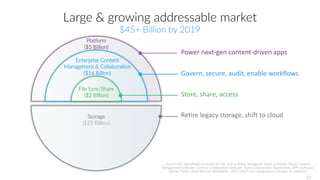

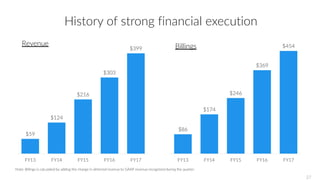

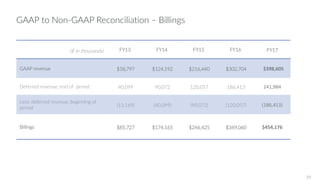

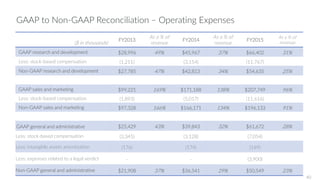

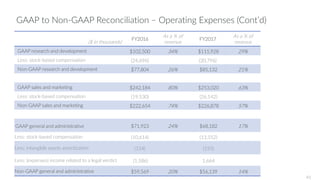

The document provides an overview of Box's recent financial performance and outlook. Some key points:

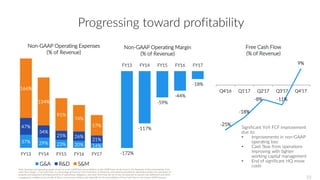

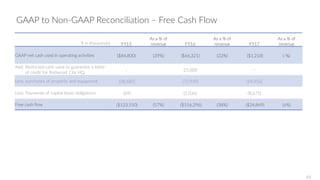

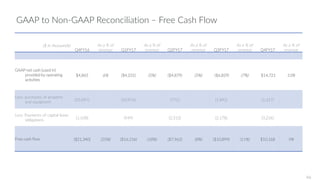

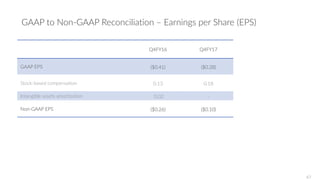

- In Q4 FY2017, Box achieved record revenue and positive free cash flow while continuing to improve operational efficiencies.

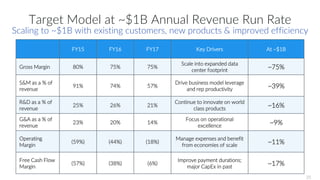

- Box is tracking to reach $1 billion in annual revenue run rate by FY2021 through expanding its existing customer base, new product introductions, and improved efficiency.

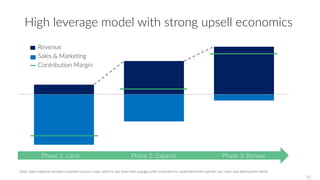

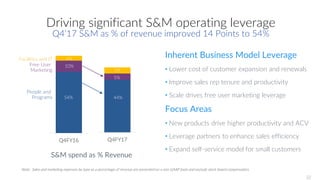

- Box's business model is expected to generate significant operating leverage as revenue scales, with sales and marketing expenses as a percentage of revenue declining to around 39% at a $1 billion revenue run rate.