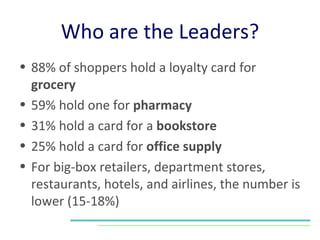

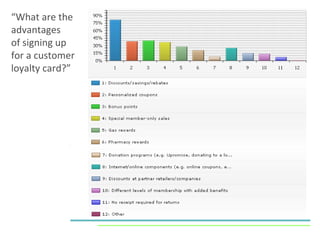

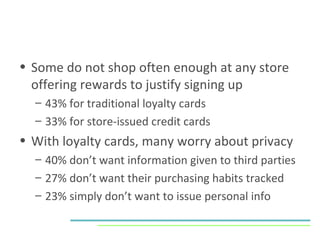

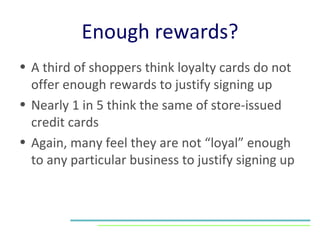

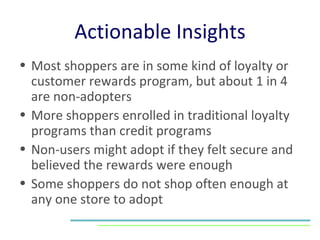

A high percentage of shoppers (77%) hold loyalty cards, but only 40% utilize store-issued credit cards, primarily due to concerns over interest rates and privacy. 82% of loyalty cardholders seek discounts and savings, yet a significant number of non-adopters cite insufficient rewards and lack of loyalty to justify sign-ups. To enhance customer satisfaction and retention, businesses should survey customers on their perceptions and ensure that rewards are perceived as valuable.