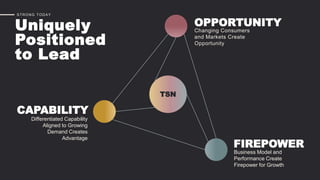

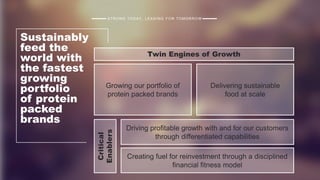

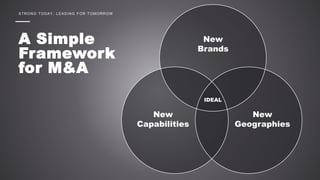

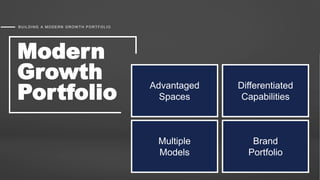

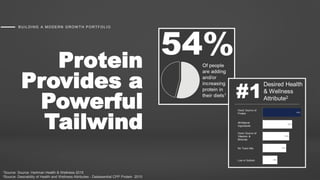

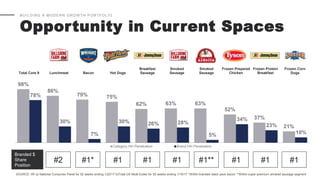

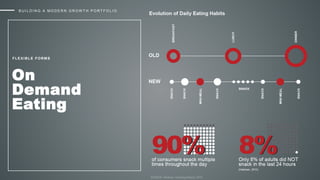

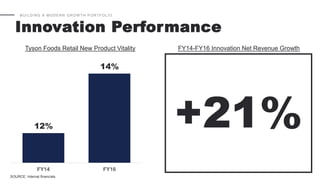

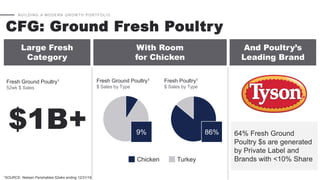

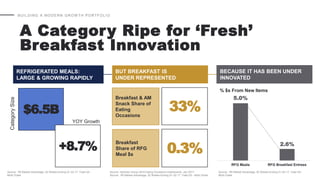

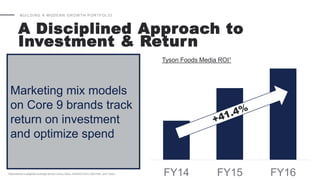

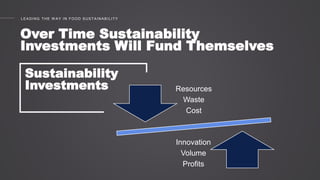

Tyson Foods presented at the Consumer Analyst Group of New York conference on February 21, 2017. The presentation outlined Tyson's strategy to build a modern growth portfolio through innovation, differentiated capabilities, and a focus on fresh, flexible, and functional foods. Recent launches in areas like ground chicken and refrigerated breakfast foods were highlighted as examples of successful innovation delivering revenue growth. Going forward, Tyson aims to sustain leadership through a balanced portfolio approach and driving growth across retail, foodservice, and e-commerce channels.