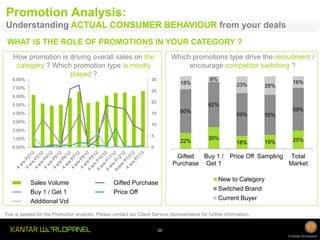

- 85% of the population in Vietnam's four largest cities purchase goods under promotion each year, with gifted purchases being the most popular promotion type at 58% of promotion value.

- Modern trade channels offer more promotions than traditional grocers and attract 34% of consumers who dedicate about 10% of their shopping basket to promoted items.

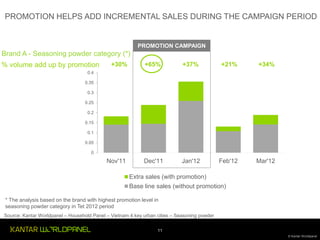

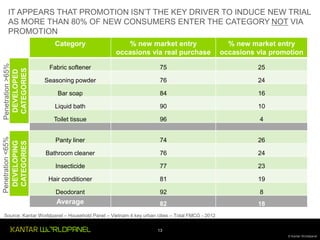

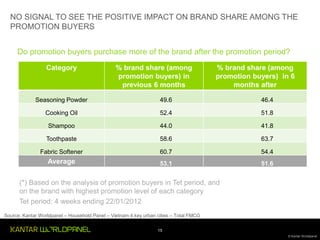

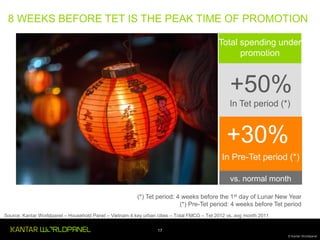

- Promotions are most common during the lead-up to Tet, with spending under promotion increasing 50% during the Tet period and 30% in the preceding four weeks compared to normal months. However, promotions have limited impact on brand trial and show no significant positive effect on brand share after the promotion period ends.