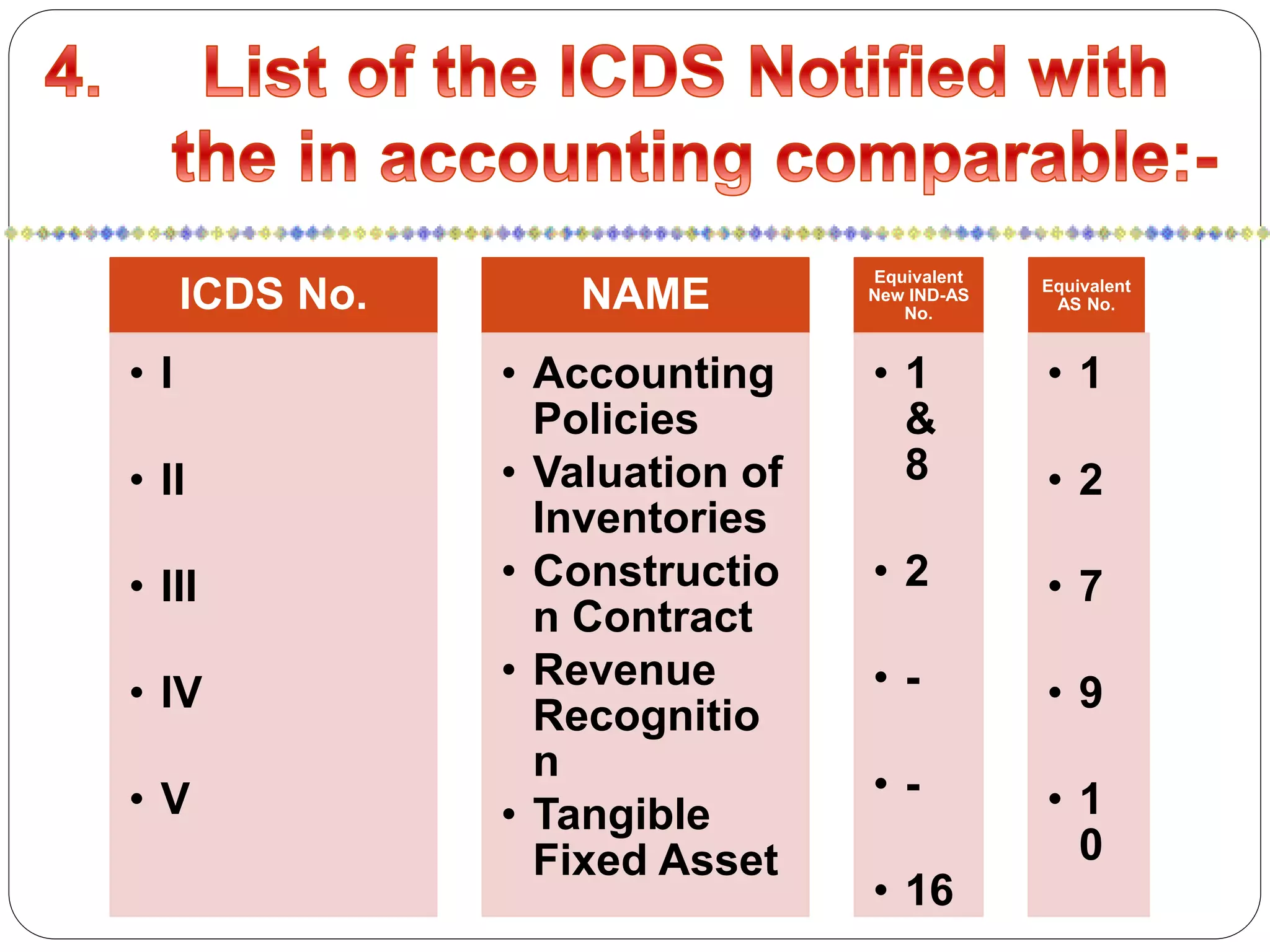

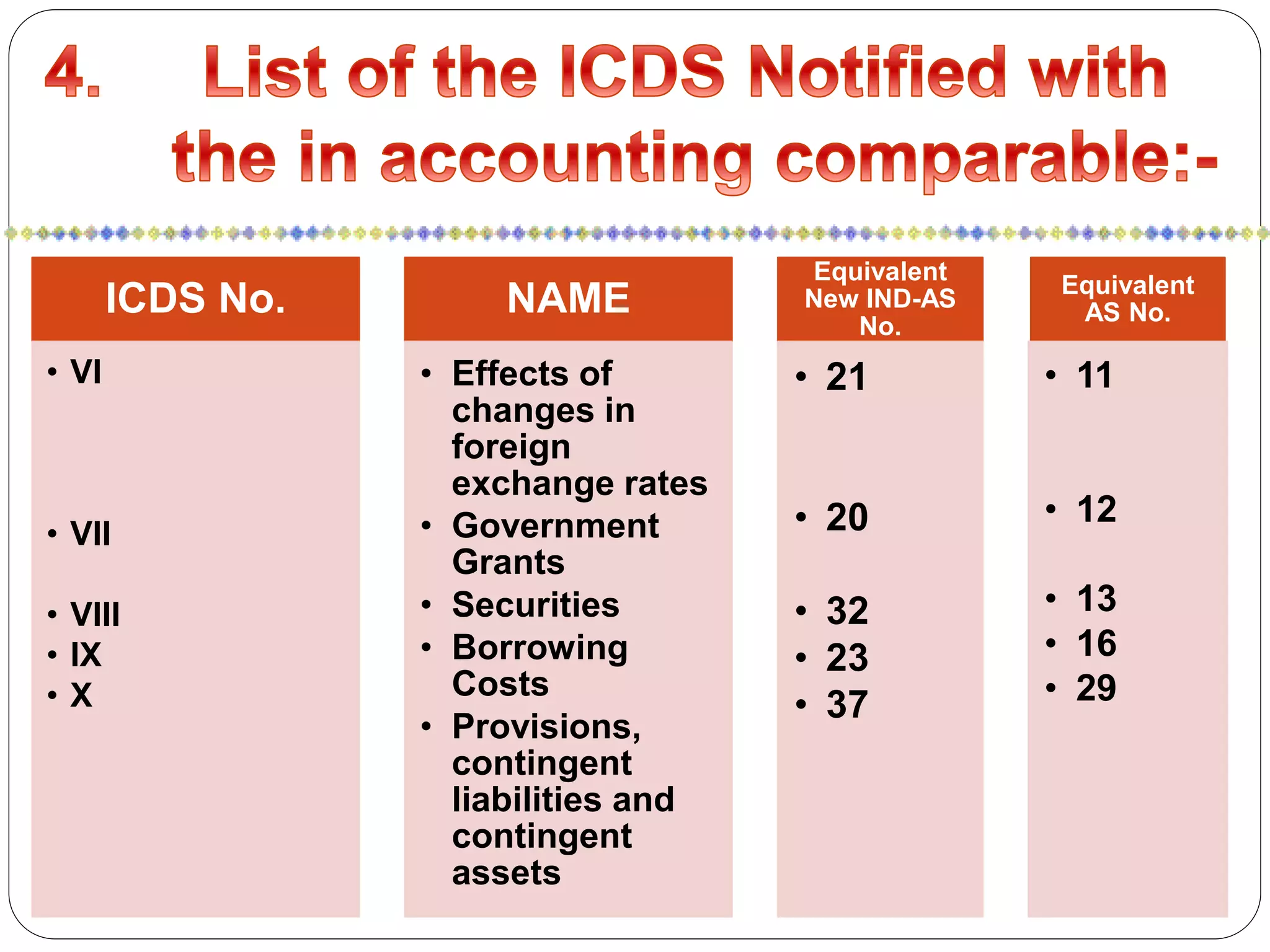

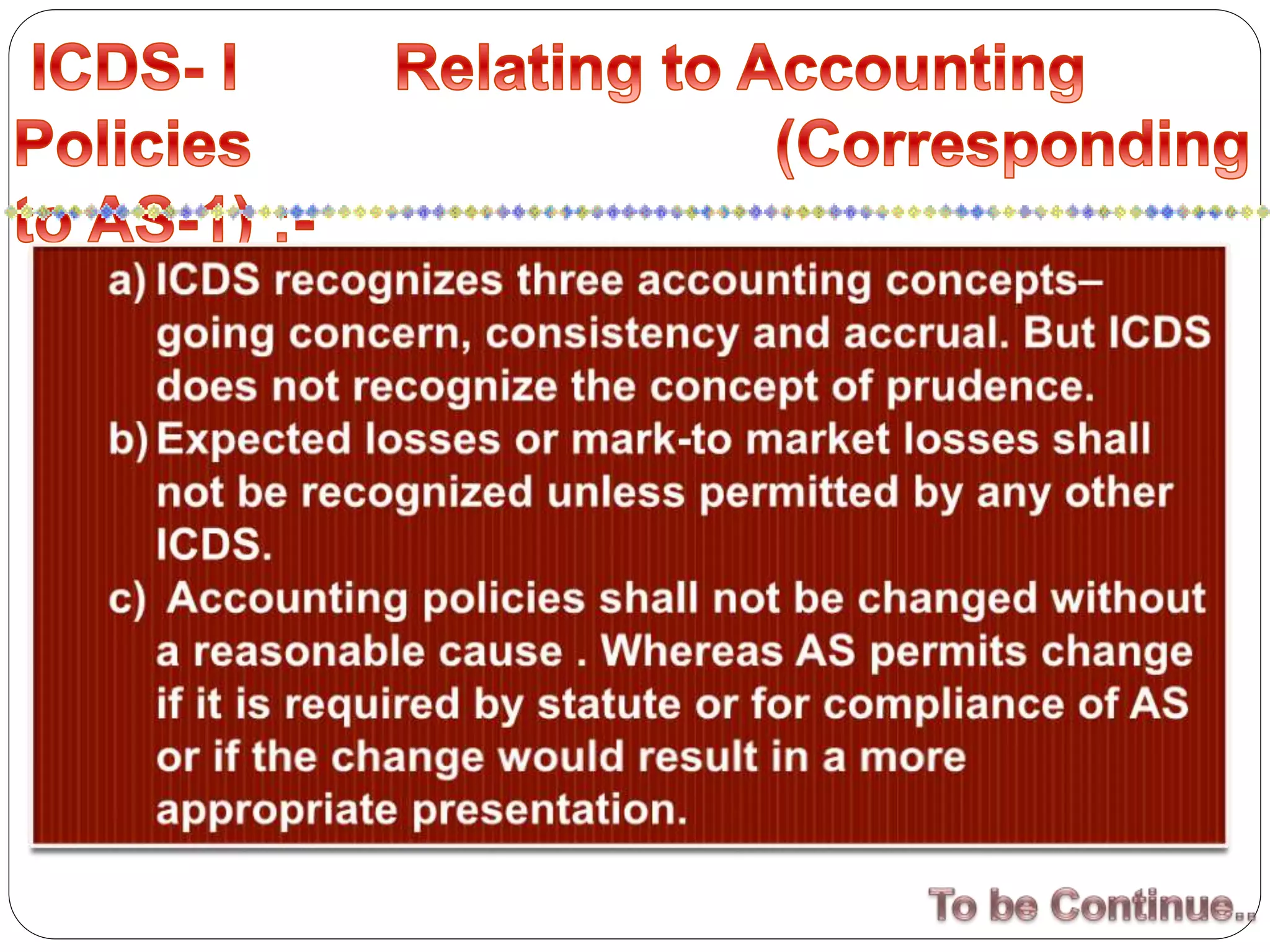

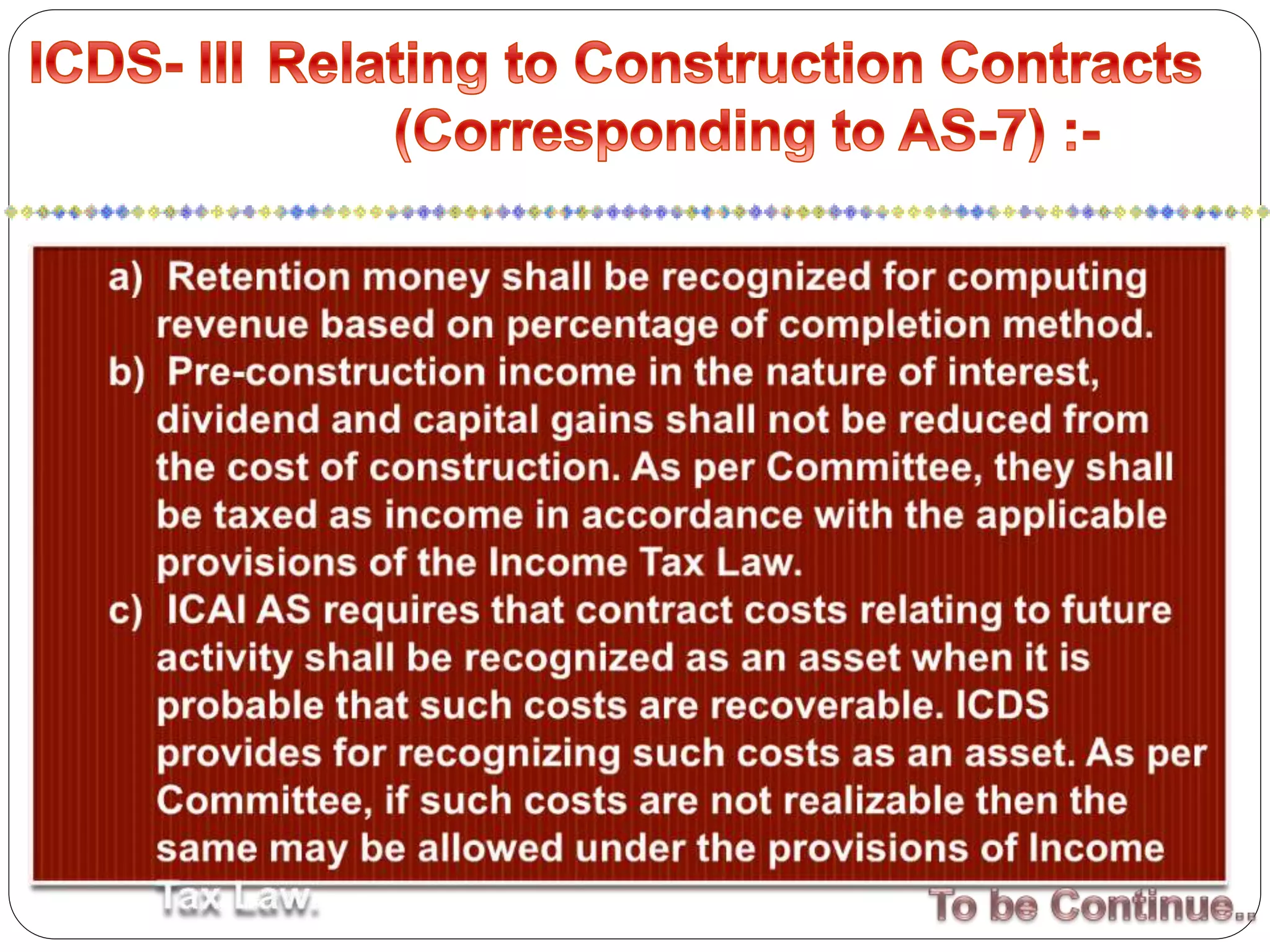

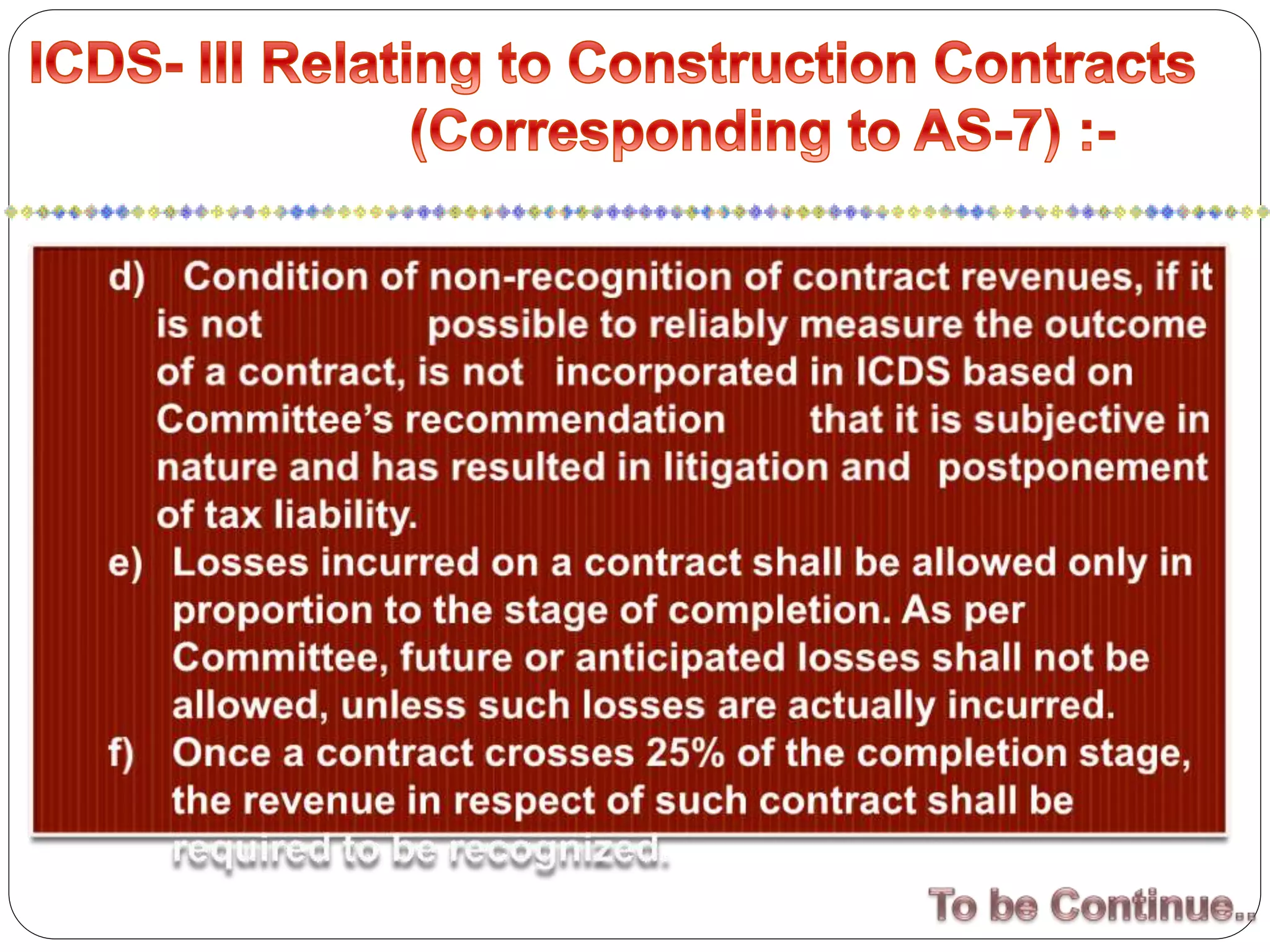

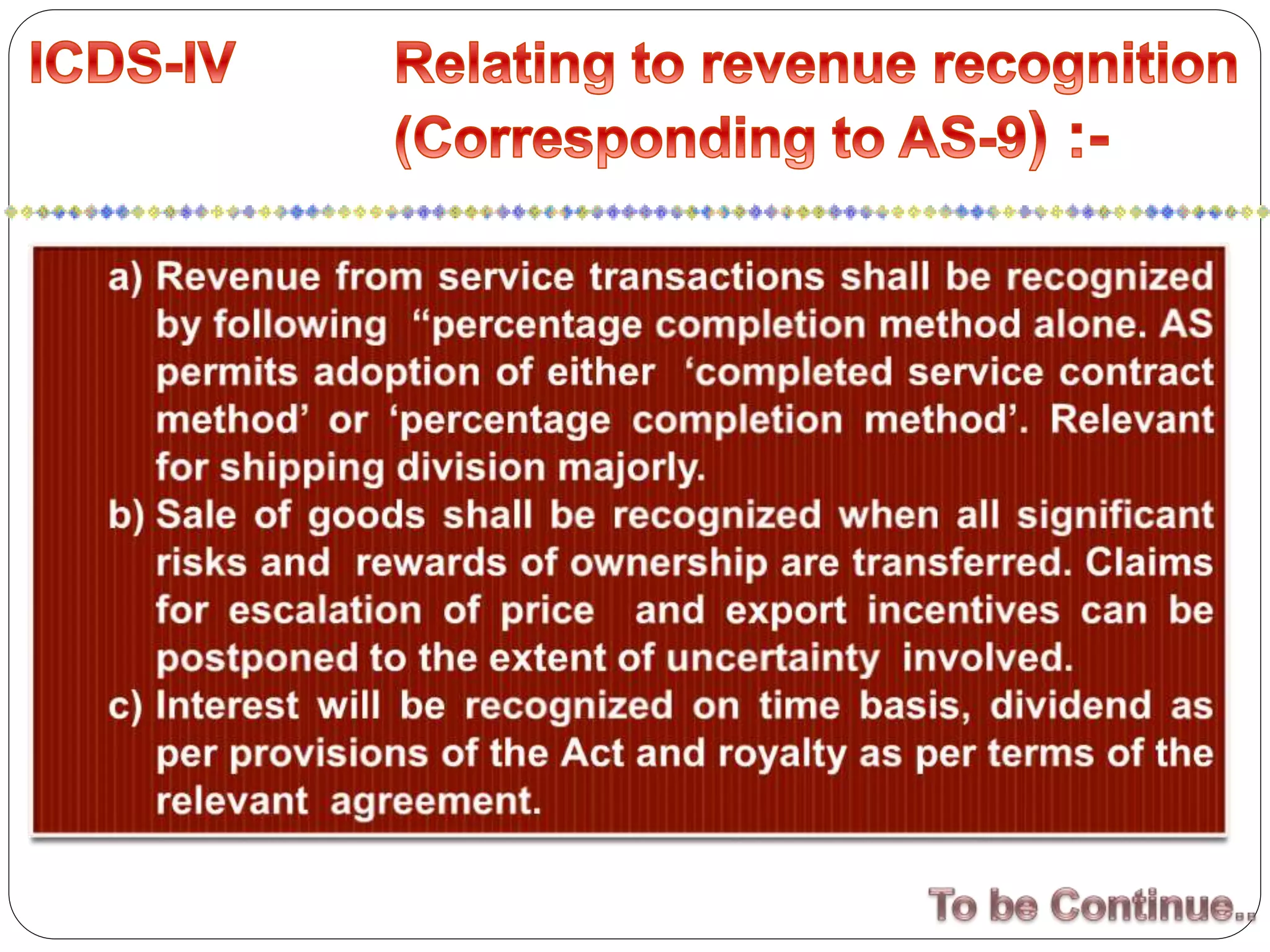

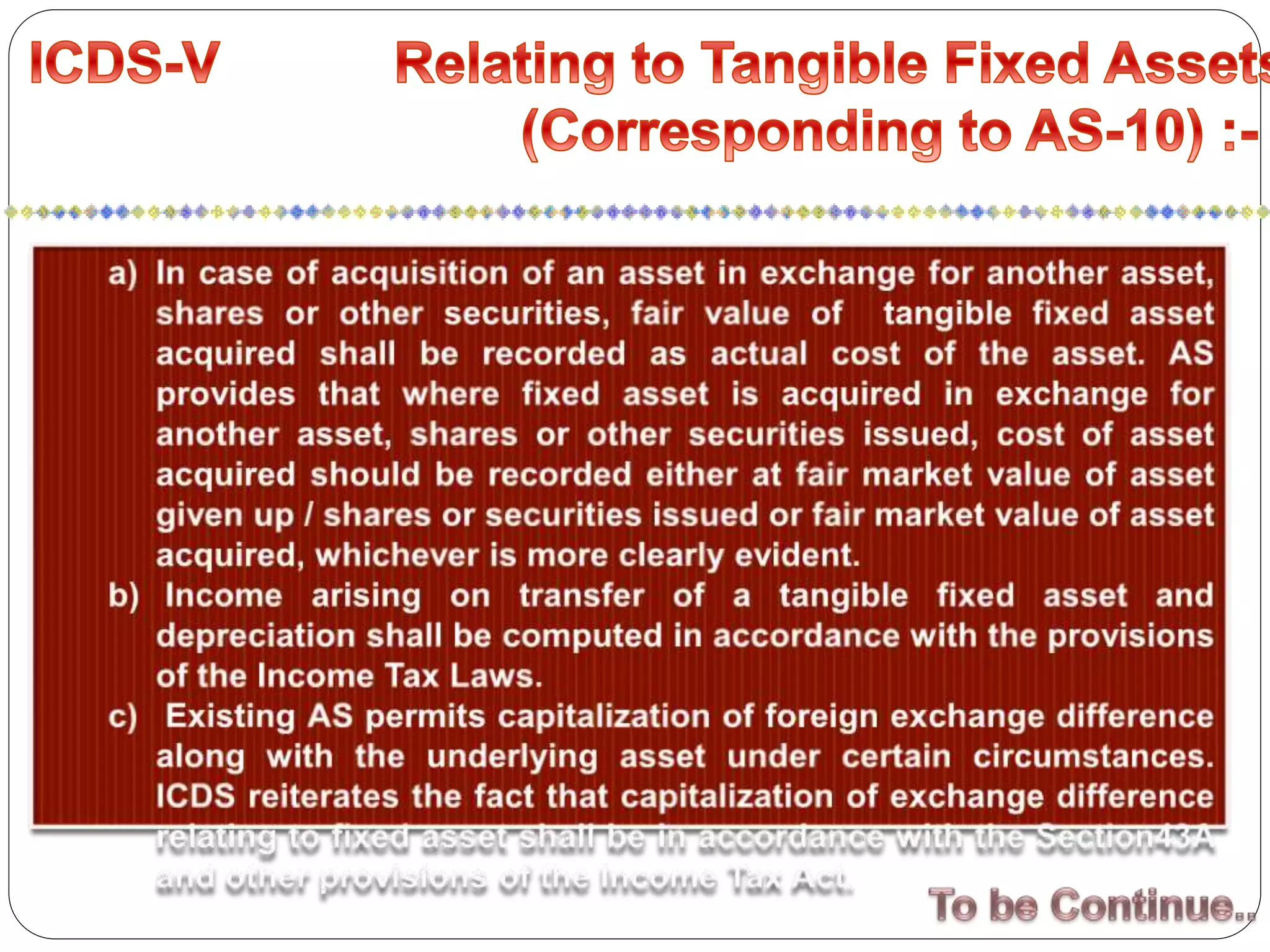

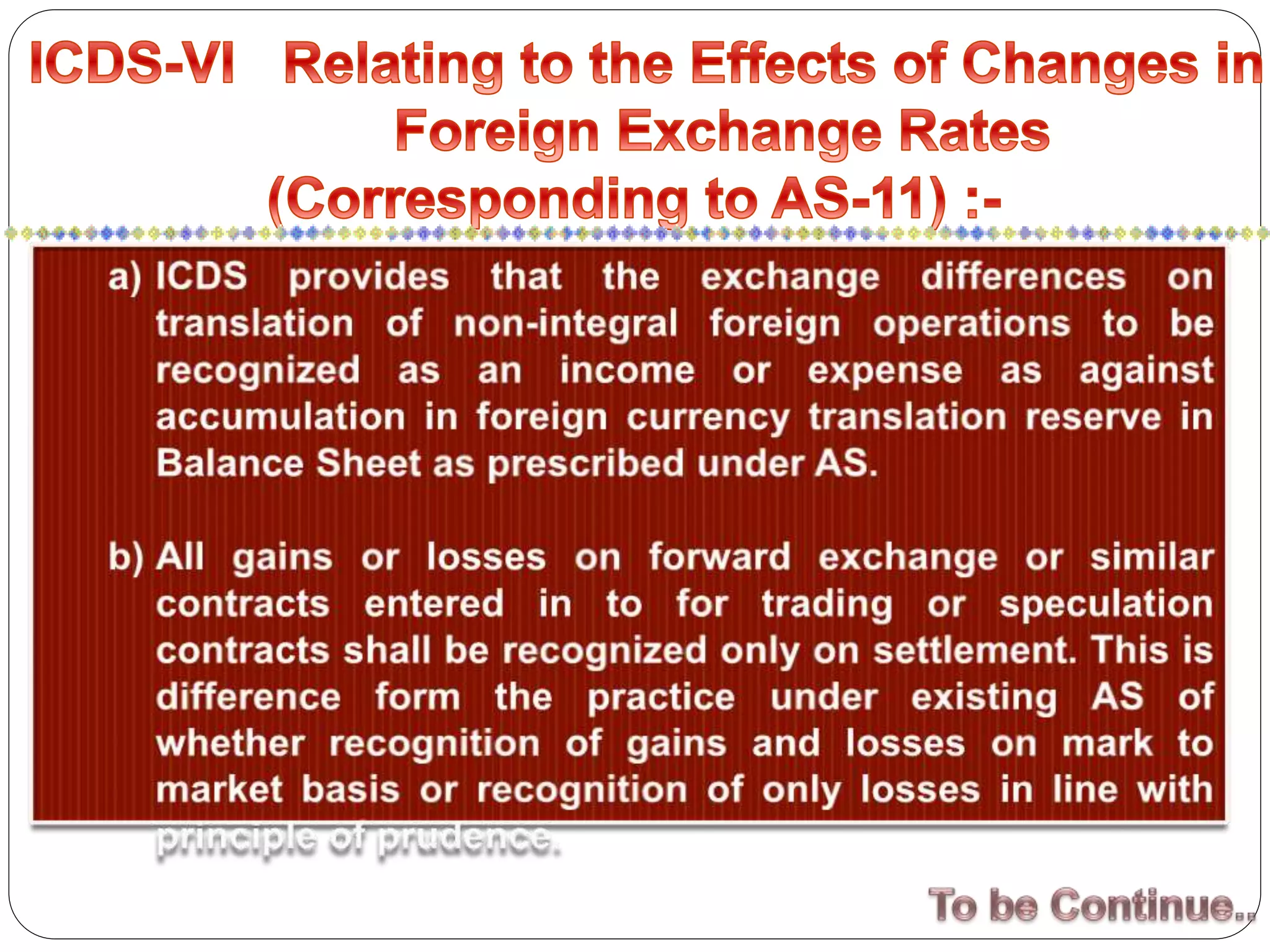

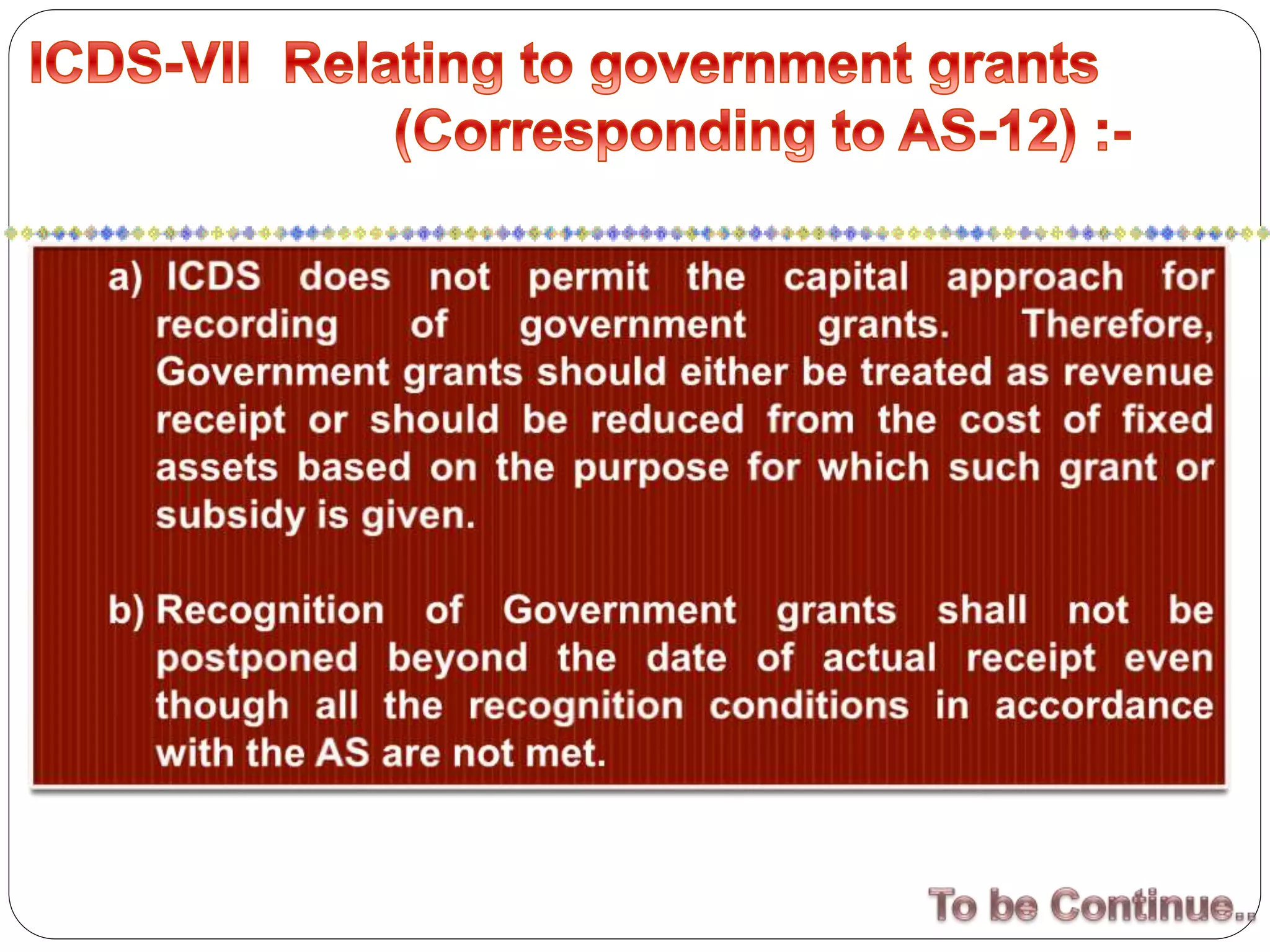

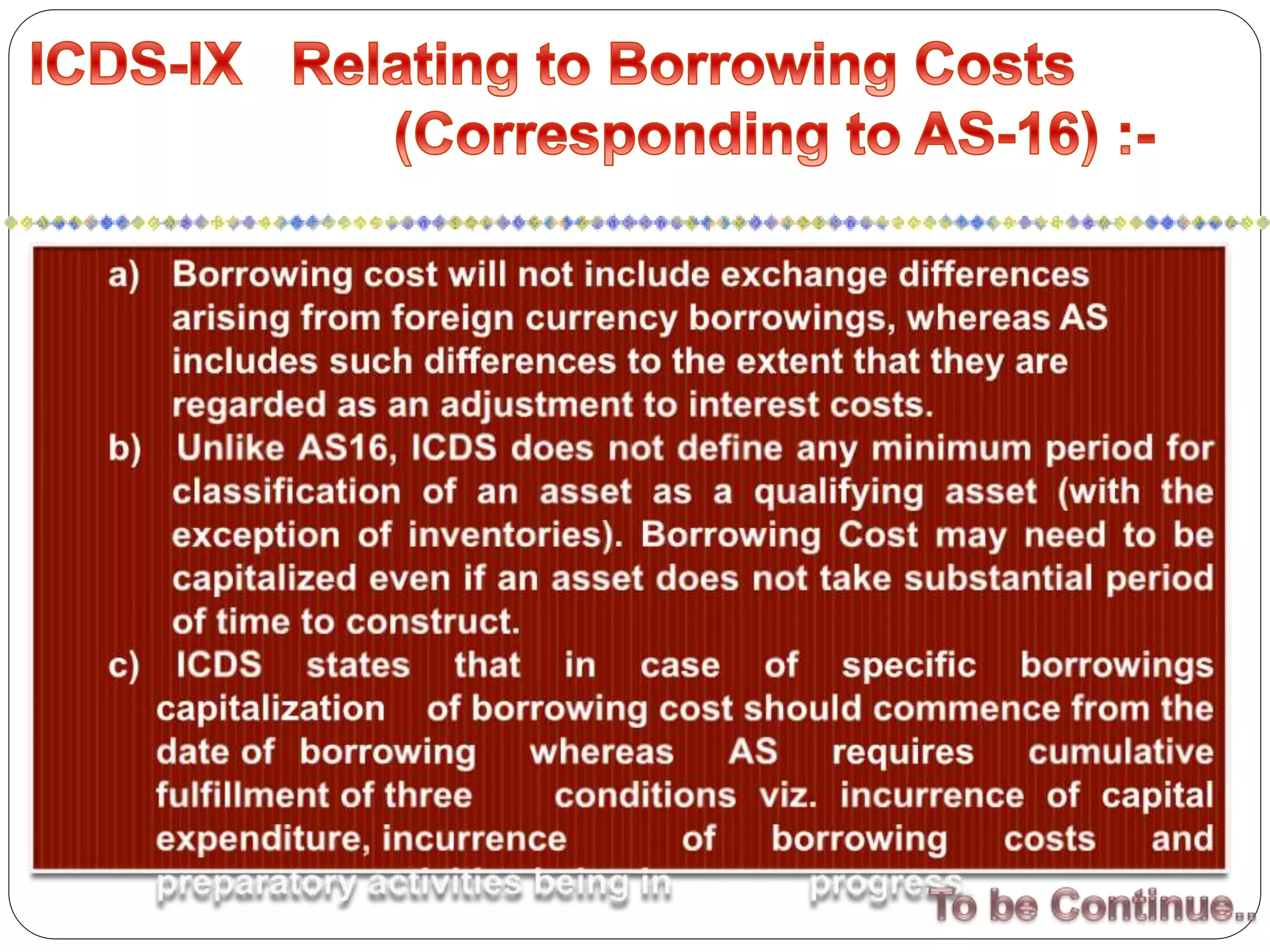

The document outlines 10 Income Computation and Disclosure Standards (ICDS) notified by the Central Board of Direct Taxes in India. It lists the ICDS, their equivalent new Indian Accounting Standards and Accounting Standards. ICDS cover topics such as accounting policies, valuation of inventories, construction contracts, revenue recognition, tangible fixed assets, effects of foreign exchange rates, government grants, securities, borrowing costs, and provisions, contingent liabilities and contingent assets. The document provides details of the ICDS to standardize the calculation and disclosure of income in India.