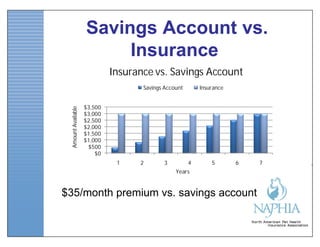

Pet insurance in the U.S. is growing, with North American sales expected to exceed $1.1 billion by 2012, offering coverage for various health issues, treatments, and emergencies. It helps pet owners manage rising veterinary costs, ultimately facilitating better care while reducing the financial burden of treatment. Veterinarians benefit as well, as pet insurance enhances client compliance, minimizes accounts receivable, and supports optimal health outcomes for pets.