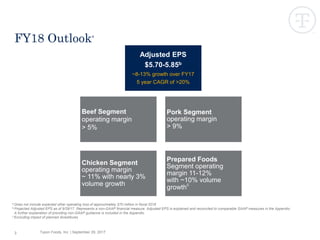

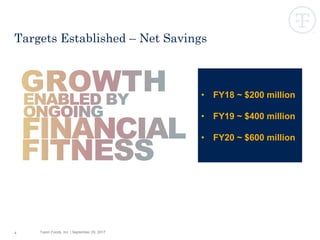

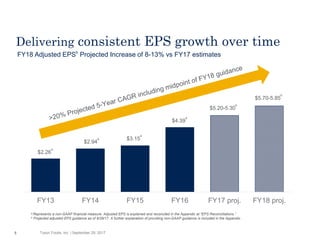

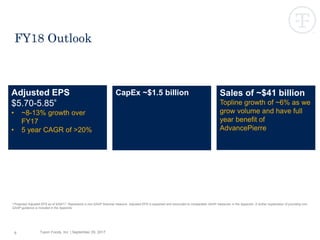

Tyson Foods provided an outlook for fiscal year 2018 that included adjusted EPS guidance of $5.70-5.85, representing 8-13% growth over fiscal year 2017 estimates. Key targets included beef segment operating margin of over 5%, pork segment operating margin of over 9%, and chicken segment operating margin of around 11% with nearly 3% volume growth. Prepared foods segment was expected to have an operating margin of 11-12% with around 10% volume growth. The company also expected to achieve $200 million in net synergies in fiscal year 2018, $400 million in fiscal year 2019, and $600 million in fiscal year 2020 from ongoing improvement efforts.