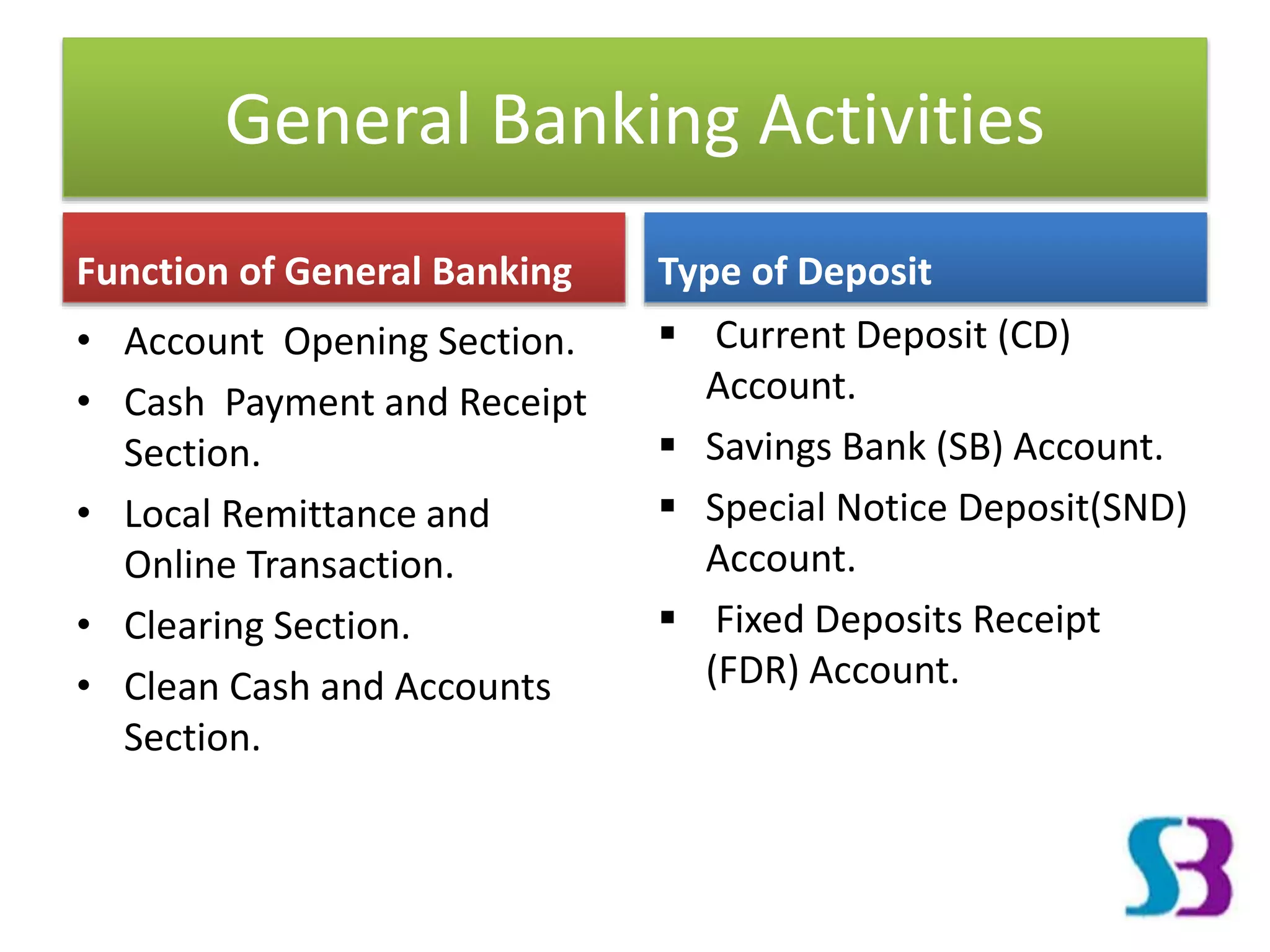

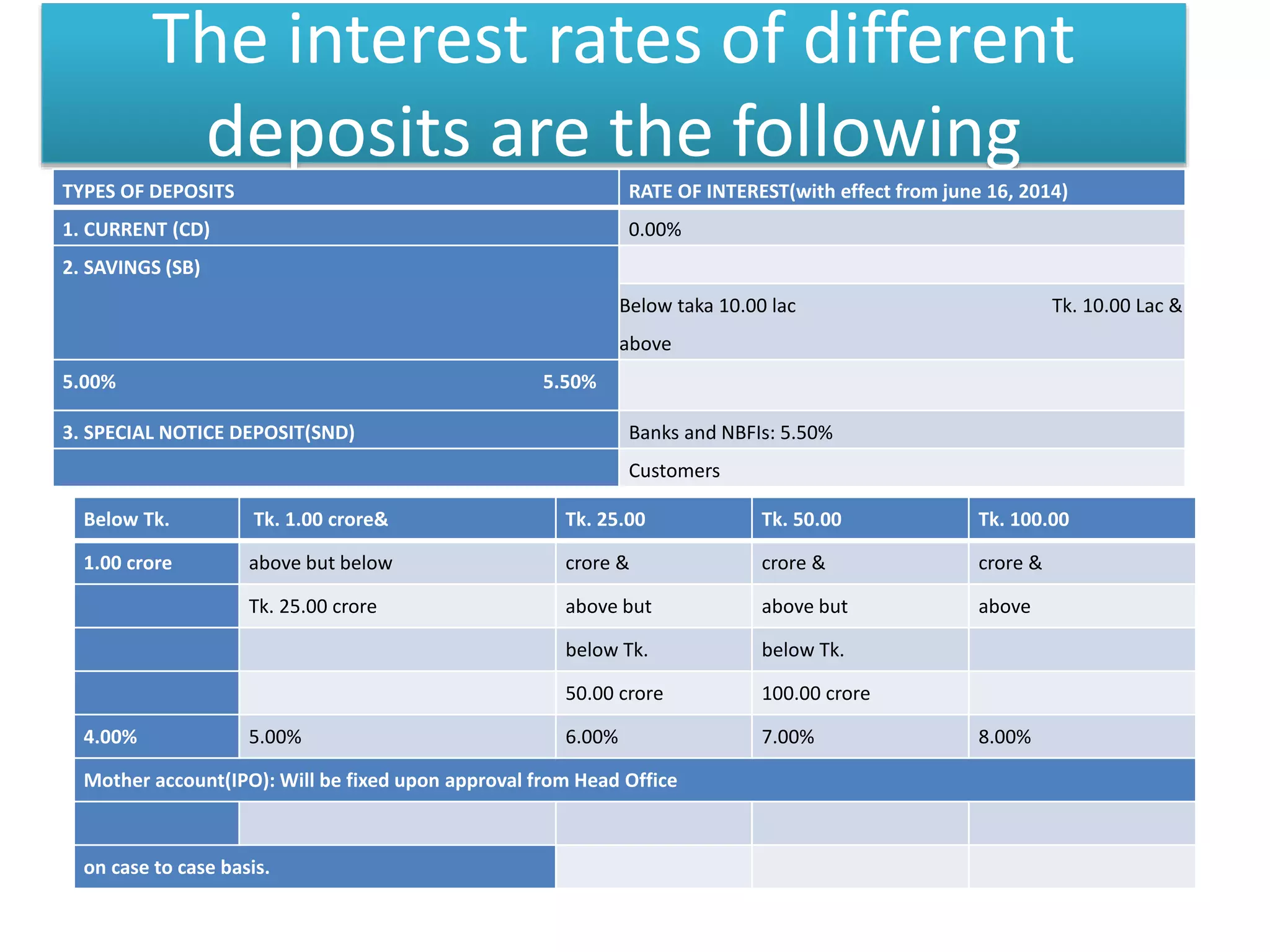

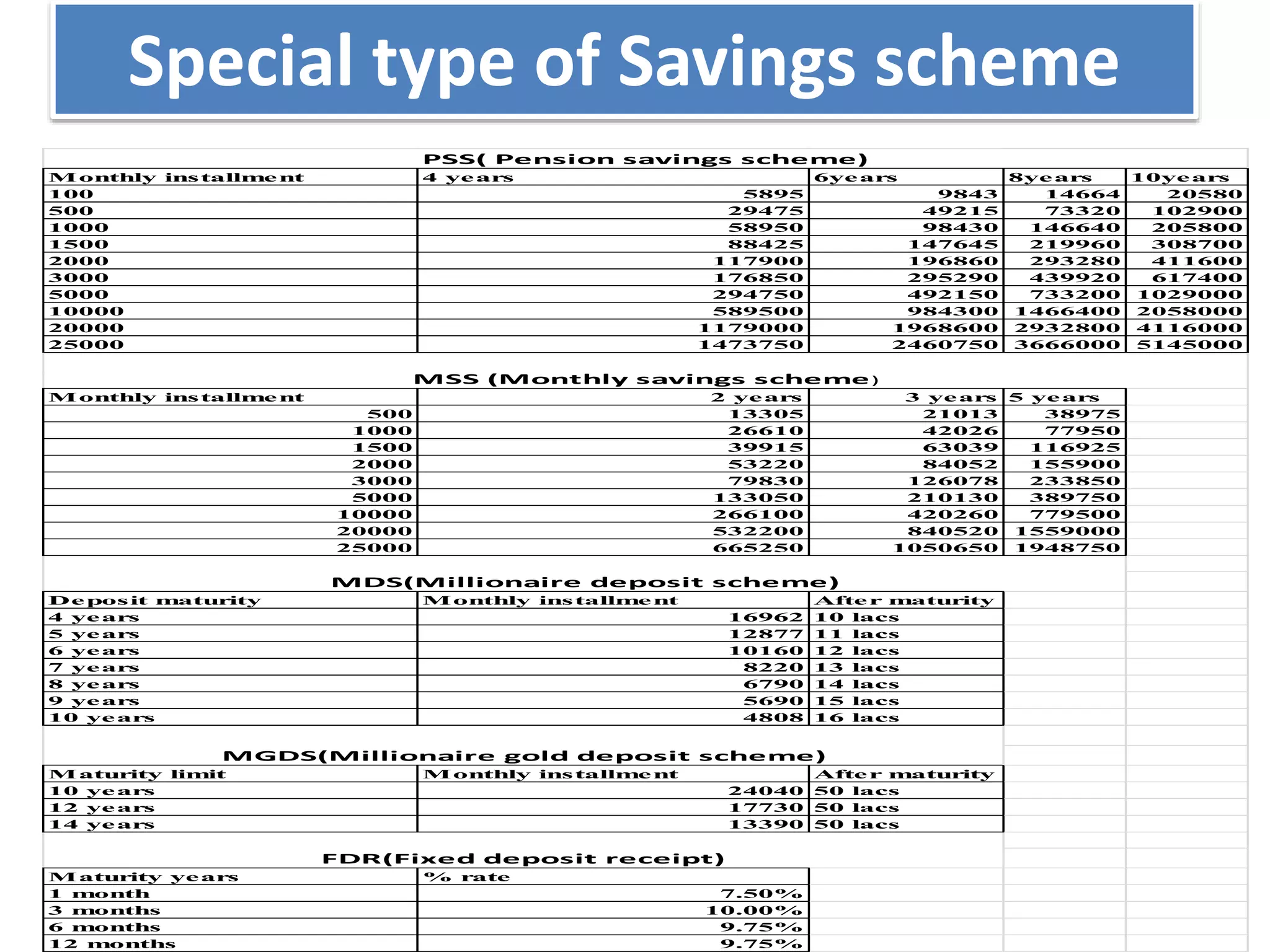

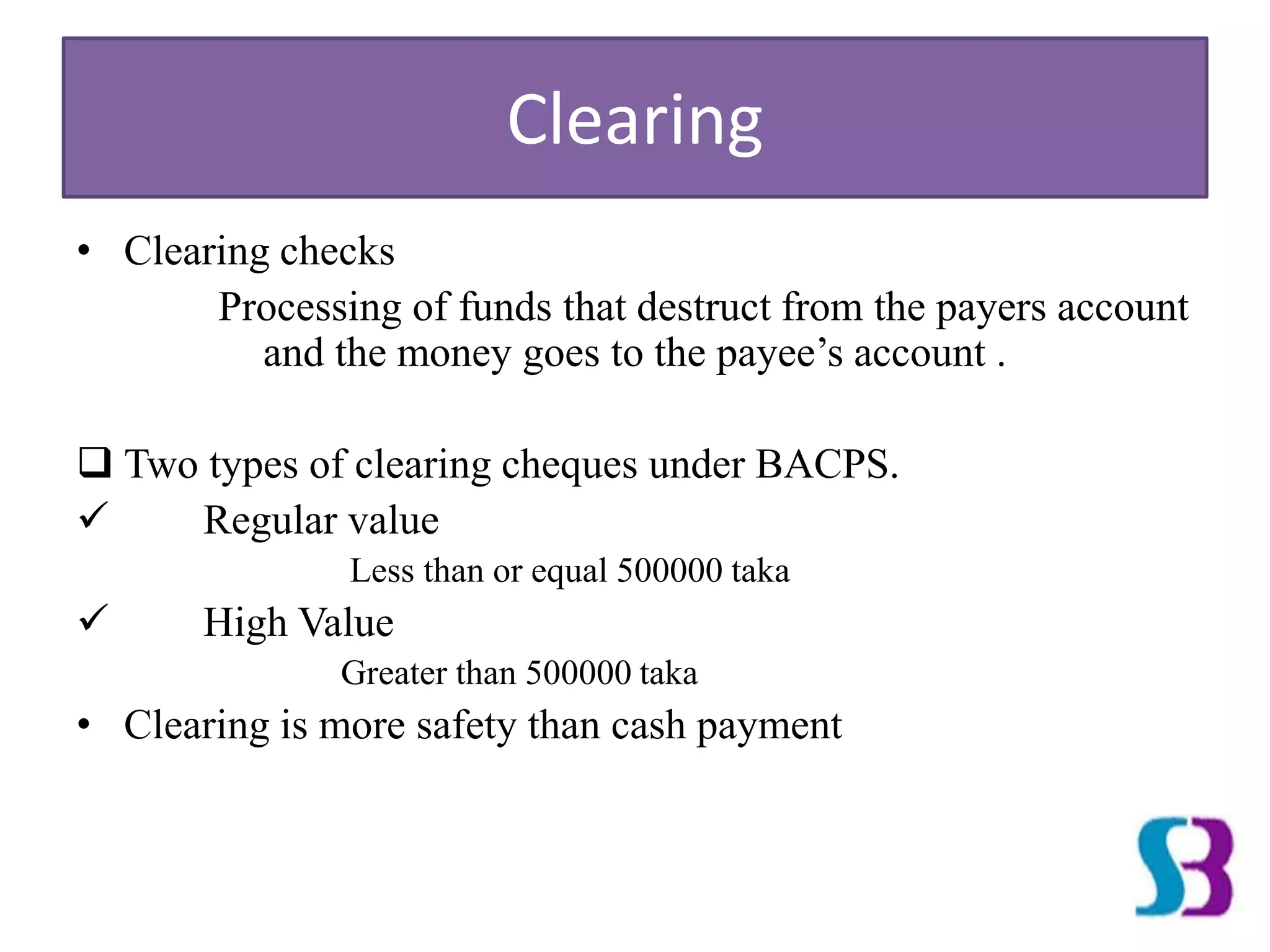

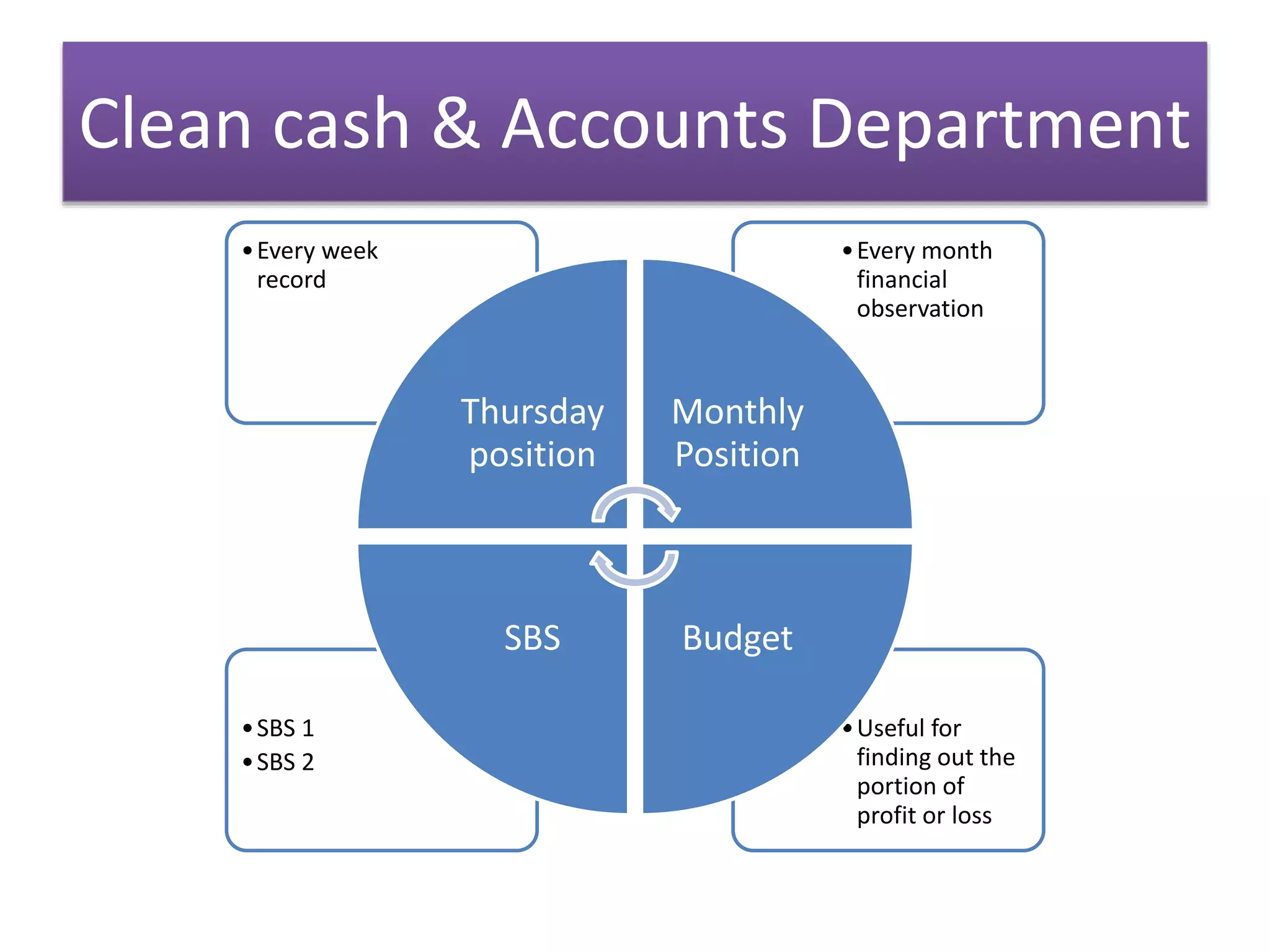

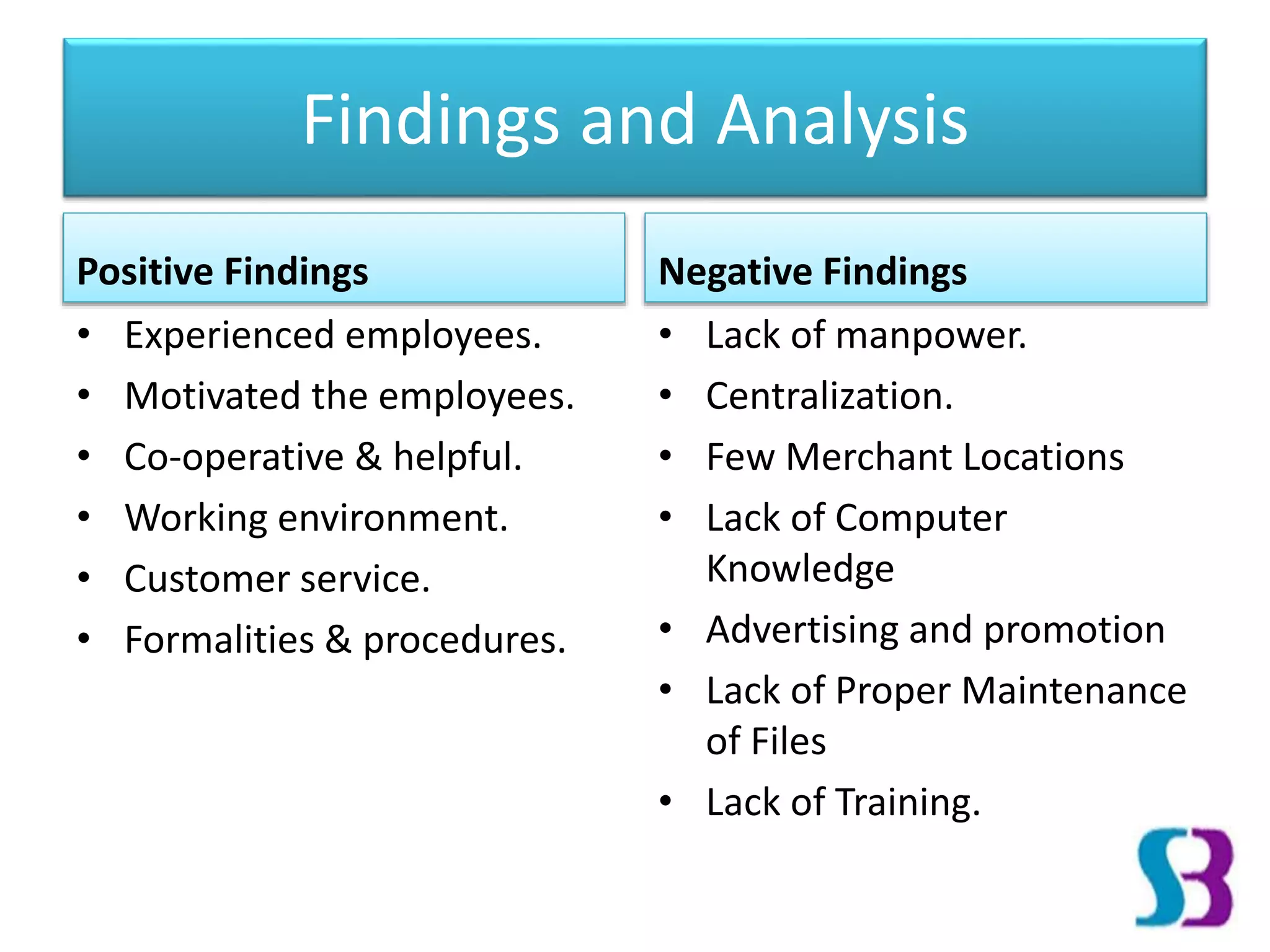

The document provides an internship report on the general banking activities of Southeast Bank Limited. It discusses the bank's organization overview including its mission, vision, and objectives. It also analyzes the bank's strengths, weaknesses, opportunities, and threats through a SWOT analysis. The report describes the bank's general banking functions like account opening, cash receipt/payment, clearing activities. It finds that while the bank has experienced employees and cooperative environment, it lacks manpower, computer knowledge, and training. It provides recommendations like expanding online banking, increasing manpower and marketing to attract more customers.