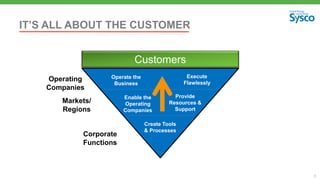

Bill Delaney, President and CEO of Sysco, presented at the 2015 CAGNY Conference on February 19, 2015. Sysco is the global leader in foodservice distribution, with annualized sales approaching $50 billion. Sysco serves over 425,000 customers with over 400,000 products through its operating companies across North America and expanding internationally. Sysco's strategy focuses on partnering with customers, improving productivity, expanding product offerings, and developing its people.