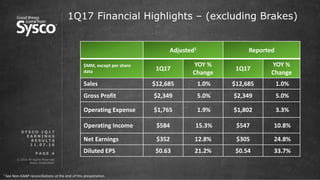

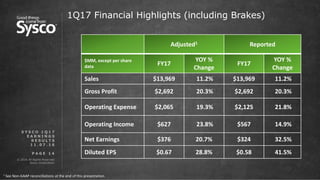

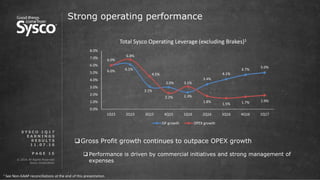

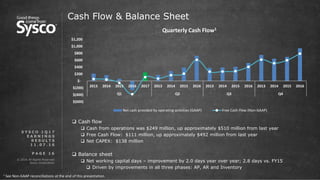

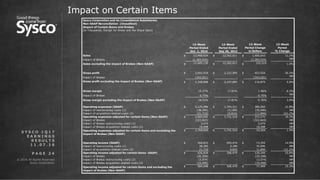

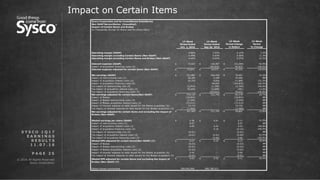

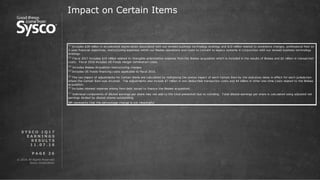

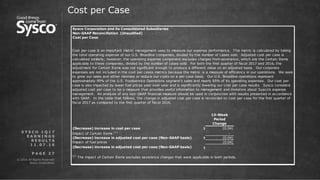

Sysco reported first quarter 2017 earnings results. Key highlights included sales growth of 1.0% excluding Brakes and 11.2% including Brakes. Gross profit grew 5.0% excluding Brakes and 20.3% including Brakes. Operating income grew 15.3% excluding Brakes and 23.8% including Brakes. The acquisition of Brakes Group was accretive to earnings per share and Sysco expects Brakes to be high-single-digit accretive for fiscal year 2017. Sysco also discussed continued focus on key initiatives to drive growth and manage expenses.