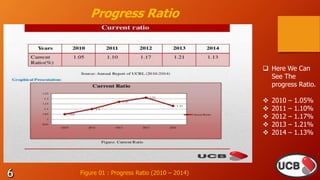

United Commercial Bank Ltd. (UCBL) is one of Bangladesh's leading private banks with over 160 branches. The presentation summarized UCBL's various banking products like savings accounts, credit cards, loans, and online services. It analyzed UCBL's financial performance over 2010-2014 using metrics like profit margin, return on equity, earnings per share, and debt ratios. The presentation concluded that UCBL has grown to become a major private bank in Bangladesh and maintains good communication between levels of management.

![Presentation

on

United Commercial Bank Ltd.

International University of

Business Agriculture and

Technology.

(IUBAT)

1. Riaz Ullah (17302045) [Group Leader].

2. Raisa Anjum (17302052)

3. Nasrin Akter Rupa (17302051)

4. Kanij Fatema Joty (17302001)

Department of BBA, Section – “E”](https://image.slidesharecdn.com/presentation-171118144507/85/UCBL-Presentation-1-320.jpg)

![[United We Achieve]

United Commercial Bank

Ltd.

Image 01 : United We Achieve.](https://image.slidesharecdn.com/presentation-171118144507/85/UCBL-Presentation-2-320.jpg)